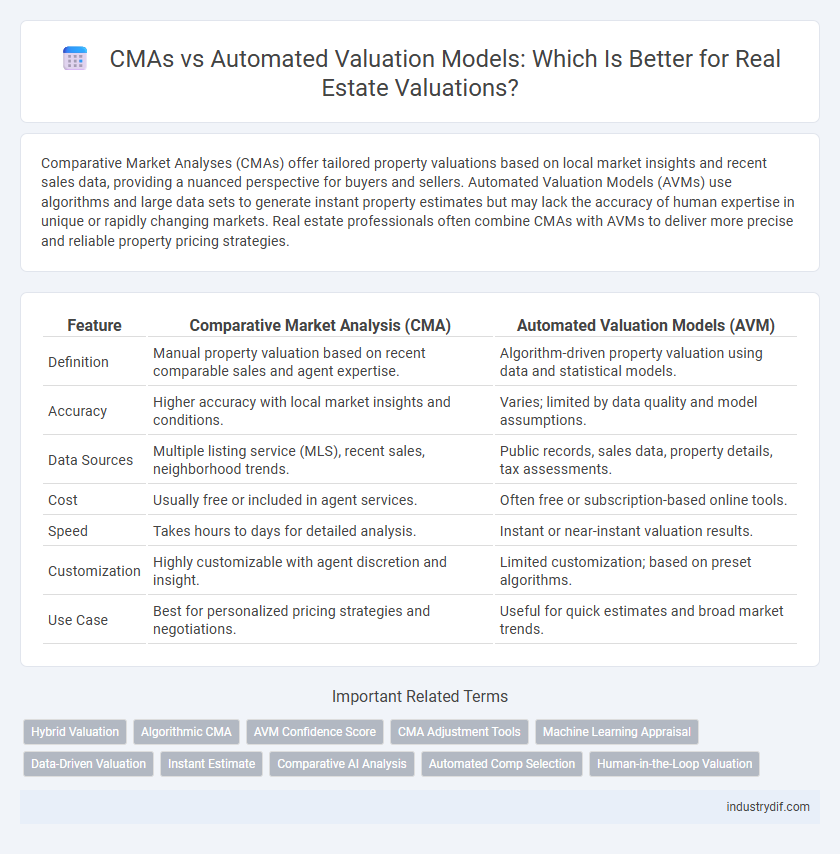

Comparative Market Analyses (CMAs) offer tailored property valuations based on local market insights and recent sales data, providing a nuanced perspective for buyers and sellers. Automated Valuation Models (AVMs) use algorithms and large data sets to generate instant property estimates but may lack the accuracy of human expertise in unique or rapidly changing markets. Real estate professionals often combine CMAs with AVMs to deliver more precise and reliable property pricing strategies.

Table of Comparison

| Feature | Comparative Market Analysis (CMA) | Automated Valuation Models (AVM) |

|---|---|---|

| Definition | Manual property valuation based on recent comparable sales and agent expertise. | Algorithm-driven property valuation using data and statistical models. |

| Accuracy | Higher accuracy with local market insights and conditions. | Varies; limited by data quality and model assumptions. |

| Data Sources | Multiple listing service (MLS), recent sales, neighborhood trends. | Public records, sales data, property details, tax assessments. |

| Cost | Usually free or included in agent services. | Often free or subscription-based online tools. |

| Speed | Takes hours to days for detailed analysis. | Instant or near-instant valuation results. |

| Customization | Highly customizable with agent discretion and insight. | Limited customization; based on preset algorithms. |

| Use Case | Best for personalized pricing strategies and negotiations. | Useful for quick estimates and broad market trends. |

Understanding CMAs in Real Estate

Comparative Market Analyses (CMAs) provide a detailed evaluation of a property's value based on recent sales data, neighborhood trends, and condition assessments conducted by real estate professionals. Unlike Automated Valuation Models (AVMs) that rely solely on algorithmic data processing, CMAs incorporate expert insights and local market knowledge to produce more accurate and customized property valuations. Real estate agents use CMAs to tailor pricing strategies, ensuring listings reflect current market conditions and maximize transaction potential.

What Are Automated Valuation Models (AVMs)?

Automated Valuation Models (AVMs) leverage advanced algorithms and extensive property data to generate real estate property value estimates quickly and accurately. AVMs analyze recent sales, property characteristics, market trends, and geographic information to provide objective valuations without human intervention. These models are widely used by lenders, appraisers, and real estate professionals to streamline the property appraisal process and enhance decision-making.

Key Differences Between CMAs and AVMs

Comparative Market Analyses (CMAs) involve detailed, agent-driven evaluations of a property's value based on recent sales of similar homes in the neighborhood, factoring in unique property features and local market trends. Automated Valuation Models (AVMs) utilize algorithms and large datasets to generate property estimates quickly but may lack the nuanced understanding of individual property conditions and hyper-local market fluctuations. While CMAs offer personalized insights reflecting expert judgment, AVMs provide scalable, data-driven valuations ideal for rapid assessments across multiple properties.

Accuracy Comparison: CMA vs AVM

Comparative Market Analyses (CMAs) typically offer higher accuracy in real estate valuation due to expert interpretation of local market trends and property nuances, unlike Automated Valuation Models (AVMs) that rely solely on algorithmic data processing. CMAs incorporate recent sales data, property condition, and location specifics, resulting in a more tailored and precise estimate. AVMs, while efficient for quick valuations, often lack the contextual sensitivity that experienced real estate agents provide, leading to less reliable price assessments.

Data Sources Used in CMAs and AVMs

Comparative Market Analyses (CMAs) rely on localized, agent-curated data including recent sales, property features, and neighborhood trends sourced directly from Multiple Listing Services (MLS) and firsthand market observations. Automated Valuation Models (AVMs) aggregate large datasets from public records, tax assessments, and broad market indicators, using algorithms to estimate property values with minimal human oversight. The accuracy of CMAs often benefits from nuanced insights and current market dynamics, while AVMs provide rapid, standardized valuations derived from extensive but less personalized data sources.

The Role of Real Estate Agents in CMAs

Real estate agents play a crucial role in Comparative Market Analysis (CMA) by leveraging their local market expertise to provide accurate and personalized property valuations. Unlike Automated Valuation Models (AVMs) that rely solely on algorithms and data points, agents incorporate factors such as neighborhood trends, property condition, and recent sales experience that are not easily quantifiable. Their professional insights help buyers and sellers make informed decisions, ensuring CMAs reflect true market conditions more effectively than automated tools.

Technology’s Impact on AVMs

Automated Valuation Models (AVMs) leverage advanced algorithms and big data analytics to provide rapid property valuations, increasing efficiency compared to traditional Comparative Market Analyses (CMAs). The integration of machine learning and artificial intelligence in AVMs enhances accuracy by continuously refining property value predictions based on real-time market trends and transactional data. Despite technological advancements, AVMs may lack the nuanced local market insights that experienced agents incorporate into CMAs, highlighting the complementary roles of both methods in real estate valuation.

Pros and Cons of CMAs for Property Valuation

Comparative Market Analyses (CMAs) offer personalized property valuation by incorporating local market trends, recent sales data, and the unique characteristics of a home, providing more accurate and context-sensitive results. CMAs allow real estate agents to leverage professional expertise, market knowledge, and client-specific needs, enhancing negotiation power and pricing strategy. However, CMAs can be time-consuming, subjective, and dependent on agent experience, which may introduce variability compared to the efficiency and consistency of Automated Valuation Models (AVMs).

Pros and Cons of AVMs for Real Estate Pricing

Automated Valuation Models (AVMs) offer quick, data-driven property price estimates by analyzing large datasets and market trends, providing real estate professionals with efficiency and scalability in pricing. However, AVMs may lack the nuanced understanding of local market conditions, property-specific features, and recent renovations that Comparative Market Analyses (CMAs) capture through expert appraisal. The reliance on algorithmic data sometimes leads to less accurate valuations in unique or rapidly changing markets, necessitating human expertise to validate and adjust AVM outputs for precise real estate pricing.

When to Use a CMA vs an AVM in Real Estate Transactions

Comparative Market Analyses (CMAs) provide personalized, agent-driven property valuations based on local market trends and unique home features, making them ideal for accurate pricing during listing or negotiation phases. Automated Valuation Models (AVMs) offer quick, algorithm-based estimates using large datasets, suitable for preliminary appraisals or when speed is essential. In complex or high-stakes transactions, CMAs deliver more precise insights, while AVMs support initial decision-making with broader market data.

Related Important Terms

Hybrid Valuation

Hybrid valuation combines the accuracy of Comparative Market Analysis (CMA) performed by real estate experts with the efficiency of Automated Valuation Models (AVMs) powered by machine learning algorithms. This approach leverages comprehensive property data and local market insights to deliver more precise home valuations, enhancing decision-making for buyers, sellers, and real estate professionals.

Algorithmic CMA

Algorithmic Comparative Market Analysis (CMA) enhances traditional CMAs by integrating machine learning algorithms and extensive real estate databases to provide more precise property valuations. This method leverages dynamic market trends, neighborhood-specific data, and historical sales to outperform standard Automated Valuation Models (AVMs) in accuracy and reliability.

AVM Confidence Score

Automated Valuation Models (AVMs) provide instant property value estimates using algorithms that analyze market data, while Comparative Market Analyses (CMAs) involve expert agent evaluations based on recent sales and local market conditions. The AVM Confidence Score quantifies the reliability of the valuation by assessing data quality, market volatility, and algorithm accuracy, guiding buyers and sellers in decision-making.

CMA Adjustment Tools

CMA adjustment tools provide real estate agents precise control over comparable property valuations by allowing manual input of variables such as location, condition, and market trends, resulting in tailored and accurate pricing strategies. Unlike Automated Valuation Models (AVMs) that rely solely on algorithm-driven data, CMAs enable nuanced adjustments reflecting current market dynamics and property-specific details, enhancing the reliability of home value estimates.

Machine Learning Appraisal

Comparative Market Analyses (CMAs) leverage expert insights to evaluate property values based on recent sales data, while Automated Valuation Models (AVMs) utilize machine learning algorithms to analyze vast datasets including location, property features, and market trends for rapid, data-driven appraisals. Machine learning appraisal enhances accuracy by continuously refining predictive models through neural networks and regression analysis, reducing human bias and improving valuation in dynamic real estate markets.

Data-Driven Valuation

Comparative Market Analyses (CMAs) leverage expert insights and localized market trends for nuanced property valuations, while Automated Valuation Models (AVMs) depend on algorithms processing extensive datasets to provide rapid, data-driven estimates. AVMs utilize property attributes, recent sales, and market indicators, offering scalability and consistency in valuations crucial for large real estate portfolios and online platforms.

Instant Estimate

Instant estimates provided by Automated Valuation Models (AVMs) offer quick property valuations using algorithms and extensive databases, while Comparative Market Analyses (CMAs) involve detailed evaluations by real estate professionals incorporating market trends and property specifics. AVMs deliver fast, data-driven insights ideal for initial assessments, whereas CMAs provide more accurate, personalized valuations essential for informed decision-making in real estate transactions.

Comparative AI Analysis

Comparative Market Analysis (CMA) leverages agent expertise and localized market data to provide nuanced property valuations, while Automated Valuation Models (AVMs) utilize machine learning algorithms and extensive datasets for rapid, data-driven estimates. Comparative AI analysis integrates these approaches by combining human insights with AI-driven analytics to enhance accuracy and reliability in real estate pricing strategies.

Automated Comp Selection

Automated Valuation Models (AVMs) leverage algorithms and extensive property databases to perform automated comp selection, ensuring rapid and data-driven estimates by analyzing recent sales, location, property characteristics, and market trends. This automated comp selection enhances accuracy and efficiency compared to traditional Comparative Market Analyses (CMAs), which rely on manual selection and local expertise.

Human-in-the-Loop Valuation

Comparative Market Analyses (CMAs) leverage local market expertise and tailored insights, enabling agents to adjust property valuations based on unique factors that Automated Valuation Models (AVMs) may overlook. Human-in-the-Loop valuation combines data-driven AVM accuracy with skilled human judgment, enhancing valuation reliability by incorporating contextual nuances such as neighborhood trends and property condition.

CMAs vs Automated Valuation Models Infographic

industrydif.com

industrydif.com