Choosing between a traditional lease and long-term Airbnb rental depends on financial goals and tenant preferences. Leasing offers stable monthly income with reduced management responsibilities, while long-term Airbnb can generate higher returns through flexible pricing and short-term stays. Consider market demand, property location, and maintenance capabilities to determine the optimal strategy for maximizing profitability in real estate investments.

Table of Comparison

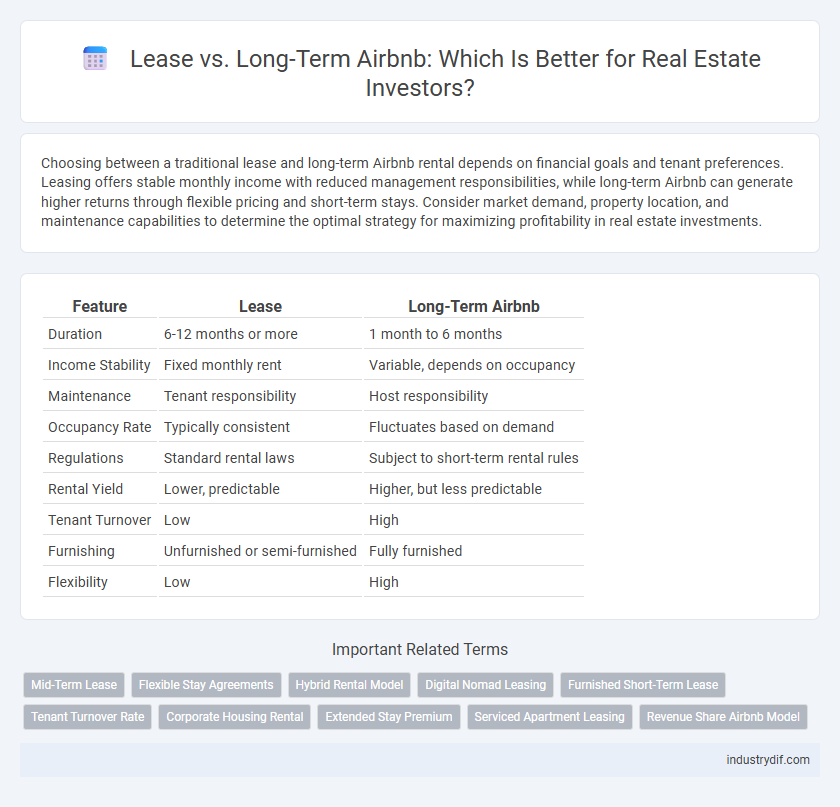

| Feature | Lease | Long-Term Airbnb |

|---|---|---|

| Duration | 6-12 months or more | 1 month to 6 months |

| Income Stability | Fixed monthly rent | Variable, depends on occupancy |

| Maintenance | Tenant responsibility | Host responsibility |

| Occupancy Rate | Typically consistent | Fluctuates based on demand |

| Regulations | Standard rental laws | Subject to short-term rental rules |

| Rental Yield | Lower, predictable | Higher, but less predictable |

| Tenant Turnover | Low | High |

| Furnishing | Unfurnished or semi-furnished | Fully furnished |

| Flexibility | Low | High |

Understanding Lease Agreements in Real Estate

Lease agreements in real estate establish legally binding terms between landlords and tenants, specifying rent amount, duration, and responsibilities. Detailed clauses such as maintenance obligations, renewal options, and termination conditions help mitigate disputes and ensure clarity. Understanding these provisions is crucial when comparing traditional long-term leases to Airbnb short-term rental models to make informed investment decisions.

What is a Long-Term Airbnb Rental?

A long-term Airbnb rental typically refers to a booking that lasts 28 days or more, blending the flexibility of short-term vacation rentals with the stability of traditional leases. This type of rental caters to travelers or professionals seeking extended stays without committing to conventional lease terms, often offering furnished spaces with utilities included. Property owners benefit from consistent income while maintaining the option to adjust rental terms more frequently than with standard leases.

Key Differences: Lease vs. Long-Term Airbnb

Leases typically involve fixed-term agreements ranging from six months to several years, offering tenants stability and predictable monthly rent, while long-term Airbnb rentals provide flexibility with shorter booking durations and fluctuating pricing based on demand. Leases often require background checks, security deposits, and formal contracts, whereas long-term Airbnb hosts may prioritize guest reviews and offer furnished apartments with utilities included. The decision between lease and long-term Airbnb depends on factors like desired commitment length, rental price stability, and level of landlord-tenant interaction.

Financial Implications for Property Owners

Lease agreements provide property owners with consistent monthly income and reduced management responsibilities, making them financially stable options for long-term revenue. Long-term Airbnb rentals, while potentially more lucrative, involve higher operating costs, frequent tenant turnover, and fluctuating occupancy rates that can impact cash flow. Property owners must weigh steady lease payments against unpredictable short-term rental income to optimize profitability.

Flexibility and Commitment: A Comparative Analysis

Lease agreements offer stability with fixed terms, typically ranging from six months to a year, ensuring predictable monthly rental costs and tenant rights protection. Long-term Airbnb rentals provide greater flexibility, allowing tenants to adjust stay durations, access fully furnished properties, and avoid traditional lease commitments, but often at a higher monthly rate. Choosing between lease and long-term Airbnb depends on prioritizing cost predictability and tenant protections versus flexible stay options and furnished accommodations.

Legal Considerations and Local Regulations

Lease agreements offer more predictable legal protection and clearly defined tenant rights under local landlord-tenant laws, while long-term Airbnb rentals often require compliance with short-term rental permits, zoning restrictions, and tax regulations that vary significantly by city. Property owners must thoroughly review municipal ordinances, homeowner association rules, and tax obligations to avoid fines or legal disputes associated with short-term rental platforms. Understanding eviction processes, security deposit limitations, and occupancy limits is essential for mitigating legal risks in both leasing and Airbnb arrangements.

Income Stability: Predictable Rent vs. Variable Earnings

Lease agreements provide income stability through fixed monthly rent payments, ensuring predictable cash flow for property owners. In contrast, long-term Airbnb rentals generate variable earnings influenced by occupancy rates, seasonal demand, and market trends. Property investors seeking consistent revenue often prefer leases, while those willing to manage fluctuations may benefit from potentially higher Airbnb returns.

Tenant Screening and Guest Turnover

Tenant screening for long-term leases involves thorough background checks, credit assessments, and reference verifications to ensure reliable occupancy and stable rental income. In contrast, Airbnb guests undergo expedited verification processes, resulting in higher guest turnover and increased management efforts. High turnover on Airbnb can lead to more frequent maintenance and cleaning costs, while long-term leases minimize vacancy rates and foster consistent tenant relationships.

Maintenance and Property Management Concerns

Lease agreements generally require less frequent maintenance due to longer tenant stays and more stable usage patterns, reducing management efforts compared to Airbnb properties. Long-term Airbnb rentals often experience higher tenant turnover, increasing wear and tear, which necessitates more frequent property inspections, cleaning, and repairs. Effective property management for Airbnb demands a proactive approach to scheduling maintenance and addressing guest-related issues promptly to maintain property standards and ratings.

Which Option Suits Your Investment Strategy?

Choosing between a traditional lease and long-term Airbnb rental depends on your investment goals, risk tolerance, and cash flow requirements. Traditional leases offer stable, predictable income with lower vacancy rates, while long-term Airbnb rentals can generate higher returns through dynamic pricing and premium nightly rates but require more management and face regulatory challenges. Assessing local market demand, property location, and legal environment helps determine which rental strategy aligns best with maximizing your real estate investment returns.

Related Important Terms

Mid-Term Lease

Mid-term leases, typically ranging from one to six months, offer a flexible alternative between traditional long-term leases and short-term Airbnb stays, catering to professionals and remote workers seeking comfortable, fully furnished accommodations without the commitment of a year-long contract. This lease type optimizes occupancy rates for property owners while minimizing turnover costs compared to Airbnb, providing a stable income stream with less wear and tear on the property.

Flexible Stay Agreements

Flexible stay agreements in real estate offer tenants the adaptability of short-term leases similar to Airbnb rentals while providing the stability and legal protections of traditional long-term leases. These hybrid contracts balance the demand for flexible living arrangements with landlord assurances, optimizing occupancy rates and tenant satisfaction.

Hybrid Rental Model

The hybrid rental model combines the stability of long-term leases with the higher income potential of short-term Airbnb rentals by alternating between tenant types based on market demand and occupancy rates. This approach maximizes property revenue while maintaining consistent occupancy, leveraging dynamic pricing algorithms and targeted marketing strategies to optimize yield.

Digital Nomad Leasing

Digital nomad leasing offers a flexible alternative to traditional long-term leases by combining the stability of lease agreements with the short-term convenience of Airbnb rentals. This hybrid approach caters to remote workers seeking furnished properties with adaptable lease durations and reliable internet, enhancing productivity while simplifying property management for landlords.

Furnished Short-Term Lease

Furnished short-term leases offer flexibility and higher rental income compared to traditional long-term leases, attracting tenants seeking temporary housing without the commitment of a typical lease term. In contrast to Airbnb, these leases provide landlords with stable tenant agreements and reduced turnover, minimizing vacancy risks while capitalizing on the demand for fully equipped rental properties.

Tenant Turnover Rate

Lease agreements typically result in a lower tenant turnover rate due to fixed rental terms lasting six months to a year, promoting stability and consistent occupancy for property owners. Long-term Airbnb rentals experience higher tenant turnover rates as guests often book stays ranging from days to weeks, increasing vacancy risks and management demands.

Corporate Housing Rental

Corporate housing rentals offer flexible lease terms and fully furnished accommodations ideal for business travelers, providing a cost-effective alternative to long-term Airbnb stays. These rentals often include utilities, maintenance, and amenities tailored to professional needs, ensuring convenience and stability that traditional leases may lack.

Extended Stay Premium

Extended Stay Premium combines the benefits of lease stability with the flexibility and higher income potential of long-term Airbnb rentals, attracting tenants seeking quality accommodations for several weeks to months. This hybrid model maximizes occupancy rates and revenue by targeting business travelers and remote workers preferring comfortable, well-equipped spaces beyond traditional short stays.

Serviced Apartment Leasing

Serviced apartment leasing offers a flexible alternative to long-term Airbnb rentals by providing fully furnished units with hotel-like amenities tailored for extended stays, attracting corporate clients and business travelers. Unlike traditional leases, serviced apartments combine the convenience of short-term rentals with the stability of long-term leases, optimizing occupancy rates and generating higher revenue per available unit.

Revenue Share Airbnb Model

The revenue share Airbnb model often generates higher short-term income compared to traditional long-term leases by capitalizing on dynamic pricing and increased occupancy rates in high-demand areas. Property owners benefit from flexible rental terms and professional management, which can optimize revenue streams while maintaining asset value.

Lease vs Long-term Airbnb Infographic

industrydif.com

industrydif.com