Monthly payment options provide flexibility by allowing tenants to pay rent manually each month, ensuring control over transaction timing. Automated recurring payments guarantee on-time rent collection by automatically deducting funds on a set schedule, reducing the risk of missed or late payments. Choosing between these methods depends on the tenant's preference for convenience versus payment control.

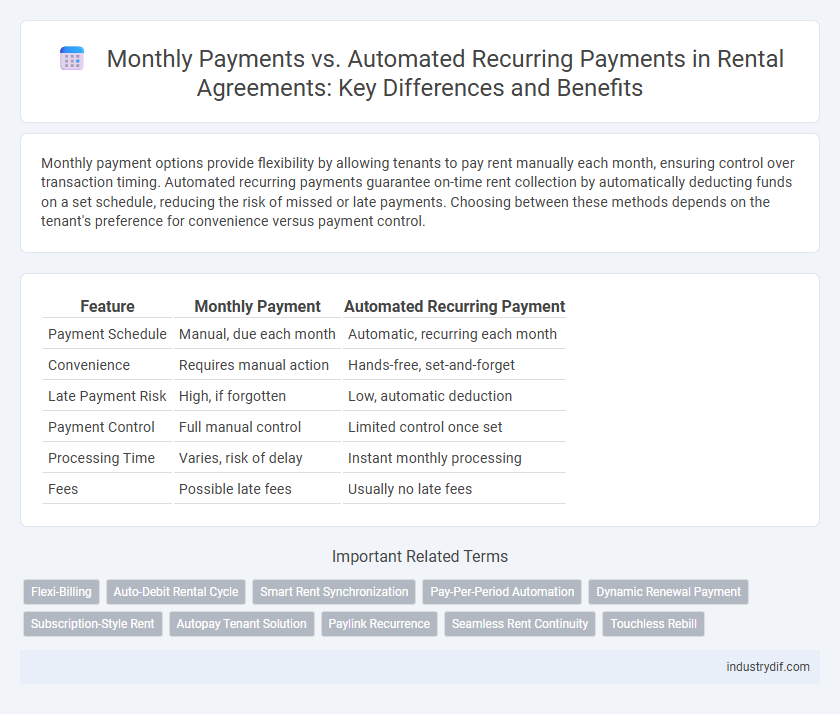

Table of Comparison

| Feature | Monthly Payment | Automated Recurring Payment |

|---|---|---|

| Payment Schedule | Manual, due each month | Automatic, recurring each month |

| Convenience | Requires manual action | Hands-free, set-and-forget |

| Late Payment Risk | High, if forgotten | Low, automatic deduction |

| Payment Control | Full manual control | Limited control once set |

| Processing Time | Varies, risk of delay | Instant monthly processing |

| Fees | Possible late fees | Usually no late fees |

Understanding Monthly Payments in Rental Agreements

Monthly payments in rental agreements represent the fixed amount tenants are required to pay each month to maintain their lease. Automated recurring payments streamline this process by ensuring on-time rent collection through scheduled electronic transfers, reducing the risk of late fees and missed payments. Understanding the distinction between manual monthly payments and automated options helps tenants manage cash flow efficiently and landlords secure consistent revenue.

What Are Automated Recurring Payments?

Automated recurring payments are scheduled transactions that automatically withdraw rental fees from a tenant's account each month, ensuring timely and consistent payments without manual intervention. This system reduces the risk of late payments and enhances cash flow predictability for landlords by streamlining the collection process. Tenants benefit from convenience and avoidance of potential late fees through seamless, automated rent debits.

Key Differences Between Monthly and Automated Payments

Monthly payments require manual submission each billing cycle, whereas automated recurring payments deduct the rent automatically on a specified date. Automated payments minimize the risk of late fees and ensure consistent cash flow for landlords. Manual monthly payments offer flexibility but may lead to occasional missed or delayed payments.

Pros and Cons of Monthly Payments for Tenants

Monthly payments offer tenants flexibility in managing their budget by allowing adjustments based on financial changes each month, but they require consistent manual effort to avoid late fees and missed payments. This method provides clear control over payment timing but increases the risk of delayed rent, affecting tenant credit and landlord-tenant relationships. Automated recurring payments reduce late payments but some tenants prefer monthly payments to maintain direct oversight and financial control.

Benefits of Automated Recurring Payments for Landlords

Automated recurring payments ensure landlords receive rent on time every month, reducing the risk of late or missed payments and enhancing cash flow stability. This system minimizes administrative tasks by automatically processing transactions, saving landlords time and effort in payment collection and follow-up. Landlords benefit from increased accuracy and security, as automated systems reduce errors and provide real-time payment tracking, improving financial transparency and record-keeping.

Common Challenges with Manual Monthly Payments

Manual monthly payments often lead to missed deadlines and late fees due to human error or forgetfulness. Tracking payments requires significant administrative effort, increasing the risk of misapplied or lost payments. Automated recurring payments streamline billing, reduce errors, and improve cash flow consistency for rental properties.

How Automation Reduces Late Rental Payments

Automated recurring payments significantly reduce late rental payments by ensuring tenants' rent is deducted automatically on the due date, eliminating forgetfulness and manual errors. This system improves cash flow predictability for landlords and minimizes disruptions caused by delayed payments. Data shows that properties utilizing automated rent collection experience up to a 70% decrease in late payments.

Security Considerations for Automated Rental Payments

Automated recurring rental payments enhance security by minimizing the risks of missed or delayed payments, reducing exposure to fraud through encryption and tokenization technologies. These systems employ multi-factor authentication and secure payment gateways to protect sensitive tenant data, ensuring compliance with data protection regulations such as PCI DSS. Landlords benefit from consistent cash flow and reduced administrative workload while tenants experience safer, hassle-free transactions.

Transitioning from Manual to Automated Payment Systems

Transitioning from manual monthly rental payments to automated recurring payment systems enhances efficiency by reducing late payments and administrative errors. Automated payments ensure timely rent collection with minimal effort, improving cash flow stability for landlords and convenience for tenants. Integrating digital payment solutions fosters transparency and secure transaction records, streamlining rental management processes.

Which Payment Method Suits Your Rental Business?

Monthly payments offer flexibility for tenants who prefer manual control and irregular payment schedules, making them ideal for short-term or seasonal rentals. Automated recurring payments streamline rent collection by reducing late payments and administrative overhead, benefiting property managers with multiple units or long-term leases. Choosing the best method depends on your rental business size, tenant reliability, and desire for operational efficiency.

Related Important Terms

Flexi-Billing

Flexi-Billing enhances rental management by allowing tenants to choose between a fixed monthly payment or automated recurring payments tailored to their cash flow, improving flexibility and reducing missed transactions. This system leverages real-time payment data to optimize billing schedules, ensuring timely rent collection and better tenant satisfaction.

Auto-Debit Rental Cycle

Automated recurring payments streamline the rental cycle by ensuring monthly rental payments are deducted automatically on the due date, reducing late fees and improving cash flow. This auto-debit system enhances convenience for tenants and landlords by providing consistent, timely payment processing without manual intervention.

Smart Rent Synchronization

Smart Rent Synchronization enhances rental management by automatically aligning monthly payments with tenants' due dates, reducing late fees and improving cash flow consistency. This automated recurring payment system streamlines rent collection, ensuring timely transactions and minimizing administrative overhead for property managers.

Pay-Per-Period Automation

Monthly payment options require manual transaction initiation each billing cycle, while automated recurring payments enable seamless pay-per-period automation, ensuring consistent on-time rent collection and reducing administrative overhead. Implementing automated recurring payment systems significantly decreases late payments and improves cash flow predictability for rental property management.

Dynamic Renewal Payment

Dynamic renewal payment enhances monthly rental payments by automatically adjusting charges based on lease terms and market fluctuations, ensuring accurate and timely transactions. Automated recurring payment systems streamline cash flow and reduce late fees, offering tenants convenience while accommodating variable rent amounts.

Subscription-Style Rent

Subscription-style rent offers streamlined monthly payment options by automatically charging tenants through automated recurring payment systems, reducing late fees and enhancing cash flow stability for landlords. This method ensures timely rent collection, simplifies financial management, and increases tenant convenience compared to manual monthly payments.

Autopay Tenant Solution

Autopay Tenant Solution streamlines rental income by enabling automated recurring payments, reducing late fees and administrative overhead. Monthly payment automation ensures consistent cash flow and improves tenant satisfaction through convenience and reliability.

Paylink Recurrence

Monthly payment options offer flexibility but risk missed due dates, while Automated Recurring Payment through Paylink Recurrence ensures seamless, timely rent collection by securely automating transactions. Utilizing Paylink Recurrence reduces late payments and administrative workload, enhancing cash flow reliability for rental property managers.

Seamless Rent Continuity

Automated recurring payments ensure seamless rent continuity by eliminating manual monthly payment delays and providing landlords with consistent cash flow. This system reduces the risk of missed payments, enhances tenant convenience, and streamlines the rental management process for both parties.

Touchless Rebill

Automated recurring payments offer a touchless rebill experience, ensuring monthly rental payments are processed seamlessly without manual intervention, reducing late fees and enhancing cash flow stability. This system leverages secure technology to authorize transactions automatically, improving tenant convenience and minimizing administrative overhead for property managers.

Monthly Payment vs Automated Recurring Payment Infographic

industrydif.com

industrydif.com