Paper applications in rental processes often lead to delays and increased risk of errors due to manual data entry and document handling. Digital identity verification streamlines tenant screening by enabling instant background checks and secure document submission, enhancing accuracy and speed. This technology reduces fraud, improves tenant experience, and accelerates lease approvals for landlords and property managers.

Table of Comparison

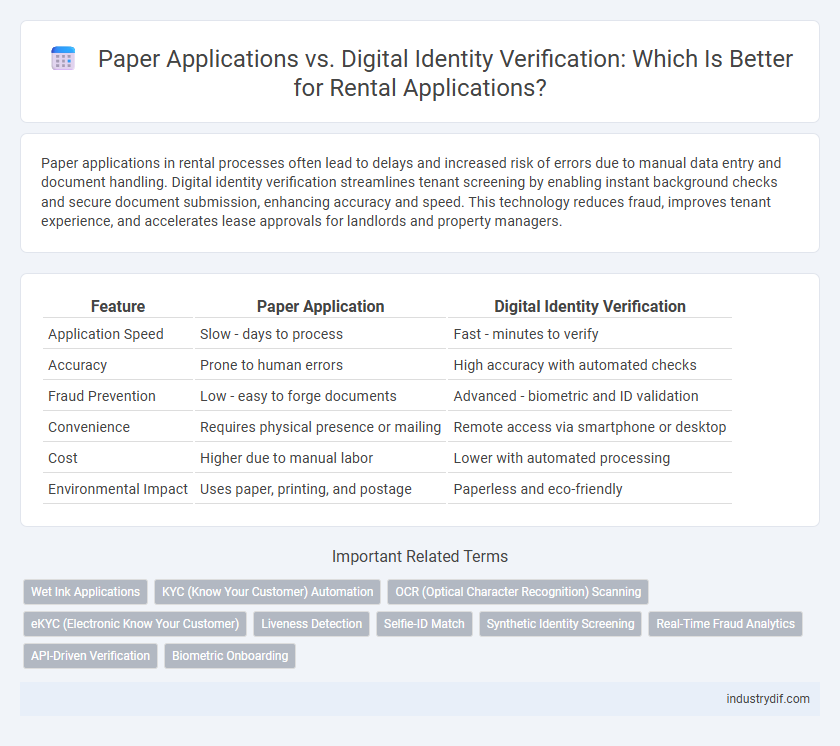

| Feature | Paper Application | Digital Identity Verification |

|---|---|---|

| Application Speed | Slow - days to process | Fast - minutes to verify |

| Accuracy | Prone to human errors | High accuracy with automated checks |

| Fraud Prevention | Low - easy to forge documents | Advanced - biometric and ID validation |

| Convenience | Requires physical presence or mailing | Remote access via smartphone or desktop |

| Cost | Higher due to manual labor | Lower with automated processing |

| Environmental Impact | Uses paper, printing, and postage | Paperless and eco-friendly |

Introduction to Rental Application Processes

Digital identity verification streamlines rental application processes by enabling instant background checks and document authentication, reducing manual errors and processing time. Paper applications often require physical submission, leading to delays and increased administrative overhead. Integrating digital identity solutions enhances accuracy, security, and tenant experience in the rental market.

Overview of Paper Application Methods

Paper application methods for rental processes involve tenants filling out physical forms that require manual input of personal information, employment details, and references. These documents are often submitted in person or via mail, leading to longer processing times and increased risk of errors or lost paperwork. Landlords must manually verify the authenticity of the information, which can delay approval compared to automated digital identity verification systems.

Rise of Digital Identity Verification in Rentals

Digital identity verification is rapidly transforming the rental industry by reducing application processing time and minimizing fraud risks through biometric authentication and real-time data validation. Unlike traditional paper applications, digital verification streamlines tenant screening with instant credit checks and background reports, enhancing decision accuracy and operational efficiency. Landlords and property managers increasingly adopt platforms integrating cutting-edge identity technologies to meet growing demands for security and convenience in rental transactions.

Speed and Efficiency Comparison

Digital identity verification accelerates rental applications by enabling instant document validation and background checks, reducing approval times from days to minutes. Paper applications require manual processing, increasing the likelihood of errors and delays that can extend the rental process. Leveraging digital methods enhances efficiency, streamlining tenant screening and improving overall workflow for property managers.

Security and Fraud Risk Assessment

Digital identity verification significantly enhances rental security by using biometric data and encrypted databases to accurately authenticate applicants, reducing impersonation and identity theft risks. Paper applications are susceptible to forgery, document tampering, and loss, increasing vulnerability to fraud and delaying risk assessment. Automated digital systems enable real-time cross-referencing with criminal and financial databases, providing landlords with a more robust and efficient fraud risk evaluation.

Accessibility for Renters and Landlords

Paper applications require physical presence and manual submission, often causing delays and accessibility challenges for renters with limited mobility or time constraints. Digital identity verification streamlines the rental process by enabling remote, instant authentication through smartphones or computers, increasing convenience and reducing barriers. Landlords benefit from faster tenant screening and secure data handling, enhancing overall efficiency in rental management.

Compliance with Legal and Regulatory Standards

Paper applications often face challenges in maintaining compliance with evolving legal and regulatory standards due to risks of document tampering and data inaccuracies. Digital identity verification leverages advanced encryption and real-time data validation, ensuring adherence to anti-fraud laws and data protection regulations such as GDPR and CCPA. Landlords and rental agencies benefit from automated audit trails and consistent compliance monitoring through secure digital platforms, reducing legal risks and enhancing tenant screening accuracy.

Costs and Resource Implications

Paper applications incur higher costs due to printing, mailing, and manual processing, leading to extended turnaround times and increased labor expenses. Digital identity verification streamlines tenant screening by automating document validation and reducing error rates, significantly lowering administrative overhead. This shift minimizes resource allocation for physical storage and enables faster decision-making, enhancing overall operational efficiency in rental management.

User Experience: Traditional vs. Digital

Paper applications in rental processes often cause delays due to manual data entry, lost documents, and lack of real-time updates, resulting in a frustrating user experience. Digital identity verification streamlines tenant screening by instantly validating information through secure online platforms, reducing errors and wait times. This modern approach enhances convenience, transparency, and trust between landlords and applicants, significantly improving overall satisfaction.

Future Trends in Rental Identity Verification

Future trends in rental identity verification emphasize the shift from traditional paper applications to digital identity verification systems that enhance speed and accuracy. Blockchain technology and biometric authentication are increasingly integrated to prevent fraud and streamline tenant screening processes. Landlords and property managers benefit from real-time verification, reducing the risk of identity theft and improving overall rental market efficiency.

Related Important Terms

Wet Ink Applications

Wet ink applications require physical signatures on paper documents, often causing delays and increased administrative workload in the rental process. Digital identity verification streamlines tenant screening by enabling instant authentication, reducing fraud risk and accelerating lease approvals.

KYC (Know Your Customer) Automation

Digital identity verification streamlines KYC automation by instantly validating tenant information, reducing fraud risk, and accelerating rental application processing compared to traditional paper applications. Automated KYC systems enhance accuracy, compliance, and tenant onboarding efficiency in the rental industry.

OCR (Optical Character Recognition) Scanning

Digital identity verification leverages OCR scanning to quickly and accurately extract tenant information from paper applications, reducing manual data entry errors. This technology streamlines the rental process by automating document verification and enhancing the accuracy of identity checks compared to traditional paper applications.

eKYC (Electronic Know Your Customer)

Paper applications in rental processes often lead to slower tenant screening and increased risk of errors, whereas digital identity verification powered by eKYC enables instant, accurate validation of renter identities through biometric data and government ID checks. Implementing eKYC significantly reduces fraud, streamlines approval times, and enhances compliance with regulatory requirements in tenant onboarding.

Liveness Detection

Digital identity verification with advanced liveness detection enhances rental application security by preventing identity fraud and ensuring the applicant is physically present during verification. Paper applications lack this biometric verification, making them more vulnerable to forgery and impersonation in the rental process.

Selfie-ID Match

Selfie-ID Match enhances rental application accuracy by using biometric facial recognition to verify identity, reducing fraud compared to traditional paper applications. Digital identity verification streamlines tenant screening, enabling faster approval processes and improved security in rental agreements.

Synthetic Identity Screening

Paper applications for rental screening lack the advanced security features needed to detect synthetic identities, increasing the risk of fraudulent tenants. Digital identity verification systems equipped with synthetic identity screening use machine learning algorithms and multi-layered data analysis to accurately identify and prevent synthetic identity fraud in rental applications.

Real-Time Fraud Analytics

Paper applications delay fraud detection by relying on manual review processes, increasing the risk of overlooked inconsistencies and identity theft. Digital identity verification leverages real-time fraud analytics with biometric data and AI-driven algorithms, enabling instant detection of suspicious activity and reducing rental application fraud significantly.

API-Driven Verification

API-driven digital identity verification streamlines the rental application process by enabling instant background and credit checks, reducing manual errors and fraud risks compared to paper applications. This technology integrates seamlessly with rental management systems, enhancing tenant screening accuracy and operational efficiency.

Biometric Onboarding

Biometric onboarding in digital identity verification streamlines the rental application process by securely capturing and authenticating renter identities through fingerprint or facial recognition, reducing fraud and accelerating approvals. Paper applications rely on manual data entry and physical documentation, increasing the risk of errors and prolonging processing times compared to the efficient and accurate digital biometric solutions.

Paper Application vs Digital Identity Verification Infographic

industrydif.com

industrydif.com