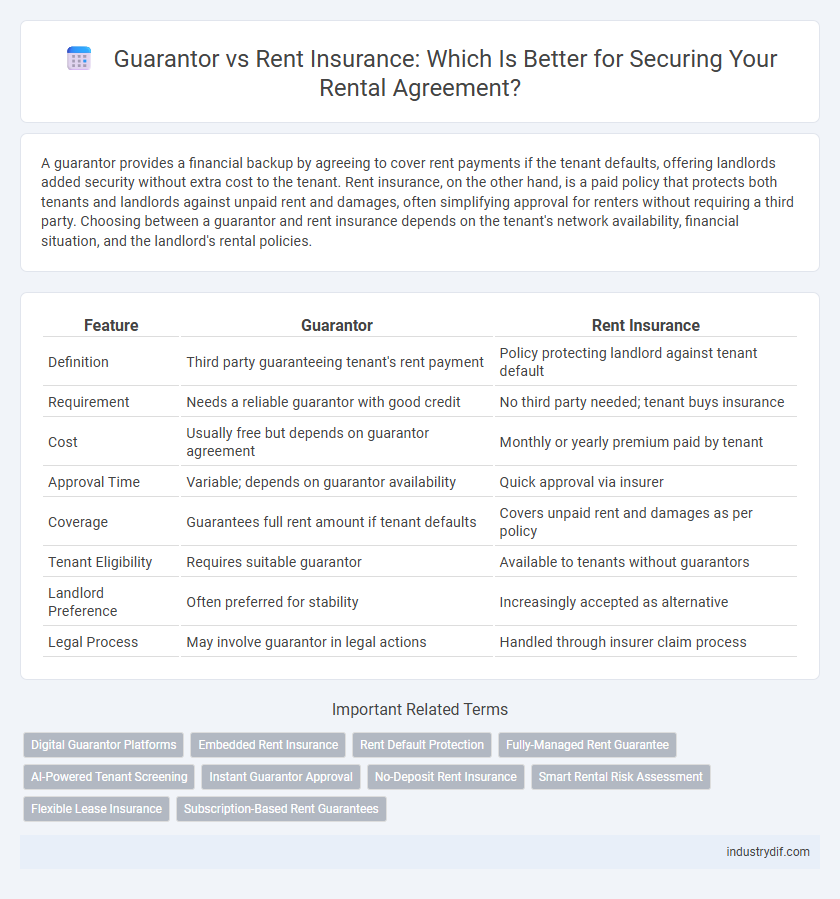

A guarantor provides a financial backup by agreeing to cover rent payments if the tenant defaults, offering landlords added security without extra cost to the tenant. Rent insurance, on the other hand, is a paid policy that protects both tenants and landlords against unpaid rent and damages, often simplifying approval for renters without requiring a third party. Choosing between a guarantor and rent insurance depends on the tenant's network availability, financial situation, and the landlord's rental policies.

Table of Comparison

| Feature | Guarantor | Rent Insurance |

|---|---|---|

| Definition | Third party guaranteeing tenant's rent payment | Policy protecting landlord against tenant default |

| Requirement | Needs a reliable guarantor with good credit | No third party needed; tenant buys insurance |

| Cost | Usually free but depends on guarantor agreement | Monthly or yearly premium paid by tenant |

| Approval Time | Variable; depends on guarantor availability | Quick approval via insurer |

| Coverage | Guarantees full rent amount if tenant defaults | Covers unpaid rent and damages as per policy |

| Tenant Eligibility | Requires suitable guarantor | Available to tenants without guarantors |

| Landlord Preference | Often preferred for stability | Increasingly accepted as alternative |

| Legal Process | May involve guarantor in legal actions | Handled through insurer claim process |

Understanding the Role of a Guarantor in Rentals

A guarantor in rental agreements acts as a financial safety net by ensuring the tenant's obligations are met if they default on rent payments or cause property damage. This role is critical for tenants with limited credit history or unstable income, providing landlords with added security beyond standard rent insurance policies. Unlike rent insurance, which primarily covers rent loss or damages, a guarantor legally commits to covering all tenant liabilities, enhancing approval chances in competitive rental markets.

What Is Rent Insurance and How Does It Work?

Rent insurance is a financial product that protects tenants and landlords against potential losses arising from unpaid rent or property damage. It operates by covering rent payments if the tenant defaults, ensuring landlords receive income without requiring a traditional guarantor. Tenants purchase rent insurance policies that include monthly premiums, which provide peace of mind and decrease the reliance on guarantors for lease agreements.

Key Differences Between Guarantors and Rent Insurance

Guarantors provide a personal guarantee to landlords, ensuring rent payment if the tenant defaults, typically requiring credit checks and proof of financial stability. Rent insurance offers a policy that covers unpaid rent up to a specified limit without involving a third party, streamlining the approval process and reducing the tenant's liability. Unlike guarantors, rent insurance often covers damages and legal fees related to tenancy disputes, offering broader financial protection.

Pros and Cons of Using a Guarantor

Using a guarantor in a rental agreement often simplifies the approval process by providing landlords with a reliable source of financial backing, which can speed up applications and secure leases for tenants with limited credit history. However, relying on a guarantor can strain personal relationships and involves risks for the guarantor, such as legal responsibility for unpaid rent or damages, potentially impacting their credit score. Unlike rent insurance, which transfers financial risks to a third party, a guarantor's commitment is personal and may be canceled or withdrawn, leading to uncertainties for landlords and tenants alike.

Advantages and Disadvantages of Rent Insurance

Rent insurance provides financial protection against tenant defaults and property damages, reducing the landlord's risk without requiring a personal guarantor. It offers a streamlined claims process and can cover legal fees, while guarantors may involve lengthy approvals and personal liability. However, rent insurance premiums add to the tenant's expenses and may have coverage limits or exclusions that do not apply with a guarantor agreement.

Impact on Tenant Screening and Approval Process

A guarantor often strengthens a tenant's rental application by providing a financial safety net, which can expedite approval and enhance tenant screening outcomes. Rent insurance serves as an alternative by protecting landlords against non-payment risks without requiring a third party, potentially broadening tenant eligibility and simplifying the approval process. Landlords may prefer rent insurance to reduce reliance on guarantors, streamlining screenings while maintaining financial security.

Financial Implications for Landlords and Tenants

Guarantors provide landlords with a direct financial backup by guaranteeing the tenant's rent payments, potentially reducing the risk of default but involving credit checks and personal liability for guarantors. Rent insurance offers a streamlined alternative where tenants pay a monthly premium to cover missed rent, minimizing the landlord's administrative burden but introducing ongoing costs for tenants. Both options impact cash flow and risk management differently, with guarantors transferring financial responsibility to an individual and rent insurance distributing risk through an insurance provider.

Legal Requirements and Regulatory Considerations

Guarantors are often legally required in rental agreements to provide a financial safety net by guaranteeing tenant obligations, while rent insurance serves as a regulatory-compliant alternative that protects landlords against tenant defaults without necessitating a third party. Legal requirements for guarantors typically involve detailed documentation and enforceability under local tenancy laws, whereas rent insurance policies must adhere to insurance regulations and consumer protection standards. Understanding the jurisdiction-specific regulations is crucial for landlords and tenants to ensure compliance and mitigate financial risk in rental contracts.

Situations When Guarantor or Rent Insurance Is Preferred

Guarantor is preferred when tenants have a stable support network willing to assume financial responsibility, often required by landlords for young professionals or students without extensive credit history. Rent insurance is ideal for renters seeking protection against potential financial loss due to unpaid rent or property damage, especially when securing a guarantor is difficult or not feasible. Both options provide security, but guarantors offer a personal guarantee while rent insurance offers a contractual financial safety net.

Choosing the Best Option: Guarantor or Rent Insurance

Selecting between a guarantor and rent insurance hinges on financial stability and risk tolerance; guarantors often require a trusted individual with sufficient income, while rent insurance provides a direct coverage solution without relying on third parties. Rent insurance policies typically cover unpaid rent and potential damages, offering landlords reassurance and tenants a streamlined application process. Understanding monthly costs, claim procedures, and eligibility criteria is crucial for renters aiming to secure housing with minimal financial burden.

Related Important Terms

Digital Guarantor Platforms

Digital guarantor platforms streamline the rental application process by providing quick, technology-driven guarantor services that reduce the need for traditional rent insurance policies. These platforms leverage data analytics and secure digital verification to enhance tenant credibility and minimize landlords' financial risks without the higher premiums typically associated with rent insurance.

Embedded Rent Insurance

Embedded rent insurance integrates seamlessly within rental agreements, offering landlords and tenants automatic protection against rent defaults without the need for a traditional guarantor. This innovative approach reduces entry barriers for tenants by eliminating third-party guarantor requirements while providing landlords with a reliable financial safety net.

Rent Default Protection

Rent default protection through rent insurance offers direct financial coverage for missed payments, providing landlords with a safety net against tenant non-payment. Guarantors serve as personal guaranties legally obligated to cover rent arrears, but rent insurance simplifies claim processes and reduces reliance on individual creditworthiness.

Fully-Managed Rent Guarantee

Fully-managed rent guarantee services provide landlords with reliable rent payment protection by acting as a guarantor, securing monthly income without requiring an individual guarantor's personal intervention. Unlike traditional rent insurance, these services offer comprehensive tenant vetting and debt recovery, minimizing risk and ensuring seamless rent collection.

AI-Powered Tenant Screening

AI-powered tenant screening enhances the evaluation of guarantors by analyzing creditworthiness, rental history, and financial stability faster and more accurately than traditional methods. Rent insurance offers a safety net for landlords by covering potential losses, yet AI-driven screening provides deeper risk assessment to select reliable tenants upfront.

Instant Guarantor Approval

Instant guarantor approval offers tenants a fast and reliable alternative to traditional rent insurance, eliminating lengthy credit checks and paperwork. This service guarantees rental payments, providing landlords with immediate financial security while streamlining the application process for renters.

No-Deposit Rent Insurance

No-deposit rent insurance eliminates the need for a traditional guarantor by providing landlords with financial security against tenant defaults, streamlining the rental application process. This innovative solution reduces upfront costs for tenants while ensuring landlords receive timely rent payments, making it a preferable alternative to conventional guarantor agreements.

Smart Rental Risk Assessment

Smart rental risk assessment leverages data-driven analysis to evaluate guarantor reliability versus rent insurance effectiveness, reducing default risks and enhancing tenant screening accuracy. Rent insurance provides financial security through direct coverage, while a guarantor offers a personal guarantee, both integral to optimizing rental risk management.

Flexible Lease Insurance

Flexible lease insurance offers a more adaptable alternative to traditional guarantor requirements by covering rent payments directly in case of tenant default, reducing reliance on third-party guarantors. This type of rent insurance enhances tenant eligibility and simplifies lease agreements while providing landlords with reliable payment protection.

Subscription-Based Rent Guarantees

Subscription-based rent guarantees offer tenants an affordable alternative to traditional guarantors by providing ongoing financial security to landlords through monthly fees. These services streamline the rental process, reduce paperwork, and enhance tenant screening, making them a preferred choice for both renters and property owners seeking reliable payment assurance.

Guarantor vs Rent Insurance Infographic

industrydif.com

industrydif.com