An appraisal provides a detailed, expert evaluation of a property's value by a licensed appraiser, considering factors like condition, location, and market trends. Automated Valuation Models (AVMs) use algorithms and public data to estimate property values quickly but may lack accuracy for unique or complex properties. Understanding the strengths and limitations of both methods is crucial for making informed real estate decisions.

Table of Comparison

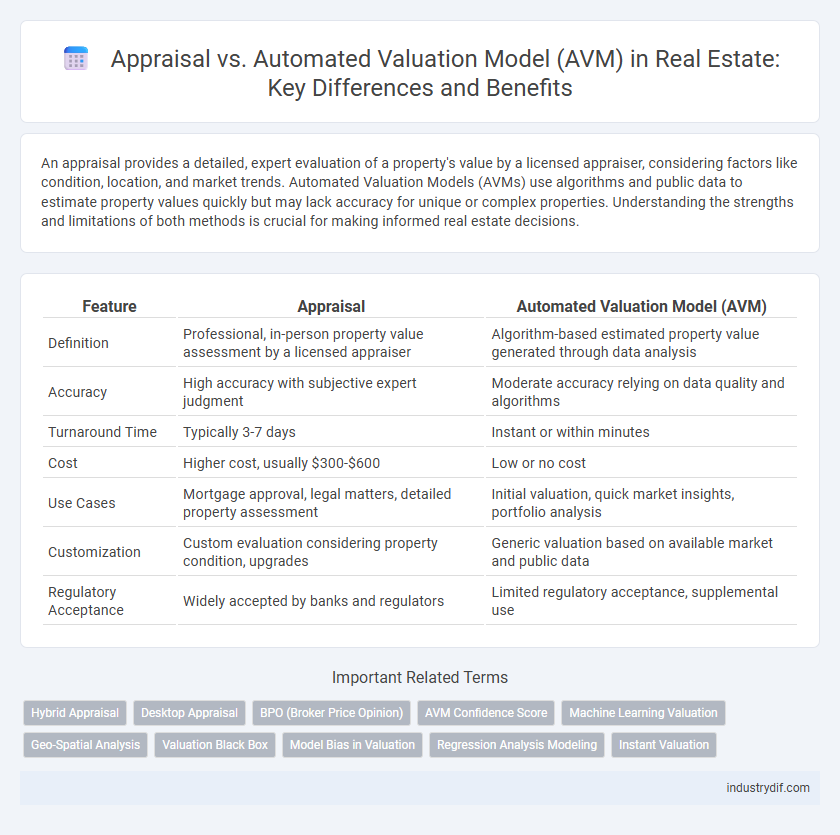

| Feature | Appraisal | Automated Valuation Model (AVM) |

|---|---|---|

| Definition | Professional, in-person property value assessment by a licensed appraiser | Algorithm-based estimated property value generated through data analysis |

| Accuracy | High accuracy with subjective expert judgment | Moderate accuracy relying on data quality and algorithms |

| Turnaround Time | Typically 3-7 days | Instant or within minutes |

| Cost | Higher cost, usually $300-$600 | Low or no cost |

| Use Cases | Mortgage approval, legal matters, detailed property assessment | Initial valuation, quick market insights, portfolio analysis |

| Customization | Custom evaluation considering property condition, upgrades | Generic valuation based on available market and public data |

| Regulatory Acceptance | Widely accepted by banks and regulators | Limited regulatory acceptance, supplemental use |

Understanding Real Estate Appraisal

Real estate appraisal involves a licensed professional conducting a detailed, on-site evaluation of a property's condition, location, and comparable sales to determine its market value accurately. Automated Valuation Models (AVMs) use algorithms and public data to estimate property values quickly but may lack nuanced insights an appraiser provides. Understanding the differences between appraisals and AVMs is crucial for buyers, sellers, and lenders to make informed decisions based on precise and reliable property valuations.

What is an Automated Valuation Model (AVM)?

An Automated Valuation Model (AVM) is a technology-driven tool that uses mathematical modeling, algorithms, and extensive property data to estimate real estate values quickly and accurately. AVMs analyze recent sales, property characteristics, market trends, and comparable properties to generate an instant property value without human intervention. Widely used by lenders, real estate agents, and online platforms, AVMs provide a cost-effective alternative to traditional appraisals but may lack the nuanced judgment of a licensed appraiser.

Key Differences Between Appraisals and AVMs

Appraisals involve a licensed professional conducting an in-depth property inspection and market analysis to determine a home's value, offering personalized and precise estimates. Automated Valuation Models (AVMs) use algorithms and large datasets like recent sales, tax records, and property characteristics to generate rapid value estimates without physical inspection. The key differences lie in accuracy, human expertise versus automation, and the level of detail in assessing property conditions and market trends.

Pros and Cons of Real Estate Appraisals

Real estate appraisals provide an in-depth, professional evaluation of property value based on physical inspection, comparable sales, and market conditions, ensuring accuracy and reliability essential for financing and legal matters. The downside includes higher costs and longer turnaround times compared to Automated Valuation Models (AVMs), which utilize algorithms and public data for instant, cost-effective estimates but may lack nuance and detail. Appraisals remain the gold standard for high-stakes transactions despite the convenience of AVMs in preliminary market analysis.

Advantages and Limitations of AVMs

Automated Valuation Models (AVMs) offer rapid property value estimates using algorithms that analyze recent sales, tax data, and market trends, providing convenience and cost efficiency for real estate professionals and lenders. AVMs excel in generating consistent valuations across large datasets but may lack accuracy in unique or complex properties where appraisals consider physical inspections and local nuances. Limitations include reduced reliability in volatile markets and challenges with data quality, prompting reliance on professional appraisals for high-stakes transactions or atypical real estate assets.

Use Cases: When to Choose Appraisal vs AVM

Appraisal is essential for high-value transactions, complex properties, or when detailed inspection and personalized analysis are required to ensure accurate market value. Automated Valuation Models (AVMs) offer quick, cost-effective estimates ideal for lower-risk decisions, such as preliminary property evaluations or mass portfolio assessments. Real estate investors, lenders, and sellers typically choose appraisals for mortgage approvals and legal matters, while AVMs serve well in online listings and initial price setting.

Accuracy: Appraisal vs Automated Valuation Model

Appraisals provide high accuracy by involving licensed professionals who assess a property's condition, location, and market trends through on-site inspections and comparative market analysis. Automated Valuation Models (AVMs) use algorithms and large datasets to estimate property values quickly but may lack precision due to limited physical inspection and potential data inaccuracies. Real estate transactions often rely on appraisals for critical decision-making because of their thoroughness and regulatory acceptance.

Impact on Mortgage Lending and Underwriting

Appraisal provides a detailed, onsite property evaluation critical for accurate mortgage lending decisions, ensuring lenders assess risks based on current market conditions and property specifics. Automated Valuation Models (AVMs) offer rapid, data-driven property value estimates by analyzing large datasets, enhancing underwriting efficiency but potentially lacking nuance for unique or distressed properties. Integrating both methods allows lenders to balance speed and precision, improving loan risk assessment and regulatory compliance in mortgage underwriting.

Cost and Speed Comparison: Appraisal vs AVM

Appraisals typically cost between $300 and $500 and require several days to complete due to the need for a physical property inspection by a licensed professional. Automated Valuation Models (AVMs) offer a cost-effective alternative, often available for under $50, providing near-instant estimates based on large datasets and algorithms. While AVMs deliver rapid valuations, appraisals offer more accuracy and detailed analysis, justifying the higher cost and longer turnaround time.

The Future of Property Valuation Technology

The future of property valuation technology hinges on the integration of traditional appraisals with advanced Automated Valuation Models (AVMs) powered by artificial intelligence and big data analytics. AVMs offer rapid, data-driven property assessments utilizing machine learning algorithms that analyze vast datasets including recent sales, market trends, and property characteristics. Combining human expertise with AVM precision promises more accurate, efficient, and scalable real estate valuations, transforming appraisal practices and enhancing decision-making processes.

Related Important Terms

Hybrid Appraisal

Hybrid appraisal combines the accuracy of traditional appraisals with the efficiency of Automated Valuation Models (AVMs) by integrating expert appraiser input and algorithmic data analysis. This approach enhances property valuation precision, leveraging machine learning trends alongside on-site inspections to provide more reliable market value estimates in real estate transactions.

Desktop Appraisal

Desktop appraisal leverages automated valuation models (AVMs) to estimate property value using algorithms and public data, offering faster and often more cost-effective assessments compared to traditional on-site appraisals. This method enhances efficiency by integrating multiple data sources such as recent sales, tax information, and market trends, while maintaining a degree of professional oversight to validate accuracy.

BPO (Broker Price Opinion)

Broker Price Opinions (BPOs) provide a cost-effective alternative to traditional appraisals by offering a real estate professional's expert estimate of a property's value based on market data and neighborhood trends. Automated Valuation Models (AVMs) leverage algorithms and extensive data sets for rapid property valuations but often lack the local market insight and nuanced judgment included in a broker's BPO assessment.

AVM Confidence Score

The Appraisal process provides a professional, on-site evaluation of property value, while the Automated Valuation Model (AVM) offers a data-driven estimate using algorithms and large datasets, enhanced by the AVM Confidence Score which indicates the reliability of the valuation based on data quality and market conditions. High AVM Confidence Scores reflect greater accuracy and trustworthiness, making them critical for lenders and buyers relying on automated estimates in real estate transactions.

Machine Learning Valuation

Machine learning valuation leverages vast datasets and complex algorithms to generate real-time property value estimates, enhancing accuracy compared to traditional appraisal methods that rely on human judgment and physical inspections. Automated Valuation Models (AVMs) utilize these machine learning techniques to rapidly assess market trends, property features, and comparable sales, providing scalable and cost-effective solutions for real estate valuation.

Geo-Spatial Analysis

Appraisal leverages expert-driven geo-spatial analysis, incorporating local market conditions, neighborhood trends, and property-specific details to provide precise real estate valuations. Automated Valuation Models (AVMs) utilize algorithms and large datasets, including satellite imagery and GIS mapping, enabling rapid estimates but may lack nuanced insights from localized geographic factors.

Valuation Black Box

Appraisal relies on expert analysis of property condition, location, and market trends, while Automated Valuation Models (AVMs) use algorithms and large datasets to estimate property values without transparency, often referred to as the "valuation black box" due to their opaque methodologies and limited discretionary judgment. This lack of transparency in AVMs can lead to discrepancies and challenges in trust compared to traditional appraisals conducted by licensed professionals.

Model Bias in Valuation

Automated Valuation Models (AVMs) often exhibit model bias due to reliance on historical data and algorithmic assumptions, potentially skewing property values by underrepresenting unique features or local market nuances. In contrast, appraisals conducted by licensed professionals can adjust for such biases through direct property inspection and expert judgment, resulting in more accurate valuations tailored to individual properties.

Regression Analysis Modeling

Regression analysis modeling in real estate appraisal leverages historical sales data and property attributes to predict accurate home values, enhancing the precision of Automated Valuation Models (AVMs). This statistical approach identifies key variables influencing property prices, enabling AVMs to deliver consistent, data-driven valuations that support buyer and seller decision-making.

Instant Valuation

Instant valuation through Automated Valuation Models (AVMs) uses algorithms and extensive property data to generate quick, data-driven estimates, offering real-time market insights with high efficiency. Traditional appraisals involve licensed professionals conducting detailed property inspections and local market analysis, providing nuanced, accurate valuations but requiring more time and cost.

Appraisal vs Automated Valuation Model Infographic

industrydif.com

industrydif.com