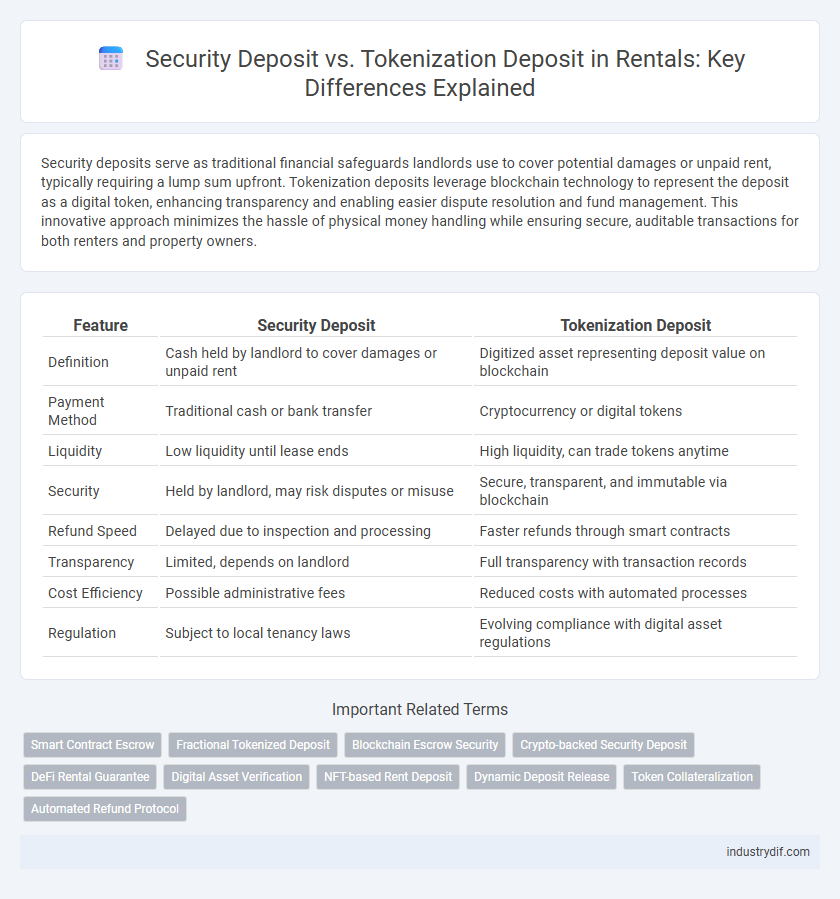

Security deposits serve as traditional financial safeguards landlords use to cover potential damages or unpaid rent, typically requiring a lump sum upfront. Tokenization deposits leverage blockchain technology to represent the deposit as a digital token, enhancing transparency and enabling easier dispute resolution and fund management. This innovative approach minimizes the hassle of physical money handling while ensuring secure, auditable transactions for both renters and property owners.

Table of Comparison

| Feature | Security Deposit | Tokenization Deposit |

|---|---|---|

| Definition | Cash held by landlord to cover damages or unpaid rent | Digitized asset representing deposit value on blockchain |

| Payment Method | Traditional cash or bank transfer | Cryptocurrency or digital tokens |

| Liquidity | Low liquidity until lease ends | High liquidity, can trade tokens anytime |

| Security | Held by landlord, may risk disputes or misuse | Secure, transparent, and immutable via blockchain |

| Refund Speed | Delayed due to inspection and processing | Faster refunds through smart contracts |

| Transparency | Limited, depends on landlord | Full transparency with transaction records |

| Cost Efficiency | Possible administrative fees | Reduced costs with automated processes |

| Regulation | Subject to local tenancy laws | Evolving compliance with digital asset regulations |

Understanding Security Deposits in the Rental Industry

Security deposits in the rental industry serve as a financial safeguard for landlords against tenant damages or unpaid rent, typically amounting to one to two months' rent. Tokenization deposits represent a modern alternative, using blockchain technology to convert the deposit into digital tokens, enhancing transparency and security while enabling easier refund processes. Understanding these distinct deposit types helps tenants and landlords manage risks, streamline transactions, and improve trust in rental agreements.

What Is a Tokenization Deposit?

A tokenization deposit is a digital asset held as collateral in rental agreements, representing a secure and transparent alternative to traditional security deposits. This deposit uses blockchain technology to tokenize the amount, ensuring immutability and easy traceability while reducing fraud and administrative costs. Tokenization deposits enable landlords and tenants to manage funds efficiently through smart contracts, which automate refund processes based on lease conditions.

Key Differences Between Security and Tokenization Deposits

Security deposits are traditional cash reserves held to cover potential damages or unpaid rent, typically refunded after tenancy ends, ensuring landlord protection. Tokenization deposits utilize blockchain technology to represent the deposit as digital tokens, enhancing transparency, security, and ease of transfer or refund through smart contracts. Unlike conventional security deposits, tokenization deposits reduce disputes by providing immutable records and faster processing, transforming the rental deposit landscape.

Benefits of Using Security Deposits for Rentals

Security deposits in rentals provide landlords with a financial safeguard against property damage or unpaid rent, ensuring tenant accountability and reducing potential losses. These deposits serve as a clear, legally recognized form of security that can be withheld or returned based on lease agreement terms. Compared to tokenization deposits, security deposits offer straightforward dispute resolution processes and greater familiarity within traditional rental markets.

Advantages of Tokenization Deposits for Landlords and Tenants

Tokenization deposits enhance security by digitally securing funds on blockchain, reducing risks of fraud and mismanagement common with traditional security deposits. Landlords benefit from faster access to funds and simplified refund processes, while tenants gain transparency and flexibility in managing payments. This innovative approach also streamlines dispute resolution by providing immutable transaction records, fostering trust between parties.

Potential Risks of Traditional Security Deposits

Traditional security deposits expose tenants to potential risks such as delayed refunds, disputes over damage claims, and lack of transparency in fund handling. Landlords may withhold excessive amounts, leading to financial strain for renters. Tokenization deposits, leveraging blockchain technology, offer increased security, faster transactions, and immutable records that mitigate these risks.

How Tokenization Enhances Deposit Security and Transparency

Tokenization enhances deposit security by replacing sensitive payment information with encrypted digital tokens, minimizing the risk of fraud and unauthorized access in rental transactions. Unlike traditional security deposits held as cash or checks, tokenized deposits provide transparent, immutable records on blockchain platforms, ensuring clear audit trails and reducing disputes between landlords and tenants. This technology streamlines refund processes and boosts trust by enabling real-time tracking and verification of deposit transactions.

Legal Implications of Both Deposit Types in Rentals

Security deposits in rentals are governed by strict legal frameworks requiring landlords to hold and return funds based on property condition, ensuring tenant protection under state laws. Tokenization deposits, leveraging blockchain technology, introduce new challenges around regulatory compliance, consumer protection, and data privacy, as legal standards for digital assets remain evolving. Understanding jurisdiction-specific statutes is crucial for landlords and tenants to navigate liabilities and enforceability in both traditional and tokenized deposit agreements.

Industry Trends: Moving from Security Deposits to Tokenization

The rental industry is increasingly shifting from traditional security deposits to tokenization deposits, leveraging blockchain technology for enhanced transparency and security. Tokenization deposits allow tenants to secure rental agreements using digital assets, reducing the lock-up of large cash amounts and enabling faster refund processes. This trend is driven by growing demand for improved liquidity and reduced financial risk in rental transactions.

Choosing the Right Deposit Solution for Your Rental Business

Security deposits provide landlords with a traditional financial safeguard by holding tenant funds until lease obligations are met, while tokenization deposits leverage blockchain technology to offer enhanced transparency, reduced fraud risk, and faster transaction settlements. Analyzing factors such as regulatory compliance, ease of fund management, tenant experience, and operational costs is essential when selecting between these deposit methods. Implementing a tokenization deposit system can streamline security management and improve scalability for modern rental businesses seeking innovative, secure, and efficient solutions.

Related Important Terms

Smart Contract Escrow

Security deposit in traditional rentals involves a refundable sum held by landlords, often requiring manual handling and limited transparency, while tokenization deposit leverages blockchain technology to create a secure, transparent smart contract escrow that automates fund release based on predefined rental agreements. Smart contract escrow enhances trust by ensuring deposits are only accessible under contract conditions, reducing disputes and streamlining the rental security process.

Fractional Tokenized Deposit

Fractional tokenized deposits transform traditional security deposits by enabling renters to lock only a portion of the total amount into a secure blockchain-based token, significantly reducing upfront cash requirements. This innovative approach enhances liquidity and transparency while maintaining landlord assurance through verifiable smart contract conditions.

Blockchain Escrow Security

Security deposits secured through blockchain escrow use smart contracts to automate fund held and release processes, reducing fraud risks and enhancing transparency compared to traditional deposit methods. Tokenization deposits convert the security funds into digital tokens on a decentralized ledger, enabling instant, immutable tracking and eliminating reliance on third-party intermediaries for deposit management.

Crypto-backed Security Deposit

Crypto-backed security deposits leverage blockchain technology to enhance transparency and traceability compared to traditional security deposits, reducing fraud and simplifying dispute resolution. Tokenization of deposits allows renters to lock funds in digital tokens, providing liquidity and faster access to funds once rental conditions are met, revolutionizing the rental security ecosystem.

DeFi Rental Guarantee

Security deposits in traditional rentals require upfront cash held by landlords, limiting liquidity and tying up tenant funds, whereas tokenization deposits leverage DeFi rental guarantees through blockchain technology to create secure, transparent, and programmable collateralized digital assets. This DeFi approach enhances trust, reduces intermediaries, and allows tenants to utilize deposited tokens for additional financial activities while ensuring landlords receive guaranteed coverage against potential lease breaches.

Digital Asset Verification

Security Deposit traditionally requires a fixed cash amount held to cover potential damages, while Tokenization Deposit leverages blockchain technology to create a secure, transparent digital asset verification process that replaces physical cash with encrypted tokens. This innovation enhances trust and minimizes fraud by enabling instant verification and traceability of deposits through immutable digital ledgers.

NFT-based Rent Deposit

NFT-based rent deposits leverage blockchain technology to create transparent, immutable records of security deposits, reducing disputes and enhancing trust between landlords and tenants. This tokenization deposit system allows tenants to securely lock funds as NFTs, enabling seamless transferability and automated refund processes compared to traditional security deposits.

Dynamic Deposit Release

Security deposit in rental agreements traditionally requires full upfront payment held until lease end, while tokenization deposit leverages blockchain for dynamic deposit release based on real-time property condition and payment compliance. This innovation reduces upfront costs and enables partial refunding or adjustments, enhancing transparency and trust between landlords and tenants.

Token Collateralization

Security deposit traditionally involves a fixed sum held by landlords to cover potential damages, whereas tokenization deposit leverages blockchain technology to collateralize rental agreements with digital tokens, enhancing transparency and liquidity. Token collateralization transforms security deposits into programmable assets, enabling faster dispute resolution and reducing financial burden on tenants by allowing partial or fractional deposits.

Automated Refund Protocol

Security deposits traditionally require manual processing for refunds, often causing delays and disputes, whereas tokenization deposits utilize blockchain technology to automate and expedite refund protocols with enhanced transparency and security. Automated refund protocols in tokenized deposits ensure immediate, tamper-proof transaction verification, minimizing administrative overhead and improving tenant trust through real-time, auditable disbursements.

Security Deposit vs Tokenization Deposit Infographic

industrydif.com

industrydif.com