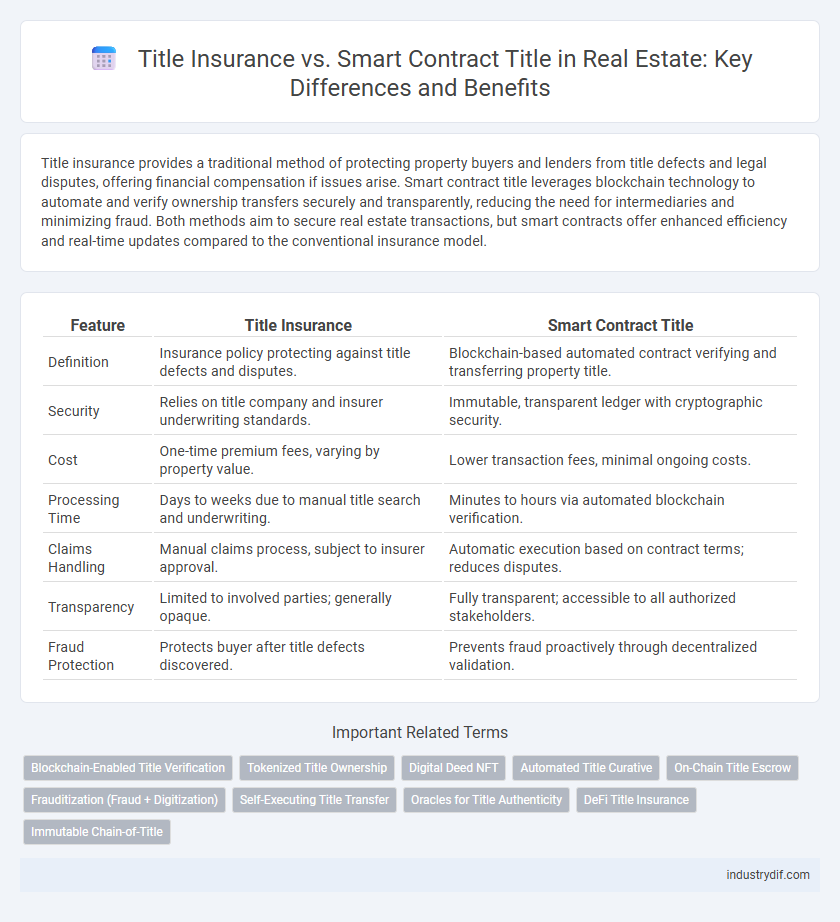

Title insurance provides a traditional method of protecting property buyers and lenders from title defects and legal disputes, offering financial compensation if issues arise. Smart contract title leverages blockchain technology to automate and verify ownership transfers securely and transparently, reducing the need for intermediaries and minimizing fraud. Both methods aim to secure real estate transactions, but smart contracts offer enhanced efficiency and real-time updates compared to the conventional insurance model.

Table of Comparison

| Feature | Title Insurance | Smart Contract Title |

|---|---|---|

| Definition | Insurance policy protecting against title defects and disputes. | Blockchain-based automated contract verifying and transferring property title. |

| Security | Relies on title company and insurer underwriting standards. | Immutable, transparent ledger with cryptographic security. |

| Cost | One-time premium fees, varying by property value. | Lower transaction fees, minimal ongoing costs. |

| Processing Time | Days to weeks due to manual title search and underwriting. | Minutes to hours via automated blockchain verification. |

| Claims Handling | Manual claims process, subject to insurer approval. | Automatic execution based on contract terms; reduces disputes. |

| Transparency | Limited to involved parties; generally opaque. | Fully transparent; accessible to all authorized stakeholders. |

| Fraud Protection | Protects buyer after title defects discovered. | Prevents fraud proactively through decentralized validation. |

Understanding Traditional Title Insurance

Traditional title insurance protects property buyers and lenders from financial loss due to defects in title, such as liens, encumbrances, or ownership disputes that may arise after the purchase. It involves a thorough title search conducted by professionals to uncover any issues before closing and provides a one-time premium coverage that remains effective as long as the insured party owns the property. This method offers legal defense and indemnity against covered title defects, establishing security in real estate transactions through a trusted insurance policy.

Introduction to Smart Contract Title Solutions

Smart contract title solutions revolutionize traditional real estate title insurance by automating verification and transfer processes using blockchain technology, reducing fraud and settlement times. These decentralized systems ensure transparent, tamper-proof records, enhancing trust between buyers, sellers, and lenders in property transactions. Adoption of smart contract titles streamlines closing procedures while maintaining comprehensive protection typically provided by conventional title insurance policies.

Key Differences Between Title Insurance and Smart Contracts

Title insurance protects property buyers from financial loss due to defects in the ownership title, providing a traditional, legally recognized safeguard after thorough title searches. Smart contract titles use blockchain technology to automate property transfers and verify ownership through encrypted, tamper-proof digital records, reducing the need for intermediaries. Unlike title insurance, smart contracts offer real-time transparency and faster transactions but rely on emerging technology that may not yet be universally accepted or legally standardized.

Advantages of Traditional Title Insurance

Traditional title insurance offers comprehensive protection against title defects, fraud, and undiscovered liens, ensuring buyers and lenders are financially safeguarded. It provides professional title searches and legal defense in case of disputes, backed by experienced insurers with established reputations. This reliability and proven track record make traditional title insurance a trusted choice in real estate transactions.

Benefits of Smart Contract-Based Title Systems

Smart contract-based title systems offer enhanced transparency and security by automating property ownership verification on a decentralized blockchain. These systems reduce the risk of fraud and errors through immutable records and real-time updates, streamlining the title transfer process. Smart contracts also significantly lower transaction costs and processing times compared to traditional title insurance, improving efficiency in real estate transactions.

Risk Management: Title Insurance vs Smart Contracts

Title insurance provides robust financial protection by mitigating risks related to ownership disputes and liens through thorough title searches and indemnity coverage. Smart contract title systems leverage blockchain technology to enhance transparency and reduce fraud by automating property transfers and verifying ownership records in real-time. While title insurance covers unforeseen legal defects, smart contracts offer proactive risk management by ensuring immutable and verifiable transaction histories.

Costs and Efficiency in Title Transfer Processes

Title insurance typically incurs upfront premiums averaging 0.5% to 1% of the property value, ensuring protection against title defects but often leading to longer closing times due to manual verification processes. Smart contract titles leverage blockchain technology to automate verification and settlement, significantly reducing transaction costs by eliminating intermediaries and accelerating title transfers from weeks to just days or even minutes. The efficiency gains from smart contract titles not only lower expenses but also enhance transparency and security in real estate transactions.

Legal Considerations and Regulatory Compliance

Title insurance provides a legally recognized guarantee protecting property buyers from defects or disputes related to ownership, adhering to established regulatory frameworks and state-specific requirements. Smart contract titles operate on blockchain technology, offering automated, transparent record-keeping but currently face evolving legal acceptance and varying compliance standards across jurisdictions. Understanding the regulatory environment governing both systems is crucial for ensuring enforceability and mitigating risk in real estate transactions.

Future Trends in Real Estate Title Management

Title insurance remains a crucial safeguard against ownership disputes and liens in traditional real estate transactions, providing financial protection through underwritten policies. Smart contract titles, leveraging blockchain technology, automate verification and recording processes, enabling transparent, tamper-proof, and instantaneous property title transfers. Future trends in real estate title management emphasize integrating decentralized ledgers to reduce fraud, streamline closings, and lower costs, signaling a shift toward hybrid models combining title insurance security with smart contract efficiency.

Choosing the Right Title Solution for Your Property

Title insurance provides a traditional guarantee against title defects and liens, offering financial protection through a comprehensive search and risk assessment. Smart contract titles leverage blockchain technology to automate transactions, ensuring transparency, reducing fraud, and enabling faster, cost-efficient transfers. Evaluating your property's complexity, legal requirements, and the importance of digital security will guide you in selecting the most effective title solution.

Related Important Terms

Blockchain-Enabled Title Verification

Title insurance provides traditional protection against ownership disputes through third-party underwriters, while blockchain-enabled smart contract titles offer transparent, immutable verification directly on the blockchain, reducing fraud and accelerating property transfers. Smart contracts automate title verification by recording every transaction securely, enhancing trust and efficiency in real estate ownership verification processes.

Tokenized Title Ownership

Title insurance protects property buyers from defects in ownership by covering financial losses due to title disputes, while smart contract titles leverage blockchain technology to enable tokenized title ownership, ensuring transparent, immutable records and streamlined transactions. Tokenized titles convert ownership into digital tokens that can be securely transferred, reducing fraud risk and enhancing the efficiency of property transfers in the real estate market.

Digital Deed NFT

Title insurance provides traditional protection against defects in property ownership, while Smart Contract Titles leverage blockchain technology to create Digital Deed NFTs that offer transparent, tamper-proof records of ownership and facilitate seamless property transfers. Digital Deed NFTs enhance real estate transactions by reducing fraud risks and enabling instant verification of property history through decentralized ledgers.

Automated Title Curative

Automated Title Curative significantly enhances the accuracy and efficiency of resolving title defects compared to traditional Title Insurance, leveraging blockchain-based Smart Contract Titles to instantly verify property ownership and automate lien clearance. This technology reduces human error, accelerates transaction times, and decreases costs by providing transparent, tamper-proof records that streamline the title curative process in real estate transactions.

On-Chain Title Escrow

Title insurance protects real estate buyers from title defects and disputes by providing financial coverage, while smart contract title using on-chain title escrow automates ownership transfer through blockchain, enhancing transparency and reducing fraud risks. On-chain title escrow securely holds property titles in a decentralized ledger, ensuring tamper-proof records and seamless, verified transactions without intermediaries.

Frauditization (Fraud + Digitization)

Title insurance protects real estate buyers from financial losses due to title defects or fraud by providing a verified legal guarantee, whereas smart contract titles leverage blockchain technology to enhance transparency, reduce fraud risks, and automate property transfer processes through decentralized ledger authentication. The frauditization trend merges traditional title security with digitization, minimizing human error and fraudulent claims by recording immutable ownership data on blockchain platforms.

Self-Executing Title Transfer

Title insurance provides buyers protection against defects or disputes in property ownership by covering financial losses, while smart contract titles utilize blockchain technology for self-executing title transfers that automate ownership verification and reduce the need for intermediaries. The self-executing nature of smart contract titles ensures faster, transparent, and tamper-proof real estate transactions, enhancing security and efficiency compared to traditional title insurance processes.

Oracles for Title Authenticity

Title insurance provides financial protection against title defects through traditional title searches and insurer underwriting, while smart contract titles leverage blockchain technology and oracles to verify title authenticity in real-time by linking on-chain data with off-chain information. Oracles play a crucial role in smart contract titles by ensuring accurate, tamper-proof property records and enabling automated, transparent ownership transfers without intermediaries.

DeFi Title Insurance

DeFi title insurance leverages blockchain technology to offer transparent, automated, and tamper-proof property ownership verification, reducing fraud and settlement delays compared to traditional title insurance. Unlike conventional title insurance policies that involve lengthy underwriting and manual claims processes, smart contract titles enable instantaneous, decentralized property transfers secured by cryptographic proofs and immutable transaction records.

Immutable Chain-of-Title

Title insurance protects real estate buyers from financial loss due to defects in the title, while smart contract titles leverage blockchain technology to create an immutable chain-of-title that ensures transparent, tamper-proof property ownership records. The immutable nature of blockchain enhances security and reliability by permanently recording each transaction, reducing fraud and streamlining the transfer process.

Title Insurance vs Smart Contract Title Infographic

industrydif.com

industrydif.com