Security deposits have long been a standard requirement in rental agreements, providing landlords with financial protection against damages or unpaid rent. Deposit-free models are emerging as an alternative, offering tenants flexibility and reducing upfront costs by substituting security deposits with insurance or guarantee services. This shift enhances rental accessibility while balancing landlord risk through innovative financial solutions.

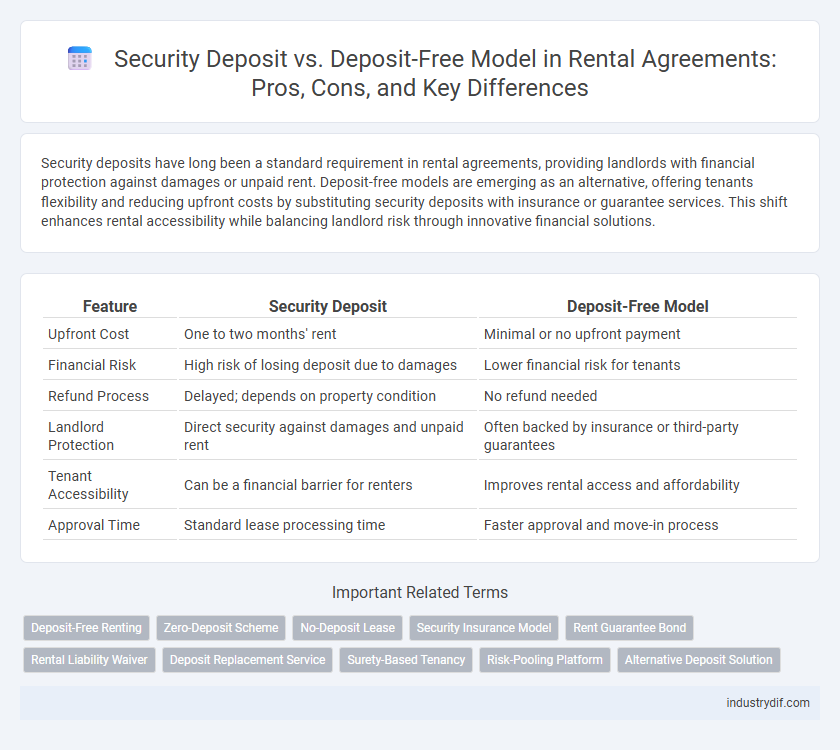

Table of Comparison

| Feature | Security Deposit | Deposit-Free Model |

|---|---|---|

| Upfront Cost | One to two months' rent | Minimal or no upfront payment |

| Financial Risk | High risk of losing deposit due to damages | Lower financial risk for tenants |

| Refund Process | Delayed; depends on property condition | No refund needed |

| Landlord Protection | Direct security against damages and unpaid rent | Often backed by insurance or third-party guarantees |

| Tenant Accessibility | Can be a financial barrier for renters | Improves rental access and affordability |

| Approval Time | Standard lease processing time | Faster approval and move-in process |

Understanding Security Deposits in Rental Agreements

Security deposits in rental agreements serve as a financial safeguard for landlords against potential damages, unpaid rent, or lease violations, typically amounting to one to two months' rent. These deposits are held in escrow and must be refunded to tenants upon lease termination, minus any justified deductions for repairs or cleaning. Deposit-free models provide an alternative by replacing traditional security deposits with a guarantee or insurance policy, reducing upfront costs for tenants while still protecting landlords' interests.

What Is the Deposit-Free Rental Model?

The deposit-free rental model eliminates the traditional upfront security deposit, replacing it with alternatives such as insurance or small monthly fees to protect landlords against damages or missed payments. This approach reduces financial barriers for tenants, enabling quicker access to rental properties without large initial costs. By leveraging technology and risk assessment tools, deposit-free models offer a streamlined, transparent rental experience appealing to both renters and property owners.

Key Differences Between Security Deposits and Deposit-Free Models

Security deposits require tenants to pay a refundable amount upfront to cover potential damages or unpaid rent, creating a financial barrier to entry, while deposit-free models use insurance or third-party guarantees to minimize initial costs without holding tenant funds. Security deposits often tie up tenant capital and must be refunded within specific timeframes according to local laws, whereas deposit-free models offer more liquidity but may involve monthly fees or insurance premiums. The key difference lies in risk allocation: security deposits directly secure landlords by holding cash, whereas deposit-free models transfer some risk to insurers or guarantors, promoting easier access to rentals but sometimes increasing long-term costs.

Pros and Cons of Traditional Security Deposits

Traditional security deposits provide landlords with financial protection against damages and unpaid rent, ensuring a safety net that reduces risk. However, these deposits can create financial barriers for tenants due to high upfront costs, often limiting rental accessibility and affordability. Additionally, disputes over deposit deductions may arise, leading to prolonged resolution processes and strained landlord-tenant relationships.

Advantages of Choosing a Deposit-Free Rental Option

Choosing a deposit-free rental option eliminates the upfront financial burden typically associated with traditional security deposits, making it easier for renters to move in without large cash reserves. It enhances tenant flexibility and improves cash flow management, as renters retain their funds for other essential expenses or investments. Moreover, deposit-free models often streamline the rental application process, reducing administrative delays and increasing tenant satisfaction.

Legal Considerations in Security Deposits vs Deposit-Free Rentals

Legal considerations in security deposits typically involve strict regulations on maximum amounts, timelines for return, and permissible deductions, varying significantly by jurisdiction to protect tenants from unfair practices. Deposit-free rental models often require alternative legal frameworks, such as insurance products or third-party guarantees, which must comply with local housing laws and consumer protection standards. Understanding these legal nuances ensures landlords and tenants navigate obligations and rights effectively, minimizing disputes related to rental agreements.

Impact on Tenants’ Cash Flow: Deposit vs Deposit-Free

Security deposits typically require tenants to pay a significant upfront sum, often equivalent to one or two months' rent, which can strain their immediate cash flow and limit financial flexibility. Deposit-free models eliminate this upfront burden by replacing the traditional deposit with a small non-refundable fee or insurance premium, allowing tenants to allocate funds toward daily expenses or savings. This shift improves tenants' liquidity and reduces the financial barrier to securing rental housing, promoting more accessible and manageable cash flow.

How Deposit-Free Models Affect Landlords

Deposit-free models reduce upfront costs for tenants, increasing rental demand and potentially shortening vacancy periods for landlords. They often replace traditional cash deposits with insurance policies or third-party guarantees, minimizing landlords' financial risk and administrative burden related to deposit management. However, some landlords may face challenges in claim recovery processes if tenant damages occur, requiring careful evaluation of the deposit-free provider's terms and reliability.

Steps to Transition from Security Deposit to Deposit-Free Rentals

Transitioning from a security deposit to a deposit-free rental model requires clear communication with tenants about new policies and payment structures. Implementing alternative safeguards such as insurance or third-party guarantee services reduces financial risk while improving cash flow and tenant accessibility. Landlords should update lease agreements and screening procedures to reflect the deposit-free approach, ensuring legal compliance and transparency throughout the process.

Future Trends in Rental Payment Models

Rental payment models are evolving with a growing emphasis on deposit-free options that use insurance or third-party guarantees to reduce upfront costs for tenants. Security deposits, traditionally held as financial protection for landlords, are increasingly supplemented or replaced by innovative digital payment platforms and flexible insurance products. These future trends aim to enhance affordability, improve tenant-landlord relationships, and streamline rental processes through technology-driven solutions.

Related Important Terms

Deposit-Free Renting

Deposit-free renting eliminates the upfront financial burden of traditional security deposits by leveraging third-party insurance or guarantee services, enabling tenants to move in with minimal initial costs. This model increases affordability and accessibility for renters while providing landlords with protection against potential damages or unpaid rent through insured coverage rather than held cash.

Zero-Deposit Scheme

The zero-deposit scheme eliminates upfront security deposits, reducing financial barriers for tenants and expediting move-in processes in rental agreements. This model leverages insurance-backed guarantees, offering landlords protection against damages and unpaid rent while enhancing tenant affordability and flexibility.

No-Deposit Lease

No-deposit lease agreements eliminate upfront security payments, making rentals more accessible and reducing initial financial barriers for tenants. This model often leverages alternative screening methods like credit checks or rental history to mitigate landlord risk while enhancing tenant flexibility.

Security Insurance Model

Security insurance models for rentals replace traditional security deposits by offering tenants a low-cost, non-refundable insurance premium that protects landlords against potential damages or unpaid rent. This approach improves tenant affordability while maintaining landlord security through backed insurance coverage.

Rent Guarantee Bond

A Rent Guarantee Bond offers tenants a security deposit alternative by providing landlords with financial protection against unpaid rent or damages, ensuring prompt compensation without the need for upfront cash from tenants. This deposit-free model enhances tenant affordability and flexibility while maintaining landlord assurance through a guaranteed rent payment system.

Rental Liability Waiver

A Rental Liability Waiver offers tenants protection against potential damages without requiring a traditional security deposit, reducing upfront costs and financial barriers. This model shifts risk from landlords to insurance providers, streamlining the rental process and enhancing tenant flexibility.

Deposit Replacement Service

Security deposit replacement services offer renters a cost-effective alternative to traditional security deposits by providing a refundable insurance policy or guarantee that covers potential damages or unpaid rent. This model improves cash flow for tenants while ensuring landlords receive financial protection similar to standard deposits without requiring substantial upfront payment.

Surety-Based Tenancy

Surety-based tenancy eliminates the need for a traditional security deposit by using a surety bond that guarantees landlord protection against damages and unpaid rent, enhancing tenant affordability and access. This deposit-free model streamlines rental agreements while maintaining financial security through third-party assurance, reducing upfront costs for tenants without compromising landlord rights.

Risk-Pooling Platform

Risk-pooling platforms in rental markets reduce tenant financial burden by distributing security deposit risks across multiple participants, enhancing affordability and access. This model contrasts traditional security deposits by eliminating upfront lump sums, instead using collective pooling to protect landlords against damages and defaults.

Alternative Deposit Solution

Alternative deposit solutions such as deposit-free models reduce upfront rental costs by replacing traditional security deposits with insurance or guarantee products, enhancing tenant affordability and landlord risk management. These innovative options streamline the rental process, increase renter accessibility, and promote faster lease agreements while maintaining financial protection for property owners.

Security Deposit vs Deposit-Free Model Infographic

industrydif.com

industrydif.com