Conventional rental agreements require tenants to pay fixed monthly rent without gaining ownership or equity in the property. Rent-to-own contracts allow tenants to apply a portion of their rent payments toward purchasing the home, providing a pathway to ownership. This option benefits renters who may not qualify for a mortgage immediately but want to invest in their future home.

Table of Comparison

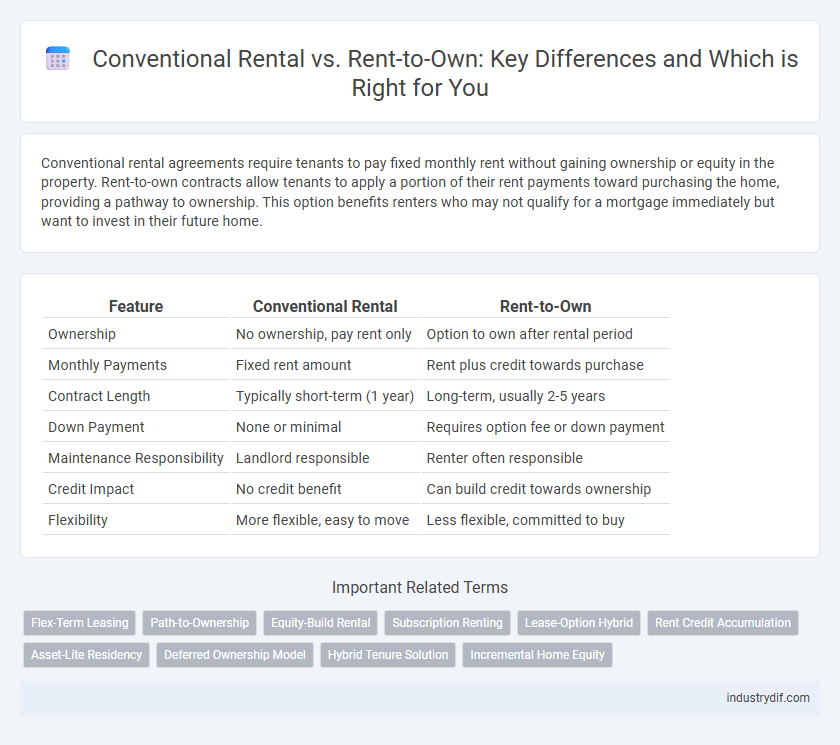

| Feature | Conventional Rental | Rent-to-Own |

|---|---|---|

| Ownership | No ownership, pay rent only | Option to own after rental period |

| Monthly Payments | Fixed rent amount | Rent plus credit towards purchase |

| Contract Length | Typically short-term (1 year) | Long-term, usually 2-5 years |

| Down Payment | None or minimal | Requires option fee or down payment |

| Maintenance Responsibility | Landlord responsible | Renter often responsible |

| Credit Impact | No credit benefit | Can build credit towards ownership |

| Flexibility | More flexible, easy to move | Less flexible, committed to buy |

Overview of Conventional Rental and Rent-to-Own

Conventional rental agreements involve tenants paying a fixed monthly rent to a landlord without ownership rights, typically requiring a security deposit and a lease term. Rent-to-own contracts combine rental payments with the option to purchase the property after a specified period, often with a portion of the rent credited toward the purchase price. This hybrid model provides renters the opportunity to build equity while living in the home, bridging the gap between renting and homeownership.

Key Differences Between Conventional Rental and Rent-to-Own

Conventional rental requires tenants to pay monthly rent with no equity or ownership benefits, strictly limiting their investment to tenancy rights. Rent-to-own agreements combine rental payments with a pathway to ownership, where a portion of the rent contributes toward the eventual purchase price. Key differences include initial financial commitment, contract flexibility, and the potential for property acquisition in rent-to-own, contrasting with the purely transactional nature of conventional rentals.

Financial Structure Comparison

Conventional rental requires tenants to pay a fixed monthly rent without building equity, often involving security deposits and strict lease terms. Rent-to-own agreements typically include higher monthly payments, part of which contribute towards a future down payment or purchase price, allowing tenants to build homeownership equity over time. The financial structure of rent-to-own offers a pathway to ownership, while conventional rental remains a short-term occupancy arrangement with no investment return.

Ownership Opportunities Explained

Conventional rental agreements require tenants to pay monthly rent without building equity or ownership rights, limiting long-term financial benefits. Rent-to-own contracts provide a pathway to ownership by allowing tenants to apply a portion of their rent toward the eventual purchase price of the property. This model offers increased opportunities for renters to transition into homeowners, leveraging rental payments as a component of their investment strategy.

Eligibility and Qualification Criteria

Conventional rental typically requires credit checks, steady income verification, and references to determine tenant eligibility, ensuring renters have a stable financial background. Rent-to-own agreements often have more flexible qualification criteria, allowing tenants with lower credit scores or inconsistent income to participate while applying a portion of rent payments toward eventual ownership. Understanding these distinct eligibility requirements helps renters choose the most suitable option based on their financial situation and long-term housing goals.

Flexibility and Commitment Level

Conventional rental agreements require fixed monthly payments with predefined lease durations, offering limited flexibility and long-term commitment. Rent-to-own arrangements provide tenants the option to apply a portion of rental payments toward ownership, allowing greater adaptability and a gradual commitment to property acquisition. This model suits individuals seeking flexibility in lease terms while progressively building equity in the rented asset.

Tenant Rights and Responsibilities

Tenants in conventional rentals typically have defined lease terms with standard rights such as property maintenance and timely rent payment, but they lack ownership benefits and equity accumulation. Rent-to-own tenants assume added responsibilities including option fee payments and potential purchase commitments, gaining rights to apply rent toward ownership and more control over the property. Both arrangements require understanding tenant protections under local housing laws to ensure compliance and fair treatment.

Long-Term Financial Impact

Conventional rental requires consistent monthly payments without building equity, often leading to long-term financial outflow without asset ownership. Rent-to-own agreements allow tenants to apply a portion of payments toward eventual property purchase, potentially resulting in homeownership and asset accumulation over time. The rent-to-own model can improve financial stability by converting rental expenses into investment, while conventional rentals may limit wealth-building opportunities.

Pros and Cons of Conventional Rental

Conventional rental offers tenants flexibility with shorter lease terms and less upfront financial commitment compared to rent-to-own agreements, making it ideal for those seeking temporary housing or uncertain about long-term plans. However, renters do not build equity or ownership rights, and rental payments contribute solely to the landlord's income without potential asset appreciation. Maintenance responsibilities typically fall on the landlord, although tenants may face restrictions on property modifications or personalization.

Pros and Cons of Rent-to-Own

Rent-to-own agreements offer renters the advantage of building equity while living in the property, with a portion of monthly payments typically applied to the purchase price. This arrangement provides a pathway to homeownership for those with limited credit or savings, but often comes with higher overall costs and non-refundable fees compared to conventional rentals. However, rent-to-own contracts may include restrictions on maintenance responsibilities and potential risk if the buyer decides not to exercise the purchase option.

Related Important Terms

Flex-Term Leasing

Flex-term leasing in conventional rentals offers fixed lease durations typically ranging from six to twelve months, providing predictable rent payments without ownership options. Rent-to-own agreements incorporate flexible lease terms combined with the option to purchase the property at the end of the lease period, allowing tenants to build equity while renting.

Path-to-Ownership

Conventional rental offers short-term occupancy without equity building, requiring tenants to secure separate financing to purchase property. Rent-to-own agreements provide a structured path-to-ownership by applying a portion of rent payments toward the eventual down payment, enabling tenants to accumulate investment while living in the home.

Equity-Build Rental

Conventional rental requires monthly payments without equity accumulation, whereas rent-to-own agreements allow tenants to build equity over time by applying a portion of rent toward ownership. Equity-build rental offers a pathway to homeownership by combining occupancy with investment in property value.

Subscription Renting

Subscription renting offers flexible monthly payments and easy upgrades, contrasting with conventional rental's fixed lease terms and long commitments. Rent-to-own combines rental convenience with eventual ownership but often includes higher cumulative costs and complex agreements.

Lease-Option Hybrid

The lease-option hybrid combines elements of conventional rental agreements with rent-to-own contracts, allowing tenants to rent a property while locking in an option to purchase it later, often applying a portion of rent payments toward the down payment. This approach provides flexibility for buyers who need time to improve credit or save funds, while giving landlords a committed tenant with potential for sale.

Rent Credit Accumulation

Rent-to-own agreements allow tenants to accumulate rent credits that can be applied toward the eventual purchase price of the property, providing a pathway to homeownership while renting. In contrast, conventional rentals typically require rent payments that do not contribute to equity or future ownership.

Asset-Lite Residency

Conventional rental requires upfront deposits and ongoing monthly payments without building equity, whereas rent-to-own agreements allow tenants to apply a portion of rent toward eventual homeownership, promoting asset-lite residency by lowering initial financial barriers. This model enables residents to enjoy flexible living arrangements while progressively investing in property ownership, aligning with modern demands for affordability and long-term asset acquisition.

Deferred Ownership Model

The Deferred Ownership Model in rent-to-own agreements allows tenants to apply a portion of their monthly payments toward eventual property ownership, contrasting with conventional rentals where payments solely cover occupancy without equity accumulation. This model benefits renters seeking homeownership flexibility by combining immediate housing with long-term investment potential.

Hybrid Tenure Solution

Hybrid tenure solutions combine conventional rental agreements with rent-to-own options, allowing tenants to accumulate equity while leasing a property. This approach offers flexible payment structures and long-term investment benefits, catering to both immediate housing needs and future homeownership goals.

Incremental Home Equity

Conventional rental agreements offer no opportunity to build home equity, as tenants pay monthly rent without ownership benefits. Rent-to-own contracts enable tenants to accumulate incremental home equity with each payment, eventually applying a portion of rent toward the home's purchase price.

Conventional Rental vs Rent-to-Own Infographic

industrydif.com

industrydif.com