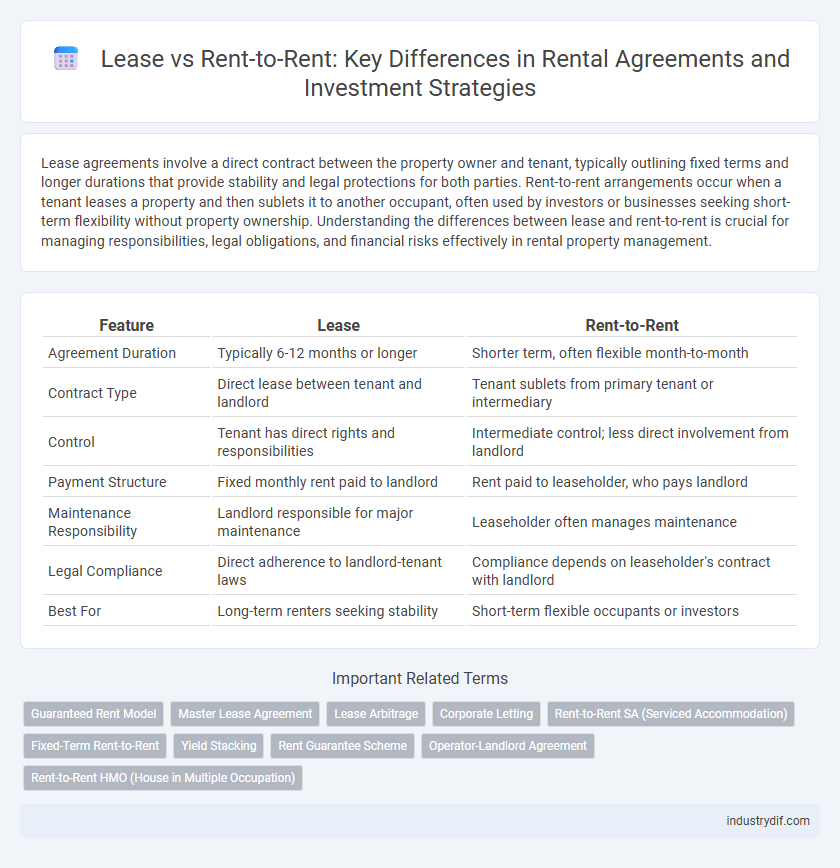

Lease agreements involve a direct contract between the property owner and tenant, typically outlining fixed terms and longer durations that provide stability and legal protections for both parties. Rent-to-rent arrangements occur when a tenant leases a property and then sublets it to another occupant, often used by investors or businesses seeking short-term flexibility without property ownership. Understanding the differences between lease and rent-to-rent is crucial for managing responsibilities, legal obligations, and financial risks effectively in rental property management.

Table of Comparison

| Feature | Lease | Rent-to-Rent |

|---|---|---|

| Agreement Duration | Typically 6-12 months or longer | Shorter term, often flexible month-to-month |

| Contract Type | Direct lease between tenant and landlord | Tenant sublets from primary tenant or intermediary |

| Control | Tenant has direct rights and responsibilities | Intermediate control; less direct involvement from landlord |

| Payment Structure | Fixed monthly rent paid to landlord | Rent paid to leaseholder, who pays landlord |

| Maintenance Responsibility | Landlord responsible for major maintenance | Leaseholder often manages maintenance |

| Legal Compliance | Direct adherence to landlord-tenant laws | Compliance depends on leaseholder's contract with landlord |

| Best For | Long-term renters seeking stability | Short-term flexible occupants or investors |

Understanding Lease Agreements in the Rental Industry

Lease agreements establish a fixed-term contract between landlords and tenants, specifying the rental price, duration, and responsibilities for property maintenance. In contrast, rent-to-rent arrangements involve a third party leasing a property from the owner to sublet it, often creating complex legal and financial obligations. Understanding the terms, rights, and risks associated with each option is essential for effective property management and compliance in the rental industry.

What is Rent-to-Rent?

Rent-to-rent is a rental strategy where an individual leases a property from a landlord and then sublets it to tenants, often at a higher rate to generate profit. This approach allows the middleman to manage the property without owning it, handling tenant agreements and maintenance responsibilities. Rent-to-rent can provide flexible income streams but requires clear contracts and compliance with local rental laws to avoid legal complications.

Key Differences Between Lease and Rent-to-Rent

Lease agreements involve a direct contract between landlord and tenant, granting exclusive property use for a fixed term with legally binding terms. Rent-to-rent arrangements require a tenant to sublet the property, creating a triple rental chain where the original tenant becomes a middleman managing sub-tenants and property maintenance. Financially, leases typically involve fixed monthly payments and long-term stability, whereas rent-to-rent can offer higher short-term returns but entail greater operational responsibilities and legal complexities.

Pros and Cons of Leasing Properties

Leasing properties offers tenants long-term stability and predictable monthly payments with fixed lease terms, making it easier to budget expenses. However, leasing limits flexibility due to lease duration commitments and potential penalties for early termination, which can be restrictive for tenants with uncertain plans. Landlords benefit from steady income and reduced turnover but may face challenges if market rents increase beyond the lease agreement.

Advantages and Disadvantages of Rent-to-Rent

Rent-to-rent offers advantages such as lower upfront costs and flexibility in managing multiple properties without ownership, making it ideal for those with limited capital. However, disadvantages include potential legal risks, less control over property modifications, and reliance on landlord agreements, which can limit long-term stability. Rent-to-rent can lead to higher profit margins but requires thorough contract review to avoid disputes and ensure compliance with local rental laws.

Legal Considerations for Lease and Rent-to-Rent

Lease agreements establish a legally binding contract between landlord and tenant, defining fixed terms such as rent amount, duration, and obligations, protected under landlord-tenant law. Rent-to-rent arrangements involve a third party renting from the original landlord and subletting to tenants, requiring careful scrutiny of subletting clauses to avoid breaches and potential legal disputes. Understanding local housing regulations and obtaining appropriate permissions ensures compliance and mitigates risks associated with both lease and rent-to-rent models.

Financial Implications: Lease vs Rent-to-Rent

Lease agreements typically require a fixed monthly payment to the property owner, offering predictable costs but often involving a significant upfront deposit and long-term financial commitment. Rent-to-rent arrangements involve subletting the property, which can generate rental income exceeding the original lease payment, creating potential profit margins but also higher financial risk due to market fluctuations and tenant management responsibilities. Understanding the cash flow differences and risk exposure in lease versus rent-to-rent models is crucial for effective financial planning in rental strategies.

Which Strategy Suits Your Property Goals?

Lease agreements offer long-term stability with fixed terms and predictable income, ideal for property owners seeking consistent cash flow and minimal management. Rent-to-rent involves leasing a property to sublet it, appealing to investors targeting higher short-term returns and flexible use but requiring active oversight and risk management. Choosing between lease and rent-to-rent depends on your financial objectives, risk tolerance, and desired involvement in property operations.

Common Pitfalls in Lease and Rent-to-Rent Agreements

Lease agreements often include hidden clauses that can lead to unexpected financial liabilities or restrictions on property modifications, impacting tenant flexibility. Rent-to-rent arrangements risk unauthorized subletting, leading to legal disputes and potential breaches of the original lease terms. Both agreements require thorough review of terms to avoid pitfalls such as unclear maintenance responsibilities and termination conditions.

Lease and Rent-to-Rent: Industry Best Practices

Lease agreements provide direct contractual relationships between landlords and tenants, ensuring clear terms on rent, maintenance, and duration, which promotes legal clarity and tenant stability. Rent-to-rent models involve intermediaries leasing properties from landlords to sublet them, requiring careful vetting of subtenants and strict compliance with regulatory standards to mitigate risks. Industry best practices emphasize transparent communication, thorough due diligence, and detailed contracts to balance profitability and legal protection in both lease and rent-to-rent arrangements.

Related Important Terms

Guaranteed Rent Model

The Guaranteed Rent Model in lease agreements ensures landlords receive fixed rental income regardless of tenant occupancy, minimizing financial risk and streamlining property management. This contrasts with rent-to-rent arrangements where intermediary tenants sublet properties, often resulting in variable income and increased complexity.

Master Lease Agreement

A Master Lease Agreement in a Lease vs Rent-to-Rent scenario establishes a comprehensive contract where the primary tenant gains rights to sublet the property, enabling revenue generation through subtenants while maintaining control over lease terms. This arrangement differentiates from a standard lease by allowing operational management and profit from subleasing without transferring ownership or direct landlord responsibilities.

Lease Arbitrage

Lease arbitrage involves renting a property long-term under a lease agreement and then subletting it to generate profit, contrasting with traditional rent-to-rent models that typically focus on shorter-term management without formal lease assignments. This strategy leverages lease agreements to create cash flow opportunities by capitalizing on the difference between the contracted lease rent and market rent from subtenants.

Corporate Letting

Corporate letting through lease agreements provides long-term stability and predictable income by securing exclusive property use for an extended period, whereas rent-to-rent models offer flexibility and lower upfront costs by subletting properties to end tenants without ownership transfer. Lease contracts in corporate letting often include detailed clauses on maintenance and tenant responsibilities, ensuring clear legal protection compared to the more informal arrangements typical of rent-to-rent agreements.

Rent-to-Rent SA (Serviced Accommodation)

Rent-to-Rent SA (Serviced Accommodation) involves leasing a property and then subletting it as short-term, fully furnished accommodations, optimizing rental income through higher nightly rates compared to traditional leases. This model requires managing guest turnover, maintenance, and compliance with hospitality regulations, distinguishing it from standard lease agreements focused on long-term tenancy.

Fixed-Term Rent-to-Rent

Fixed-term rent-to-rent agreements involve leasing a property from a landlord for a set period, then subletting it to tenants, allowing for predictable cash flow and control over rental income. This model differs from traditional leases by emphasizing tenant management and property maintenance while mitigating financial risk through contractually defined durations.

Yield Stacking

Lease agreements provide stable, long-term rental income by securing tenant occupancy, while rent-to-rent strategies enable higher yield stacking by subletting properties at multiple levels to maximize rental returns. Yield stacking in rent-to-rent models leverages short-term or serviced rentals, increasing cash flow beyond standard lease yields through diversified income streams.

Rent Guarantee Scheme

The Rent Guarantee Scheme offers landlords a reliable income by ensuring rent payments under both lease and rent-to-rent agreements, reducing financial risk associated with tenant defaults. Rent-to-rent arrangements often include this scheme to attract investors by providing consistent cash flow and minimizing vacancy periods.

Operator-Landlord Agreement

In rental agreements, a Lease establishes a legal contract directly between the landlord and tenant, granting exclusive possession and defined terms for the property, while Rent-to-Rent involves an Operator-Landlord Agreement where the operator leases the property from the landlord and sublets it to tenants, often managing all operational responsibilities. This model requires clear agreements on rent payment, maintenance duties, and liability to ensure alignment between landlord and operator roles.

Rent-to-Rent HMO (House in Multiple Occupation)

Rent-to-Rent HMO involves leasing a property from the owner and subletting individual rooms to tenants, generating higher rental yields compared to traditional leasing. This strategy requires compliance with HMO licensing regulations, ensuring safety standards and maximizing income through multiple occupancy arrangements.

Lease vs Rent-to-Rent Infographic

industrydif.com

industrydif.com