Public funding provides essential, stable resources for pet welfare programs, ensuring widespread access and basic care. Impact investing targets innovative solutions with measurable social benefits, attracting private capital to drive sustainable improvements in pet health and community engagement. Balancing public funding with impact investing enhances the scalability and effectiveness of initiatives supporting public pets.

Table of Comparison

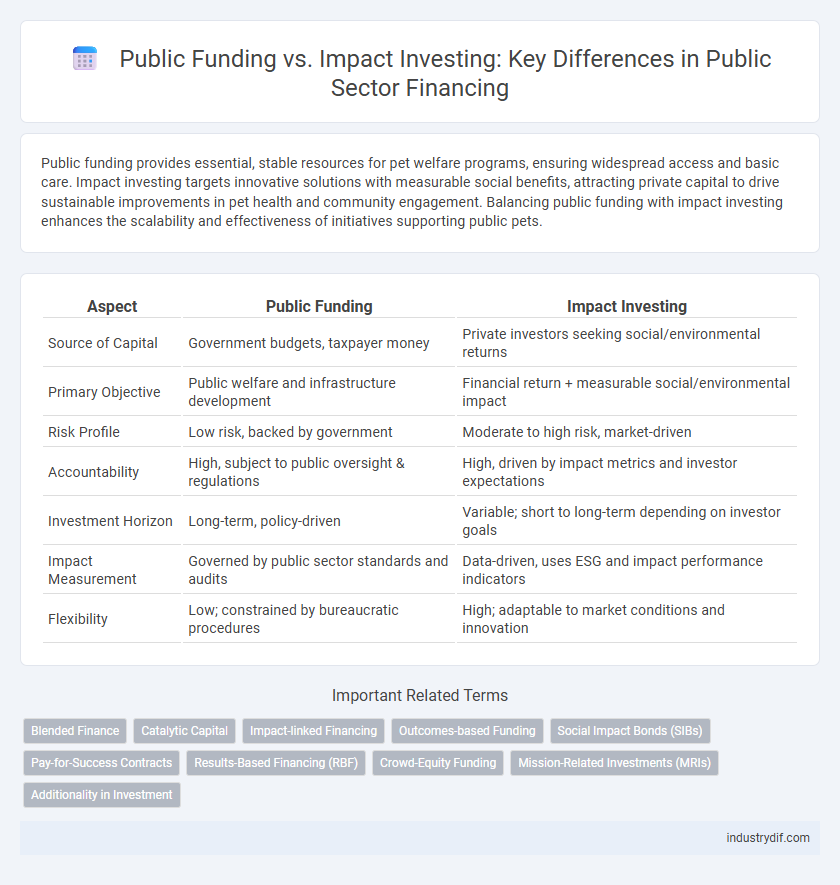

| Aspect | Public Funding | Impact Investing |

|---|---|---|

| Source of Capital | Government budgets, taxpayer money | Private investors seeking social/environmental returns |

| Primary Objective | Public welfare and infrastructure development | Financial return + measurable social/environmental impact |

| Risk Profile | Low risk, backed by government | Moderate to high risk, market-driven |

| Accountability | High, subject to public oversight & regulations | High, driven by impact metrics and investor expectations |

| Investment Horizon | Long-term, policy-driven | Variable; short to long-term depending on investor goals |

| Impact Measurement | Governed by public sector standards and audits | Data-driven, uses ESG and impact performance indicators |

| Flexibility | Low; constrained by bureaucratic procedures | High; adaptable to market conditions and innovation |

Understanding Public Funding and Impact Investing

Public funding involves government allocation of resources to support projects with broad societal benefits, often emphasizing accountability and long-term sustainability. Impact investing directs private capital toward businesses and organizations that generate measurable social and environmental impact alongside financial returns. Understanding these mechanisms highlights the complementary roles they play in advancing economic development and social innovation.

Key Differences Between Public Funding and Impact Investing

Public funding typically involves government grants or subsidies aimed at supporting social programs without direct financial returns, prioritizing public welfare and infrastructure. Impact investing directs private capital toward ventures that generate positive social or environmental impacts alongside financial returns, blending profit motives with ethical goals. Key differences lie in the source of funds, expected returns, and accountability mechanisms, with public funding emphasizing public accountability and impact investing focusing on measurable financial and social outcomes.

Historical Development of Public Funding

Public funding has evolved over centuries, with origins dating back to early government taxation systems supporting infrastructure and social programs. The 20th century saw significant expansion in public budgets for education, healthcare, and welfare, driven by industrialization and urbanization. This historical development contrasts with impact investing, which emerged more recently as a market-driven approach targeting social and environmental returns alongside financial gain.

The Rise of Impact Investing in Modern Finance

Impact investing has rapidly grown within modern finance, attracting over $1 trillion in global assets under management by 2023, surpassing many traditional public funding channels. This shift highlights investors' increasing demand for measurable social and environmental outcomes alongside financial returns. Public funding remains essential but is increasingly complemented by impact investments driving sustainable development and innovation.

Measuring Social Outcomes: Metrics in Public Funding vs Impact Investing

Measuring social outcomes in public funding often relies on standardized metrics such as cost-benefit analysis, social return on investment (SROI), and compliance with government-mandated benchmarks. Impact investing employs more flexible, outcome-driven metrics including impact-weighted accounts, customized key performance indicators (KPIs), and third-party impact verification to capture nuanced social and environmental effects. The divergence in metrics reflects the difference between regulatory accountability in public funding and market-driven performance in impact investing.

Advantages and Disadvantages of Public Funding

Public funding offers significant advantages such as predictable financial support, broad accessibility, and alignment with public policy goals, which ensures projects address social needs. However, it often involves bureaucratic delays, limited flexibility, and dependence on political priorities, which can hinder innovation and timely implementation. Unlike impact investing, public funding may lack performance-based incentives, leading to less efficient allocation of resources.

Impact Investing: Opportunities and Challenges

Impact investing channels capital into ventures that generate measurable social and environmental benefits alongside financial returns, addressing critical global issues such as climate change, poverty, and healthcare disparities. Unlike traditional public funding, which often relies on government budgets and may face bureaucratic constraints, impact investing mobilizes private sector resources, fostering innovation and scalability in sustainable projects. Challenges include the need for standardized metrics to assess impact performance and balancing financial viability with social objectives, yet the sector's rapid growth signals strong potential for transformative change.

Case Studies: Successful Projects Funded by Public and Impact Investments

Case studies reveal that public funding has successfully supported large-scale infrastructure projects such as the High-Speed Rail in California, leveraging billions of dollars in government grants and bonds. Impact investing has driven significant advancements in renewable energy startups like SolarHome, enabling scalable clean technology solutions through private capital focused on social and environmental returns. Both funding mechanisms demonstrate effective resource mobilization, with public funds ensuring foundational infrastructure and impact investments fostering innovation in sustainable development.

Regulatory Environment: Public Funding and Impact Investing

Public funding operates within a stringent regulatory environment designed to ensure transparency, accountability, and equitable distribution of resources, often governed by government agencies and legislative frameworks. Impact investing, while also regulated, benefits from more flexible policies that encourage private capital flow into socially beneficial projects, balancing financial returns with measurable social and environmental impact. Regulatory frameworks for impact investing are evolving to enhance investor protection and standardize impact measurement, promoting greater market confidence and scalability.

Future Trends: The Evolving Landscape of Social Financing

Public funding continues to play a crucial role in supporting essential social programs, yet impact investing is rapidly reshaping the social financing landscape by attracting private capital toward measurable social and environmental outcomes. Future trends indicate increased collaboration between governments and impact investors, leveraging data-driven metrics and technology to optimize resource allocation and scale innovations. Emerging models prioritize transparency, accountability, and blending financial returns with societal impact, reflecting a shift toward more strategic and outcome-focused social financing.

Related Important Terms

Blended Finance

Blended finance strategically combines public funding with private capital to leverage greater investment in sustainable development projects, enhancing both risk mitigation and financial returns. This approach maximizes impact investing by unlocking additional resources and fostering collaboration between governments, private investors, and development agencies.

Catalytic Capital

Catalytic capital in public funding leverages patient, risk-tolerant investments to mobilize additional private sector resources, accelerating social and environmental impact beyond traditional grant mechanisms. This strategic use of catalytic capital enhances the scale and effectiveness of public funds by de-risking innovative projects and attracting impact investors seeking blended financial returns.

Impact-linked Financing

Impact-linked financing leverages public funding to drive measurable social and environmental outcomes by tying financial returns to specific impact metrics, creating incentives for better performance. This approach attracts private investments alongside public resources, amplifying capital efficiency and fostering scalable solutions in sectors like renewable energy and social infrastructure.

Outcomes-based Funding

Outcomes-based funding in public financing emphasizes measurable results to ensure accountability and efficient use of taxpayer money, contrasting with impact investing's preference for blending financial returns with social impact. This model directs public funds toward programs that meet specific performance indicators, fostering transparency and incentivizing success in addressing societal challenges.

Social Impact Bonds (SIBs)

Social Impact Bonds (SIBs) leverage private investment to fund public social programs, enabling governments to pay only for successful outcomes, which enhances accountability and resource efficiency compared to traditional public funding. This innovative financing mechanism attracts impact investors by aligning financial returns with measurable social impact, creating scalable solutions for complex social issues.

Pay-for-Success Contracts

Pay-for-Success Contracts leverage public funding by tying government expenditures to measurable social outcomes, encouraging private investors to finance initiatives with proven impact. This model aligns financial returns with public benefits, optimizing resource allocation and driving performance-based innovation in sectors like education, healthcare, and criminal justice reform.

Results-Based Financing (RBF)

Results-Based Financing (RBF) links public funding to measurable outcomes, driving efficiency and accountability in projects by disbursing funds only after achieving specified results. Impact investing complements RBF by mobilizing private capital aimed at generating both social impact and financial returns, expanding the resources available for high-impact interventions.

Crowd-Equity Funding

Crowd-equity funding merges public involvement with investment opportunities, allowing numerous small investors to acquire equity in startups or projects, thereby democratizing capital access and enhancing community engagement. Unlike traditional public funding, crowd-equity aligns investor returns with project success, driving greater accountability and potential for scalable social and economic impact.

Mission-Related Investments (MRIs)

Mission-Related Investments (MRIs) strategically deploy public funding to achieve measurable social and environmental outcomes alongside financial returns, bridging gaps often left by traditional grants. By leveraging MRIs, governments enhance the efficiency of public resources, attracting private capital to scale high-impact initiatives in sectors like renewable energy, affordable housing, and social services.

Additionality in Investment

Public funding often lacks additionality as it primarily reallocates existing resources without significantly increasing total investment flows, while impact investing explicitly targets additional capital deployment to generate measurable social and environmental benefits alongside financial returns. The core principle of additionality in impact investing ensures that investments address market gaps and catalyze positive change beyond what would occur through traditional public funding mechanisms.

public funding vs impact investing Infographic

industrydif.com

industrydif.com