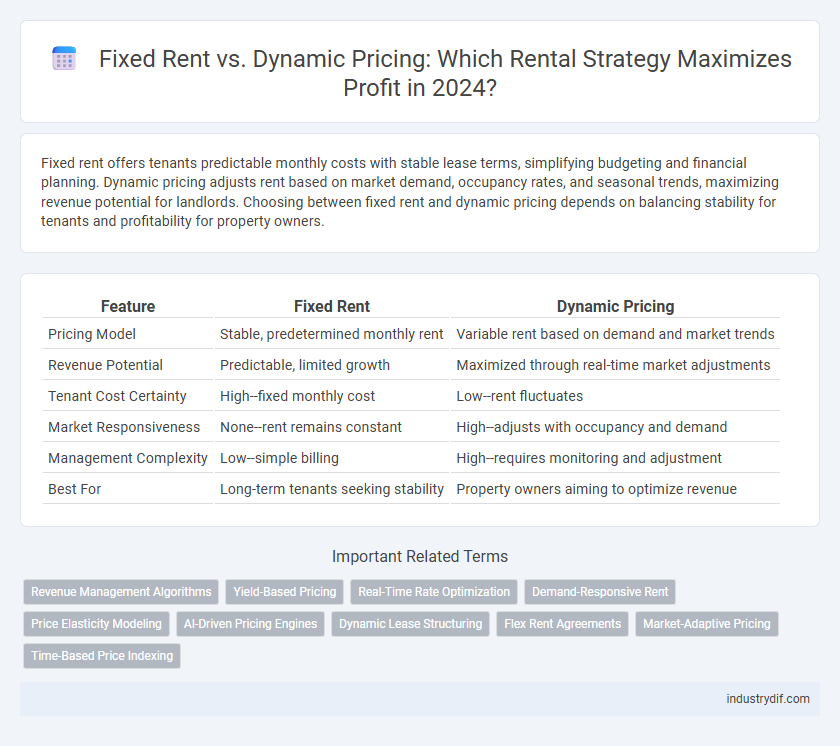

Fixed rent offers tenants predictable monthly costs with stable lease terms, simplifying budgeting and financial planning. Dynamic pricing adjusts rent based on market demand, occupancy rates, and seasonal trends, maximizing revenue potential for landlords. Choosing between fixed rent and dynamic pricing depends on balancing stability for tenants and profitability for property owners.

Table of Comparison

| Feature | Fixed Rent | Dynamic Pricing |

|---|---|---|

| Pricing Model | Stable, predetermined monthly rent | Variable rent based on demand and market trends |

| Revenue Potential | Predictable, limited growth | Maximized through real-time market adjustments |

| Tenant Cost Certainty | High--fixed monthly cost | Low--rent fluctuates |

| Market Responsiveness | None--rent remains constant | High--adjusts with occupancy and demand |

| Management Complexity | Low--simple billing | High--requires monitoring and adjustment |

| Best For | Long-term tenants seeking stability | Property owners aiming to optimize revenue |

Introduction to Rental Pricing Models

Fixed rent provides tenants with predictable monthly payments by establishing a consistent rate throughout the lease term, facilitating straightforward budgeting and financial planning. Dynamic pricing adjusts rental rates based on market demand, seasonal trends, and occupancy levels, optimizing revenue for property owners. Understanding these rental pricing models is crucial for landlords seeking to balance stability and profitability while attracting and retaining tenants.

What is Fixed Rent?

Fixed rent is a rental pricing model where tenants pay a consistent, predetermined amount throughout the lease term, providing predictable monthly housing expenses. This approach benefits both landlords and tenants by ensuring stable income and simplifying budgeting without fluctuations due to market demand or seasonality. Fixed rent agreements typically last for the duration of a lease, commonly 6 to 12 months, offering financial stability in residential or commercial rental markets.

What is Dynamic Pricing?

Dynamic pricing in rental markets refers to adjusting rent prices in real-time based on demand, seasonality, and local market conditions. This flexible strategy leverages algorithms and data analytics to optimize occupancy rates and maximize revenue. Unlike fixed rent, dynamic pricing enables landlords to respond swiftly to market fluctuations and tenant behaviors.

Key Differences Between Fixed Rent and Dynamic Pricing

Fixed rent provides tenants with a consistent, predictable monthly payment, simplifying budgeting and financial planning for both landlords and renters. Dynamic pricing adjusts rental rates based on real-time market demand, property availability, and seasonal trends, maximizing income potential during high-demand periods. Key differences include the stability of fixed rent versus the revenue optimization and flexibility offered by dynamic pricing models.

Pros and Cons of Fixed Rent

Fixed rent offers predictable monthly expenses, simplifying budgeting for both landlords and tenants. This stability can attract long-term renters but may lead to missed revenue opportunities during high-demand periods. However, fixed rent lacks flexibility to adjust prices based on market fluctuations, potentially resulting in below-market income or increased vacancy rates.

Pros and Cons of Dynamic Pricing

Dynamic pricing in rental markets allows rates to adjust based on real-time demand, maximizing revenue during peak periods and increasing occupancy during slow seasons. This strategy offers flexibility and can improve profitability but requires sophisticated pricing algorithms and continuous market analysis to avoid pricing errors and customer dissatisfaction. However, frequent price fluctuations may deter long-term tenants seeking predictable rental costs.

Factors Influencing Pricing Strategy Selection

Factors influencing the choice between fixed rent and dynamic pricing include market demand variability, competitive landscape, and property location. Fixed rent suits stable markets with predictable occupancy rates, while dynamic pricing thrives in fluctuating markets driven by seasonality and events. Landlord risk tolerance and tenant expectations also play crucial roles in determining the optimal pricing strategy.

Impact on Occupancy Rates and Revenue

Fixed rent offers predictable income but can lead to lower occupancy rates if prices remain above market value during demand fluctuations. Dynamic pricing adjusts rental rates based on real-time market conditions, enhancing occupancy by attracting tenants during low-demand periods and maximizing revenue when demand peaks. Data shows properties employing dynamic pricing models experience up to 20% higher occupancy and a 15% increase in overall rental revenue compared to fixed rent strategies.

Technology’s Role in Dynamic Pricing

Technology leverages algorithms and real-time market data to optimize rental pricing dynamically, enabling landlords to adjust rates based on demand, seasonality, and competitor pricing. Advanced tools such as AI-driven platforms analyze consumer behavior and local market trends to maximize occupancy and revenue. This technological integration transforms static fixed rent models into flexible pricing strategies that respond promptly to fluctuations in the rental market.

Choosing the Right Model for Your Rental Business

Fixed rent provides predictable income and simplifies budgeting by setting a consistent rental rate, ideal for long-term stability in rental businesses. Dynamic pricing adjusts rent based on demand, seasonality, and market trends, maximizing revenue during high-demand periods and minimizing vacancies. Analyzing local market conditions, tenant preferences, and business goals helps determine whether a fixed or dynamic pricing model better suits your rental strategy.

Related Important Terms

Revenue Management Algorithms

Revenue management algorithms leverage dynamic pricing to optimize rental income by adjusting rates based on real-time demand, market trends, and competitor pricing, outperforming fixed rent models that maintain static prices regardless of fluctuating market conditions. These algorithms increase revenue predictability and maximize occupancy rates by utilizing data analytics and machine learning to respond swiftly to market signals.

Yield-Based Pricing

Yield-based pricing in rentals adjusts rates dynamically based on demand, occupancy, and market trends to maximize revenue. Fixed rent offers stability but lacks responsiveness to fluctuations, making yield-based pricing more effective for optimizing income in competitive markets.

Real-Time Rate Optimization

Fixed rent offers predictable income through set lease agreements, while dynamic pricing leverages real-time rate optimization to adjust rental prices based on market demand, occupancy levels, and competitor rates. Real-time rate optimization increases revenue potential by utilizing algorithms and data analytics to maximize rental yields in fluctuating market conditions.

Demand-Responsive Rent

Demand-responsive rent adjusts pricing based on real-time market demand, maximizing revenue by aligning rent with occupancy trends and seasonal fluctuations. Fixed rent provides predictable costs but may miss opportunities to optimize income during high-demand periods.

Price Elasticity Modeling

Fixed rent offers predictable cash flow by setting a stable monthly rate, while dynamic pricing leverages price elasticity modeling to adjust rental rates based on market demand, seasonality, and tenant behavior for maximizing revenue. Price elasticity modeling analyzes how changes in rental prices impact occupancy rates and tenant retention, enabling landlords to optimize prices in real-time for greater profitability.

AI-Driven Pricing Engines

AI-driven pricing engines optimize rental income by analyzing market trends, demand fluctuations, and competitor rates in real-time, enabling dynamic pricing strategies that maximize occupancy and revenue. Fixed rent models offer stability but often miss opportunities for higher profits during peak demand, making AI-powered dynamic pricing more effective for revenue management in competitive rental markets.

Dynamic Lease Structuring

Dynamic lease structuring leverages real-time market data and tenant demand to adjust rental prices, maximizing property revenue and occupancy rates compared to fixed rent models. This adaptive approach allows landlords to optimize lease terms and pricing strategies based on fluctuations in local market trends and seasonal demand.

Flex Rent Agreements

Flex rent agreements offer tenants the advantage of dynamic pricing, allowing rental rates to adjust based on market demand, occupancy levels, and seasonal trends. Unlike fixed rent contracts, these agreements provide landlords with optimized revenue potential while giving renters flexibility in lease terms and payment structures.

Market-Adaptive Pricing

Market-adaptive pricing leverages real-time demand and supply data to dynamically adjust rental rates, optimizing occupancy and revenue compared to fixed rent models that remain constant regardless of market fluctuations. By responding to seasonal trends and competitor pricing, dynamic pricing enables landlords to maximize profitability while offering competitive rates aligned with current market conditions.

Time-Based Price Indexing

Time-based price indexing in rental markets adjusts fixed rent according to predefined economic indicators such as inflation rates or market rent indices, ensuring predictable yet competitively aligned pricing over lease terms. This method contrasts with dynamic pricing, which fluctuates based on real-time demand and supply, making time-based indexing a preferred strategy for stability and long-term financial planning in rental agreements.

Fixed Rent vs Dynamic Pricing Infographic

industrydif.com

industrydif.com