Rental properties offer flexibility for tenants seeking short- to medium-term housing options, while build-to-rent developments cater specifically to long-term rental markets with purpose-built units designed for durability and community living. Build-to-rent properties often feature enhanced amenities and professional management that attract stable tenants, providing investors with consistent income streams. Choosing between rental property types depends on investment goals, tenant demographics, and the desired level of property management involvement.

Table of Comparison

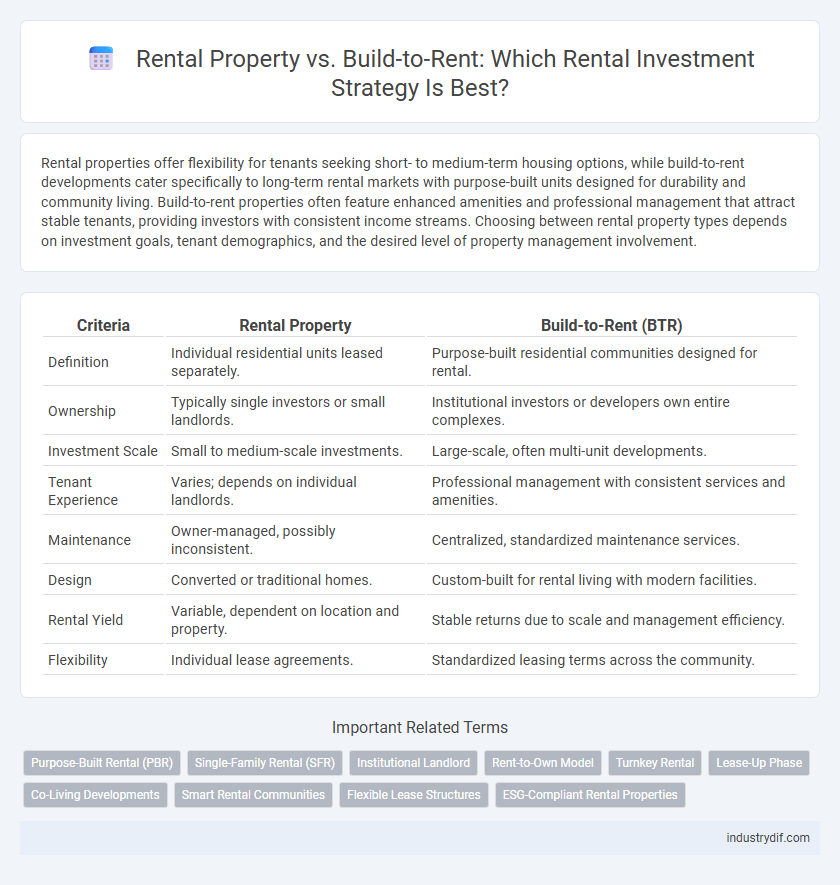

| Criteria | Rental Property | Build-to-Rent (BTR) |

|---|---|---|

| Definition | Individual residential units leased separately. | Purpose-built residential communities designed for rental. |

| Ownership | Typically single investors or small landlords. | Institutional investors or developers own entire complexes. |

| Investment Scale | Small to medium-scale investments. | Large-scale, often multi-unit developments. |

| Tenant Experience | Varies; depends on individual landlords. | Professional management with consistent services and amenities. |

| Maintenance | Owner-managed, possibly inconsistent. | Centralized, standardized maintenance services. |

| Design | Converted or traditional homes. | Custom-built for rental living with modern facilities. |

| Rental Yield | Variable, dependent on location and property. | Stable returns due to scale and management efficiency. |

| Flexibility | Individual lease agreements. | Standardized leasing terms across the community. |

Definition: Rental Property vs Build-to-Rent

Rental property refers to individual real estate units, such as houses or apartments, owned by landlords and leased to tenants on a periodic basis. Build-to-Rent (BTR) is a purpose-built housing development designed specifically for long-term rental, often managed by professional operators offering amenities and consistent rental standards. While rental properties may vary in type and ownership, BTR developments emphasize scale, design, and tenant experience tailored for rental markets.

Ownership Structure in Rental Models

Rental property ownership typically involves individual landlords or small investment groups holding title to single or multiple rental units, leading to decentralized management and varied tenant experiences. Build-to-Rent (BTR) developments are owned by institutional investors or real estate companies, enabling centralized ownership with professional management and consistent service standards across properties. This ownership structure in BTR models facilitates long-term asset management strategies and scalable operations, distinguishing it from traditional rental property ownership.

Investment Returns: Traditional Rental vs Build-to-Rent

Investment returns in traditional rental properties often depend on individual unit appreciation and market rental yields, which can vary widely based on location and property management quality. Build-to-rent developments, designed specifically for rental income, typically offer more stable and predictable cash flows through professionally managed portfolios and economies of scale. Investors in build-to-rent models benefit from lower vacancy rates and higher operational efficiencies, resulting in potentially stronger long-term returns compared to fragmented traditional rental investments.

Tenant Experience and Amenities

Rental properties often offer a range of amenities such as fitness centers, lounges, and maintenance services that enhance tenant satisfaction and convenience. Build-to-rent communities prioritize tenant experience by integrating smart home technology, communal spaces, and flexible lease terms tailored to long-term renters. Emphasizing modern amenities and seamless service delivery in build-to-rent developments creates a more cohesive and engaging living environment compared to traditional rental properties.

Property Management Approaches

Rental properties typically rely on traditional property management strategies involving individual tenant relationships, maintenance scheduling, and localized marketing efforts. Build-to-Rent developments emphasize scalable management systems using centralized online platforms, automated rent collection, and community amenities to attract long-term tenants. This approach prioritizes operational efficiency, resident engagement, and consistent service delivery across multiple units.

Scalability and Portfolio Growth

Rental property investments offer localized portfolio growth but face limitations in scalability due to property-by-property acquisition and management. Build-to-rent developments enable large-scale projects with streamlined construction and management processes, facilitating rapid portfolio expansion and operational efficiencies. Institutional investors prefer build-to-rent for scalable growth, consistent rental income, and enhanced asset diversification in multifamily markets.

Regulatory and Compliance Considerations

Rental properties often face varied regulatory requirements based on zoning laws, tenant protection statutes, and landlord licensing, which can differ significantly from those governing build-to-rent developments. Build-to-rent projects must comply with comprehensive planning permissions, multi-unit safety standards, and long-term occupancy regulations to meet both market demands and legal frameworks. Navigating these regulatory landscapes requires thorough understanding of local housing policies and ongoing compliance management to avoid penalties and ensure tenant rights are upheld.

Market Trends in Build-to-Rent and Traditional Rentals

Build-to-Rent (BTR) developments are rapidly gaining traction in major urban centers due to increased demand for purpose-built rental communities offering modern amenities and long-term lease stability. Traditional rental properties continue to dominate through diverse housing stock and localized management but face challenges from rising maintenance costs and inconsistent tenant experiences. Market trends indicate a shift towards institutional investment in BTR as a preferred asset class, driven by demographic shifts and a preference for professionally managed, scalable rental solutions.

Maintenance and Operational Efficiency

Rental properties often face higher maintenance costs due to varied tenant needs and older infrastructure, leading to frequent repairs and inconsistent operational efficiency. Build-to-Rent developments streamline maintenance through standardized construction and integrated management systems, resulting in lower downtime and more consistent operational performance. Efficient resource allocation in Build-to-Rent properties enhances long-term cost savings and tenant satisfaction compared to traditional rental properties.

Future Outlook for Rental Property Investments

Rental property investments are expected to remain strong as urbanization and housing demand increase, with traditional rental properties offering steady cash flow and long-term appreciation. Build-to-Rent communities, designed specifically for renters with amenities and modern designs, are gaining popularity and attracting institutional investors seeking scalable, purpose-built rental assets. The future outlook indicates a growing shift towards Build-to-Rent developments due to changing renter preferences and the need for professionally managed rental communities.

Related Important Terms

Purpose-Built Rental (PBR)

Purpose-Built Rental (PBR) properties are designed specifically for long-term rental occupancy, offering enhanced amenities, professional management, and community-focused layouts that differentiate them from traditional rental properties, which are often converted from owner-occupied units. PBR developments prioritize tenant experience, energy efficiency, and sustainability, leading to higher retention rates and predictable income streams for investors compared to conventional rental investments.

Single-Family Rental (SFR)

Single-Family Rental (SFR) properties offer individual homes leased to tenants, providing flexible occupancy and diverse location options, while Build-to-Rent (BTR) developments are purpose-built communities designed specifically for rental living, often featuring shared amenities and professional management. SFR investments benefit from strong demand in suburban markets and higher tenant retention rates due to detached home appeal, whereas BTR projects emphasize scalability and modern rental features that attract long-term renters seeking community-focused environments.

Institutional Landlord

Institutional landlords increasingly prefer build-to-rent developments due to their ability to deliver purpose-built, scalable rental properties with consistent income streams and enhanced asset management controls. Unlike traditional rental properties, build-to-rent schemes offer higher tenant retention rates and long-term value appreciation through professional operation and strategic location selection.

Rent-to-Own Model

The Rent-to-Own model bridges traditional rental properties and build-to-rent developments by allowing tenants to accumulate equity while leasing, offering a pathway to homeownership without immediate mortgage approval. This approach provides flexibility and financial benefits, making it an attractive alternative for renters seeking long-term investment in their residence.

Turnkey Rental

Turnkey rental properties offer immediate income potential with minimal management, contrasting with build-to-rent developments that require longer construction timelines and operational setup. Investors seeking hassle-free rental income often prefer turnkey rentals due to their established tenant base and streamlined property management.

Lease-Up Phase

The lease-up phase in Rental Property typically involves marketing existing units to quickly secure tenants, while Build-to-Rent properties focus on pre-leasing strategies before construction completion to stabilize cash flow early. Effective lease-up for Build-to-Rent projects often requires targeted campaigns and incentives to attract long-term renters attracted by new amenities and community features.

Co-Living Developments

Rental property investments typically involve acquiring individual homes or apartments for lease, whereas build-to-rent (BTR) developments focus on purpose-built communities designed specifically for long-term rentals, enhancing tenant experience through shared amenities. Co-living developments within BTR frameworks optimize space utilization and foster social interaction by offering private bedrooms alongside extensive communal areas, appealing to affordable urban living demands.

Smart Rental Communities

Smart rental communities within build-to-rent developments integrate advanced technology and data-driven management systems that enhance tenant experience, improve energy efficiency, and streamline maintenance operations. Compared to traditional rental properties, these communities offer connected amenities, smart home features, and seamless digital interactions that address modern renter demands and increase long-term asset value.

Flexible Lease Structures

Rental properties typically offer standard lease agreements with fixed terms, while Build-to-Rent developments emphasize flexible lease structures designed to accommodate varying tenant needs. These flexible leases often include options for shorter durations, customizable renewal terms, and tailored payment plans, enhancing tenant satisfaction and market adaptability.

ESG-Compliant Rental Properties

ESG-compliant rental properties prioritize environmental sustainability, social responsibility, and strong governance practices, offering tenants energy-efficient designs, reduced carbon footprints, and community-focused amenities. Build-to-rent developments often lead the market in ESG standards by integrating smart technologies and green building materials from inception, aligning financial returns with long-term environmental and social benefits.

Rental Property vs Build-to-Rent Infographic

industrydif.com

industrydif.com