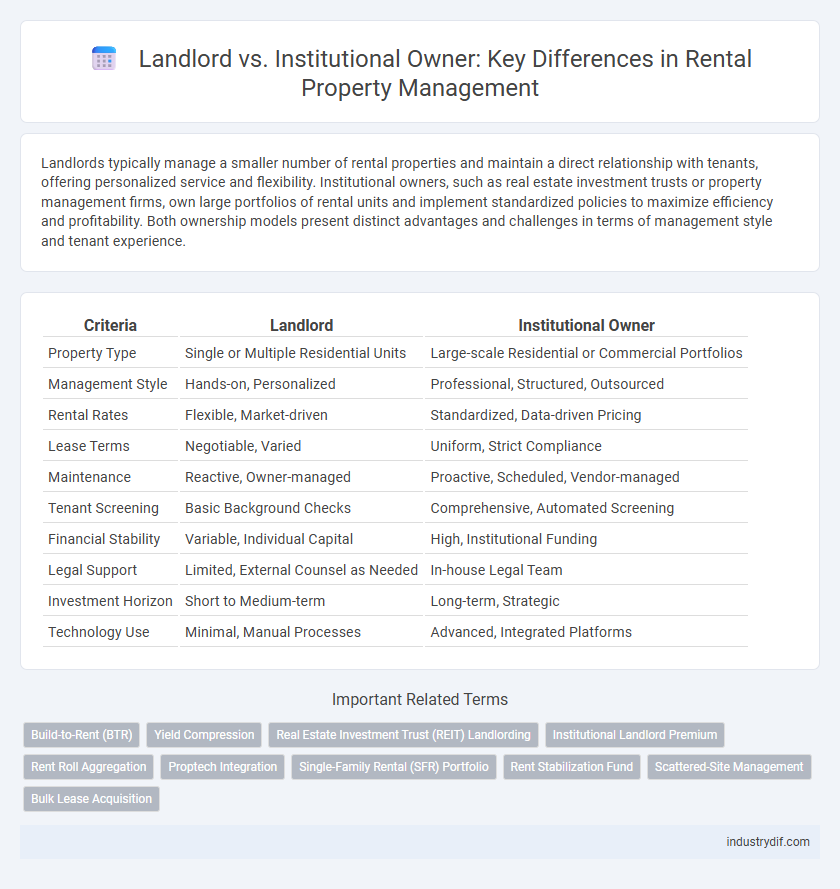

Landlords typically manage a smaller number of rental properties and maintain a direct relationship with tenants, offering personalized service and flexibility. Institutional owners, such as real estate investment trusts or property management firms, own large portfolios of rental units and implement standardized policies to maximize efficiency and profitability. Both ownership models present distinct advantages and challenges in terms of management style and tenant experience.

Table of Comparison

| Criteria | Landlord | Institutional Owner |

|---|---|---|

| Property Type | Single or Multiple Residential Units | Large-scale Residential or Commercial Portfolios |

| Management Style | Hands-on, Personalized | Professional, Structured, Outsourced |

| Rental Rates | Flexible, Market-driven | Standardized, Data-driven Pricing |

| Lease Terms | Negotiable, Varied | Uniform, Strict Compliance |

| Maintenance | Reactive, Owner-managed | Proactive, Scheduled, Vendor-managed |

| Tenant Screening | Basic Background Checks | Comprehensive, Automated Screening |

| Financial Stability | Variable, Individual Capital | High, Institutional Funding |

| Legal Support | Limited, External Counsel as Needed | In-house Legal Team |

| Investment Horizon | Short to Medium-term | Long-term, Strategic |

| Technology Use | Minimal, Manual Processes | Advanced, Integrated Platforms |

Definition of Landlord and Institutional Owner

A landlord is an individual or private entity who owns and rents out residential or commercial properties to tenants for income generation. Institutional owners are large organizations such as real estate investment trusts (REITs), pension funds, or private equity firms that hold and manage portfolios of rental properties on a significant scale. Unlike landlords, institutional owners operate with professional management teams and focus on long-term asset appreciation and high-volume leasing strategies.

Ownership Structure Differences

Landlords typically hold ownership of a few residential properties, managing them personally or with small teams, allowing for flexible and hands-on property oversight. Institutional owners, such as real estate investment trusts (REITs) or property management firms, control large portfolios of rental units, leveraging economies of scale and standardized operational systems. These differences in ownership structures impact tenant relations, maintenance protocols, and investment strategies, with landlords prioritizing localized management and institutional owners emphasizing efficiency and asset diversification.

Property Management Approaches

Landlords often adopt personalized property management approaches tailored to individual tenant needs, ensuring direct communication and flexibility in lease terms. Institutional owners utilize professional property management teams that emphasize standardized processes, scalability, and technology integration to maximize efficiency and return on investment. Both approaches impact tenant experience and operational effectiveness differently, with landlords prioritizing relationship-driven management and institutions focusing on systematic asset optimization.

Scale of Operations

Institutional owners typically manage rental properties on a much larger scale than individual landlords, often owning thousands of units across multiple regions. This scale of operations enables institutional owners to leverage economies of scale in maintenance, marketing, and tenant management, resulting in more efficient property management. Individual landlords generally focus on a handful of properties, limiting their operational reach and resource allocation compared to institutional portfolios.

Lease Agreement Variations

Landlord lease agreements typically offer more flexible terms tailored to individual or small rental properties, often allowing for personalized negotiations on rent, maintenance, and duration. Institutional owners, managing large portfolios, usually implement standardized lease agreements with fixed clauses to ensure consistency, legal compliance, and streamlined administration. Variations between these agreements also reflect differences in tenant screening processes, renewal policies, and dispute resolution mechanisms.

Tenant Experience and Services

Institutional owners often provide more comprehensive tenant services, including dedicated management teams, streamlined maintenance requests, and enhanced digital platforms for communication, resulting in a more consistent tenant experience. In contrast, individual landlords may offer personalized interactions but can lack the resources for rapid issue resolution or robust amenities. Tenants renting from institutional owners generally benefit from standardized lease agreements and professional customer service, contributing to higher satisfaction levels.

Legal and Regulatory Compliance

Landlords must navigate local tenant laws, zoning regulations, and safety codes to ensure compliance, often managing these responsibilities individually or through small teams. Institutional owners, such as real estate investment trusts (REITs), operate under stringent regulatory frameworks, including SEC rules, fair housing laws, and comprehensive risk management protocols. Both entities face legal obligations, but institutional owners typically leverage advanced compliance systems and legal expertise to mitigate risks across large property portfolios.

Investment Objectives

Landlords typically invest in rental properties to generate steady cash flow and achieve long-term capital appreciation, often balancing personal financial goals with property management responsibilities. Institutional owners prioritize large-scale portfolio diversification, risk mitigation, and maximizing returns through professional asset management and economies of scale. Investment objectives for landlords are more individualized and flexible, whereas institutional owners focus on systematic growth and consistent yield optimization.

Risk Management Strategies

Landlords typically employ personalized risk management strategies such as thorough tenant screening, regular property inspections, and tailored lease agreements to minimize vacancy and damage risks. Institutional owners leverage advanced data analytics, diversified property portfolios, and comprehensive insurance policies to mitigate financial exposure and market fluctuations. Both prioritize proactive maintenance and legal compliance but differ in scale and technological integration for risk oversight.

Market Impact and Trends

Institutional owners dominate rental markets by acquiring large portfolios, driving market consolidation and influencing rental pricing trends more consistently than individual landlords. Their access to substantial capital allows for scalable property upgrades and technology integration, enhancing tenant experience and operational efficiency. Market data indicates rising institutional investment correlates with increased rental demand and a shift toward professional management standards.

Related Important Terms

Build-to-Rent (BTR)

Landlords typically manage single or small portfolios of rental properties, whereas institutional owners dominate the Build-to-Rent (BTR) sector with large-scale developments designed for long-term rental income and professional management. Institutional owners leverage economies of scale and data-driven asset management to enhance tenant experience and operational efficiency in BTR communities.

Yield Compression

Landlord-operated rental properties often experience higher yield compression due to localized management and faster responsiveness to market conditions, while institutional owners benefit from economies of scale but face tighter yield margins driven by competitive capital inflows and rigorous underwriting standards. Yield compression impacts rental income growth potential, with institutional owners leveraging portfolio diversification to mitigate risks compared to singular landlord holdings.

Real Estate Investment Trust (REIT) Landlording

Institutional owners, particularly Real Estate Investment Trusts (REITs), manage large portfolios of rental properties with a focus on maximizing shareholder returns through diversified real estate assets and professional management. Unlike individual landlords, REIT landlording offers economies of scale, standardized leasing processes, and access to capital markets, driving consistent income and property value appreciation.

Institutional Landlord Premium

Institutional landlords typically command a premium due to their ability to offer stable, long-term leases and professional property management, resulting in higher rental yields and reduced vacancy rates compared to individual landlords. Their access to larger capital pools enables investments in property upgrades, enhancing tenant satisfaction and justifying increased rental rates within competitive markets.

Rent Roll Aggregation

Landlords typically manage smaller portfolios with direct tenant relationships, allowing for detailed rent roll aggregation that provides granular insight into individual unit performance and tenant stability. Institutional owners, managing extensive portfolios, utilize advanced software platforms to aggregate rent rolls at scale, enabling comprehensive analysis of market trends, cash flow projections, and portfolio optimization for enhanced investment returns.

Proptech Integration

Landlords benefit from Proptech integration by using automated rent collection and maintenance tracking systems that enhance operational efficiency and tenant communication. Institutional owners leverage advanced data analytics and IoT-enabled property management platforms to optimize asset performance, reduce vacancies, and increase long-term returns.

Single-Family Rental (SFR) Portfolio

Institutional owners control over 70% of the single-family rental (SFR) portfolio, leveraging scale and professional management to maximize returns and maintain property values. In contrast, individual landlords typically manage smaller portfolios, often facing greater challenges in operational efficiency and access to capital.

Rent Stabilization Fund

The Rent Stabilization Fund supports tenants by limiting rent increases in units managed by both individual landlords and institutional owners, ensuring affordability and stability in rental housing markets. Institutional owners often contribute more significantly to the fund, reflecting their larger portfolios and regulatory obligations compared to private landlords.

Scattered-Site Management

Scattered-site management poses unique challenges for landlords compared to institutional owners, as individual landlords often lack centralized resources and professional property management teams that institutional owners employ for efficient maintenance and tenant coordination. Institutional owners leverage advanced technology platforms and economies of scale to streamline operations across multiple dispersed rental properties, improving cost efficiency and tenant satisfaction.

Bulk Lease Acquisition

Institutional owners often engage in bulk lease acquisitions, securing multiple rental units to manage large-scale investment portfolios, which contrasts with individual landlords who typically lease properties on a unit-by-unit basis. Bulk lease acquisitions enable institutional owners to achieve economies of scale, streamlined property management, and enhanced bargaining power in rental markets.

Landlord vs Institutional Owner Infographic

industrydif.com

industrydif.com