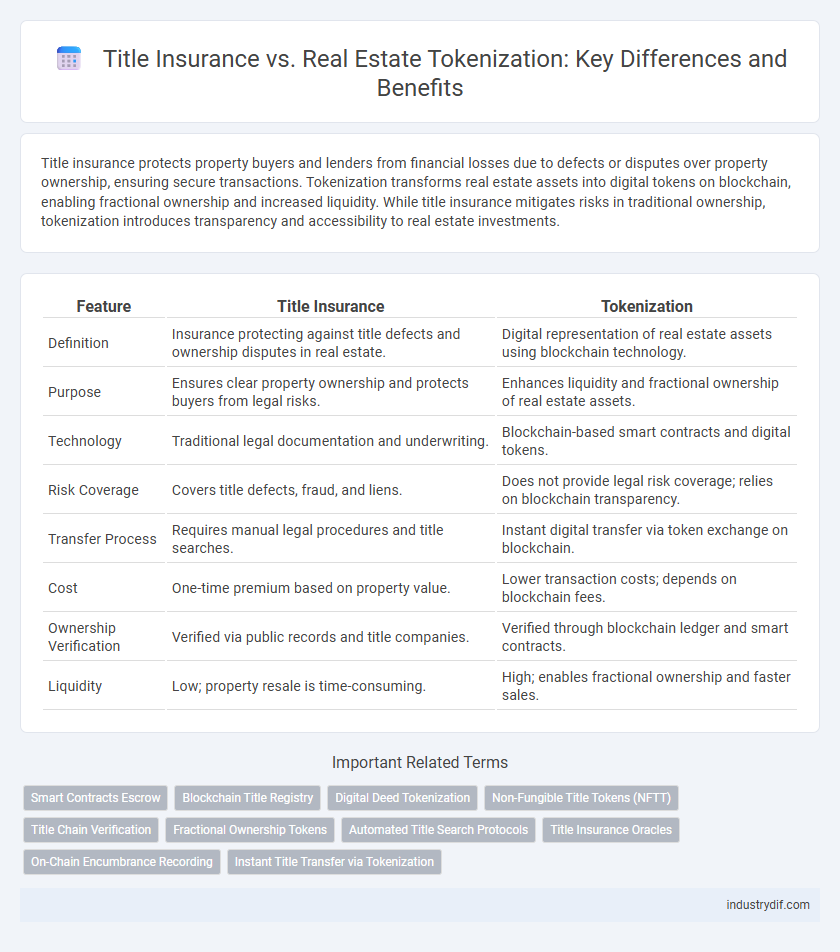

Title insurance protects property buyers and lenders from financial losses due to defects or disputes over property ownership, ensuring secure transactions. Tokenization transforms real estate assets into digital tokens on blockchain, enabling fractional ownership and increased liquidity. While title insurance mitigates risks in traditional ownership, tokenization introduces transparency and accessibility to real estate investments.

Table of Comparison

| Feature | Title Insurance | Tokenization |

|---|---|---|

| Definition | Insurance protecting against title defects and ownership disputes in real estate. | Digital representation of real estate assets using blockchain technology. |

| Purpose | Ensures clear property ownership and protects buyers from legal risks. | Enhances liquidity and fractional ownership of real estate assets. |

| Technology | Traditional legal documentation and underwriting. | Blockchain-based smart contracts and digital tokens. |

| Risk Coverage | Covers title defects, fraud, and liens. | Does not provide legal risk coverage; relies on blockchain transparency. |

| Transfer Process | Requires manual legal procedures and title searches. | Instant digital transfer via token exchange on blockchain. |

| Cost | One-time premium based on property value. | Lower transaction costs; depends on blockchain fees. |

| Ownership Verification | Verified via public records and title companies. | Verified through blockchain ledger and smart contracts. |

| Liquidity | Low; property resale is time-consuming. | High; enables fractional ownership and faster sales. |

Understanding Title Insurance in Real Estate

Title insurance protects real estate buyers and lenders from losses due to defects in property ownership, such as liens, encumbrances, or errors in public records. It provides financial security by covering legal costs and claims that arise after the property transaction is completed. Unlike tokenization, which digitizes property ownership through blockchain, title insurance remains a traditional safeguard ensuring clear and marketable title.

What is Tokenization of Real Estate Assets?

Tokenization of real estate assets involves converting ownership rights into digital tokens on a blockchain, enabling fractional ownership and increased liquidity in the property market. This method facilitates easier transferability and accessibility for investors by breaking down large assets into smaller, tradable units. Unlike title insurance, which protects against title defects, tokenization focuses on asset digitization and democratizing real estate investment through transparent, secure transactions.

Key Differences Between Title Insurance and Tokenization

Title insurance provides financial protection against property ownership disputes and defects in the title, ensuring buyers and lenders are safeguarded in traditional real estate transactions. Tokenization digitizes real estate assets by converting ownership rights into blockchain-based tokens, enabling fractional ownership, enhanced liquidity, and streamlined transfer processes. Unlike title insurance's risk mitigation, tokenization focuses on asset digitization and market accessibility, representing a fundamental shift in how property rights are managed and transferred.

Benefits of Title Insurance for Property Owners

Title insurance protects property owners from financial loss due to defects in property titles, such as liens, encumbrances, or ownership disputes, ensuring clear ownership rights. It offers peace of mind by covering legal fees and claims that might arise after purchase, safeguarding investments against unforeseen title issues. Unlike tokenization, which focuses on asset digitization and liquidity, title insurance provides direct, tangible protection for real estate ownership and transactions.

Advantages of Real Estate Tokenization

Real estate tokenization enables fractional ownership, significantly lowering entry barriers for investors by allowing smaller, more accessible investment amounts. It enhances liquidity by facilitating faster and more efficient transactions through blockchain technology, reducing the reliance on traditional title insurance processes. Tokenization also offers increased transparency and security, as all transaction records are immutably stored on a decentralized ledger, minimizing risks associated with title fraud or errors.

Risk Management: Title Insurance vs. Tokenized Properties

Title insurance protects property owners and lenders from losses due to defects in the property's title, offering a financial safeguard against claims and hidden title issues. Tokenization of properties leverages blockchain technology to distribute ownership rights through digital tokens, enhancing transparency and reducing fraud risks but introducing new cybersecurity and regulatory concerns. Effective risk management in real estate increasingly involves balancing the traditional security of title insurance with the innovation and potential vulnerabilities of tokenized property assets.

Legal and Regulatory Considerations

Title insurance provides a traditional legal safeguard by guaranteeing clear property ownership and protecting against defects in the title under established regulatory frameworks. Tokenization introduces a blockchain-based method for representing real estate ownership, raising new regulatory questions about securities laws, digital asset classification, and compliance with existing property transfer statutes. Legal considerations for tokenization require navigating uncharted regulatory landscapes, emphasizing the need for robust frameworks to validate digital titles and ensure investor protection.

Impact on Real Estate Transactions

Title insurance guarantees protection against ownership disputes and hidden liens, ensuring secure property transfers in traditional real estate transactions. Tokenization revolutionizes the market by enabling fractional ownership and faster, blockchain-based settlements, reducing transaction costs and increasing liquidity. Both impact real estate by enhancing security and efficiency, but tokenization introduces greater accessibility and real-time verification compared to conventional title insurance methods.

Costs Involved: Title Insurance vs. Tokenization

Title insurance involves upfront premium costs typically ranging from 0.5% to 1% of the property's purchase price, covering risks such as liens and ownership disputes. Tokenization in real estate requires ongoing blockchain transaction fees and technology platform costs, which can vary widely depending on the token issuance and trading volume. While title insurance provides a fixed, predictable cost for risk mitigation, tokenization expenses fluctuate with market activity and platform complexity.

Future Trends in Title Insurance and Tokenized Real Estate

Future trends in title insurance include increased integration of blockchain technology to enhance transparency and reduce fraud. Tokenized real estate leverages digital assets to enable fractional ownership, increasing liquidity and accessibility for investors. These innovations are transforming traditional real estate transactions by streamlining processes and expanding market participation.

Related Important Terms

Smart Contracts Escrow

Title insurance secures property ownership by protecting against title defects and claims, while tokenization leverages smart contracts escrow to automate and enforce real estate transactions, reducing intermediaries and increasing transparency. Smart contracts escrow in tokenization ensures funds are held securely and released only when predefined conditions are met, streamlining the closing process and enhancing trust in property transfers.

Blockchain Title Registry

Blockchain Title Registry leverages decentralized ledger technology to enhance transparency and reduce fraud in real estate ownership records, contrasting traditional title insurance that relies on centralized verification and risk assessment. Tokenization of property titles on blockchain enables fractional ownership and seamless transferability, fundamentally transforming title transfer processes by ensuring immutable and easily auditable records.

Digital Deed Tokenization

Digital deed tokenization revolutionizes real estate ownership by converting property titles into blockchain-based tokens that enhance transparency, reduce fraud, and streamline transactions compared to traditional title insurance methods. This innovative approach enables fractional ownership, faster property transfers, and immutable record-keeping, positioning tokenization as a future-forward alternative within the title insurance landscape.

Non-Fungible Title Tokens (NFTT)

Non-Fungible Title Tokens (NFTTs) represent a revolutionary shift in real estate ownership by providing blockchain-based proof of title that is tamper-proof and easily transferable, unlike traditional title insurance which only offers financial protection against title defects. NFTTs enhance transparency and reduce fraud risks by embedding property rights directly into a digital ledger, enabling faster transactions and streamlined verification for buyers, sellers, and lenders.

Title Chain Verification

Title insurance provides a traditional safeguard by verifying ownership history through title chain verification, ensuring protection against potential legal claims. Tokenization leverages blockchain technology to create an immutable, transparent record of ownership transfers, enhancing accuracy and reducing fraud in the title verification process.

Fractional Ownership Tokens

Fractional Ownership Tokens revolutionize real estate investment by enabling multiple investors to hold secured shares of a property on a blockchain, providing transparency and liquidity compared to traditional Title Insurance that primarily protects against ownership disputes. Tokenization enhances asset transfer efficiency and reduces transaction costs, while Title Insurance offers risk mitigation for title defects in conventional property deals.

Automated Title Search Protocols

Automated title search protocols streamline property ownership verification through advanced blockchain technology, enhancing accuracy and reducing human error compared to traditional title insurance processes. Tokenization enables fractional ownership and faster transactions, but relies heavily on reliable automated title searches to ensure clear, undisputed property titles.

Title Insurance Oracles

Title insurance protects property buyers and lenders from financial losses due to defects in a property's title that may arise after the purchase, ensuring secure ownership transfer and reducing legal risks. Title insurance oracles integrate blockchain technology with real-time title record verification, enhancing accuracy and trustworthiness in title insurance processes while bridging traditional property data with decentralized ledger systems.

On-Chain Encumbrance Recording

Title insurance provides protection against disputes over property ownership by verifying and insuring the title, while tokenization enables on-chain encumbrance recording that transparently tracks liens, mortgages, and claims in a decentralized ledger. Blockchain-based tokenization enhances real estate transactions by ensuring immutable, real-time updates of encumbrance status, reducing fraud and settlement delays compared to traditional title insurance processes.

Instant Title Transfer via Tokenization

Tokenization enables instant title transfer by representing property ownership as secure digital tokens on a blockchain, eliminating the lengthy verification processes typically associated with traditional title insurance. This technology enhances transparency, reduces fraud risks, and significantly speeds up real estate transactions by allowing immediate ownership settlement without extensive paperwork or manual title searches.

Title Insurance vs Tokenization Infographic

industrydif.com

industrydif.com