Background checks provide a comprehensive review of a tenant's history, including credit reports, criminal records, and eviction history, ensuring landlords have detailed insights into potential risks. Instant ID verification offers a quick method to confirm a tenant's identity and prevent fraud by validating government-issued IDs in real-time. Combining both methods enhances renter screening efficiency, balancing thorough risk assessment with expedited approval processes.

Table of Comparison

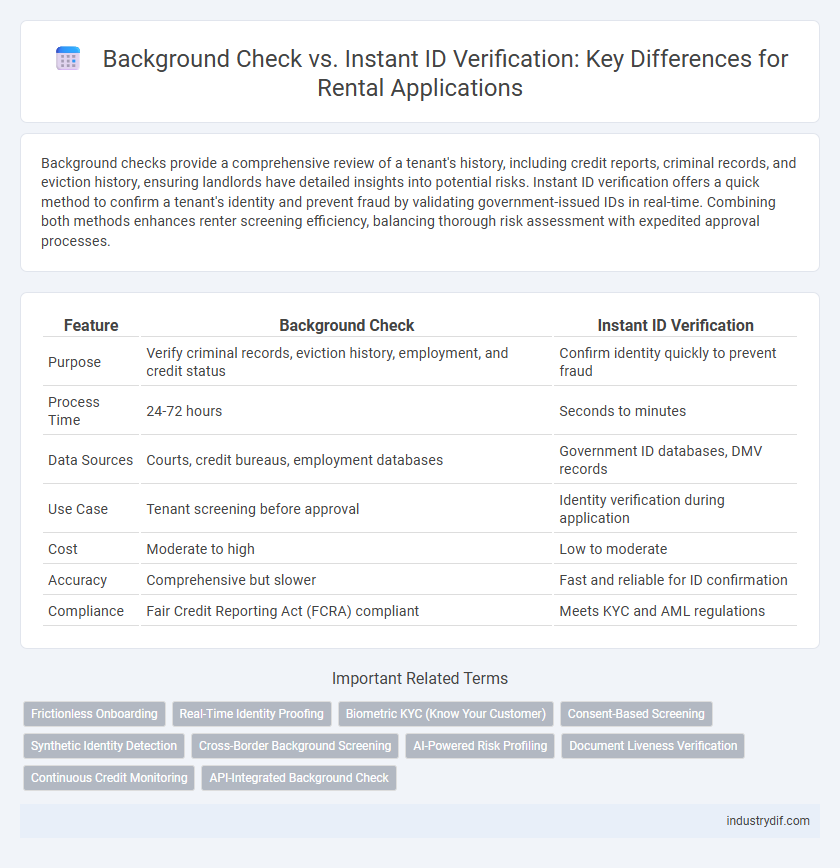

| Feature | Background Check | Instant ID Verification |

|---|---|---|

| Purpose | Verify criminal records, eviction history, employment, and credit status | Confirm identity quickly to prevent fraud |

| Process Time | 24-72 hours | Seconds to minutes |

| Data Sources | Courts, credit bureaus, employment databases | Government ID databases, DMV records |

| Use Case | Tenant screening before approval | Identity verification during application |

| Cost | Moderate to high | Low to moderate |

| Accuracy | Comprehensive but slower | Fast and reliable for ID confirmation |

| Compliance | Fair Credit Reporting Act (FCRA) compliant | Meets KYC and AML regulations |

Introduction to Rental Industry Verification

Rental industry verification relies on both background checks and instant ID verification to ensure tenant reliability and security. Background checks provide comprehensive information on criminal history, credit scores, and rental history, helping landlords assess long-term suitability. Instant ID verification offers quick validation of identity and fraud prevention, streamlining the tenant screening process without compromising accuracy.

Defining Background Checks in Rentals

Background checks in rentals involve a thorough examination of an applicant's criminal history, credit score, eviction records, and employment verification to assess their reliability as a tenant. This process helps landlords mitigate risks by identifying potential red flags that could affect timely rent payments and property maintenance. Unlike instant ID verification, background checks provide a comprehensive view of a renter's history beyond mere identity confirmation.

What Is Instant ID Verification?

Instant ID verification is a technology used in rental applications to quickly confirm a tenant's identity by cross-referencing government-issued IDs with real-time databases. This process enhances security by detecting fraudulent documents and providing immediate confirmation of identity, significantly reducing wait times compared to traditional background checks. Instant ID verification supports faster leasing decisions by streamlining identity validation while maintaining compliance with legal standards.

Key Differences: Background Check vs Instant ID Verification

Background checks provide a comprehensive review of an applicant's criminal history, credit report, and eviction records, offering landlords detailed insights into potential risks. Instant ID verification, on the other hand, quickly confirms the authenticity of the applicant's identity using government-issued IDs and facial recognition technology, ensuring the person is who they claim to be. While background checks emphasize past behavior and financial reliability, instant ID verification focuses on real-time identity confirmation to prevent fraud during the rental application process.

Benefits of Background Checks for Landlords

Background checks provide landlords with comprehensive insights into a tenant's rental history, criminal records, and creditworthiness, helping to reduce the risk of property damage and unpaid rent. Unlike instant ID verification, which only confirms identity, background checks offer detailed information that supports better decision-making and tenant screening. This thorough evaluation improves tenant reliability and contributes to a more secure rental environment.

Advantages of Instant ID Verification for Tenants

Instant ID verification offers tenants a faster, more convenient application process by providing immediate confirmation of identity and reducing wait times compared to traditional background checks. This method enhances tenant privacy by minimizing the sharing of extensive personal information and lowers the risk of errors commonly associated with manual data entry. Instant ID verification often integrates seamlessly with digital rental platforms, streamlining tenant approval and improving overall rental experience efficiency.

Speed vs Accuracy: Choosing the Right Verification Method

Instant ID verification prioritizes speed by quickly confirming identity through real-time database cross-references, making it ideal for fast-paced rental environments. Background checks provide a more thorough assessment by examining criminal records, credit history, and eviction reports, ensuring accuracy and reliability in tenant screening. Choosing the right verification method depends on balancing the need for rapid tenant approval with the importance of comprehensive risk evaluation.

Regulatory Compliance in Tenant Screening

Background checks provide a comprehensive review of a tenant's criminal history, credit reports, and eviction records, ensuring landlords meet regulatory compliance for tenant screening. Instant ID verification streamlines identity validation by cross-referencing government-issued IDs with authoritative databases, reducing fraud risk while maintaining adherence to legal standards. Both methods help landlords comply with Fair Housing Act regulations and local tenant screening laws, protecting against discrimination and negligence claims.

Impact on Rental Application Process

Background checks provide a comprehensive review of an applicant's rental history, criminal records, and credit information, which can lengthen the rental application process due to detailed data gathering and verification. Instant ID verification streamlines tenant screening by quickly confirming identity and reducing the time landlords spend on preliminary checks, significantly speeding up approval decisions. Integrating instant ID verification with thorough background checks balances efficiency and accuracy, improving the overall rental application experience for both landlords and applicants.

Best Practices for Rental Verification

Background checks provide comprehensive screening including criminal records, credit history, and eviction reports essential for informed rental decisions. Instant ID verification offers rapid confirmation of identity, minimizing fraud risk and speeding up tenant approval processes. Best practices combine both methods to ensure reliable tenant screening while enhancing efficiency and security in rental verification.

Related Important Terms

Frictionless Onboarding

Background checks provide comprehensive tenant screening by analyzing criminal records, credit history, and eviction reports, ensuring long-term reliability while potentially delaying the onboarding process. Instant ID verification streamlines rental applications through real-time identity confirmation using government-issued IDs and biometrics, enabling frictionless onboarding with minimal wait times.

Real-Time Identity Proofing

Real-Time Identity Proofing enhances rental security by instantly verifying applicant identities through biometric data and government databases, reducing fraud more effectively than traditional background checks. While background checks provide comprehensive past records, instant ID verification offers immediate confirmation of identity, streamlining the tenant screening process.

Biometric KYC (Know Your Customer)

Biometric KYC in rental processes enhances security by using fingerprint, facial recognition, or iris scans to verify identities more accurately than traditional background checks. Instant ID verification combined with biometrics reduces fraud risk and expedites tenant screening, ensuring compliance with regulatory standards while improving user experience.

Consent-Based Screening

Consent-based screening through background checks ensures landlords obtain authorized permission to access credit, criminal, and eviction records, providing a comprehensive tenant profile essential for reducing rental risks. Instant ID verification offers quick identity confirmation but lacks the depth of detailed history found in consent-driven background reports critical for informed leasing decisions.

Synthetic Identity Detection

Background checks provide comprehensive criminal and financial history reports, while instant ID verification uses biometric and database cross-referencing to quickly authenticate identity. Synthetic identity detection leverages AI-driven pattern recognition in instant ID verification to uncover fabricated or manipulated identities that traditional background checks may miss.

Cross-Border Background Screening

Cross-border background screening ensures comprehensive tenant verification by validating identity documents and criminal history across multiple countries, unlike instant ID verification which primarily confirms identity in real-time. Incorporating international databases and compliance with varying legal frameworks enhances rental risk assessment and tenant reliability in global leasing markets.

AI-Powered Risk Profiling

AI-powered risk profiling enhances rental background checks by analyzing extensive behavioral data, credit history, and social patterns to identify high-risk tenants more accurately than traditional methods. Instant ID verification complements this process by providing real-time identity authentication, reducing fraud and streamlining tenant screening for landlords.

Document Liveness Verification

Document liveness verification enhances rental background checks by ensuring submitted IDs are authentic and not digitally tampered with, reducing fraud risks effectively. Instant ID verification integrates this technology to provide real-time validation, streamlining tenant screening with higher accuracy compared to traditional background checks.

Continuous Credit Monitoring

Continuous credit monitoring offers ongoing insights into a tenant's financial behavior, helping landlords detect potential risks after the initial background check. Unlike instant ID verification, which confirms identity at a single point in time, continuous credit monitoring tracks credit report changes to provide real-time alerts on late payments, new debts, or significant credit inquiries.

API-Integrated Background Check

API-integrated background checks offer comprehensive tenant screening by accessing criminal records, eviction histories, and credit reports in real-time, ensuring landlords receive thorough and reliable data. Unlike instant ID verification, which confirms identity quickly but lacks depth, API-based background checks provide detailed insights critical for informed rental decisions.

Background Check vs Instant ID Verification Infographic

industrydif.com

industrydif.com