Property management involves overseeing rental properties, handling tenant relations, maintenance, and rent collection to maximize investment returns. Fractional ownership allows multiple investors to share equity in a single property, reducing individual costs and enabling vacation home usage without full ownership responsibilities. While property management requires active involvement or hiring a manager, fractional ownership offers a more passive approach with shared benefits and limitations based on ownership agreements.

Table of Comparison

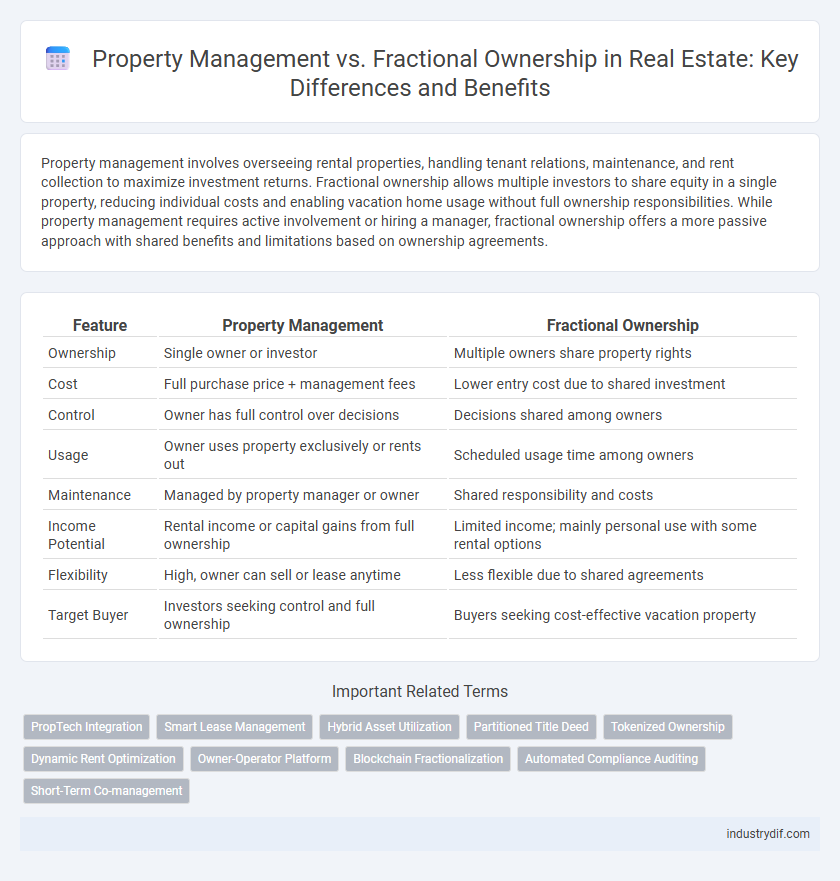

| Feature | Property Management | Fractional Ownership |

|---|---|---|

| Ownership | Single owner or investor | Multiple owners share property rights |

| Cost | Full purchase price + management fees | Lower entry cost due to shared investment |

| Control | Owner has full control over decisions | Decisions shared among owners |

| Usage | Owner uses property exclusively or rents out | Scheduled usage time among owners |

| Maintenance | Managed by property manager or owner | Shared responsibility and costs |

| Income Potential | Rental income or capital gains from full ownership | Limited income; mainly personal use with some rental options |

| Flexibility | High, owner can sell or lease anytime | Less flexible due to shared agreements |

| Target Buyer | Investors seeking control and full ownership | Buyers seeking cost-effective vacation property |

Understanding Property Management in Real Estate

Property management in real estate involves overseeing daily operations, maintenance, tenant relations, and rent collection to maximize investment value. Professional property managers ensure regulatory compliance, handle repairs, and market vacancies, providing owners with hassle-free income generation. Unlike fractional ownership, property management centers on maximizing returns from a single property rather than distributing ownership among multiple investors.

Defining Fractional Ownership: A Modern Approach

Fractional ownership in real estate allows multiple investors to purchase a share of a property, providing access to luxury or high-value assets without full ownership costs. This model diversifies investment risk and offers shared maintenance and management responsibilities, contrasting with traditional property management where a single owner hires a manager. Modern fractional ownership leverages technology platforms to streamline usage schedules, financial reporting, and legal agreements, enhancing transparency and convenience for stakeholders.

Key Differences Between Property Management and Fractional Ownership

Property management involves professional oversight of rental properties, including tenant relations, maintenance, and rent collection, while fractional ownership divides property rights among multiple owners who share usage and expenses. Property managers handle day-to-day operations and preserve asset value, whereas fractional ownership requires coordination among co-owners for scheduling and decision-making. Understanding these differences helps investors choose between passive management services and shared ownership with usage benefits.

Pros and Cons of Property Management

Property management offers professional oversight, reducing the burden of day-to-day responsibilities such as tenant screening, rent collection, and maintenance, which enhances asset value and tenant retention. However, property management incurs ongoing fees, typically 8-12% of monthly rental income, which can reduce overall profitability for owners. Dependence on management quality and potential mismatches in expectations may lead to inconsistent property care and communication challenges.

Advantages and Disadvantages of Fractional Ownership

Fractional ownership offers significant cost savings by enabling multiple investors to share the expense and benefits of a property, making high-value real estate more accessible. However, it can limit flexibility due to shared usage schedules and potential conflicts among co-owners. The model also often involves complex legal agreements, which require careful management to avoid disputes and ensure clear responsibilities.

Investment Opportunities: Which Model Suits You Best?

Property management offers investors steady rental income and hands-off involvement by delegating tenant relations and maintenance to professional firms, ideal for those seeking passive revenue streams. Fractional ownership allows multiple investors to share the cost and benefits of high-value properties, providing access to luxury real estate with reduced financial risk and potential for capital appreciation. Evaluating your financial goals, risk tolerance, and desired level of engagement guides the choice between consistent income via property management or shared asset growth through fractional ownership.

Legal Considerations in Property Management vs Fractional Ownership

Property management involves comprehensive legal responsibilities including tenant agreements, compliance with local housing laws, and property maintenance liabilities, whereas fractional ownership requires clear contractual agreements delineating ownership shares, usage rights, and exit strategies to avoid disputes among co-owners. Regulatory compliance varies significantly; property managers must adhere to landlord-tenant laws and fair housing regulations, while fractional ownership structures often fall under specific securities laws and contract law complexities. Understanding these legal frameworks is essential to mitigate risks and ensure transparent governance in both property management and fractional ownership arrangements.

Cost Analysis: Property Management vs Fractional Ownership

Property management typically involves ongoing fees averaging 8-12% of rental income, covering maintenance, tenant coordination, and administrative duties. Fractional ownership requires a larger upfront investment, with costs shared among multiple owners, often reducing individual financial responsibility while enabling access to premium properties. Evaluating total expenses reveals property management as a steady operational cost, whereas fractional ownership balances asset acquisition costs with shared usage benefits.

Revenue Potential in Both Ownership Structures

Property management generates steady rental income by leveraging professional oversight and tenant management, maximizing occupancy rates and minimizing vacancies. Fractional ownership offers potential for higher returns through shared equity appreciation and usage, appealing to investors seeking part-time property benefits. Revenue potential in property management relies on consistent cash flow, while fractional ownership capitalizes on asset value growth and reduced individual financial responsibility.

Choosing Between Property Management and Fractional Ownership

Choosing between property management and fractional ownership depends on your investment goals and involvement level. Property management offers hands-off control with professional oversight of rental operations, ideal for investors seeking passive income. Fractional ownership provides shared equity and personal usage rights, appealing to those who want both financial return and vacation benefits.

Related Important Terms

PropTech Integration

PropTech integration enhances property management through automated tenant screening, maintenance scheduling, and real-time financial reporting, streamlining operations for property owners. Fractional ownership leverages blockchain and smart contracts to secure transparent transaction records and facilitate shared asset governance among multiple stakeholders.

Smart Lease Management

Smart lease management in property management leverages automation and real-time data analytics to optimize tenant interactions, streamline rent collection, and enhance maintenance scheduling, ensuring efficient, cost-effective oversight of entire properties. Fractional ownership benefits from smart lease management by enabling precise allocation of shared usage rights and transparent financial reporting, maximizing asset utilization and investor returns through technology-driven lease coordination.

Hybrid Asset Utilization

Hybrid asset utilization in real estate combines property management's full control and maintenance responsibilities with fractional ownership's shared investment and usage benefits, optimizing occupancy rates and revenue streams. This approach leverages professional management efficiency while providing multiple owners flexible access, enhancing overall asset performance and reducing individual financial burdens.

Partitioned Title Deed

Partitioned title deeds in property management grant individual owners exclusive rights over specific units while sharing common areas, enhancing legal clarity and ease of maintenance. Fractional ownership involves multiple investors sharing usage rights without distinct title partitions, which can complicate resale and decision-making processes.

Tokenized Ownership

Tokenized ownership transforms fractional ownership by digitizing property shares on blockchain, enhancing liquidity and transparency compared to traditional property management models that centralize control and lack real-time transferability. This decentralized approach enables investors to buy, sell, and trade property tokens effortlessly, reducing entry barriers and operational costs associated with conventional property management.

Dynamic Rent Optimization

Dynamic rent optimization in property management maximizes rental income by continuously adjusting rates based on market demand, occupancy trends, and competitor pricing. Fractional ownership offers fixed, pre-agreed rental values, limiting flexibility and potential income growth compared to the adaptive strategies of professional property management systems.

Owner-Operator Platform

Owner-operator platforms in property management enable direct control and personalized oversight, contrasting the shared usage and investment model of fractional ownership. Real estate investors leveraging owner-operator platforms benefit from streamlined asset management, enhanced revenue potential, and increased property value through active involvement.

Blockchain Fractionalization

Blockchain fractionalization transforms property management by enabling decentralized ownership through secure, transparent tokenization of real estate assets, reducing costs and increasing liquidity. Fractional ownership on blockchain platforms allows investors to buy, sell, and trade property shares seamlessly, bypassing traditional management complexities and enhancing access to diverse real estate portfolios.

Automated Compliance Auditing

Automated compliance auditing in property management leverages software to continuously monitor regulatory adherence, reducing risks and ensuring timely updates across multi-unit portfolios. Fractional ownership platforms utilize automated compliance tools to streamline legal obligations for multiple stakeholders, enhancing transparency and minimizing administrative burdens.

Short-Term Co-management

Short-term co-management in real estate blends the benefits of property management with fractional ownership, allowing multiple investors to share maintenance responsibilities and rental income while ensuring professional oversight. This collaboration maximizes occupancy rates and optimizes asset performance by combining hands-on owner involvement with expert management services.

Property Management vs Fractional Ownership Infographic

industrydif.com

industrydif.com