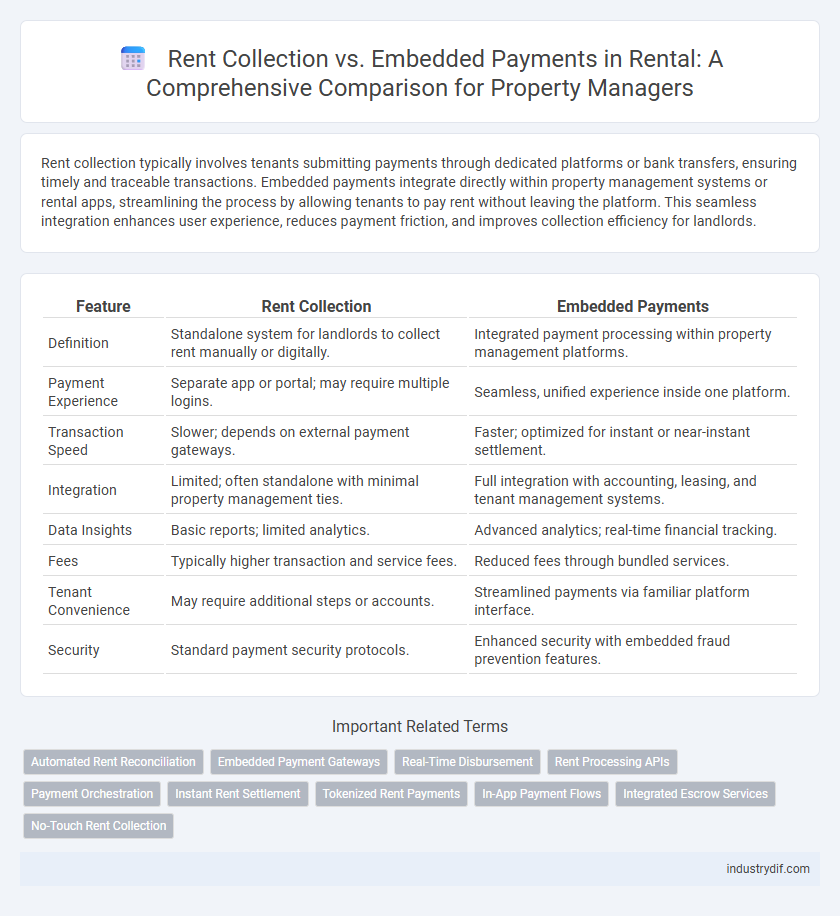

Rent collection typically involves tenants submitting payments through dedicated platforms or bank transfers, ensuring timely and traceable transactions. Embedded payments integrate directly within property management systems or rental apps, streamlining the process by allowing tenants to pay rent without leaving the platform. This seamless integration enhances user experience, reduces payment friction, and improves collection efficiency for landlords.

Table of Comparison

| Feature | Rent Collection | Embedded Payments |

|---|---|---|

| Definition | Standalone system for landlords to collect rent manually or digitally. | Integrated payment processing within property management platforms. |

| Payment Experience | Separate app or portal; may require multiple logins. | Seamless, unified experience inside one platform. |

| Transaction Speed | Slower; depends on external payment gateways. | Faster; optimized for instant or near-instant settlement. |

| Integration | Limited; often standalone with minimal property management ties. | Full integration with accounting, leasing, and tenant management systems. |

| Data Insights | Basic reports; limited analytics. | Advanced analytics; real-time financial tracking. |

| Fees | Typically higher transaction and service fees. | Reduced fees through bundled services. |

| Tenant Convenience | May require additional steps or accounts. | Streamlined payments via familiar platform interface. |

| Security | Standard payment security protocols. | Enhanced security with embedded fraud prevention features. |

Introduction to Rent Collection and Embedded Payments

Rent collection involves landlords or property managers directly receiving rental payments from tenants, often through traditional methods like checks or bank transfers. Embedded payments integrate rental transactions within digital platforms, enabling seamless, automated rent processing and real-time payment tracking. This approach enhances convenience, reduces late payments, and improves cash flow management for rental businesses.

Traditional Rent Collection Methods Explained

Traditional rent collection methods typically involve paper checks, in-person payments, and manual record-keeping, which can lead to delays and increased administrative effort. These conventional processes lack real-time payment tracking and often result in late payments or errors. Compared to embedded payment solutions, traditional methods offer limited automation and convenience for both landlords and tenants.

What Are Embedded Payments in the Rental Industry?

Embedded payments in the rental industry refer to integrated payment solutions within property management platforms, allowing tenants to pay rent directly through a seamless and secure interface. These systems streamline rent collection by automating transactions, reducing manual processing errors, and enhancing the overall tenant experience. By embedding payments, landlords improve cash flow predictability and reduce administrative overhead compared to traditional rent collection methods.

Benefits of Traditional Rent Collection

Traditional rent collection offers landlords direct control over payment schedules and tenant interactions, reducing reliance on third-party platforms that may charge fees or introduce delays. This method provides clear, transparent records of transactions and fosters stronger communication, helping landlords promptly address missed payments or disputes. Additionally, traditional rent collection supports flexible payment options, accommodating various tenant preferences without the limitations of embedded payment systems.

Advantages of Embedded Payment Solutions

Embedded payment solutions streamline rent collection by integrating payment processing directly within property management platforms, reducing delays and errors associated with manual transactions. These solutions enhance tenant convenience through automated payment schedules, multiple payment options, and real-time transaction tracking, improving cash flow predictability for landlords. Enhanced security features and compliance with PCI standards minimize fraud risks compared to traditional rent collection methods.

Key Differences Between Rent Collection and Embedded Payments

Rent collection typically involves third-party platforms or property management systems that aggregate tenant payments and disburse funds to landlords on a scheduled basis. Embedded payments integrate payment processing directly within rental or accounting software, enabling seamless rent transactions without redirecting users. Key differences include payment processing speed, user experience continuity, and the degree of integration with other rental management tools.

Security and Compliance in Payment Processing

Rent collection through embedded payments offers enhanced security by leveraging tokenization and encryption protocols that reduce the risk of data breaches compared to traditional methods. Embedded payment systems comply with PCI DSS standards, ensuring that tenant payment information is securely stored and processed. These secure frameworks minimize fraud and unauthorized access, providing landlords and property managers with reliable and compliant transaction processing.

Impact on Landlord and Tenant Experience

Rent collection methods significantly affect both landlord and tenant experience by influencing transaction speed, transparency, and convenience. Embedded payments streamline the process through integrated platforms, reducing missed payments and improving cash flow for landlords while offering tenants seamless, automated rent submission options. This integration enhances communication, fosters trust, and minimizes conflicts compared to traditional rent collection methods reliant on manual or external payment systems.

Cost Comparison: Rent Collection vs Embedded Payments

Rent collection platforms typically charge landlords a fixed fee or a percentage of each transaction, which can accumulate significantly over time. Embedded payment systems, integrated directly into property management software, often offer lower processing fees and reduce administrative costs by automating reconciliations. Choosing embedded payments can lead to substantial savings in transaction fees and operational expenses compared to traditional rent collection methods.

Future Trends in Rental Payment Technology

Rent collection is evolving with embedded payment systems streamlining rental transactions through seamless integration with property management platforms. Future trends indicate increased adoption of blockchain for secure, transparent payment processing and AI-driven analytics to predict payment behaviors and reduce defaults. Mobile-first solutions and contactless payments will dominate, enhancing convenience and accelerating transaction speeds in the rental market.

Related Important Terms

Automated Rent Reconciliation

Automated rent reconciliation streamlines rent collection by instantly matching payments to tenant accounts, reducing manual errors and improving cash flow accuracy. Embedded payments integrate directly into property management platforms, enabling seamless transaction processing and real-time financial reporting for landlords.

Embedded Payment Gateways

Embedded payment gateways streamline rent collection by integrating seamless transaction processing directly within rental platforms, reducing payment friction and enhancing tenant convenience. This integration improves cash flow reliability for landlords through automated billing, secure data handling, and real-time payment tracking.

Real-Time Disbursement

Rent collection leveraging embedded payments ensures real-time disbursement, significantly improving cash flow management for landlords and property managers. This immediate transfer of funds minimizes delays and enhances financial transparency within rental property operations.

Rent Processing APIs

Rent processing APIs streamline rent collection by automating payment tracking, reducing manual errors, and ensuring timely transaction settlements. Embedded payments integrate seamlessly within property management platforms, providing tenants with a convenient, frictionless experience while enabling landlords to monitor cash flow and reconcile accounts efficiently.

Payment Orchestration

Rent collection platforms streamline payment orchestration by integrating multiple embedded payment methods, ensuring faster transaction processing and improved cash flow for landlords and property managers. Leveraging payment orchestration enables seamless coordination between diverse payment gateways, reducing transaction failures and enhancing tenant payment experiences in the rental market.

Instant Rent Settlement

Instant rent settlement via embedded payments streamlines cash flow by enabling tenants to pay rent directly through integrated platforms, reducing delays common in traditional rent collection methods. This seamless transaction process enhances landlord liquidity and accuracy while minimizing administrative overhead and payment reconciliation errors.

Tokenized Rent Payments

Tokenized rent payments streamline rent collection by securely storing tenant payment information, enabling seamless recurring transactions and reducing late payments. Embedded payments integrate directly into property management platforms, enhancing user experience and improving cash flow through automated, token-based authorization.

In-App Payment Flows

In-app payment flows for rent collection streamline tenant transactions by enabling direct payments within the rental platform, reducing friction and improving cash flow management for landlords. Embedded payments enhance this process by integrating multiple payment methods and automating reconciliation, ensuring faster settlement and increased transparency.

Integrated Escrow Services

Integrated escrow services streamline rent collection by securely holding tenant payments until all rental conditions are met, reducing disputes and enhancing trust between landlords and tenants. Embedded payments simplify this process by allowing automatic transfers directly within rental platforms, ensuring timely rent deposits and transparent transaction tracking.

No-Touch Rent Collection

No-touch rent collection streamlines rent payments by automating transaction processing, reducing delays and administrative workload for landlords while enhancing tenant convenience with seamless embedded payment options integrated directly into property management platforms. This approach leverages secure digital channels, minimizes cash handling errors, and accelerates cash flow, ensuring timely rent collection and improved financial transparency for rental businesses.

Rent Collection vs Embedded Payments Infographic

industrydif.com

industrydif.com