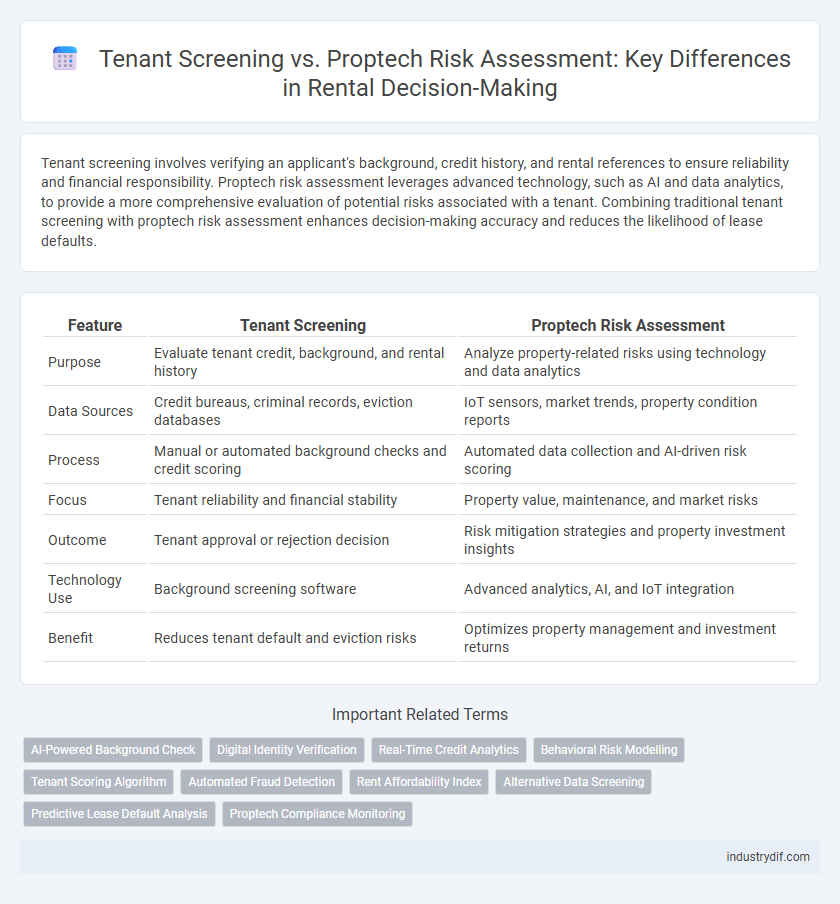

Tenant screening involves verifying an applicant's background, credit history, and rental references to ensure reliability and financial responsibility. Proptech risk assessment leverages advanced technology, such as AI and data analytics, to provide a more comprehensive evaluation of potential risks associated with a tenant. Combining traditional tenant screening with proptech risk assessment enhances decision-making accuracy and reduces the likelihood of lease defaults.

Table of Comparison

| Feature | Tenant Screening | Proptech Risk Assessment |

|---|---|---|

| Purpose | Evaluate tenant credit, background, and rental history | Analyze property-related risks using technology and data analytics |

| Data Sources | Credit bureaus, criminal records, eviction databases | IoT sensors, market trends, property condition reports |

| Process | Manual or automated background checks and credit scoring | Automated data collection and AI-driven risk scoring |

| Focus | Tenant reliability and financial stability | Property value, maintenance, and market risks |

| Outcome | Tenant approval or rejection decision | Risk mitigation strategies and property investment insights |

| Technology Use | Background screening software | Advanced analytics, AI, and IoT integration |

| Benefit | Reduces tenant default and eviction risks | Optimizes property management and investment returns |

Introduction to Tenant Screening and Proptech Risk Assessment

Tenant screening involves evaluating potential renters' credit scores, rental history, and background checks to ensure reliability and reduce default risks. Proptech risk assessment uses advanced technology such as AI algorithms, data analytics, and machine learning to provide real-time tenant evaluations and predictive insights. Integrating traditional tenant screening with proptech solutions enhances accuracy and efficiency in rental decision-making.

Understanding Traditional Tenant Screening Processes

Traditional tenant screening processes involve background checks, credit history evaluations, and employment verification to assess a prospective renter's reliability and financial stability. These methods rely on established databases and reports from credit bureaus, criminal records, and landlord references to identify potential risks. While effective, they often lack real-time data integration and predictive analytics offered by proptech risk assessment platforms.

The Evolution of Proptech in Rental Risk Assessment

The evolution of proptech in rental risk assessment has transformed traditional tenant screening by integrating AI-driven analytics and big data to provide more accurate and comprehensive insights into tenant behavior. Advanced algorithms analyze financial history, rental patterns, and social data, reducing bias and improving risk prediction compared to conventional credit checks. This technological shift enables landlords to make informed decisions quickly, enhancing rental market efficiency and minimizing default rates.

Key Differences Between Tenant Screening and Proptech Solutions

Tenant screening primarily evaluates an applicant's credit history, background, and rental behavior to determine qualification for a lease, relying on traditional data sources such as credit bureaus and eviction records. Proptech risk assessment leverages advanced technologies like AI, big data analytics, and real-time market trends to provide a broader, more dynamic evaluation of tenant risk and property performance. Key differences include the scope of data usage, with proptech offering predictive insights beyond historical tenant behavior, enabling landlords to make more informed, proactive decisions.

Benefits of Traditional Tenant Screening Methods

Traditional tenant screening methods offer proven reliability by thoroughly verifying credit history, employment status, and rental background, ensuring landlords can assess applicant credibility effectively. These methods utilize established databases and in-depth interviews, providing a comprehensive picture of tenant behavior that aids in minimizing rental defaults and property damage. By relying on time-tested procedures, landlords gain confidence in decision-making and maintain consistency in tenant selection processes.

Advantages of Proptech-Driven Risk Assessment

Proptech-driven risk assessment leverages advanced algorithms and real-time data integration to provide a more comprehensive and accurate evaluation of tenant reliability compared to traditional tenant screening methods. This technology enhances predictive accuracy by analyzing a wider range of factors such as payment history, social behavior, and market trends, reducing the likelihood of defaults and property damage. Automated risk assessment platforms streamline the decision-making process, saving landlords time and costs while improving tenant selection efficiency.

Compliance and Fair Housing Considerations

Tenant screening involves evaluating applicants through credit checks, background reports, and eviction history to ensure compliance with Fair Housing laws. Proptech risk assessment platforms automate this process using data-driven algorithms, reducing human bias and enhancing adherence to regulatory standards. Both approaches must prioritize transparency and nondiscriminatory practices to comply with federal and state housing regulations.

Impact on Rental Decision-Making and Efficiency

Tenant screening traditionally relies on credit scores, rental history, and background checks to evaluate applicant risk, providing landlords with clear but limited data points. Proptech risk assessment incorporates advanced analytics, machine learning, and real-time data to deliver deeper insights into tenant behavior and financial reliability, enhancing predictive accuracy. This integration significantly streamlines rental decision-making, reduces manual effort, and increases overall efficiency in managing tenant selection processes.

Challenges and Limitations of Each Approach

Tenant screening often relies on credit scores, background checks, and rental history, which may not capture real-time financial instability or character nuances, leading to potential misjudgments. Proptech risk assessment integrates advanced data analytics and AI for dynamic, predictive insights, yet faces challenges like data privacy concerns, algorithm biases, and limited transparency in decision-making processes. Both approaches struggle with incomplete data sets and regulatory compliance issues, affecting the accuracy and fairness of rental risk evaluations.

Future Trends in Rental Industry Risk Management

Tenant screening increasingly integrates AI-driven algorithms, enhancing predictive accuracy for rental risk assessment. Proptech risk assessment platforms leverage big data analytics and IoT devices to provide real-time property and occupant insights. Future trends emphasize seamless digital ecosystems combining tenant screening, credit scoring, and smart sensors for proactive rental risk mitigation.

Related Important Terms

AI-Powered Background Check

AI-powered background checks in tenant screening utilize advanced algorithms to analyze credit scores, criminal history, eviction records, and rental histories faster and more accurately than traditional methods. Proptech risk assessment platforms integrate these AI-driven insights with market trends and property data to provide landlords with a comprehensive evaluation of tenant reliability and potential risks.

Digital Identity Verification

Tenant screening traditionally relies on credit checks and background verification, while proptech risk assessment leverages advanced digital identity verification to enhance accuracy and reduce fraud. Digital identity verification integrates biometric authentication and AI-driven data analysis, providing landlords with real-time, reliable tenant profiles to streamline rental decisions.

Real-Time Credit Analytics

Tenant screening leverages traditional credit reports and background checks, while proptech risk assessment integrates real-time credit analytics for dynamic evaluation of tenant financial stability. Real-time credit data enables landlords to make informed decisions by tracking payment behavior and credit changes instantly, reducing default risks more effectively than static reports.

Behavioral Risk Modelling

Behavioral risk modeling in tenant screening leverages data analytics and machine learning to predict lease compliance and payment reliability, enhancing traditional background checks. Proptech risk assessment integrates real-time behavioral insights with property management platforms, enabling landlords to proactively identify potential tenant risks and optimize rental decision-making.

Tenant Scoring Algorithm

Tenant screening relies on traditional credit checks and background verification, while proptech risk assessment leverages advanced tenant scoring algorithms that analyze behavioral data, payment history, and social indicators to predict rental reliability more accurately. These algorithms enhance decision-making by providing a comprehensive risk profile, reducing vacancy rates and minimizing default risk for property managers.

Automated Fraud Detection

Tenant screening relies on traditional background and credit checks to evaluate applicants, while proptech risk assessment integrates automated fraud detection algorithms that analyze patterns in real-time data to identify potential fraud risks more accurately. Leveraging machine learning and big data, these advanced systems reduce human error, expedite decision-making, and enhance security in rental property management.

Rent Affordability Index

Tenant screening traditionally evaluates credit scores, rental history, and background checks, while Proptech risk assessment incorporates dynamic data such as the Rent Affordability Index, which measures an applicant's income relative to local rental prices to predict financial stability more accurately. Utilizing the Rent Affordability Index enhances decision-making by aligning tenant selection with real-time market conditions and affordability metrics.

Alternative Data Screening

Alternative data screening in tenant selection leverages non-traditional sources such as utility payments, rental history, and social behavior to provide a more comprehensive risk assessment compared to traditional tenant screening methods. Proptech risk assessment platforms integrate these alternative datasets with AI analytics, enhancing accuracy in predicting tenant reliability and reducing default rates for landlords.

Predictive Lease Default Analysis

Tenant screening traditionally relies on credit scores and background checks, whereas Proptech risk assessment leverages predictive lease default analysis using AI algorithms and big data to forecast tenant reliability more accurately. This advanced approach integrates rental history, financial behavior, and market trends to reduce default risks and optimize property management decisions.

Proptech Compliance Monitoring

Proptech compliance monitoring integrates automated tenant screening with real-time regulatory updates to reduce risks and ensure adherence to local housing laws. This advanced technology streamlines risk assessment by analyzing tenant behavior patterns and financial data, providing landlords with proactive compliance alerts and minimizing potential legal liabilities.

Tenant Screening vs Proptech Risk Assessment Infographic

industrydif.com

industrydif.com