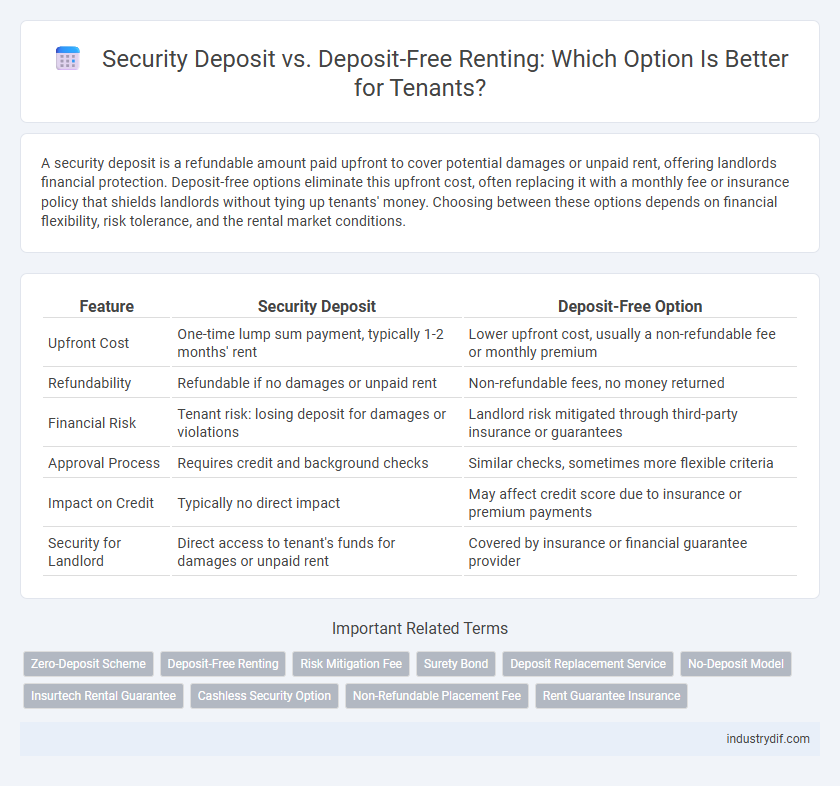

A security deposit is a refundable amount paid upfront to cover potential damages or unpaid rent, offering landlords financial protection. Deposit-free options eliminate this upfront cost, often replacing it with a monthly fee or insurance policy that shields landlords without tying up tenants' money. Choosing between these options depends on financial flexibility, risk tolerance, and the rental market conditions.

Table of Comparison

| Feature | Security Deposit | Deposit-Free Option |

|---|---|---|

| Upfront Cost | One-time lump sum payment, typically 1-2 months' rent | Lower upfront cost, usually a non-refundable fee or monthly premium |

| Refundability | Refundable if no damages or unpaid rent | Non-refundable fees, no money returned |

| Financial Risk | Tenant risk: losing deposit for damages or violations | Landlord risk mitigated through third-party insurance or guarantees |

| Approval Process | Requires credit and background checks | Similar checks, sometimes more flexible criteria |

| Impact on Credit | Typically no direct impact | May affect credit score due to insurance or premium payments |

| Security for Landlord | Direct access to tenant's funds for damages or unpaid rent | Covered by insurance or financial guarantee provider |

Understanding Security Deposits in Rental Agreements

Security deposits are a common requirement in rental agreements, typically equivalent to one or two months' rent, serving as financial protection against tenant damages or unpaid rent. Deposit-free options, such as surety bonds or insurance policies, offer renters an alternative by reducing upfront costs while still safeguarding landlords. Understanding the implications of security deposits versus deposit-free methods helps tenants make informed decisions and landlords manage risk effectively.

What Is a Deposit-Free Rental Option?

A deposit-free rental option allows tenants to move in without paying a traditional security deposit, often replacing it with a small non-refundable fee or a third-party insurance policy. This alternative reduces upfront costs and can improve cash flow for renters while still providing landlords financial protection against damages and unpaid rent. Deposit-free programs are becoming increasingly popular in urban rental markets, offering a flexible and accessible way to secure housing.

Key Differences Between Security Deposit and Deposit-Free

Security deposits typically require tenants to pay a refundable sum upfront to cover potential damages or unpaid rent, whereas deposit-free options often involve paying a non-refundable fee or using insurance products to secure the lease without holding a cash deposit. Security deposits tie up tenant funds for the lease duration and are returned after move-out inspections, while deposit-free solutions offer more liquidity and may ease upfront financial burdens. The key difference lies in the nature of payment--cash held by landlords versus third-party risk management--that impacts tenant cash flow and landlord risk mitigation strategies.

Pros and Cons of Traditional Security Deposits

Traditional security deposits offer landlords financial protection against property damage and unpaid rent, typically amounting to one or two months' rent. However, they can pose a significant upfront cost for tenants, making it harder for renters with limited savings to secure housing. The main disadvantage lies in the potential for disputes over deposit deductions, which can delay refunds and strain landlord-tenant relationships.

Advantages of Deposit-Free Rentals

Deposit-free rentals eliminate the upfront financial burden of a traditional security deposit, making home access more affordable and accessible for tenants. These rentals often use insurance or alternative agreements that protect landlords from damages while enhancing tenant liquidity and flexibility. This approach reduces move-in costs, supports quicker rental agreements, and minimizes disputes over deposit returns.

Impact on Tenant Affordability and Accessibility

Security deposits typically require tenants to pay a substantial upfront amount, which can limit affordability and reduce access to rental housing for low-income individuals. Deposit-free alternatives, such as insurance-backed guarantees, eliminate this upfront cost, improving financial accessibility without compromising landlord security. These models lower initial financial barriers, enabling a broader range of tenants to secure rental properties more easily.

Landlord Perspective: Risk Management and Protections

Landlords prefer security deposits as they provide a direct financial safeguard against tenant damages, late payments, or lease violations, ensuring quick access to compensation without legal complexity. Deposit-free options, while attractive to tenants, often require landlords to rely on third-party insurance or guarantees, which may involve delayed reimbursement and less control over claim processes. Effective risk management for landlords involves balancing upfront security deposits with tenant attraction strategies while maintaining clear policies for damage assessment and claim enforcement.

Industry Trends: Adoption of Deposit-Free Solutions

The rental industry is increasingly embracing deposit-free solutions as a cost-effective and consumer-friendly alternative to traditional security deposits. These innovative models leverage insurance or third-party guarantees, reducing upfront costs for tenants while maintaining landlord protection. Market data reveals a growing preference among renters for deposit-free options, driven by improved liquidity and simplified rental processes.

Legal Considerations for Security Deposits and Deposit-Free Options

Security deposits are regulated by state laws requiring landlords to hold funds in separate accounts and return them within a specified timeframe after tenancy ends, ensuring tenant protection against unfair withholding. Deposit-free options, such as insurance or guarantee programs, shift the financial risk from tenants to third-party providers but may involve legal stipulations on liability and disclosure requirements. Understanding local landlord-tenant regulations is crucial for both parties to avoid disputes and ensure compliance when choosing between traditional security deposits and alternative deposit-free solutions.

Choosing the Right Option: Security Deposit vs Deposit-Free

Security deposits typically require upfront payment equal to one or more months' rent, providing landlords with financial protection against damages or unpaid rent. Deposit-free options, often facilitated through third-party insurance or guarantee programs, reduce initial move-in costs and improve tenant affordability while maintaining landlord security. Evaluating personal financial flexibility, rental market standards, and long-term cost implications helps renters select between traditional security deposits and deposit-free alternatives.

Related Important Terms

Zero-Deposit Scheme

Zero-deposit schemes eliminate upfront security deposits by using third-party insurance or guarantee programs, reducing initial rental costs and increasing tenant affordability. These alternatives provide landlords with financial protection against damages or unpaid rent without requiring tenants to tie up large sums of cash.

Deposit-Free Renting

Deposit-free renting eliminates the upfront financial burden by replacing traditional security deposits with affordable insurance or guarantee programs, enhancing tenant accessibility and flexibility. This innovative approach reduces move-in costs, protects landlords against damages, and accelerates the rental process, making it a preferred option in competitive housing markets.

Risk Mitigation Fee

A Risk Mitigation Fee offers tenants a deposit-free alternative that reduces upfront financial burden while providing landlords protection against potential damages and unpaid rent, streamlining the rental process. This fee enhances risk management by covering costs typically secured by traditional security deposits, thereby increasing affordability and minimizing tenant turnover.

Surety Bond

A surety bond offers a deposit-free alternative to traditional security deposits by providing landlords with financial protection against tenant defaults without requiring upfront cash from renters. This method enhances tenant accessibility while ensuring landlords can recover damages or unpaid rent through the bonded amount secured by a third-party guarantor.

Deposit Replacement Service

Security deposits typically require tenants to pay a large upfront sum to cover potential damages or unpaid rent, while deposit replacement services offer a cost-effective alternative by allowing renters to pay a small monthly fee instead of a full deposit. Deposit replacement services enhance affordability and accessibility in the rental market by reducing initial financial barriers and providing landlords with a guarantee against tenant default.

No-Deposit Model

The no-deposit model eliminates upfront security deposits, reducing financial barriers for tenants while shifting risk management to landlords or third-party insurance providers. This approach enhances tenant accessibility and accelerates rental agreements by replacing traditional deposit holds with alternative risk mitigation strategies.

Insurtech Rental Guarantee

Security Deposit requires upfront cash held by landlords as collateral against damages or unpaid rent, whereas Deposit-Free leverage Insurtech Rental Guarantee solutions offering tenants a low-cost insurance alternative that protects landlords without tying up tenant funds. Insurtech Rental Guarantees streamline rental agreements, reduce financial barriers for tenants, and enhance security for landlords through digitally managed insurance policies.

Cashless Security Option

Cashless security options eliminate the need for traditional security deposits by using third-party insurers to guarantee rental agreements, providing tenants with affordable, interest-free coverage instead of upfront cash payments. This innovative approach enhances cash flow flexibility while ensuring landlords maintain financial protection against potential damages or unpaid rent.

Non-Refundable Placement Fee

Security deposits typically require tenants to pay upfront funds refundable at lease end, while deposit-free options replace this with a non-refundable placement fee that covers landlord risk without upfront large cash payments. Non-refundable placement fees often streamline approval processes but provide no reimbursement, contrasting with security deposits that protect landlords against damages but return balances.

Rent Guarantee Insurance

Rent Guarantee Insurance offers tenants an alternative to traditional security deposits by providing landlords with financial protection against unpaid rent without requiring upfront cash from renters. This deposit-free solution enhances tenant affordability while ensuring landlords receive timely rent payments and coverage for potential losses.

Security Deposit vs Deposit-Free Infographic

industrydif.com

industrydif.com