Feed-in Tariffs guarantee fixed payments to renewable energy producers for the electricity they supply to the grid, ensuring predictable income and encouraging investment in clean energy. Transactive Energy leverages real-time pricing signals and decentralized energy trading to optimize grid efficiency and balance supply and demand dynamically. While Feed-in Tariffs provide stability, Transactive Energy fosters flexibility and consumer participation in energy markets.

Table of Comparison

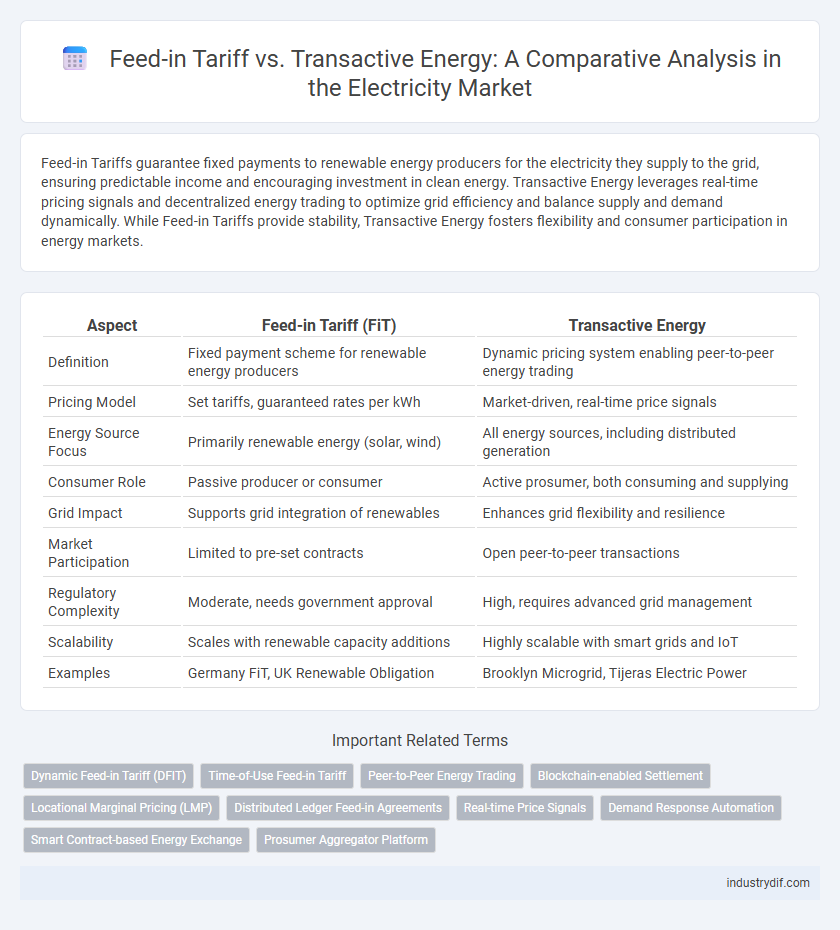

| Aspect | Feed-in Tariff (FiT) | Transactive Energy |

|---|---|---|

| Definition | Fixed payment scheme for renewable energy producers | Dynamic pricing system enabling peer-to-peer energy trading |

| Pricing Model | Set tariffs, guaranteed rates per kWh | Market-driven, real-time price signals |

| Energy Source Focus | Primarily renewable energy (solar, wind) | All energy sources, including distributed generation |

| Consumer Role | Passive producer or consumer | Active prosumer, both consuming and supplying |

| Grid Impact | Supports grid integration of renewables | Enhances grid flexibility and resilience |

| Market Participation | Limited to pre-set contracts | Open peer-to-peer transactions |

| Regulatory Complexity | Moderate, needs government approval | High, requires advanced grid management |

| Scalability | Scales with renewable capacity additions | Highly scalable with smart grids and IoT |

| Examples | Germany FiT, UK Renewable Obligation | Brooklyn Microgrid, Tijeras Electric Power |

Introduction to Feed-in Tariff (FiT) and Transactive Energy

Feed-in Tariff (FiT) programs guarantee fixed payments to renewable energy producers, incentivizing decentralized energy generation by providing long-term contracts at predefined rates. Transactive Energy involves dynamic, market-based interactions where consumers and producers actively trade electricity using real-time pricing signals to optimize grid efficiency and reliability. FiT emphasizes stable compensation to accelerate renewable adoption, while Transactive Energy leverages advanced communication and control technologies for flexible, decentralized grid management.

Core Principles of Feed-in Tariff Systems

Feed-in Tariff (FiT) systems guarantee fixed payments to renewable energy producers for each unit of electricity fed into the grid, ensuring predictable revenue streams and incentivizing clean energy investments. Core principles of FiT include long-term contracts, tariff differentiation based on technology and project size, and priority grid access for producers. Unlike transactive energy models that enable dynamic energy trading and grid responsiveness, FiTs focus on stability and regulatory certainty to accelerate renewable energy deployment.

Understanding the Transactive Energy Model

The Transactive Energy model enables dynamic, real-time energy exchange between producers and consumers, optimizing grid efficiency through decentralized control and automated pricing mechanisms. Unlike the fixed-rate Feed-in Tariff system, Transactive Energy leverages smart grid technologies to balance supply and demand, incentivizing prosumers to adjust energy usage based on market signals. This approach enhances grid resilience, promotes renewable integration, and fosters consumer participation in energy markets.

Key Differences: FiT vs Transactive Energy

Feed-in Tariff (FiT) guarantees fixed payments to renewable energy producers for the electricity they supply to the grid, fostering investment in solar and wind power through stable revenue. Transactive Energy, in contrast, uses real-time pricing and automated negotiation between producers and consumers to optimize grid efficiency and balance supply and demand dynamically. FiT emphasizes long-term financial incentives, while Transactive Energy prioritizes market-driven flexibility and decentralized energy management.

Economic Impacts on Utilities and Consumers

Feed-in Tariffs offer utilities predictable revenue streams by guaranteeing fixed rates for renewable energy generation, which can stabilize utility finances but may lead to higher costs for consumers due to fixed tariffs above market rates. Transactive Energy systems enable dynamic pricing and peer-to-peer energy trading, promoting economic efficiency and potentially lowering costs for consumers by matching supply and demand in real-time. While Feed-in Tariffs prioritize stable utility income and renewable adoption, Transactive Energy fosters market-driven incentives and consumer participation, impacting utility revenue models and consumer energy expenses differently.

Regulatory Framework and Policy Considerations

Feed-in Tariff (FiT) policies guarantee fixed payments for renewable energy producers, ensuring predictable revenue streams and incentivizing clean energy investment under clear regulatory frameworks. Transactive Energy systems rely on real-time pricing and decentralized energy trading, requiring adaptive policy frameworks that support dynamic market participation and grid flexibility. Regulatory considerations must balance FiT's long-term contracts with Transactive Energy's market responsiveness to promote integration, reliability, and equitable access.

Grid Integration and Flexibility

Feed-in Tariffs provide fixed payments for renewable energy fed into the grid, ensuring grid integration by incentivizing steady renewable supply but often lack dynamic flexibility for varying demand. Transactive Energy systems enable real-time, bidirectional energy transactions between producers and consumers, enhancing grid flexibility through decentralized decision-making and adaptive load management. This dynamic interaction improves grid stability and supports higher penetration of distributed energy resources compared to traditional tariff-based models.

Technological Requirements and Infrastructure

Feed-in Tariff systems rely on centralized infrastructure with smart meters and reliable grid connectivity to measure and reward renewable energy production, emphasizing consistent data collection and secure communication channels. In contrast, Transactive Energy demands advanced decentralized technologies, including blockchain platforms, IoT devices, and real-time data analytics, to facilitate peer-to-peer energy trading and dynamic grid balancing. Both approaches require robust cybersecurity measures and scalable communication networks to ensure efficient and resilient electricity management.

Sustainability and Renewable Energy Adoption

Feed-in Tariffs (FITs) guarantee fixed payments to renewable energy producers, accelerating the adoption of solar and wind power by providing financial stability. Transactive Energy systems use dynamic pricing and real-time energy trading to optimize grid efficiency and integrate distributed renewable resources sustainably. Combining FITs with transactive energy mechanisms can drive higher renewable energy penetration while maintaining grid reliability and economic incentives for sustainable electricity.

Future Trends in Electricity Market Structures

Feed-in Tariffs (FiTs) have historically provided guaranteed pricing for renewable energy producers, promoting early adoption and grid integration, but face challenges in scalability and market flexibility. Transactive Energy systems leverage real-time pricing and decentralized decision-making, enabling dynamic demand response, peer-to-peer trading, and enhanced grid efficiency. Future electricity market structures are shifting towards transactive models driven by advanced technologies like blockchain, IoT, and AI, fostering more resilient, decentralized, and consumer-empowered energy ecosystems.

Related Important Terms

Dynamic Feed-in Tariff (DFIT)

Dynamic Feed-in Tariff (DFIT) enhances the traditional Feed-in Tariff by adjusting rates in real-time based on grid demand and supply conditions, promoting more efficient energy distribution and incentivizing renewable energy producers during peak periods. Unlike static tariffs, DFIT integrates with transactive energy systems, enabling dynamic pricing signals that facilitate decentralized energy trading and grid stability.

Time-of-Use Feed-in Tariff

Time-of-Use Feed-in Tariff incentivizes energy producers by varying payment rates based on electricity generation during peak and off-peak hours, optimizing grid efficiency and renewable integration. Transactive Energy enables real-time energy trading among consumers and producers, leveraging blockchain and smart grid technologies to enhance demand response and decentralized balance.

Peer-to-Peer Energy Trading

Feed-in Tariffs (FIT) provide fixed payments for renewable energy fed into the grid, enabling predictable income for producers but limiting direct consumer interaction. Peer-to-peer energy trading within transactive energy systems allows prosumers to dynamically buy and sell electricity locally, enhancing grid efficiency and consumer engagement through blockchain-based smart contracts.

Blockchain-enabled Settlement

Feed-in Tariff programs guarantee fixed payments for renewable energy producers, whereas Transactive Energy systems leverage blockchain-enabled settlement to facilitate real-time, transparent peer-to-peer energy transactions. Blockchain technology ensures secure, immutable records that enhance trust and efficiency in decentralized energy markets by automating settlement processes without intermediaries.

Locational Marginal Pricing (LMP)

Feed-in Tariff (FIT) offers fixed, location-independent payments for renewable energy generation, while Transactive Energy utilizes Locational Marginal Pricing (LMP) to reflect real-time congestion and losses on the electric grid, optimizing economic signals for supply and demand at specific nodes. LMP enhances grid efficiency by incentivizing generation and consumption decisions based on dynamic, location-specific electricity costs rather than static tariffs typical of FIT schemes.

Distributed Ledger Feed-in Agreements

Distributed Ledger Feed-in Agreements enhance transparency and security in Feed-in Tariff schemes by recording transactions on a blockchain, enabling efficient peer-to-peer energy trading and real-time settlement. This decentralized approach supports Transactive Energy systems by facilitating dynamic pricing and automated contract execution, fostering greater grid flexibility and consumer participation.

Real-time Price Signals

Feed-in Tariff (FIT) offers fixed, pre-determined rates for electricity fed into the grid, providing stable revenue but lacking real-time price signals that reflect current supply and demand dynamics. In contrast, Transactive Energy systems leverage real-time price signals to enable dynamic energy trading, enhancing grid flexibility and efficiency by incentivizing consumers and producers to adjust consumption and generation based on instantaneous market conditions.

Demand Response Automation

Feed-in Tariff programs guarantee fixed payments for renewable energy fed into the grid, while Transactive Energy leverages dynamic pricing signals to automate demand response, optimizing grid stability and energy consumption. Demand Response Automation in Transactive Energy systems uses real-time data and smart devices to adjust electricity usage, enhancing grid flexibility and reducing peak demand more efficiently than traditional fixed-rate schemes.

Smart Contract-based Energy Exchange

Smart Contract-based energy exchange in transactive energy systems enables automated, transparent, and real-time peer-to-peer electricity trading, enhancing grid efficiency beyond the fixed rates of traditional Feed-in Tariffs. This decentralized approach supports dynamic pricing and local energy balancing, driving greater adoption of renewable resources and reducing reliance on centralized utilities.

Prosumer Aggregator Platform

Feed-in Tariff programs guarantee fixed payments to prosumers for surplus electricity fed back to the grid, ensuring stable revenue streams but often limiting market participation. In contrast, Transactive Energy systems leverage Prosumer Aggregator Platforms to enable dynamic peer-to-peer energy trading, optimizing grid efficiency and empowering prosumers to maximize financial returns through real-time price signals.

Feed-in Tariff vs Transactive Energy Infographic

industrydif.com

industrydif.com