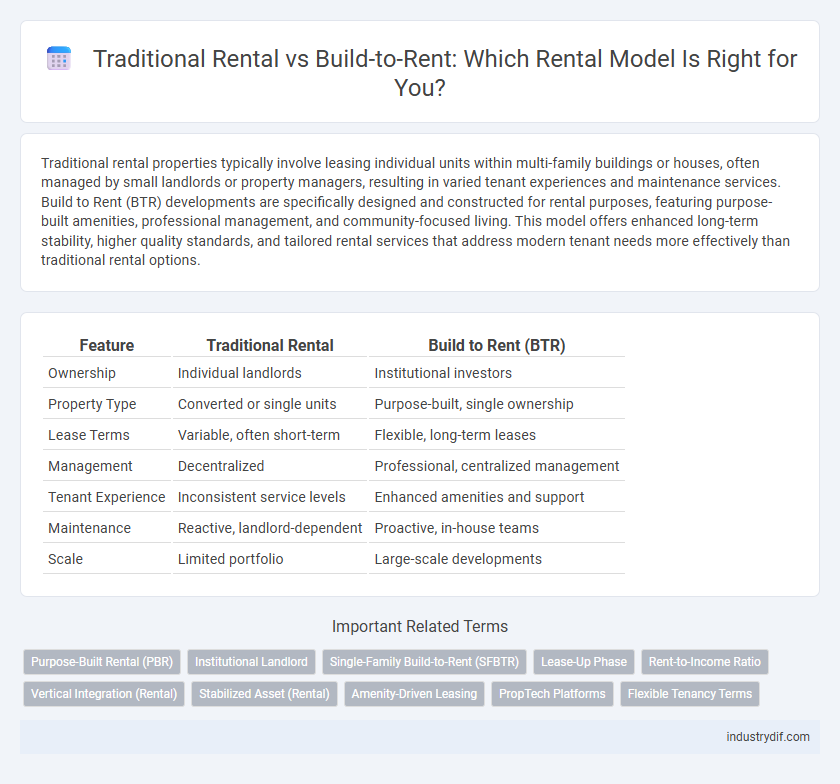

Traditional rental properties typically involve leasing individual units within multi-family buildings or houses, often managed by small landlords or property managers, resulting in varied tenant experiences and maintenance services. Build to Rent (BTR) developments are specifically designed and constructed for rental purposes, featuring purpose-built amenities, professional management, and community-focused living. This model offers enhanced long-term stability, higher quality standards, and tailored rental services that address modern tenant needs more effectively than traditional rental options.

Table of Comparison

| Feature | Traditional Rental | Build to Rent (BTR) |

|---|---|---|

| Ownership | Individual landlords | Institutional investors |

| Property Type | Converted or single units | Purpose-built, single ownership |

| Lease Terms | Variable, often short-term | Flexible, long-term leases |

| Management | Decentralized | Professional, centralized management |

| Tenant Experience | Inconsistent service levels | Enhanced amenities and support |

| Maintenance | Reactive, landlord-dependent | Proactive, in-house teams |

| Scale | Limited portfolio | Large-scale developments |

Overview of Traditional Rental and Build to Rent

Traditional rental properties typically involve individual landlords leasing single units or houses, often resulting in varied management styles and inconsistent tenant experiences. Build to Rent (BTR) refers to purpose-built residential developments designed specifically for long-term rental, featuring professional management and amenities tailored to renters. BTR offers scalable, consistent rental options with streamlined maintenance, contrasting with the fragmented nature of traditional rental markets.

Key Differences Between Traditional Rental and Build to Rent

Traditional rental properties typically consist of individually owned units managed by landlords or small property managers, whereas Build to Rent (BTR) developments are purpose-built apartment communities owned and operated by institutional investors. BTR emphasizes large-scale, professionally managed properties with amenities tailored for long-term residents, leading to higher tenant retention and consistent income streams. Traditional rentals often lack integrated community spaces and modern amenities found in BTR, resulting in different tenant experiences and operational efficiencies.

Investment Models: Traditional Rental vs Build to Rent

Traditional rental investment models typically involve purchasing individual properties or smaller portfolios for long-term income through tenant leases, relying on steady cash flow and capital appreciation. Build to Rent (BTR) models focus on large-scale, purpose-built residential developments designed exclusively for the rental market, offering scalable asset management and operational efficiencies. BTR investments benefit from modern amenities, professional management, and higher tenant retention rates, appealing to institutional investors seeking predictable returns and portfolio diversification.

Tenant Experience: Comparing Services and Amenities

Traditional rental properties typically offer basic services such as maintenance and security, with amenities limited to common areas like laundry rooms or parking lots. Build to Rent communities emphasize enhanced tenant experience by providing a wide range of on-site amenities including fitness centers, co-working spaces, and social lounges, fostering a sense of community. Enhanced digital services such as streamlined rent payments and maintenance requests further differentiate Build to Rent from traditional rental models.

Property Management Approaches

Traditional rental property management often involves individual landlords handling maintenance, tenant screening, and rent collection on a case-by-case basis, leading to inconsistent tenant experiences. Build to Rent (BTR) developments employ professional property management teams that implement standardized processes, technology-driven maintenance, and community engagement strategies to enhance tenant satisfaction. This approach improves operational efficiency, reduces vacancy rates, and ensures consistent service quality across multiple units.

Financial Returns and Risk Factors

Traditional rental properties typically offer steady cash flow but face higher vacancy rates and unpredictability in tenant turnover, impacting financial returns. Build to Rent developments benefit from scale economies, professional management, and longer lease terms, resulting in more stable income streams and potentially lower risk profiles. Investors in Build to Rent ventures often experience enhanced returns due to diversified portfolios and reduced exposure to single-asset volatility.

Regulatory and Compliance Impacts

Traditional rental properties often face fragmented regulatory frameworks that vary by locality, creating complex compliance challenges for individual landlords. Build to Rent (BTR) developments benefit from integrated regulatory approaches, including streamlined planning permissions and standardized safety certifications tailored to multi-unit residential schemes. Enhanced compliance in BTR projects ensures consistent tenant protections, energy efficiency standards, and fire safety measures, aligning with evolving housing regulations and reducing operational risks for developers.

Market Trends in Rental Housing

Market trends in rental housing reveal a growing preference for Build to Rent developments due to their design focus on long-term tenant satisfaction and amenities, contrasting with traditional rental properties that often repurpose existing buildings without tailored community features. Data shows Build to Rent projects increasingly dominate urban markets, driven by rising demand for quality rental experiences and stable rental income for investors. Traditional rentals face challenges adapting to these expectations, resulting in a shifting landscape where purpose-built rental communities set new standards for convenience and lifestyle.

Sustainability and Design Considerations

Traditional rental properties often lack integrated sustainability features, whereas Build to Rent developments prioritize energy-efficient designs, sustainable materials, and green building certifications to reduce environmental impact. Design considerations in Build to Rent focus on community spaces, optimized layouts for long-term tenant comfort, and smart home technologies that enhance energy management. Emphasizing sustainability and innovative design, Build to Rent models address growing demand for eco-friendly, durable rental housing solutions.

Future Outlook for Rental Sector

The rental sector is increasingly shifting from traditional rental models, characterized by individually owned units, to build-to-rent developments designed specifically for long-term renters. Build-to-rent properties offer enhanced amenities, professional management, and tailored community features that address evolving tenant demands and urbanization trends. Market analyses forecast sustained growth in build-to-rent projects driven by demographic shifts, rising home prices, and increasing investor interest in stable rental income streams.

Related Important Terms

Purpose-Built Rental (PBR)

Purpose-Built Rental (PBR) properties are designed specifically for long-term leasing, offering residents amenities and layouts tailored to rental lifestyles, unlike traditional rental units adapted from existing buildings. PBR developments optimize operational efficiency, tenant experience, and community engagement, making them more sustainable and attractive in the evolving housing market.

Institutional Landlord

Institutional landlords favor Build to Rent (BTR) developments due to their ability to deliver purpose-built, professionally managed rental communities with stable, long-term cash flows and lower vacancy rates compared to traditional rentals. BTR properties optimize operational efficiency and tenant satisfaction by offering tailored amenities and consistent maintenance, enhancing asset value and investor returns.

Single-Family Build-to-Rent (SFBTR)

Single-Family Build-to-Rent (SFBTR) communities offer purpose-built, professionally managed homes designed specifically for long-term tenants, providing consistent rental income and modern amenities compared to traditional single-family rentals, which often involve individually owned homes with varied maintenance standards. SFBTR leverages economies of scale, standardized construction, and integrated property management to enhance tenant satisfaction and operational efficiency, making it a growing trend in the rental housing market.

Lease-Up Phase

In the Lease-Up Phase, Traditional Rental properties often experience slower tenant acquisition due to fragmented marketing efforts and individual lease negotiations, leading to extended vacancy periods. Build to Rent developments leverage cohesive branding, streamlined leasing processes, and bulk marketing strategies, achieving faster occupancy rates and reducing time-to-market effectively.

Rent-to-Income Ratio

Traditional rental properties often require tenants to meet strict rent-to-income ratio thresholds, typically around 30-35%, limiting affordability and access. Build to Rent developments offer more flexible criteria and integrated amenities, improving rent-to-income ratios and supporting long-term tenant retention in competitive rental markets.

Vertical Integration (Rental)

Vertical integration in traditional rental models often involves fragmented ownership and management, leading to inefficiencies and inconsistent tenant experiences. Build to Rent developments integrate property ownership, management, and maintenance under a single entity, optimizing operational efficiency and enhancing service quality for long-term residents.

Stabilized Asset (Rental)

Stabilized assets in Traditional Rental typically involve longer lease-up periods and varied tenant turnover, leading to fluctuating cash flows, whereas Build to Rent properties are designed for immediate occupancy with uniform management, ensuring steady rental income and consistent operational efficiencies. Institutional investors favor Build to Rent for its ability to deliver predictable yields and reduced vacancy risk through purpose-built, amenity-rich communities that attract long-term renters.

Amenity-Driven Leasing

Amenity-driven leasing in Build to Rent (BTR) developments offers residents access to features like fitness centers, communal lounges, and co-working spaces, enhancing lifestyle and community engagement compared to traditional rental properties. These purpose-built amenities increase tenant retention rates and justify premium rents, positioning BTR as a competitive alternative in the rental market.

PropTech Platforms

Traditional rental processes rely heavily on manual management and face challenges like slower lease approvals and limited tenant engagement, while Build to Rent developments leverage PropTech platforms to streamline tenant onboarding, enable real-time property management, and enhance data-driven decision-making for optimized operational efficiency. These PropTech platforms integrate smart home technology, automated maintenance requests, and digital payment systems, significantly improving tenant satisfaction and reducing vacancy rates in Build to Rent communities.

Flexible Tenancy Terms

Traditional rental agreements typically involve fixed lease periods with limited flexibility, often requiring tenants to commit for 12 months or more, whereas Build to Rent schemes emphasize flexible tenancy terms, allowing shorter leases and easy renewals to accommodate evolving renter needs and lifestyle changes. This flexibility in Build to Rent enhances tenant satisfaction by providing options for month-to-month agreements or rolling contracts, catering to modern renters seeking adaptability in their housing arrangements.

Traditional Rental vs Build to Rent Infographic

industrydif.com

industrydif.com