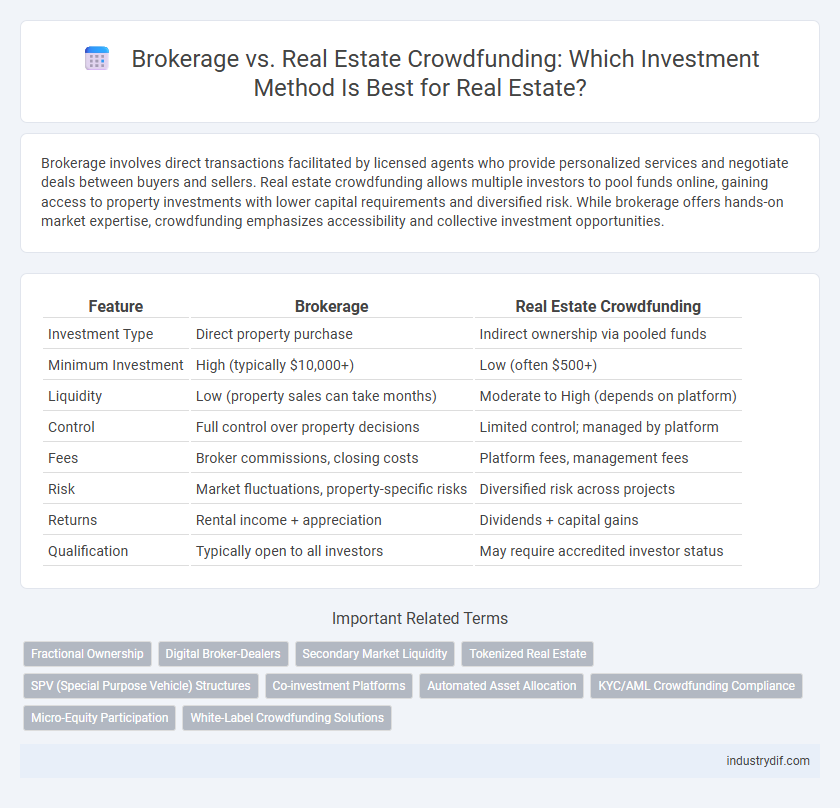

Brokerage involves direct transactions facilitated by licensed agents who provide personalized services and negotiate deals between buyers and sellers. Real estate crowdfunding allows multiple investors to pool funds online, gaining access to property investments with lower capital requirements and diversified risk. While brokerage offers hands-on market expertise, crowdfunding emphasizes accessibility and collective investment opportunities.

Table of Comparison

| Feature | Brokerage | Real Estate Crowdfunding |

|---|---|---|

| Investment Type | Direct property purchase | Indirect ownership via pooled funds |

| Minimum Investment | High (typically $10,000+) | Low (often $500+) |

| Liquidity | Low (property sales can take months) | Moderate to High (depends on platform) |

| Control | Full control over property decisions | Limited control; managed by platform |

| Fees | Broker commissions, closing costs | Platform fees, management fees |

| Risk | Market fluctuations, property-specific risks | Diversified risk across projects |

| Returns | Rental income + appreciation | Dividends + capital gains |

| Qualification | Typically open to all investors | May require accredited investor status |

Overview of Brokerage and Real Estate Crowdfunding

Brokerage involves licensed agents who facilitate buying, selling, or leasing properties through direct negotiations and market expertise, earning commissions based on transaction values. Real estate crowdfunding allows multiple investors to pool funds online to finance large property projects, providing access to real estate investments with lower capital requirements and diversified portfolios. Both methods offer distinct pathways to real estate participation, with brokerage focusing on personalized, transaction-based services and crowdfunding emphasizing collective investment opportunities.

Key Differences Between Brokerage and Crowdfunding

Brokerage involves licensed agents facilitating property transactions, offering personalized services including market analysis, negotiation, and legal guidance. Real estate crowdfunding allows multiple investors to pool funds online to finance properties, providing access to real estate investments with lower capital requirements but less control. Key differences include the level of investor involvement, regulatory frameworks, and liquidity, with brokerages offering tailored advice and crowdfunding emphasizing collective investment opportunities.

How Traditional Brokerages Operate

Traditional real estate brokerages operate by connecting buyers and sellers through licensed agents who facilitate property transactions, negotiate deals, and provide market expertise. They typically earn commissions based on a percentage of the property's sale price, aligning their income with successful closings. Brokerages maintain in-person offices or networks and leverage personal relationships and localized market knowledge to guide clients throughout the buying or selling process.

The Basics of Real Estate Crowdfunding Platforms

Real estate crowdfunding platforms enable multiple investors to pool their resources online and invest in large-scale property projects, offering access to commercial and residential investments with lower capital requirements compared to traditional brokerage methods. These platforms provide detailed property information, investor dashboards, and transparent reporting, streamlining the investment process without the need for direct property management. Unlike traditional real estate brokerages that facilitate buying and selling properties, crowdfunding platforms emphasize collective investment opportunities with diversified portfolios and potential for passive income.

Investment Process: Brokerage vs Crowdfunding

The investment process in traditional real estate brokerage typically involves working directly with agents to identify properties, conduct due diligence, negotiate terms, and secure financing, often requiring substantial capital and manual effort. Real estate crowdfunding streamlines this by allowing investors to pool funds online, access pre-vetted projects, and participate with lower minimum investments, simplifying due diligence through platform transparency. Brokerage demands active involvement and longer timelines, whereas crowdfunding emphasizes passive investment with faster, technology-driven transactions.

Risk Profiles: Comparing Brokerage and Crowdfunding

Brokerage investments in real estate typically involve lower risk due to regulated markets and established property valuations, making them suitable for conservative investors. Real estate crowdfunding carries higher risk profiles as it often involves direct ownership stakes in projects with variable outcomes and less liquidity. Investors must evaluate risk tolerance, potential returns, and investment timelines when choosing between traditional brokerage and crowdfunding platforms.

Returns and Profitability in Brokerage vs Crowdfunding

Brokerage in real estate typically offers profitability through commissions and fees earned from property transactions, often providing immediate returns upon closing deals. Real estate crowdfunding generates returns via shared rental income and property appreciation over time, potentially offering higher long-term yields but with increased market risk and liquidity constraints. Investors seeking steady, short-term profits may prefer brokerage models, while those targeting diversified, passive income streams might benefit more from crowdfunding platforms.

Accessibility and Minimum Investment Requirements

Real estate brokerage typically requires significant capital or securing traditional loans, limiting accessibility to high-net-worth individuals or those with substantial credit histories. Real estate crowdfunding platforms democratize property investment by lowering minimum investment thresholds, sometimes as low as $500, enabling broader participation from retail investors. This shift in accessibility has transformed real estate investing into a more inclusive market with diversified portfolios available to non-accredited investors.

Regulatory Landscape for Brokerages and Crowdfunding

Brokerage firms are regulated by state real estate commissions and must comply with the Real Estate Settlement Procedures Act (RESPA) and the Securities and Exchange Commission (SEC) when dealing with investments. Real estate crowdfunding platforms operate under SEC regulations, specifically Regulation CF or Regulation A, requiring registration and adherence to investor protection rules. Brokerages face stringent licensing and fiduciary duties, while crowdfunding platforms focus on compliance with securities laws and limits on investor contributions.

Which Model Suits Your Real Estate Investment Goals?

Brokerage services offer personalized guidance, access to multiple listing services (MLS), and the ability to negotiate property prices, making them ideal for investors seeking hands-on control and traditional homeownership. Real estate crowdfunding provides a lower-cost, more diversified approach by pooling funds with other investors to access large-scale projects, suitable for those prioritizing passive income and portfolio diversification. Selecting the right model depends on your investment goals, risk tolerance, desired involvement level, and capital availability.

Related Important Terms

Fractional Ownership

Fractional ownership through real estate crowdfunding allows investors to acquire smaller, more affordable shares of high-value properties compared to traditional brokerage transactions, which typically require full property purchases. This model enhances portfolio diversification and liquidity by enabling multiple investors to co-own and trade fractional shares easily.

Digital Broker-Dealers

Digital broker-dealers leverage advanced technology platforms to streamline property transactions, offering greater transparency and lower fees compared to traditional brokerage models. Real estate crowdfunding, facilitated by these digital entities, provides investors with fractional ownership opportunities, enhancing liquidity and democratizing access to diverse real estate assets.

Secondary Market Liquidity

Brokerage platforms offer higher secondary market liquidity by enabling investors to quickly buy and sell real estate assets through established networks and direct transactions. Real estate crowdfunding typically involves longer holding periods with limited secondary market options, reducing immediate liquidity for investors.

Tokenized Real Estate

Tokenized real estate in crowdfunding offers fractional ownership through blockchain technology, enabling investors to buy and sell property shares with increased liquidity and lower entry barriers compared to traditional brokerage models. Unlike brokerage, which typically involves higher fees and limited access, tokenized platforms provide transparent, efficient transactions and democratize real estate investment by leveraging smart contracts and digital tokens.

SPV (Special Purpose Vehicle) Structures

Brokerage in real estate facilitates direct property transactions between buyers and sellers, whereas real estate crowdfunding leverages SPV (Special Purpose Vehicle) structures to pool investor funds into a single entity for targeted property investments. SPVs isolate financial risk and streamline asset management, providing transparency and legal protection for multiple stakeholders in crowdfunding ventures.

Co-investment Platforms

Co-investment platforms in real estate crowdfunding enable investors to pool capital alongside professional sponsors, offering access to diversified property portfolios with lower minimum investments compared to traditional brokerage transactions. These platforms leverage technology-driven marketplaces to streamline deal sourcing, due diligence, and asset management, providing enhanced transparency and potential for passive income without the need for property ownership or direct brokerage fees.

Automated Asset Allocation

Automated asset allocation in real estate crowdfunding leverages algorithms to diversify investments across multiple properties, optimizing risk and potential returns without active management. Traditional brokerage requires manual selection and direct ownership, often involving higher fees and less diversification compared to algorithm-driven crowdfunding platforms.

KYC/AML Crowdfunding Compliance

Real estate crowdfunding platforms implement robust KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance processes to verify investor identities and prevent fraudulent activities, ensuring regulatory adherence and financial security. Traditional brokerages also follow KYC/AML protocols but often face higher operational costs and less scalability compared to automated compliance frameworks utilized in real estate crowdfunding.

Micro-Equity Participation

Micro-equity participation in real estate crowdfunding enables investors to acquire fractional ownership stakes in properties, offering diversified portfolio exposure with lower capital requirements compared to traditional brokerage transactions. This model democratizes access to commercial and residential real estate markets by allowing small-scale investments, bypassing high entry costs and enhancing liquidity opportunities.

White-Label Crowdfunding Solutions

White-label crowdfunding solutions enable real estate brokerages to launch branded investment platforms, expanding access to capital without developing technology from scratch. These turnkey platforms streamline investor management and compliance, offering a scalable alternative to traditional brokerage models while enhancing market reach and client engagement.

Brokerage vs Real Estate Crowdfunding Infographic

industrydif.com

industrydif.com