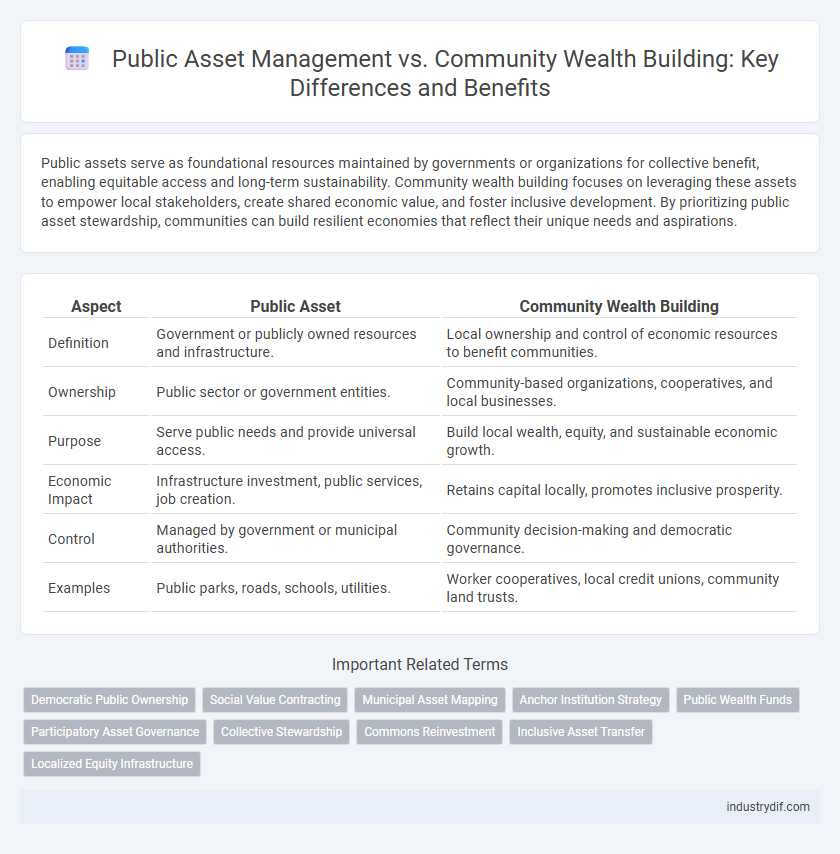

Public assets serve as foundational resources maintained by governments or organizations for collective benefit, enabling equitable access and long-term sustainability. Community wealth building focuses on leveraging these assets to empower local stakeholders, create shared economic value, and foster inclusive development. By prioritizing public asset stewardship, communities can build resilient economies that reflect their unique needs and aspirations.

Table of Comparison

| Aspect | Public Asset | Community Wealth Building |

|---|---|---|

| Definition | Government or publicly owned resources and infrastructure. | Local ownership and control of economic resources to benefit communities. |

| Ownership | Public sector or government entities. | Community-based organizations, cooperatives, and local businesses. |

| Purpose | Serve public needs and provide universal access. | Build local wealth, equity, and sustainable economic growth. |

| Economic Impact | Infrastructure investment, public services, job creation. | Retains capital locally, promotes inclusive prosperity. |

| Control | Managed by government or municipal authorities. | Community decision-making and democratic governance. |

| Examples | Public parks, roads, schools, utilities. | Worker cooperatives, local credit unions, community land trusts. |

Defining Public Assets in Modern Economies

Public assets in modern economies refer to resources and infrastructure owned collectively by government entities, including parks, transportation systems, schools, and utilities. These assets serve as foundational elements supporting economic stability and equitable access to essential services. Effective management of public assets integrates long-term sustainability with community engagement, enhancing local wealth-building initiatives and social outcomes.

Understanding Community Wealth Building Principles

Community Wealth Building prioritizes local ownership and democratic control of assets to foster sustainable economic growth. Unlike traditional Public Asset management, it emphasizes reinvesting profits into the community, supporting local businesses, and creating resilient economic ecosystems. Key principles include equitable wealth distribution, collaborative governance, and leveraging local resources to empower residents.

Key Differences: Public Assets vs. Community Wealth Building

Public assets, such as government-owned infrastructure, parks, and buildings, are tangible resources managed by public entities for collective use and benefit. Community wealth building emphasizes local economic strategies that retain and grow wealth within the community through cooperative ownership, local investments, and inclusive governance. Unlike public assets, community wealth building focuses on empowering residents to create sustainable economic opportunities and equitable resource distribution.

Historical Context of Public Asset Management

Historical public asset management involved centralized control of government-owned resources such as land, infrastructure, and utilities, primarily aimed at generating revenue and maintaining public services. Community wealth building emerged as a response to the limitations of traditional public asset strategies by emphasizing inclusive ownership, local reinvestment, and democratic stewardship to address economic inequality. This shift highlights a transition from top-down asset management toward participatory models that empower communities and foster sustainable local development.

Community Wealth Building: Models and Strategies

Community Wealth Building initiatives prioritize local ownership and democratic control of assets, leveraging models such as cooperatives, community land trusts, and local financial institutions. These strategies emphasize reinvestment in the community, fostering economic resilience and reducing wealth extraction by external entities. By integrating local stakeholders into governance and decision-making, Community Wealth Building creates sustainable economic ecosystems that enhance social equity and long-term prosperity.

Ownership Structures and Governance in Public Assets

Public assets are typically owned and managed by government entities or public institutions, ensuring accountability through elected officials and regulatory frameworks. Community wealth building emphasizes decentralized ownership structures, such as cooperatives or land trusts, which empower local stakeholders with direct governance and decision-making authority. This shift in governance promotes equitable distribution of resources and long-term economic resilience within communities.

The Role of Local Government in Community Wealth Building

Local governments play a pivotal role in community wealth building by leveraging public assets such as land, infrastructure, and financial resources to foster inclusive economic growth. Utilizing strategies like community land trusts, municipal ownership, and local procurement policies, they can redistribute wealth and enhance economic resilience. These efforts align public asset management with long-term community-driven economic empowerment and social equity goals.

Measuring Impact: Economic and Social Outcomes

Measuring the impact of public assets versus community wealth building requires analyzing economic indicators such as job creation, income growth, and local business development alongside social outcomes like improved health, educational attainment, and social cohesion. Robust data collection methods, including surveys, economic modeling, and community feedback, provide quantifiable evidence of how public investments generate equitable prosperity and strengthen community resilience. Tracking these metrics over time reveals the effectiveness of strategies that prioritize local ownership and sustainable economic empowerment.

Challenges Facing Public Asset Development

Public asset development faces challenges such as limited funding sources, complex regulatory environments, and difficulties in maintaining long-term community engagement. Insufficient coordination between government entities and local stakeholders often results in underutilized or mismanaged assets. Furthermore, balancing economic viability with equitable access remains a persistent obstacle in aligning public assets with community wealth building goals.

Future Trends in Public Assets and Community Wealth Building

Future trends in public assets and community wealth building emphasize sustainable development, equitable resource distribution, and digital transformation. Integration of smart technologies and data analytics enhances transparency and efficiency in managing public assets. Collaborative governance models and inclusive investment strategies drive resilient economic growth within communities.

Related Important Terms

Democratic Public Ownership

Democratic public ownership emphasizes collective control over assets, ensuring that public resources generate equitable benefits and sustainable wealth for communities rather than private interests. This approach integrates public assets within community wealth building strategies to promote economic democracy, local empowerment, and long-term social equity.

Social Value Contracting

Social value contracting leverages public assets to generate measurable social, economic, and environmental benefits, directly enhancing community wealth building through inclusive procurement practices and local job creation. By aligning public investments with community priorities, this approach transforms traditional asset management into a catalyst for equitable growth and long-term social impact.

Municipal Asset Mapping

Municipal asset mapping identifies and catalogs public assets such as parks, libraries, and infrastructure to strategically leverage them for community wealth building. This process transforms underutilized public resources into economic opportunities that enhance local equity, resilience, and sustainable growth.

Anchor Institution Strategy

Anchor institution strategy leverages large, locally rooted entities like hospitals and universities to drive community wealth building by prioritizing local hiring, procurement, and investment. This approach transforms public assets into sustainable economic drivers that circulate wealth within the community, fostering inclusive growth and resilience.

Public Wealth Funds

Public wealth funds serve as strategic investment vehicles that leverage publicly owned assets to generate long-term financial returns for community reinvestment and sustainable development. These funds enhance community wealth building by converting underutilized public resources into capital that supports local businesses, affordable housing, and infrastructure improvements.

Participatory Asset Governance

Participatory asset governance empowers communities to directly manage public assets, enhancing transparency and accountability while fostering equitable resource distribution. This approach bridges public asset stewardship with community wealth building by enabling local stakeholders to influence decision-making and ensure benefits align with collective needs.

Collective Stewardship

Public assets serve as foundational resources managed through collective stewardship, ensuring long-term community benefits and equitable access. Community wealth building leverages these public assets to foster inclusive economic growth, keeping wealth circulating locally and empowering residents through shared ownership and decision-making.

Commons Reinvestment

Commons reinvestment channels public assets into community wealth building by transforming underutilized public resources into sustainable, locally controlled assets that generate long-term economic and social benefits. This approach prioritizes collective ownership and stewardship, ensuring equitable access, economic inclusivity, and resilience within communities.

Inclusive Asset Transfer

Inclusive asset transfer prioritizes equitable distribution of public assets to marginalized communities, fostering long-term community wealth building by ensuring local ownership and control. This approach transforms public resources into generational wealth, reducing economic disparities and promoting sustainable economic empowerment.

Localized Equity Infrastructure

Public assets serve as foundational resources managed by governments to support community needs, while community wealth building emphasizes localized equity infrastructure by empowering residents through collective ownership and control of economic institutions. This approach fosters inclusive economic development by reinvesting local capital into affordable housing, small businesses, and workforce development, driving sustainable prosperity within marginalized neighborhoods.

Public Asset vs Community Wealth Building Infographic

industrydif.com

industrydif.com