Tenant screening relies on traditional methods such as credit checks, background verification, and rental history to evaluate applicant reliability. Proptech vetting leverages advanced technology, including AI-driven analytics and automated data integration, to provide real-time insights and predictive risk assessments. Integrating proptech vetting enhances accuracy and efficiency in identifying qualified tenants, reducing vacancies and costly evictions.

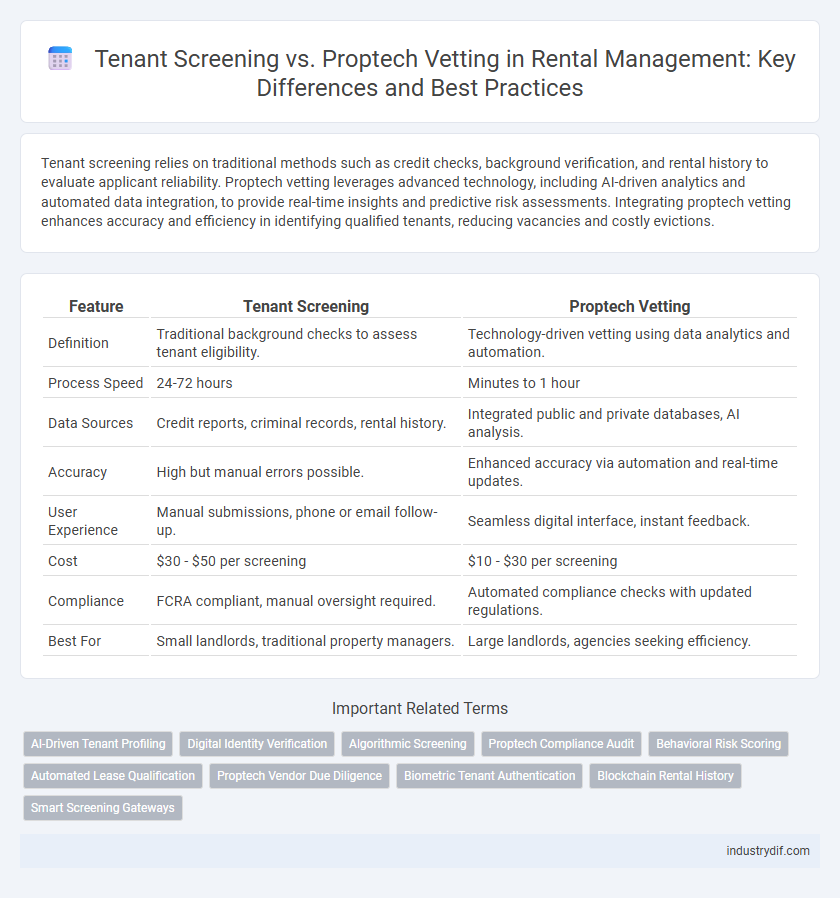

Table of Comparison

| Feature | Tenant Screening | Proptech Vetting |

|---|---|---|

| Definition | Traditional background checks to assess tenant eligibility. | Technology-driven vetting using data analytics and automation. |

| Process Speed | 24-72 hours | Minutes to 1 hour |

| Data Sources | Credit reports, criminal records, rental history. | Integrated public and private databases, AI analysis. |

| Accuracy | High but manual errors possible. | Enhanced accuracy via automation and real-time updates. |

| User Experience | Manual submissions, phone or email follow-up. | Seamless digital interface, instant feedback. |

| Cost | $30 - $50 per screening | $10 - $30 per screening |

| Compliance | FCRA compliant, manual oversight required. | Automated compliance checks with updated regulations. |

| Best For | Small landlords, traditional property managers. | Large landlords, agencies seeking efficiency. |

Introduction to Tenant Screening and Proptech Vetting

Tenant screening involves a thorough evaluation of rental applicants through background checks, credit reports, employment verification, and rental history analysis to determine their reliability and risk level. Proptech vetting leverages advanced technology platforms and AI-driven algorithms to automate and enhance the accuracy of the screening process, offering real-time data integration and predictive insights. Both methods aim to minimize landlord risk, but proptech vetting provides faster, data-rich assessments compared to traditional tenant screening.

Defining Tenant Screening: Key Concepts

Tenant screening involves evaluating potential renters through background checks, credit reports, and rental history to assess their reliability and financial stability. This process aims to minimize the risk of tenant default and property damage by identifying red flags before lease agreements. Proptech vetting integrates advanced technology to automate and enhance screening accuracy, providing real-time data insights and decision-making efficiency.

What is Proptech Vetting?

Proptech vetting leverages advanced technology platforms to streamline tenant screening by integrating data analytics, AI-driven background checks, and real-time financial assessments. This approach enhances accuracy and efficiency compared to traditional methods, reducing landlord risk and improving tenant quality. Proptech vetting platforms often include automated lease management and identity verification, creating a seamless rental process for both tenants and property managers.

Importance of Thorough Screening in Rentals

Thorough tenant screening is critical in rentals to minimize risks such as non-payment, property damage, and legal complications. Proptech vetting enhances traditional screening by leveraging data analytics, credit reports, and real-time background checks to provide landlords with accurate and comprehensive insights. Effective screening processes ensure reliable tenants, protect property investments, and promote long-term rental success.

Traditional Tenant Screening Methods

Traditional tenant screening methods rely heavily on credit reports, criminal background checks, and rental history verification to assess applicant reliability and financial stability. These methods often involve manual data collection and verification processes that can be time-consuming and prone to human error. While effective in evaluating basic tenant eligibility, traditional screening may lack the comprehensive insights provided by modern proptech vetting tools that integrate multiple data sources for a holistic risk assessment.

How Proptech is Transforming Vetting

Proptech is revolutionizing tenant screening by leveraging advanced algorithms, AI, and big data analytics to provide faster, more accurate evaluations of potential renters. Automated platforms integrate credit history, rental background, and behavioral data to reduce human bias and streamline decision-making. This transformation enhances efficiency, improves risk assessment, and ensures landlords access comprehensive, real-time insights into tenant reliability.

Pros and Cons: Manual vs Digital Vetting

Manual tenant screening allows personalized assessment and direct verification of applicant credentials but can be time-consuming and prone to human error. Digital proptech vetting offers faster processing, automated background checks, and scalable data analysis, though it may miss nuanced tenant qualities and rely heavily on algorithmic decision-making. Balancing both methods can optimize accuracy and efficiency in tenant selection for rental properties.

Compliance and Data Privacy Considerations

Tenant screening prioritizes compliance with the Fair Credit Reporting Act (FCRA) and state-specific tenant laws to protect applicant rights and ensure lawful data use. Proptech vetting platforms integrate advanced encryption and anonymization protocols, enhancing data privacy while streamlining identity verification and background checks. Both approaches require strict adherence to GDPR and CCPA guidelines to maintain tenant confidentiality and mitigate legal risks.

Impact on Landlord and Tenant Experience

Tenant screening relies on traditional background checks and credit reports, providing landlords with risk assessment but potentially slowing down the rental process. Proptech vetting leverages AI-driven analytics and real-time data integration, enhancing accuracy and speeding up tenant approval, which improves overall landlord and tenant satisfaction. This technology fosters transparency and efficiency, resulting in a smoother rental experience and reduced vacancy periods.

Future Trends in Rental Applicant Evaluation

Tenant screening is evolving with advancements in proptech vetting tools that leverage AI-driven data analytics and blockchain for transparent, real-time applicant verification. Future trends in rental applicant evaluation emphasize predictive analytics to assess tenant reliability, incorporating social behavior data and alternative credit scoring models. These innovations aim to reduce bias, streamline application processes, and enhance decision-making accuracy for landlords and property managers.

Related Important Terms

AI-Driven Tenant Profiling

AI-driven tenant profiling in proptech vetting leverages machine learning algorithms to analyze extensive data sets, enhancing accuracy and reducing bias compared to traditional tenant screening methods. This technology enables landlords to predict tenant reliability and payment behavior more effectively, optimizing rental decisions and minimizing risk.

Digital Identity Verification

Tenant screening traditionally relies on credit reports, background checks, and rental history to assess applicants, while PropTech vetting integrates digital identity verification using biometric authentication, blockchain, and AI to ensure accuracy and reduce fraud. Digital identity verification streamlines the rental process by providing landlords with secure, real-time validation of tenant credentials, increasing trust and efficiency.

Algorithmic Screening

Algorithmic screening in tenant screening leverages machine learning models to analyze rental applications, credit scores, and background checks with greater efficiency and accuracy. Proptech vetting integrates advanced data analytics and AI algorithms to automate risk assessment, enhancing predictive outcomes and minimizing human bias in tenant selection.

Proptech Compliance Audit

Proptech compliance audits leverage advanced technology to automate tenant screening processes, ensuring thorough background checks and regulatory adherence with greater efficiency than traditional methods. These audits integrate real-time data analytics and machine learning algorithms to detect fraud, verify identity, and confirm legal compliance, enhancing risk management for property managers.

Behavioral Risk Scoring

Behavioral risk scoring in tenant screening utilizes data analytics to predict renters' likelihood of lease compliance, enhancing decision accuracy beyond traditional credit checks. Proptech vetting integrates automated tools with behavioral insights, streamlining tenant evaluation while minimizing human bias and maximizing predictive reliability in rental property management.

Automated Lease Qualification

Automated lease qualification streamlines tenant screening by leveraging proptech vetting tools that analyze credit scores, rental history, and income verification in real-time. This technology enhances accuracy and efficiency, reducing manual errors and accelerating approval processes for property managers.

Proptech Vendor Due Diligence

Proptech vendor due diligence streamlines the tenant screening process by integrating advanced data analytics, AI-driven background checks, and automated property management tools to ensure accuracy and compliance. This approach enhances risk mitigation and tenant quality, surpassing traditional tenant screening methods that rely heavily on manual verification and limited data sources.

Biometric Tenant Authentication

Biometric tenant authentication enhances tenant screening by using fingerprint, facial recognition, or iris scans to verify identity, reducing fraud and ensuring accurate applicant verification. Proptech vetting integrates biometric data with AI-driven analytics, streamlining the rental approval process and improving security standards across property management platforms.

Blockchain Rental History

Tenant screening traditionally relies on credit scores and background checks, but proptech vetting leverages blockchain rental history to provide immutable, transparent records of past tenant behavior and payment reliability. This decentralized ledger enhances trust between landlords and tenants by reducing fraud and streamlining verification processes in the rental market.

Smart Screening Gateways

Smart screening gateways integrate advanced AI algorithms and big data analytics to enhance tenant screening accuracy beyond traditional methods, reducing defaults and improving rental profitability. Proptech vetting leverages real-time digital verification and behavioral insights, streamlining tenant selection while minimizing risk through automated background checks and credit scoring.

Tenant Screening vs Proptech Vetting Infographic

industrydif.com

industrydif.com