The defense industry encompasses a broad range of sectors focused on manufacturing weapons, military vehicles, and equipment for national security. The defense tech industry specifically targets innovative technologies such as cybersecurity, AI-driven surveillance, and advanced weaponry, driving modernization within defense capabilities. Advancements in defense tech are crucial for maintaining strategic advantages and enhancing the effectiveness of traditional defense industry products.

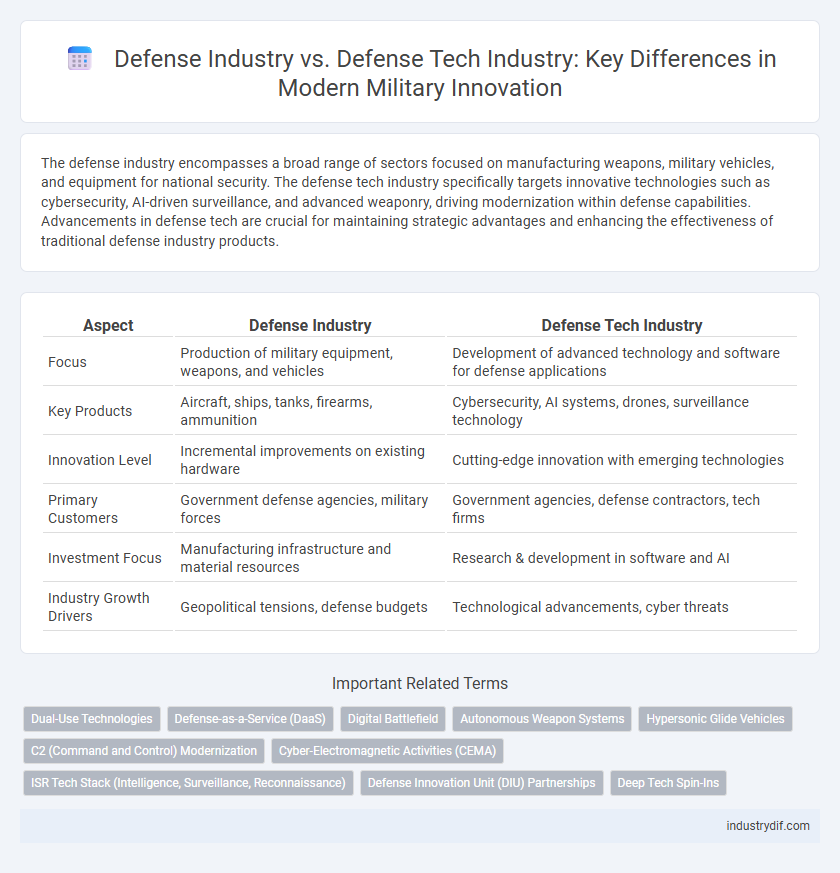

Table of Comparison

| Aspect | Defense Industry | Defense Tech Industry |

|---|---|---|

| Focus | Production of military equipment, weapons, and vehicles | Development of advanced technology and software for defense applications |

| Key Products | Aircraft, ships, tanks, firearms, ammunition | Cybersecurity, AI systems, drones, surveillance technology |

| Innovation Level | Incremental improvements on existing hardware | Cutting-edge innovation with emerging technologies |

| Primary Customers | Government defense agencies, military forces | Government agencies, defense contractors, tech firms |

| Investment Focus | Manufacturing infrastructure and material resources | Research & development in software and AI |

| Industry Growth Drivers | Geopolitical tensions, defense budgets | Technological advancements, cyber threats |

Defining the Defense Industry and Defense Tech Industry

The Defense Industry primarily encompasses companies involved in the manufacturing, supply, and maintenance of military equipment, weapons, and infrastructure. The Defense Tech Industry focuses on cutting-edge technologies such as cybersecurity, artificial intelligence, and unmanned systems designed to enhance defense capabilities and intelligence operations. Both sectors are integral to national security, with the Defense Tech Industry driving innovation within traditional defense frameworks.

Key Differences Between Defense Industry and Defense Tech Industry

The defense industry encompasses a broad range of sectors involved in manufacturing weapons, equipment, and military services, while the defense tech industry specifically focuses on advanced technological innovations such as artificial intelligence, cybersecurity, and autonomous systems. Key differences lie in the defense industry's reliance on traditional manufacturing and logistics contrasted with the defense tech industry's emphasis on research, software development, and data-driven solutions. Investment priorities in the defense tech sector include cutting-edge innovation and digital transformation, distinguishing it from the defense industry's large-scale production and infrastructure capabilities.

Historical Evolution of Defense vs. Defense Tech

The defense industry has historically centered on manufacturing traditional military equipment such as vehicles, firearms, and ammunition critical for national security since the early 20th century. The defense tech industry emerged more recently, driven by innovations in cyber warfare, artificial intelligence, and unmanned systems that transform modern combat capabilities. This evolution reflects a shift from conventional hardware production to advanced technology development, emphasizing software, sensor integration, and network-centric warfare.

Core Products and Services in Each Sector

The defense industry primarily produces traditional military equipment such as aircraft, armored vehicles, naval vessels, and weaponry, while providing large-scale manufacturing, maintenance, and logistical support services. In contrast, the defense tech industry specializes in advanced technologies including cybersecurity solutions, artificial intelligence for autonomous systems, missile defense systems, and battlefield communication networks. Core products in defense tech emphasize innovation and software-driven capabilities that enhance real-time data analysis, intelligence, surveillance, and reconnaissance (ISR) operations.

Role of Innovation in Defense and Defense Tech

Innovation drives both the defense industry and the defense tech industry, but defense tech focuses more on cutting-edge advancements like artificial intelligence, cybersecurity, and autonomous systems, which enhance military capabilities. The defense industry integrates traditional manufacturing and large-scale production with emerging technologies to deliver comprehensive defense solutions. Rapid technological innovation accelerates the development of next-generation weaponry and defense infrastructure, ensuring strategic superiority and operational efficiency.

Market Leaders: Traditional Defense vs. Tech-Driven Companies

Traditional defense industry leaders like Lockheed Martin, BAE Systems, and Northrop Grumman dominate with expertise in aerospace, military vehicles, and weapons manufacturing. In contrast, tech-driven defense companies such as Palantir Technologies, SpaceX, and Anduril leverage advancements in AI, data analytics, and autonomous systems to offer cutting-edge solutions. Market dynamics increasingly favor technology integration, pushing traditional defense giants to invest heavily in innovation and digital transformation.

Investment Trends in Defense vs. Defense Tech

Investment trends in the defense industry show steady growth driven by government contracts and infrastructure development, while the defense tech industry attracts higher venture capital due to innovation in AI, cybersecurity, and autonomous systems. Defense tech investments emphasize rapid prototyping and scalable technologies, reflecting the shift towards modernization and operational efficiency. Funding in traditional defense lags behind technological advancements, highlighting a strategic pivot towards cutting-edge defense technologies.

Regulatory and Compliance Considerations

The defense industry faces stringent regulatory frameworks such as ITAR and EAR to control the export and handling of defense-related technologies and materials. The defense tech sector must navigate both these regulations and emerging standards for cybersecurity and data privacy to ensure compliance with evolving national security requirements. Adhering to these complex compliance requirements is critical for maintaining government contracts and avoiding severe legal and financial penalties.

Collaboration and Competition Between the Sectors

The defense industry and defense tech industry exhibit a dynamic interplay characterized by collaboration on advanced weapon systems and AI-driven cybersecurity solutions while competing for government contracts and technological supremacy. Shared goals in innovation drive partnerships that enhance military capabilities, yet diverging priorities in speed of development and regulatory compliance fuel competitive tensions. Investment trends from entities like the U.S. Department of Defense and venture capital firms highlight the ongoing balancing act between cooperative ventures and market rivalry.

Future Outlook: Convergence or Divergence of Defense and Defense Tech

The defense industry and defense tech industry are increasingly converging as advanced technologies like artificial intelligence, cyber warfare, and autonomous systems become integral to modern military capabilities. Investment in research and development within defense tech startups is driving rapid innovation, reshaping traditional defense procurement and strategy. Future outlooks suggest that seamless integration of emerging technologies will define competitive advantage and operational superiority in national defense.

Related Important Terms

Dual-Use Technologies

The Defense industry primarily focuses on the development and production of military-specific equipment and systems, whereas the Defense tech industry emphasizes innovations in dual-use technologies that serve both military and civilian applications. Dual-use technologies drive advancements in areas such as cybersecurity, artificial intelligence, and unmanned systems, enhancing national security while fostering commercial innovation.

Defense-as-a-Service (DaaS)

The Defense-as-a-Service (DaaS) model revolutionizes the traditional defense industry by integrating advanced defense technology solutions into scalable, on-demand service platforms, enabling more agile and cost-effective military operations. This shift emphasizes software-driven defense capabilities, remote threat detection, and real-time data analytics, contrasting with the conventional defense sector's focus on hardware manufacturing and large-scale infrastructure.

Digital Battlefield

The defense industry encompasses traditional sectors such as manufacturing of weapons, vehicles, and logistics, while the defense tech industry specializes in developing advanced digital battlefield technologies including AI-driven surveillance, cyber warfare tools, and autonomous systems. Digital battlefield innovations enhance situational awareness, decision-making speed, and operational efficiency by integrating real-time data analytics, IoT sensors, and secure communication networks.

Autonomous Weapon Systems

The defense industry encompasses a broad range of military products and services, including traditional weaponry, vehicles, and support systems, while the defense tech industry specifically focuses on cutting-edge innovations such as autonomous weapon systems that leverage artificial intelligence and machine learning for enhanced precision and reduced human intervention. Autonomous weapon systems represent a critical advancement within defense technology, integrating sensors, AI-driven decision-making, and real-time data analysis to transform modern warfare and strategic defense capabilities.

Hypersonic Glide Vehicles

The defense industry broadly encompasses the manufacturing and supply of military weapons, equipment, and services, whereas the defense tech industry specializes in advanced technologies such as Hypersonic Glide Vehicles (HGVs), which enable ultra-fast, maneuverable missile delivery beyond traditional ballistic trajectories. HGVs represent a critical innovation within defense tech, pushing the boundaries of speed and evasiveness, thereby significantly enhancing strategic deterrence and battlefield dominance.

C2 (Command and Control) Modernization

The Defense industry traditionally encompasses manufacturing of military equipment and weapons, while the Defense tech industry centers on innovative Command and Control (C2) modernization, integrating advanced software, AI, and cybersecurity to enhance battlefield communication and decision-making efficiency. Cutting-edge C2 solutions focus on real-time data fusion, secure network architecture, and autonomous systems to ensure superior situational awareness and rapid response in modern warfare environments.

Cyber-Electromagnetic Activities (CEMA)

The Defense industry primarily encompasses traditional military hardware and logistics, while the Defense tech industry focuses on advanced innovations such as Cyber-Electromagnetic Activities (CEMA) that integrate cyber warfare, electronic warfare, and spectrum operations to enhance operational capabilities. CEMA leverages cutting-edge technologies like artificial intelligence, machine learning, and signal intelligence to provide real-time battlefield situational awareness and disrupt adversarial communications effectively.

ISR Tech Stack (Intelligence, Surveillance, Reconnaissance)

The Defense industry encompasses a broad range of sectors including weapons manufacturing, logistics, and military services, while the Defense tech industry specifically focuses on cutting-edge ISR tech stacks that integrate advanced sensors, data analytics, and AI-driven platforms to enhance real-time intelligence, surveillance, and reconnaissance capabilities. Innovations in radar systems, satellite imagery, and cyber intelligence within the ISR tech stack are critical for maintaining strategic advantages and force readiness in modern defense operations.

Defense Innovation Unit (DIU) Partnerships

The Defense Innovation Unit (DIU) accelerates the integration of cutting-edge technologies from the private sector into the Defense industry, bridging the gap between traditional defense contractors and the Defense tech industry startups. DIU partnerships emphasize rapid prototyping and scalable solutions in areas such as artificial intelligence, cybersecurity, and advanced materials, fostering innovation that enhances military capabilities and operational readiness.

Deep Tech Spin-Ins

The Defense industry traditionally centers on manufacturing and logistics, whereas the Defense tech industry drives innovation through Deep Tech spin-ins, integrating quantum computing, AI, and advanced materials to enhance strategic capabilities. These spin-ins accelerate modernization by transferring breakthrough technologies from commercial deep tech sectors directly into defense applications, boosting operational efficiency and resilience.

Defense industry vs Defense tech industry Infographic

industrydif.com

industrydif.com