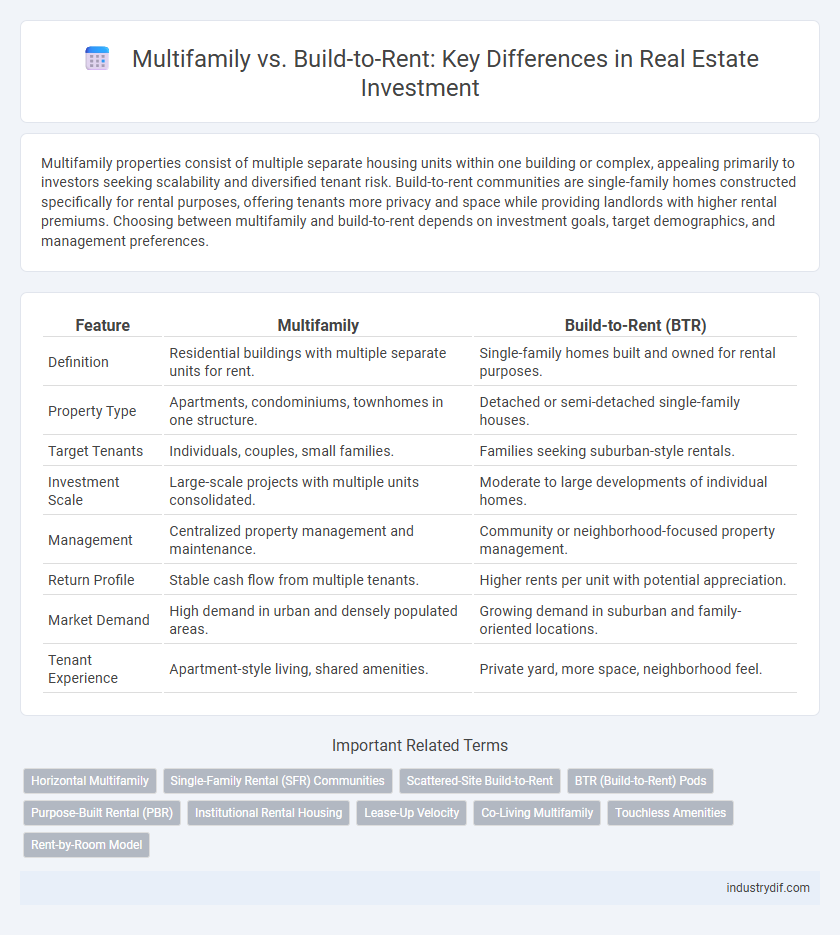

Multifamily properties consist of multiple separate housing units within one building or complex, appealing primarily to investors seeking scalability and diversified tenant risk. Build-to-rent communities are single-family homes constructed specifically for rental purposes, offering tenants more privacy and space while providing landlords with higher rental premiums. Choosing between multifamily and build-to-rent depends on investment goals, target demographics, and management preferences.

Table of Comparison

| Feature | Multifamily | Build-to-Rent (BTR) |

|---|---|---|

| Definition | Residential buildings with multiple separate units for rent. | Single-family homes built and owned for rental purposes. |

| Property Type | Apartments, condominiums, townhomes in one structure. | Detached or semi-detached single-family houses. |

| Target Tenants | Individuals, couples, small families. | Families seeking suburban-style rentals. |

| Investment Scale | Large-scale projects with multiple units consolidated. | Moderate to large developments of individual homes. |

| Management | Centralized property management and maintenance. | Community or neighborhood-focused property management. |

| Return Profile | Stable cash flow from multiple tenants. | Higher rents per unit with potential appreciation. |

| Market Demand | High demand in urban and densely populated areas. | Growing demand in suburban and family-oriented locations. |

| Tenant Experience | Apartment-style living, shared amenities. | Private yard, more space, neighborhood feel. |

Understanding Multifamily and Build-to-Rent: Key Definitions

Multifamily properties consist of residential buildings with multiple separate housing units, typically apartments or condos, designed for rental income and efficient property management. Build-to-Rent (BTR) developments are newly constructed single-family homes or townhomes specifically built for long-term rental purposes, often featuring community amenities and professional management. Understanding the distinctions between multifamily and build-to-rent helps investors evaluate property types based on tenant demographics, operational complexity, and market growth potential.

Investment Models: Multifamily vs Build-to-Rent

Multifamily investment models typically involve acquiring existing apartment complexes with established cash flow, leveraging economies of scale for steady rental income. Build-to-Rent focuses on developing single-family homes specifically for rental purposes, targeting long-term tenant retention and higher per-unit rent premiums. Investors must weigh immediate income stability against potential appreciation and operational control when choosing between these models.

Target Demographics and Resident Profiles

Multifamily properties attract diverse tenant profiles, including young professionals, families, and retirees seeking shared amenities and community living, with a strong emphasis on urban convenience and social engagement. Build-to-Rent developments primarily target suburban families and long-term renters prioritizing space, privacy, and single-family home features without the drawbacks of homeownership. Understanding these demographic distinctions enables developers and investors to tailor property designs, amenities, and marketing strategies effectively to meet resident needs and maximize occupancy rates.

Ownership Structures in Multifamily and BTR

Multifamily ownership structures often involve syndications, joint ventures, and real estate investment trusts (REITs), enabling multiple investors to share equity and risk. Build-to-Rent (BTR) properties typically feature single ownership or institutional investors, streamlining management and promoting long-term holding strategies. These distinct ownership models influence operational control, investment horizons, and capital deployment in multifamily and BTR sectors.

Design and Construction Differences

Multifamily properties typically feature shared walls and centralized amenities optimized for high-density living, while build-to-rent communities emphasize detached or semi-detached homes with private yards and personalized layouts. Construction materials in multifamily developments often prioritize fire resistance and soundproofing to enhance resident comfort, whereas build-to-rent focuses on durability and low-maintenance exteriors suited for long-term single-family occupancy. Design strategies in multifamily projects aim to maximize unit counts within limited footprints, contrasting with build-to-rent's emphasis on spacious floor plans and community-oriented outdoor spaces.

Leasing and Property Management Strategies

Multifamily properties benefit from high tenant turnover, requiring efficient leasing cycles and proactive property management to maintain occupancy and reduce vacancies. Build-to-rent communities emphasize long-term tenants, focusing on personalized leasing experiences and comprehensive property management that fosters resident retention and community engagement. Both asset types leverage technology-driven platforms for streamlined leasing processes, maintenance requests, and tenant communication, enhancing overall operational efficiency.

Financing Options for Multifamily and Build-to-Rent

Financing options for multifamily properties typically include conventional bank loans, government-backed programs like Fannie Mae and Freddie Mac, and commercial mortgage-backed securities (CMBS), offering competitive rates and longer terms. Build-to-Rent projects often require construction loans transitioning to permanent financing, with growing interest from institutional investors and specialized lenders focused on rental housing development. Both asset types benefit from tailored loan structures, but build-to-rent financing emphasizes phased funding aligned with construction milestones and lease-up periods.

Market Trends and Growth Outlook

Multifamily housing continues to attract institutional investors due to its ability to generate stable cash flow and meet urban rental demand, with global market growth projected at a CAGR of 5.2% from 2024 to 2030. Build-to-Rent (BTR) developments are rapidly gaining traction, driven by shifting consumer preferences for suburban living and increasing demand for newly constructed rental homes, with the U.S. BTR market expected to reach $15 billion by 2025. Both sectors benefit from demographic trends like rising renter populations and affordability challenges, but BTR offers scalability and design flexibility that appeal to long-term investors seeking portfolio diversification.

Risk Factors and Returns Compared

Multifamily properties often offer stable cash flow and lower vacancy risk due to diversified tenant bases, but they require significant management and maintenance costs. Build-to-rent developments present higher initial construction risk and longer lease-up periods but can achieve premium rents and attract long-term tenants seeking single-family home amenities. Investors typically see multifamily as lower risk with steady returns, whereas build-to-rent carries higher risk balanced by potentially greater yield and appreciation opportunities.

Choosing the Right Asset Class for Your Portfolio

Multifamily properties offer established rental income streams through traditional apartment communities, attracting investors seeking stability and lower vacancy risks. Build-to-Rent developments present opportunities for customized designs and modern amenities tailored to long-term renters, appealing to portfolios aiming for growth and differentiation in emerging markets. Assessing market demand, investment horizon, and operational complexity is crucial for selecting the asset class that aligns with your portfolio's risk tolerance and income objectives.

Related Important Terms

Horizontal Multifamily

Horizontal multifamily properties typically consist of low-rise, spread-out units that mimic single-family home layouts, offering privacy and community appeal within build-to-rent developments. This format enhances tenant satisfaction by combining the benefits of multifamily efficiency with the spaciousness and accessibility often sought in suburban living.

Single-Family Rental (SFR) Communities

Single-family rental (SFR) communities offer a suburban-style living experience with the benefits of detached homes, attracting tenants seeking privacy and space compared to multifamily units. These built-to-rent neighborhoods provide scalable investment opportunities with lower tenant turnover and stable cash flow, distinguishing them from traditional multifamily properties.

Scattered-Site Build-to-Rent

Scattered-site Build-to-Rent offers investors diversified risk by distributing single-family rental homes across multiple neighborhoods, contrasting with the concentrated density of traditional multifamily developments. This model enhances community integration and provides tenants with greater privacy and access to suburban amenities while maintaining consistent rental income streams for investors.

BTR (Build-to-Rent) Pods

Build-to-Rent (BTR) pods are a growing segment in multifamily real estate, designed as standalone, single-family-style units within larger rental communities that offer residents both privacy and shared amenities. BTR pods attract investors by providing stable rental income through purpose-built properties tailored for long-term tenancy and efficient property management.

Purpose-Built Rental (PBR)

Purpose-Built Rental (PBR) communities are designed specifically for long-term residential leasing, offering amenities and layouts tailored to renter needs compared to traditional multifamily properties, which often include a mix of owned and rented units. PBR developments emphasize operational efficiency and tenant experience to attract stable, long-term residents, distinguishing themselves from multifamily buildings that may prioritize ownership or shorter-term rentals.

Institutional Rental Housing

Institutional rental housing increasingly favors build-to-rent developments for their scale economies and tailored amenities designed to meet long-term tenant demand, contrasting with traditional multifamily properties that often comprise a mix of acquisitions and older assets. Build-to-rent projects deliver higher operational efficiencies and brand consistency, appealing to institutional investors seeking predictable cash flows and lower management complexity.

Lease-Up Velocity

Multifamily properties generally experience faster lease-up velocity due to established demand and broader market acceptance, with average lease-up periods typically ranging from 6 to 12 months. Build-to-Rent developments, although growing rapidly, often encounter slower initial lease-up rates as they establish tenant trust and awareness, sometimes extending lease-up durations beyond a year.

Co-Living Multifamily

Co-living multifamily developments enhance build-to-rent communities by offering shared amenities and flexible leases tailored to urban millennials and remote workers. These properties combine affordability and social interaction, driving higher occupancy rates and tenant retention compared to traditional multifamily rentals.

Touchless Amenities

Multifamily developments increasingly integrate touchless amenities such as keyless entry, voice-activated elevators, and app-controlled communal spaces to enhance tenant convenience and health safety. Build-to-rent communities also prioritize these technologies, leveraging smart home systems and contactless package delivery to streamline resident experiences while minimizing physical interactions.

Rent-by-Room Model

The rent-by-room model in multifamily properties offers individual lease agreements per bedroom, maximizing flexibility and affordability for tenants compared to traditional build-to-rent homes that lease entire units. This model enhances cash flow stability for landlords by reducing vacancy risks and attracting a diverse tenant base, particularly in urban areas with high demand for shared housing options.

Multifamily vs Build-to-Rent Infographic

industrydif.com

industrydif.com