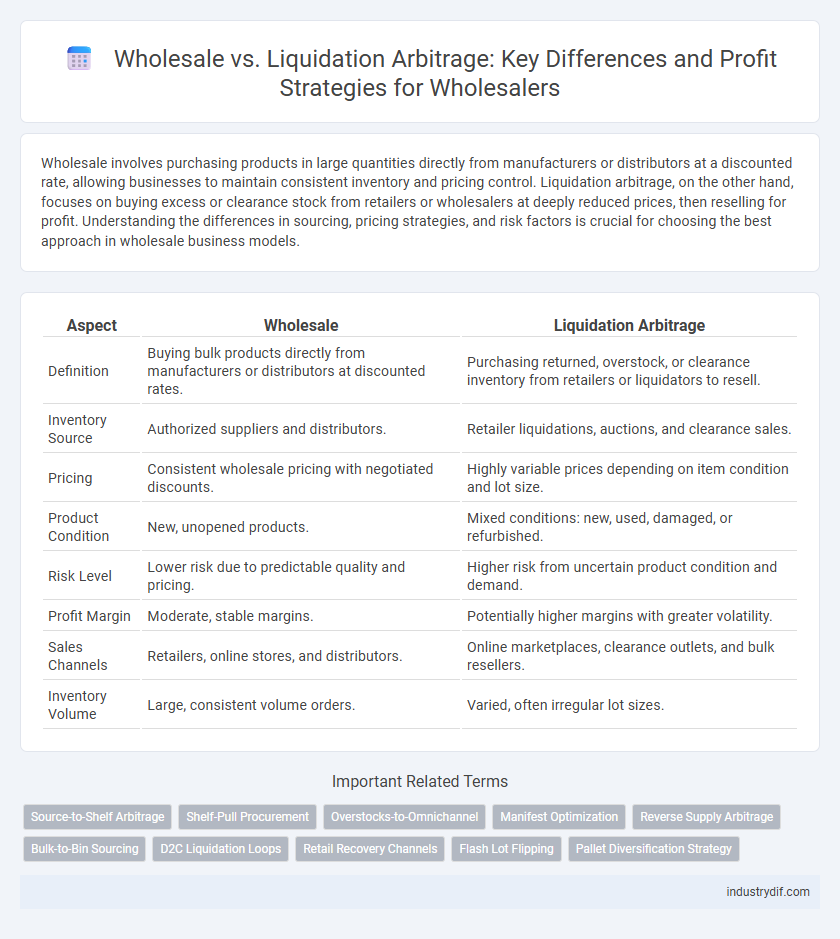

Wholesale involves purchasing products in large quantities directly from manufacturers or distributors at a discounted rate, allowing businesses to maintain consistent inventory and pricing control. Liquidation arbitrage, on the other hand, focuses on buying excess or clearance stock from retailers or wholesalers at deeply reduced prices, then reselling for profit. Understanding the differences in sourcing, pricing strategies, and risk factors is crucial for choosing the best approach in wholesale business models.

Table of Comparison

| Aspect | Wholesale | Liquidation Arbitrage |

|---|---|---|

| Definition | Buying bulk products directly from manufacturers or distributors at discounted rates. | Purchasing returned, overstock, or clearance inventory from retailers or liquidators to resell. |

| Inventory Source | Authorized suppliers and distributors. | Retailer liquidations, auctions, and clearance sales. |

| Pricing | Consistent wholesale pricing with negotiated discounts. | Highly variable prices depending on item condition and lot size. |

| Product Condition | New, unopened products. | Mixed conditions: new, used, damaged, or refurbished. |

| Risk Level | Lower risk due to predictable quality and pricing. | Higher risk from uncertain product condition and demand. |

| Profit Margin | Moderate, stable margins. | Potentially higher margins with greater volatility. |

| Sales Channels | Retailers, online stores, and distributors. | Online marketplaces, clearance outlets, and bulk resellers. |

| Inventory Volume | Large, consistent volume orders. | Varied, often irregular lot sizes. |

Understanding Wholesale: Key Concepts and Benefits

Wholesale involves purchasing large quantities of products directly from manufacturers or distributors at reduced prices to resell them for profit, providing businesses with consistent inventory and better margin control. Key concepts include bulk buying, supplier relationships, and demand forecasting, which help optimize stock levels and reduce costs. Benefits of wholesale include lower per-unit costs, access to exclusive product lines, and increased scalability for businesses aiming to expand their market presence.

What Is Liquidation Arbitrage? An Overview

Liquidation arbitrage involves purchasing surplus or returned inventory from retailers or manufacturers at significantly reduced prices to resell for profit, capitalizing on discounted goods that may not have consistent wholesale demand. Unlike traditional wholesale, which relies on bulk purchasing from manufacturers at set prices, liquidation arbitrage exploits market inefficiencies to access undervalued merchandise. Key factors include understanding liquidation channels, assessing product condition, and swiftly moving inventory to maximize returns.

Supply Chain Differences: Wholesale vs Liquidation

Wholesale involves acquiring products directly from manufacturers or authorized distributors, ensuring consistent supply chain reliability and regular product availability. Liquidation arbitrage sources inventory from overstock, returns, or clearance sales, leading to fluctuating supply and unpredictable product conditions. The wholesale supply chain emphasizes long-term vendor relationships and bulk ordering, while liquidation relies on opportunistic purchases with varying lead times.

Sourcing Products: Wholesale and Liquidation Arbitrage Compared

Wholesale sourcing involves purchasing large quantities of products directly from manufacturers or authorized distributors, ensuring consistent quality and reliable supply chains for bulk buyers. Liquidation arbitrage relies on acquiring clearance, overstock, or returned items from liquidators at steep discounts, often resulting in unpredictable inventory and varied product conditions. Choosing between wholesale and liquidation depends on factors like product consistency, sourcing reliability, and risk tolerance in inventory management.

Pricing Models in Wholesale and Liquidation Arbitrage

Wholesale pricing models typically involve fixed or tiered rates based on volume purchases, allowing businesses to predict costs and maintain steady profit margins. Liquidation arbitrage pricing fluctuates significantly due to variable lot conditions and time-sensitive inventory clearance, often resulting in lower upfront costs but higher uncertainty. Understanding the distinct pricing dynamics enables sellers to choose between predictable wholesale pricing and opportunistic liquidation arbitrage strategies.

Pros and Cons: Wholesale vs Liquidation Arbitrage

Wholesale offers consistent inventory quality and reliable supplier relationships, enabling scalable business growth with predictable profit margins. Liquidation arbitrage provides access to deeply discounted products, allowing for higher potential returns but comes with risks such as inventory inconsistency and unpredictable product conditions. Wholesale requires higher upfront investment, while liquidation arbitrage offers lower entry costs but demands strong skills in product inspection and market resale analysis.

Risk Factors in Wholesale and Liquidation Arbitrage

Wholesale involves purchasing large quantities of products directly from manufacturers or distributors, often ensuring consistent supply but exposing buyers to risks such as inventory obsolescence, demand fluctuations, and capital lock-up. Liquidation arbitrage entails buying discontinued or excess inventory at steep discounts to resell for profit, carrying higher risks including inaccurate product condition assessments, unpredictable resale demand, and potential legal issues with product authenticity or restrictions. Understanding these distinct risk profiles helps wholesalers and arbitrageurs mitigate potential losses and optimize inventory management strategies.

Profit Margins: Analyzing Wholesale and Liquidation Returns

Wholesale typically offers more stable profit margins with predictable returns due to bulk purchasing and consistent supplier relationships, often ranging between 10-30%. Liquidation arbitrage, while riskier, can yield significantly higher margins, sometimes exceeding 50%, by capitalizing on deeply discounted excess or returned inventory. Analyzing these profit margins reveals that wholesale is better suited for steady cash flow, whereas liquidation arbitrage demands rigorous market knowledge and risk tolerance for higher potential profits.

Legal and Compliance Considerations

Wholesale involves purchasing large quantities of goods directly from manufacturers or distributors under legally binding contracts, ensuring compliance with trade regulations and intellectual property rights. Liquidation arbitrage entails buying surplus or returned merchandise often sold as-is, requiring thorough due diligence to navigate potential legal risks, product liability, and warranty issues. Both strategies demand adherence to consumer protection laws and transparent record-keeping to maintain regulatory compliance and avoid penalties.

Choosing the Right Model: Wholesale or Liquidation Arbitrage

Choosing the right model between wholesale and liquidation arbitrage requires analyzing inventory consistency, profit margins, and risk tolerance. Wholesale offers stable supply chains and predictable pricing, ideal for long-term business scalability, while liquidation arbitrage provides higher margin opportunities with faster turnover but increased variability in product availability. Evaluating market demand and supplier reliability streamlines decision-making in wholesale or liquidation arbitrage selection.

Related Important Terms

Source-to-Shelf Arbitrage

Source-to-Shelf Arbitrage maximizes profit margins by directly purchasing inventory from wholesalers and strategically distributing products to retail shelves, bypassing middlemen. Unlike Liquidation Arbitrage, which relies on buying discounted excess stock, Wholesale Arbitrage emphasizes consistent supply chains and product selection to meet market demand efficiently.

Shelf-Pull Procurement

Shelf-pull procurement in wholesale involves purchasing returned or overstock products directly from retailers to secure bulk inventory at reduced prices, offering predictable product quality and brand consistency. In contrast, liquidation arbitrage relies on acquiring deeply discounted items from clearance sales or auctions, often with variable quality and unpredictable inventory, making shelf-pull procurement a more reliable strategy for steady wholesale supply chains.

Overstocks-to-Omnichannel

Wholesale involves purchasing large quantities of products directly from manufacturers or distributors at a discounted rate, enabling businesses to stock and distribute merchandise efficiently across multiple channels. Liquidation arbitrage capitalizes on overstocks and clearance inventory by acquiring surplus goods at reduced prices, then reselling them through omnichannel platforms to maximize profit margins while minimizing holding costs.

Manifest Optimization

Wholesale benefits from manifest optimization by ensuring accurate inventory data, reducing errors, and streamlining shipment processes. Liquidation arbitrage relies on optimized manifests to quickly identify undervalued products, enhancing turnaround speed and maximizing profit margins.

Reverse Supply Arbitrage

Reverse supply arbitrage in wholesale leverages discrepancies in supply chain costs by sourcing products from higher-priced markets and redistributing them to lower-cost markets, maximizing profit margins. Unlike liquidation arbitrage, which focuses on purchasing discounted surplus inventory, reverse supply arbitrage emphasizes strategic geographic and supply chain insights to optimize inventory flow and capital efficiency.

Bulk-to-Bin Sourcing

Wholesale sourcing involves purchasing large quantities of products directly from manufacturers or distributors at discounted bulk rates, enabling consistent inventory replenishment and predictable profit margins. In contrast, liquidation arbitrage focuses on acquiring surplus or returned goods from clearance sales or closeouts, often requiring extensive sorting and quality checks before resale through bin-based bulk purchases.

D2C Liquidation Loops

Wholesale involves purchasing bulk inventory directly from manufacturers or distributors to sell at retail prices, whereas liquidation arbitrage capitalizes on acquiring clearance or overstock items from D2C brands to resell for profit. D2C liquidation loops create a continuous flow of discounted products from brand owners to secondary sellers, optimizing inventory turnover and enhancing profit margins in the arbitrage ecosystem.

Retail Recovery Channels

Wholesale involves purchasing bulk products directly from manufacturers or distributors at lower prices to resell through traditional retail channels, ensuring consistent inventory and pricing stability. Liquidation arbitrage exploits discounted retail recovery channels by acquiring surplus or returned goods from retailers and reselling them individually or in smaller lots, often achieving higher margins despite variable product conditions.

Flash Lot Flipping

Wholesale involves purchasing large quantities of inventory at discounted rates to resell for consistent profit margins, while liquidation arbitrage centers on acquiring clearance or returned goods at significantly reduced prices and quickly flipping flash lots for rapid turnover. Flash lot flipping requires swift analysis and transaction speed to capitalize on short-window deals, maximizing gains by leveraging market demand fluctuations in wholesale and liquidation sectors.

Pallet Diversification Strategy

Wholesale offers consistent inventory flow through bulk purchasing directly from manufacturers, while liquidation arbitrage relies on acquiring diverse pallets of distressed or surplus goods at steep discounts. A pallet diversification strategy enhances risk management by combining wholesale reliability with the unpredictable variety of liquidation pallets, optimizing profit margins through balanced product variety and cost-efficiency.

Wholesale vs Liquidation Arbitrage Infographic

industrydif.com

industrydif.com