Mortgage financing offers traditional homebuyers stability through fixed interest rates and established lending institutions, ensuring predictable monthly payments and long-term financial planning. Blockchain financing leverages decentralized technology to provide faster transactions, reduced costs, and increased transparency by eliminating intermediaries in real estate deals. Choosing between mortgage and blockchain financing depends on factors like risk tolerance, desire for innovation, and the regulatory environment impacting property investments.

Table of Comparison

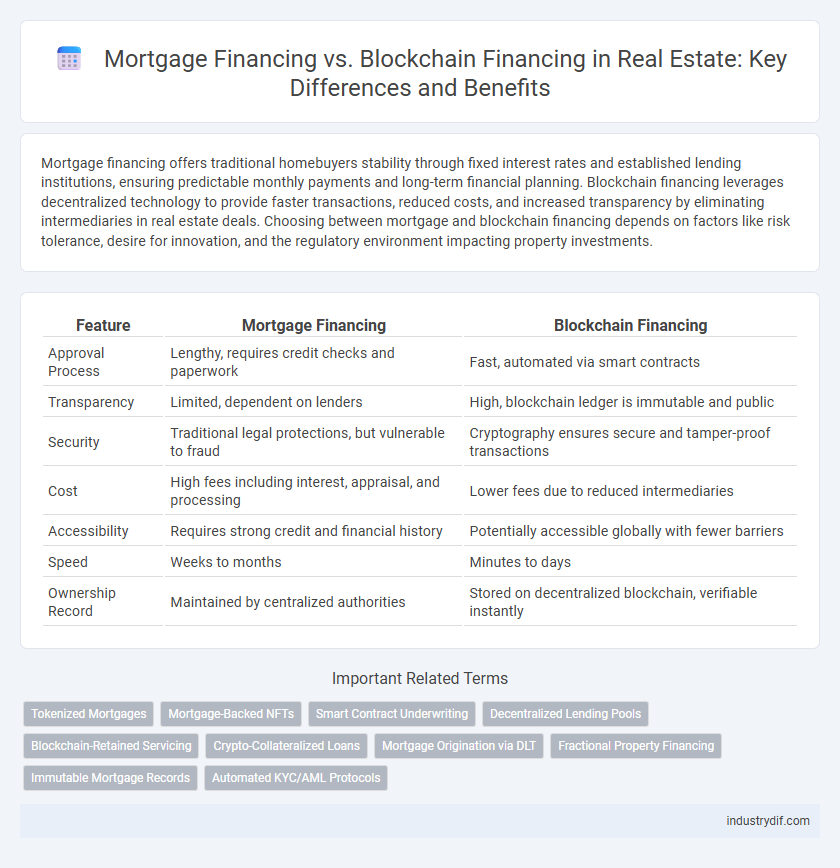

| Feature | Mortgage Financing | Blockchain Financing |

|---|---|---|

| Approval Process | Lengthy, requires credit checks and paperwork | Fast, automated via smart contracts |

| Transparency | Limited, dependent on lenders | High, blockchain ledger is immutable and public |

| Security | Traditional legal protections, but vulnerable to fraud | Cryptography ensures secure and tamper-proof transactions |

| Cost | High fees including interest, appraisal, and processing | Lower fees due to reduced intermediaries |

| Accessibility | Requires strong credit and financial history | Potentially accessible globally with fewer barriers |

| Speed | Weeks to months | Minutes to days |

| Ownership Record | Maintained by centralized authorities | Stored on decentralized blockchain, verifiable instantly |

Introduction to Mortgage and Blockchain Financing

Mortgage financing traditionally involves a lender providing a loan secured by real estate property, with repayments made over a set term and interest rate. Blockchain financing leverages decentralized digital ledgers to enable transparent, secure, and faster transactions without intermediaries. Both methods impact the real estate market by offering distinct advantages in terms of accessibility, speed, and trust.

Traditional Mortgage: Key Features

Traditional mortgage financing involves a lender providing a borrower with a loan secured by real estate property, typically requiring a fixed or variable interest rate and a repayment term of 15 to 30 years. The process requires extensive credit checks, income verification, and appraisal of the property to assess risk and determine loan eligibility. These mortgages typically involve intermediaries like banks and mortgage brokers, resulting in longer approval times and higher processing fees compared to blockchain-based alternatives.

Understanding Blockchain-Based Financing

Blockchain-based financing revolutionizes real estate mortgages by enabling decentralized, transparent transactions secured through cryptographic methods. Smart contracts automate loan agreements, reducing reliance on traditional intermediaries and minimizing processing times and costs. This technology enhances trust and efficiency in mortgage processing, offering a scalable alternative to conventional financing methods.

Eligibility Criteria: Mortgage vs Blockchain

Mortgage eligibility criteria typically require a strong credit score, stable income, and extensive documentation, including employment history and debt-to-income ratio assessments. Blockchain financing eligibility often prioritizes digital asset ownership and smart contract capabilities, enabling faster verification through decentralized ledgers without traditional credit checks. This shift reduces barriers for unbanked individuals and streamlines approval processes by leveraging blockchain transparency and security features.

Application Process Comparison

Mortgage financing requires extensive documentation, credit checks, and approval from financial institutions, often resulting in a time-consuming and rigid application process. Blockchain financing leverages smart contracts to automate verification and approval, enabling faster, transparent, and decentralized property transactions. The application for blockchain-based loans eliminates intermediaries, reducing processing times from weeks to hours while maintaining security through cryptographic protocols.

Transaction Speed and Efficiency

Blockchain financing revolutionizes real estate transactions by enabling near-instantaneous settlement times compared to traditional mortgage processes, which can take 30 to 45 days due to extensive paperwork and underwriting. The decentralized nature of blockchain reduces reliance on intermediaries, lowering transaction costs and minimizing errors through automated smart contracts. Enhanced transparency and security further streamline operations, driving efficiency and accelerating property transfers.

Security and Transparency Differences

Mortgage financing relies on traditional centralized institutions, which can be vulnerable to fraud and errors due to manual processes and opaque records. Blockchain financing offers enhanced security through decentralized, immutable ledgers that ensure transaction transparency and reduce the risk of tampering. Smart contracts automate mortgage terms, increasing trust and accelerating loan processing while maintaining secure and transparent digital records.

Cost and Fee Structures

Mortgage financing typically involves fixed interest rates, appraisal fees, origination fees, and closing costs, which can cumulatively increase the overall expense for homebuyers. Blockchain financing offers reduced transaction fees by eliminating intermediaries and leveraging smart contracts, lowering costs associated with loan processing and approval. The decentralized nature of blockchain also enables more transparent and potentially faster funding with fewer hidden charges compared to traditional mortgage models.

Risk Factors and Regulatory Challenges

Mortgage financing faces risks such as interest rate fluctuations, borrower creditworthiness, and foreclosure risks, while blockchain financing introduces challenges like smart contract vulnerabilities and cybersecurity threats. Regulatory challenges for traditional mortgages involve compliance with federal and state lending laws, whereas blockchain financing must navigate evolving regulations around digital assets, securities classification, and anti-money laundering (AML) standards. Both financing methods demand rigorous due diligence to mitigate financial exposure and ensure adherence to legal frameworks.

Future Trends in Real Estate Financing

Mortgage financing remains the dominant method for real estate purchases, but blockchain financing is rapidly gaining traction due to its potential for increased transparency, reduced transaction costs, and faster settlements. Future trends indicate a growing integration of smart contracts and decentralized finance (DeFi) platforms to streamline mortgage approvals and property transfers. This shift promises enhanced security and efficiency, fundamentally transforming how real estate financing is conducted worldwide.

Related Important Terms

Tokenized Mortgages

Tokenized mortgages leverage blockchain technology to create secure, transparent, and easily tradable digital assets, reducing the complexity and costs associated with traditional mortgage financing. This innovation enhances liquidity by enabling fractional ownership and faster settlement times compared to conventional mortgage processes.

Mortgage-Backed NFTs

Mortgage-backed NFTs revolutionize real estate financing by tokenizing mortgage assets on the blockchain, enabling increased liquidity and transparency compared to traditional mortgage financing. These digital securities reduce reliance on intermediaries, lower transaction costs, and provide fractional ownership opportunities, enhancing market accessibility for investors.

Smart Contract Underwriting

Smart contract underwriting leverages blockchain technology to automate and secure mortgage approval processes, reducing intermediaries and enhancing transparency in real estate financing. This decentralized approach ensures real-time verification of borrower data, minimizing fraud risk and expediting loan disbursement compared to traditional mortgage methods.

Decentralized Lending Pools

Decentralized lending pools leverage blockchain technology to enable peer-to-peer mortgage financing, reducing reliance on traditional banks and streamlining loan approval processes through smart contracts. These platforms increase transparency, lower costs, and offer borrowers access to a wider pool of lenders, optimizing liquidity and risk distribution in real estate financing.

Blockchain-Retained Servicing

Blockchain-Retained Servicing revolutionizes mortgage financing by securely managing loan servicing records on a decentralized ledger, enhancing transparency and reducing fraud risks compared to traditional mortgage servicing. This approach streamlines payment processing, escrow management, and investor reporting through smart contracts, delivering increased efficiency and cost savings in real estate finance.

Crypto-Collateralized Loans

Crypto-collateralized loans leverage blockchain technology to offer real estate financing by allowing borrowers to pledge digital assets such as Bitcoin or Ethereum as collateral, enabling faster approval and reduced reliance on traditional credit scores. These loans provide increased liquidity and transparency compared to conventional mortgages, with smart contracts automating repayment terms and reducing the risk of fraud.

Mortgage Origination via DLT

Mortgage origination via distributed ledger technology (DLT) enhances transparency, reduces processing time, and minimizes fraud risks by securely recording all transaction data on an immutable blockchain. This innovation streamlines lender-borrower interactions, automates compliance checks, and facilitates real-time verification of property titles and credit histories, outperforming traditional mortgage financing methods.

Fractional Property Financing

Fractional property financing leverages blockchain technology to enable multiple investors to own a percentage of real estate assets, increasing liquidity and reducing entry barriers compared to traditional mortgage financing that typically requires full loan applications and long approval processes. Blockchain's transparency and smart contracts streamline transactions, lower costs, and provide secure, immutable records, offering a more efficient alternative to conventional mortgage-based property investment.

Immutable Mortgage Records

Immutable mortgage records stored on blockchain enhance transparency and security by preventing tampering and fraud in real estate transactions. This technology ensures permanent, verifiable loan documentation, reducing disputes and streamlining mortgage approvals compared to traditional financing methods.

Automated KYC/AML Protocols

Automated KYC/AML protocols in blockchain financing streamline identity verification and compliance by leveraging smart contracts and decentralized ledgers, reducing fraud risk and enhancing transaction transparency. Traditional mortgage processes rely heavily on manual KYC/AML checks, leading to longer approval times and increased administrative costs.

Mortgage vs Blockchain Financing Infographic

industrydif.com

industrydif.com