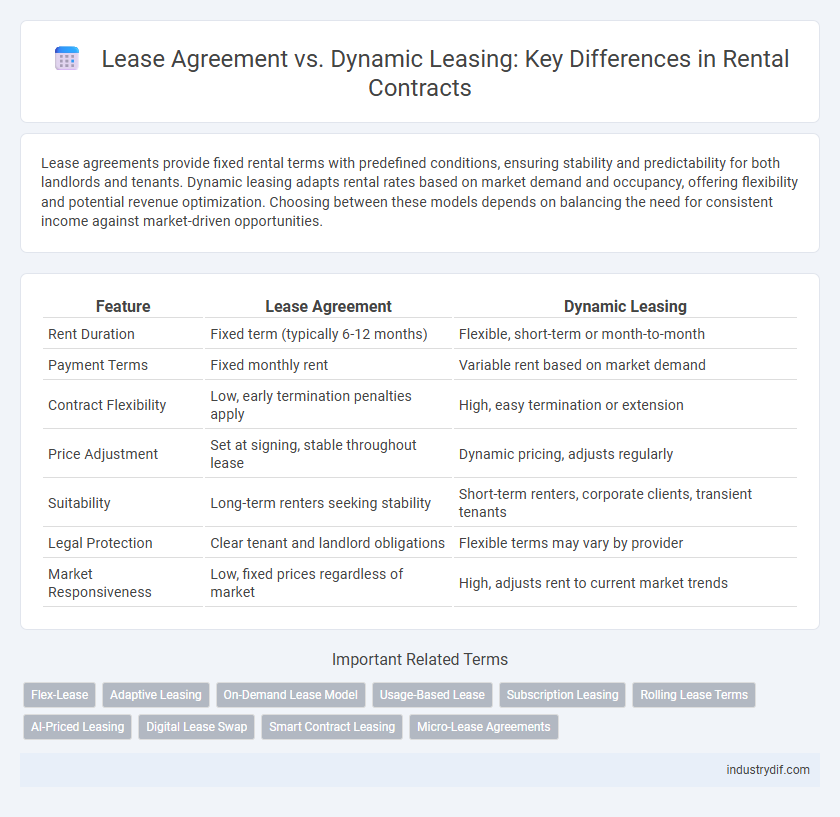

Lease agreements provide fixed rental terms with predefined conditions, ensuring stability and predictability for both landlords and tenants. Dynamic leasing adapts rental rates based on market demand and occupancy, offering flexibility and potential revenue optimization. Choosing between these models depends on balancing the need for consistent income against market-driven opportunities.

Table of Comparison

| Feature | Lease Agreement | Dynamic Leasing |

|---|---|---|

| Rent Duration | Fixed term (typically 6-12 months) | Flexible, short-term or month-to-month |

| Payment Terms | Fixed monthly rent | Variable rent based on market demand |

| Contract Flexibility | Low, early termination penalties apply | High, easy termination or extension |

| Price Adjustment | Set at signing, stable throughout lease | Dynamic pricing, adjusts regularly |

| Suitability | Long-term renters seeking stability | Short-term renters, corporate clients, transient tenants |

| Legal Protection | Clear tenant and landlord obligations | Flexible terms may vary by provider |

| Market Responsiveness | Low, fixed prices regardless of market | High, adjusts rent to current market trends |

Introduction to Lease Agreements and Dynamic Leasing

Lease agreements establish fixed, legally binding terms between landlords and tenants, specifying rent, duration, and obligations to ensure stability in rental arrangements. Dynamic leasing adapts rental terms in real-time based on market demand, occupancy rates, and seasonal fluctuations, offering flexibility and maximizing property revenue. Understanding the fundamental differences between traditional lease contracts and dynamic leasing models is essential for optimizing rental property management.

Key Definitions: Lease Agreement vs Dynamic Leasing

A Lease Agreement is a fixed-term contract specifying rental duration, payment terms, and responsibilities between landlord and tenant, providing stability and predictability. Dynamic Leasing introduces flexible, real-time adjustments to rental terms based on market demand, utilization rates, or tenant needs, enhancing adaptability and revenue optimization. Understanding these key definitions is crucial for landlords and tenants to choose the best rental strategy for maximizing asset value and occupancy.

Structure and Terms of Traditional Lease Agreements

Traditional lease agreements feature fixed terms typically ranging from six months to a year, outlining specific rent amounts, payment schedules, and tenant obligations. The structure is static, with predetermined clauses covering maintenance responsibilities, renewal options, and penalties for breaches. These agreements emphasize stability and predictability, contrasting with dynamic leasing models that adjust terms and prices based on market demand and occupancy trends.

How Dynamic Leasing Works

Dynamic leasing optimizes rental agreements by adjusting lease terms and pricing based on real-time market demand and tenant needs, ensuring higher occupancy rates and increased revenue for property owners. This flexible approach allows tenants to modify lease duration and payment schedules through automated platforms, providing greater convenience and cost-efficiency. Property management systems integrate data analytics to continuously update lease conditions, enabling responsive adaptation to market fluctuations.

Flexibility Comparison: Fixed vs Variable Terms

Lease agreements offer fixed terms with predetermined lease durations and rental amounts, ensuring predictable costs and stability for both landlords and tenants. Dynamic leasing provides variable terms that adjust based on market demand or occupancy rates, increasing flexibility for tenants seeking short-term or fluctuating rental arrangements. Flexibility comparison highlights that fixed leases secure long-term commitments while dynamic leasing adapts to changing needs and maximizes occupancy efficiency.

Cost Analysis: Upfront and Ongoing Expenses

Lease agreements typically involve fixed upfront costs such as security deposits, administrative fees, and sometimes the first month's rent, while ongoing expenses include stable monthly payments that facilitate budgeting. Dynamic leasing models introduce variable upfront costs that can be lower, but ongoing expenses fluctuate based on usage, market demand, or resource allocation, potentially increasing total expenditure over time. Cost analysis should consider the predictability of fixed leasing versus the flexibility and possible variable costs of dynamic leasing to determine the most financially viable option for renters.

Legal Considerations and Compliance

Lease agreements establish fixed legal obligations and terms between landlords and tenants, ensuring clear compliance with local rental laws and tenant rights regulations. Dynamic leasing involves flexible terms that may adapt to changing market conditions or tenant needs but require careful review to maintain adherence to housing laws and prevent disputes. Both models must prioritize transparent contract clauses, timely disclosures, and adherence to jurisdiction-specific landlord-tenant statutes to mitigate legal risks.

Suitability for Different Rental Scenarios

Traditional lease agreements provide fixed rental terms ideal for long-term tenants seeking stability and predictable costs, such as residential renters or commercial businesses with consistent space needs. Dynamic leasing offers flexible contract durations and adjustable rates, catering to short-term tenants, pop-up shops, or seasonal businesses requiring adaptability to market fluctuations. Selecting between lease agreement and dynamic leasing depends on the tenant's rental duration, financial flexibility, and operational requirements within specific market environments.

Pros and Cons: Lease Agreements vs Dynamic Leasing

Lease agreements provide fixed rental terms and predictable income, offering stability for landlords and tenants but lack flexibility to adjust rent based on market conditions. Dynamic leasing adapts rental prices in real-time according to demand and occupancy, maximizing revenue potential but can create uncertainty for tenants and increase administrative complexity. Choosing between lease agreements and dynamic leasing depends on priorities such as income stability versus revenue optimization in rental management.

Choosing the Right Rental Model for Your Needs

Lease agreements provide fixed-term contracts with predictable rental payments, ideal for tenants seeking stability and long-term occupancy. Dynamic leasing offers flexible terms and variable pricing based on market demand, suited for businesses looking to scale or adapt quickly. Assessing your budget, occupancy goals, and market conditions helps determine whether a traditional lease or dynamic leasing aligns best with your rental needs.

Related Important Terms

Flex-Lease

Flex-Lease offers a dynamic leasing model that provides tenants with flexible rental terms and adjustable lease durations, contrasting traditional lease agreements which often involve fixed, long-term commitments. This innovative approach allows landlords to maximize occupancy and adapt rental rates based on market demand, enhancing profitability and tenant satisfaction.

Adaptive Leasing

Adaptive Leasing enhances traditional lease agreements by allowing flexible terms and real-time adjustments based on market demand and tenant needs. This dynamic leasing model optimizes rental income and occupancy rates by adapting lease durations, pricing, and conditions in response to changing circumstances.

On-Demand Lease Model

The On-Demand Lease Model offers flexible rental terms tailored to immediate tenant needs, contrasting with traditional Lease Agreements that typically require fixed, long-term commitments and predetermined conditions. This dynamic leasing approach enables property owners to maximize occupancy rates and revenue by adjusting lease durations and pricing in real time based on demand and market trends.

Usage-Based Lease

Usage-Based Lease in dynamic leasing adapts rental payments according to actual usage metrics such as mileage, hours, or consumption, offering flexibility and cost efficiency compared to traditional fixed-term lease agreements. This model enhances transparency and aligns costs directly with tenant activity, reducing financial risk and optimizing resource allocation for both lessors and lessees.

Subscription Leasing

Subscription leasing offers flexible rental terms and straightforward access to vehicles without long-term commitments found in traditional lease agreements. Unlike fixed-term leases, subscription leasing allows users to switch vehicles or cancel plans with minimal penalties, meeting the growing demand for adaptable mobility solutions.

Rolling Lease Terms

Rolling lease terms in dynamic leasing offer greater flexibility compared to traditional lease agreements by allowing tenants to extend or terminate their rental period on a month-to-month basis without long-term commitment. This adaptive approach caters to changing market demands and tenant needs, optimizing occupancy rates and reducing vacancy periods for property owners.

AI-Priced Leasing

AI-priced leasing leverages machine learning algorithms to optimize rent based on real-time market demand, tenant behavior, and property features, contrasting with traditional lease agreements that set fixed rental rates for the term. Dynamic leasing enhances revenue potential and occupancy rates through continuous price adjustments, providing landlords flexibility and renters access to competitive, data-driven pricing models.

Digital Lease Swap

Digital Lease Swap revolutionizes traditional lease agreements by enabling tenants to seamlessly transfer rental contracts through online platforms, reducing vacancy periods and administrative costs. This innovative approach contrasts with static lease agreements, offering flexibility and real-time market adjustments that benefit both landlords and renters in dynamic rental markets.

Smart Contract Leasing

Smart contract leasing automates rental agreements by embedding lease terms into blockchain-based contracts, reducing administrative overhead and increasing transparency compared to traditional lease agreements. Dynamic leasing adapts rental terms in real-time based on market demand and tenant behavior, enhancing flexibility and optimizing revenue streams for property owners.

Micro-Lease Agreements

Micro-lease agreements offer flexible, short-term rental options compared to traditional lease agreements, allowing tenants to lease properties for days or weeks instead of months or years. Dynamic leasing optimizes rental income by adjusting terms and pricing based on real-time market demand, making micro-leases an ideal solution for property owners seeking higher occupancy and adaptability.

Lease Agreement vs Dynamic Leasing Infographic

industrydif.com

industrydif.com