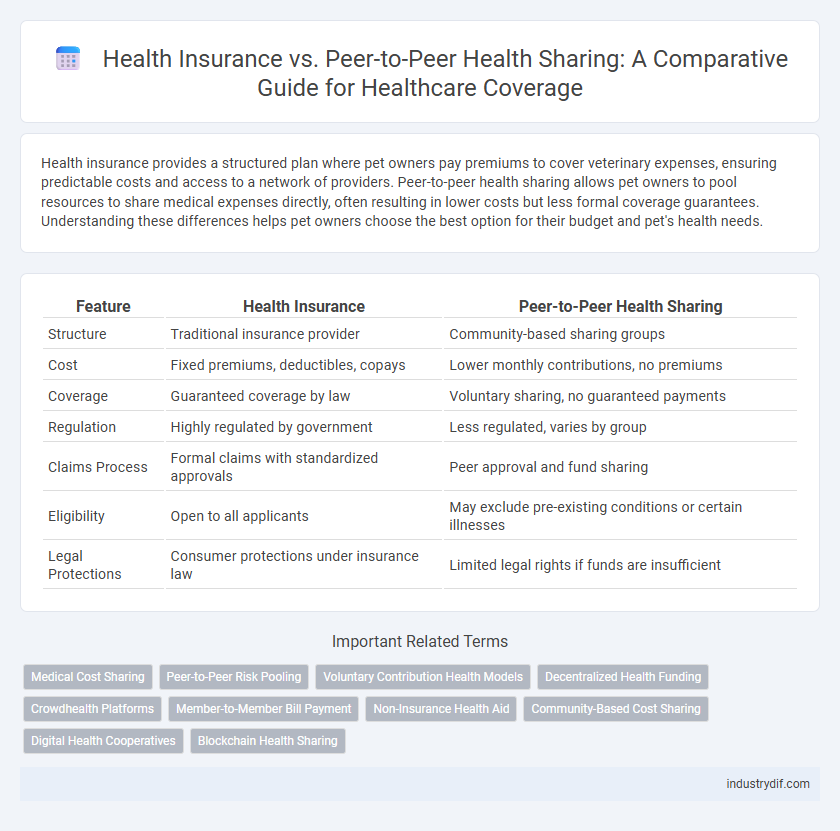

Health insurance provides a structured plan where pet owners pay premiums to cover veterinary expenses, ensuring predictable costs and access to a network of providers. Peer-to-peer health sharing allows pet owners to pool resources to share medical expenses directly, often resulting in lower costs but less formal coverage guarantees. Understanding these differences helps pet owners choose the best option for their budget and pet's health needs.

Table of Comparison

| Feature | Health Insurance | Peer-to-Peer Health Sharing |

|---|---|---|

| Structure | Traditional insurance provider | Community-based sharing groups |

| Cost | Fixed premiums, deductibles, copays | Lower monthly contributions, no premiums |

| Coverage | Guaranteed coverage by law | Voluntary sharing, no guaranteed payments |

| Regulation | Highly regulated by government | Less regulated, varies by group |

| Claims Process | Formal claims with standardized approvals | Peer approval and fund sharing |

| Eligibility | Open to all applicants | May exclude pre-existing conditions or certain illnesses |

| Legal Protections | Consumer protections under insurance law | Limited legal rights if funds are insufficient |

Understanding Health Insurance: Key Concepts

Health insurance involves a contract between an individual and an insurance company, guaranteeing coverage for medical expenses through regular premium payments. It offers comprehensive protection against high healthcare costs by pooling risk among many policyholders, ensuring financial support for hospital stays, surgeries, and prescription medications. Unlike peer-to-peer health sharing, health insurance is regulated by government laws, providing standardized benefits and consumer protections.

What is Peer-to-Peer Health Sharing?

Peer-to-peer health sharing is a cooperative financial arrangement where members contribute funds to cover each other's medical expenses, operating outside traditional health insurance frameworks. This model emphasizes community support and transparency, often appealing to individuals seeking alternatives to conventional insurance due to cost or personal beliefs. Unlike standard health insurance, peer-to-peer health sharing may have limitations in regulatory protections and guaranteed payments, making it essential to understand the terms and risks involved.

Coverage Scope: Comparing Benefits and Exclusions

Health insurance offers comprehensive coverage for a wide range of medical expenses, including hospital stays, prescription drugs, and preventive services, with protections for pre-existing conditions as mandated by law. Peer-to-peer health sharing allows members to contribute monthly funds toward each other's medical bills but often excludes coverage for chronic conditions, preventive care, and certain treatments, with no guaranteed payment. While traditional health insurance provides structured benefits and regulatory oversight, peer-to-peer health sharing relies on member contributions and may result in gaps due to exclusions or limited scope of covered services.

Cost Structures: Premiums vs. Contribution Rates

Health insurance requires fixed monthly premiums that provide predictable costs but can be higher depending on coverage and risk factors. Peer-to-peer health sharing involves variable contribution rates based on group size and healthcare needs, often resulting in lower monthly expenses. Understanding these cost structures helps individuals choose between stable payments or potentially fluctuating contributions for medical expense coverage.

Claims Process: Traditional Insurance vs. Peer Sharing

Traditional health insurance claims involve submitting detailed medical records for verification, followed by insurer approval and payout based on policy terms and coverage limits. Peer-to-peer health sharing requires members to submit medical bills to the community, where funds are pooled and disbursed collaboratively, often with fewer bureaucratic procedures. The peer-sharing model emphasizes transparency and communal responsibility, potentially resulting in faster claim resolutions but may lack the regulatory protections found in traditional insurance.

Industry Regulation and Consumer Protection

Health insurance operates under strict industry regulations enforced by state and federal agencies, ensuring standardized consumer protections such as guaranteed coverage, dispute resolution mechanisms, and financial solvency requirements. Peer-to-peer health sharing arrangements are largely unregulated, classified as voluntary agreements rather than insurance, which limits consumer protections and exposes members to potential risks, including denied claims and lack of legal recourse. Regulatory oversight in the traditional health insurance industry provides consumers with enforceable rights and transparency, unlike peer-to-peer health sharing models that rely on community cooperation without formal guarantees.

Participant Eligibility and Enrollment Requirements

Health insurance typically requires individuals to meet specific eligibility criteria such as age, income, and pre-existing conditions, with a formal enrollment period guided by regulatory standards. Peer-to-peer health sharing platforms often have more flexible participant eligibility, focusing on shared values or faith-based criteria rather than strict medical underwriting. Enrollment in health sharing programs usually involves a simple application process without medical exams, contrasting with health insurance's comprehensive underwriting and formal enrollment deadlines.

Financial Risk and Security Considerations

Health insurance provides comprehensive financial risk protection by covering a broad range of medical expenses, ensuring policyholders are shielded from high out-of-pocket costs and unexpected medical bills. Peer-to-peer health sharing relies on community contributions, which may lack guaranteed payouts and regulatory oversight, potentially exposing members to financial uncertainty during major health events. Evaluating security considerations, traditional insurance offers stability through regulated contracts and insurer solvency, whereas health sharing programs operate on voluntary donations without legal enforcement of coverage.

Transparency and Community Support Aspects

Health insurance provides structured transparency through regulated policy documents and standardized claims processes ensuring clear coverage details. Peer-to-peer health sharing fosters a transparent community where members collectively decide on fund allocation and support, often leading to personalized assistance and shared responsibility. The strong community support in health sharing networks enhances emotional and financial backing, contrasting with the more formalized but less personal structure of traditional health insurance.

Choosing the Right Option: Factors to Consider

Choosing between health insurance and peer-to-peer health sharing involves evaluating factors such as coverage comprehensiveness, cost, and flexibility. Health insurance typically offers guaranteed coverage for pre-existing conditions and specialist care, while peer-to-peer health sharing may provide lower monthly costs but often excludes certain treatments. Consider eligibility, legal protections, and network restrictions to select the option that best aligns with personal healthcare needs and financial capacity.

Related Important Terms

Medical Cost Sharing

Health insurance provides comprehensive coverage with set premiums and deductibles, while peer-to-peer health sharing relies on community contributions to cover medical expenses, potentially reducing upfront costs but lacking guaranteed claim payments. Medical cost sharing in peer-to-peer models varies based on member contributions and sharing pools, presenting risks of uncovered expenses compared to traditional insurance policies regulated by state and federal laws.

Peer-to-Peer Risk Pooling

Peer-to-peer health sharing leverages risk pooling by allowing participants to collectively share medical expenses, reducing reliance on traditional insurance companies and potentially lowering costs through community contributions. This decentralized approach fosters transparency and personalized support, aligning financial responsibility with shared health risks among members.

Voluntary Contribution Health Models

Voluntary contribution health models in health insurance offer structured, risk-pooled coverage with regulated benefits and legal protections, whereas peer-to-peer health sharing relies on direct member contributions and community agreements without formal insurance guarantees. These models differ in financial predictability, compliance with regulatory standards, and the scope of covered medical expenses, affecting consumer choice based on cost, coverage reliability, and risk tolerance.

Decentralized Health Funding

Peer-to-peer health sharing leverages decentralized health funding by enabling individuals to pool resources directly, bypassing traditional insurance intermediaries and reducing administrative costs. This model offers a transparent, member-driven approach to healthcare expenses, contrasting with conventional health insurance's centralized underwriting and risk management.

Crowdhealth Platforms

Crowdhealth platforms offer a decentralized alternative to traditional health insurance by enabling peer-to-peer health sharing, reducing administrative costs and increasing transparency in medical expense management. These platforms leverage community-driven contributions to cover healthcare costs, often providing more affordable and flexible options compared to conventional insurance plans.

Member-to-Member Bill Payment

Health insurance provides coverage through a network of providers with set premiums, deductibles, and copays, while peer-to-peer health sharing enables members to contribute funds directly to pay each other's medical bills, fostering a community-based payment system. Member-to-member bill payment in health sharing often results in more personalized support but lacks the guaranteed coverage and regulatory protections typically offered by traditional health insurance.

Non-Insurance Health Aid

Non-insurance health aid through Peer-to-Peer Health Sharing offers a community-driven approach where members contribute funds to assist each other's medical expenses, contrasting with traditional health insurance's risk-pooling model. This alternative emphasizes transparency, lower costs, and personalized support, but lacks regulatory protections and guaranteed coverage inherent in conventional health insurance policies.

Community-Based Cost Sharing

Community-based cost sharing in peer-to-peer health sharing leverages groups of individuals pooling resources to cover medical expenses, often resulting in lower premiums and more personalized support than traditional health insurance. Unlike standard insurance plans regulated by state mandates, health sharing ministries emphasize shared values and transparency, offering a collaborative approach to healthcare funding.

Digital Health Cooperatives

Digital Health Cooperatives leverage peer-to-peer health sharing models to reduce costs and enhance transparency compared to traditional health insurance by enabling members to directly contribute to one another's medical expenses. These cooperatives utilize blockchain technology and smart contracts to facilitate secure, efficient fund distribution while fostering a community-driven approach to healthcare financing.

Blockchain Health Sharing

Blockchain health sharing leverages decentralized ledger technology to enhance transparency, security, and efficiency in peer-to-peer health sharing models by enabling immutable transaction records and automated smart contracts. This approach contrasts with traditional health insurance by reducing administrative costs and increasing participant control over healthcare funds and decisions.

Health Insurance vs Peer-to-Peer Health Sharing Infographic

industrydif.com

industrydif.com