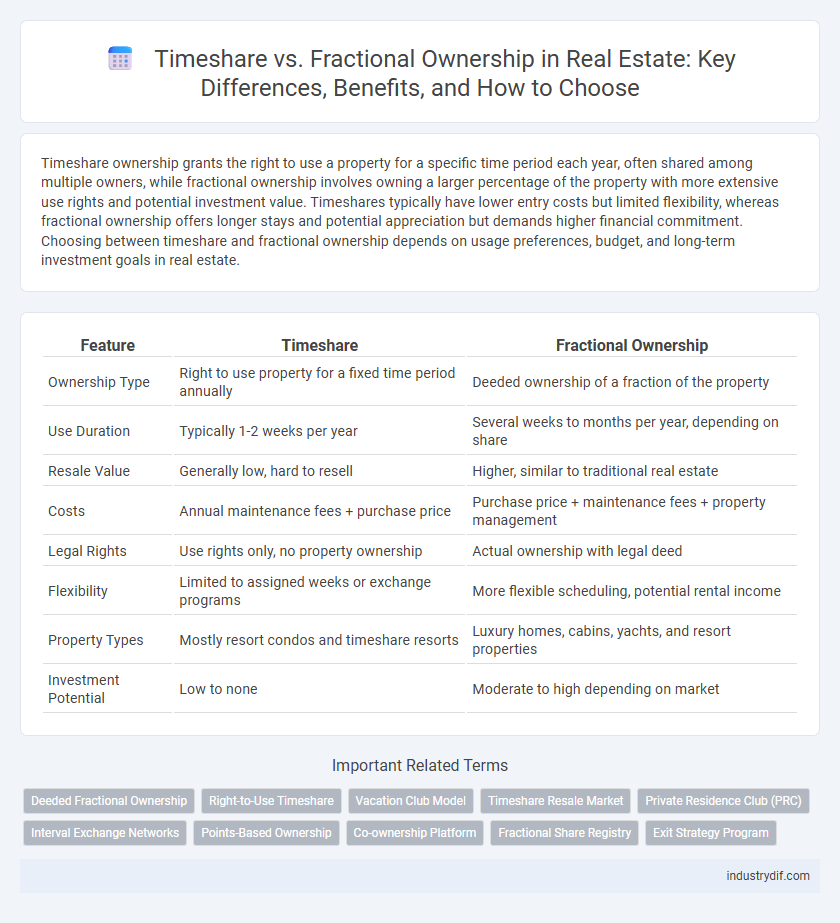

Timeshare ownership grants the right to use a property for a specific time period each year, often shared among multiple owners, while fractional ownership involves owning a larger percentage of the property with more extensive use rights and potential investment value. Timeshares typically have lower entry costs but limited flexibility, whereas fractional ownership offers longer stays and potential appreciation but demands higher financial commitment. Choosing between timeshare and fractional ownership depends on usage preferences, budget, and long-term investment goals in real estate.

Table of Comparison

| Feature | Timeshare | Fractional Ownership |

|---|---|---|

| Ownership Type | Right to use property for a fixed time period annually | Deeded ownership of a fraction of the property |

| Use Duration | Typically 1-2 weeks per year | Several weeks to months per year, depending on share |

| Resale Value | Generally low, hard to resell | Higher, similar to traditional real estate |

| Costs | Annual maintenance fees + purchase price | Purchase price + maintenance fees + property management |

| Legal Rights | Use rights only, no property ownership | Actual ownership with legal deed |

| Flexibility | Limited to assigned weeks or exchange programs | More flexible scheduling, potential rental income |

| Property Types | Mostly resort condos and timeshare resorts | Luxury homes, cabins, yachts, and resort properties |

| Investment Potential | Low to none | Moderate to high depending on market |

Understanding Timeshare: Definition and Key Features

Timeshare is a vacation property ownership model where multiple individuals purchase the right to use a property for specific time periods annually, typically one week. Key features include fixed or floating weeks, limited user rights without full property ownership, and maintenance fees shared among owners. This arrangement differs from fractional ownership, which grants a deeded share of the property along with equity rights and potential resale value.

What is Fractional Ownership? An Overview

Fractional ownership in real estate allows multiple buyers to share equity in a single property, dividing both usage time and ownership costs among stakeholders. Each owner holds a legal deed reflecting their percentage of the property, enabling rights to use and sell their share independently. This model provides higher equity investment in premium properties compared to timeshares, offering potential for property appreciation and more flexible usage terms.

Ownership Structure: Timeshare vs Fractional Ownership

Timeshare ownership involves purchasing the right to use a property for a specific time period annually, typically divided into weekly intervals, without actual ownership of the property itself. Fractional ownership grants buyers a deeded share of the property, allowing them partial ownership interest and equity in the real estate asset. This structural difference impacts legal rights, transferability, and potential financial benefits associated with each type of ownership.

Cost Analysis: Initial Investment and Ongoing Fees

Timeshare typically requires a lower initial investment, often ranging from $5,000 to $25,000, with annual maintenance fees between $500 and $1,000, making it more affordable for short-term vacationers. Fractional ownership demands a higher upfront cost, usually $50,000 to $200,000 or more, reflecting greater equity and usage rights, while ongoing fees such as property taxes, insurance, and management costs can exceed $2,000 annually. Understanding these cost differences helps buyers align their budget with long-term ownership benefits and usage flexibility in vacation real estate.

Usage Rights and Flexibility Compared

Timeshare ownership grants fixed or rotating usage rights, typically offering one or two weeks annually, which limits flexibility in scheduling. Fractional ownership provides extended usage periods, often several months per year, allowing owners more control and adaptability in vacation planning. This greater flexibility in fractional ownership appeals to buyers seeking longer stays and more personalized property access.

Resale and Exit Strategies: Which Offers Better Options?

Timeshare resale often faces limited market demand and lower return on investment due to restrictive usage terms and fluctuating popularity. Fractional ownership provides greater resale value and flexibility, as owners hold equity shares and enjoy more control over asset disposition. The exit strategies in fractional ownership typically involve selling partial interests or buyout agreements, offering clearer paths compared to the timeshare model's complex and less lucrative resale processes.

Legal Considerations and Contract Terms

Timeshare agreements typically involve purchasing the right to use a property for a specific period each year, with contracts outlining fixed or floating weeks, maintenance fees, and usage restrictions, often governed by consumer protection laws varying by state or country. Fractional ownership contracts grant a deeded portion of the property, offering equity interest and potential resale value, with legal considerations including shared management responsibilities, prorated expenses, and clear terms on usage rights and exit strategies. Understanding the differences in contract enforceability, duration, transferability, and buyer protections is crucial when evaluating timeshare versus fractional ownership investments.

Suitability: Who Should Choose Timeshare or Fractional Ownership?

Timeshare ownership suits individuals seeking affordable, short-term vacation options with fixed usage periods and minimal maintenance responsibilities. Fractional ownership appeals to buyers desiring more extensive property access, higher equity stakes, and flexibility in usage, often suitable for frequent travelers or those seeking investment potential. Understanding personal vacation habits and financial goals is crucial in selecting between timeshare's limited commitment and fractional ownership's greater control.

Potential Risks and Pitfalls for Buyers

Timeshare buyers face potential risks such as complex contract terms, high annual maintenance fees, and difficulty reselling their interests in a saturated market. Fractional ownership involves risks like shared decision-making conflicts, unexpected costs for property upkeep, and legal complexities related to co-ownership agreements. Understanding these pitfalls helps buyers make informed decisions and avoid long-term financial liabilities.

Market Trends: Future Outlook for Shared Ownership Models

Market trends indicate a growing preference for fractional ownership due to its flexibility and higher asset value appreciation compared to traditional timeshares. Increasing demand from millennials and international buyers is driving innovation in shared ownership platforms, integrating blockchain for transparency and ease of transfer. Forecasts predict the fractional ownership market will expand at a CAGR of over 12% by 2030, outpacing timeshare growth amid shifting consumer priorities towards investment and lifestyle balance.

Related Important Terms

Deeded Fractional Ownership

Deeded Fractional Ownership in real estate offers buyers a legally recorded title with an ownership percentage, providing long-term property rights and potential equity appreciation compared to timeshares, which only grant usage rights without title. This form of ownership enables shared expenses, flexible usage schedules, and resale opportunities, making it a superior investment for luxury vacation homes or high-value properties.

Right-to-Use Timeshare

Right-to-Use Timeshare grants buyers limited property usage rights for a specified period without ownership equity, offering affordable vacation options with fixed intervals. Fractional Ownership provides buyers actual equity in the property, allowing more flexible use and potential property value appreciation.

Vacation Club Model

Vacation club models offer flexible access to luxury properties through timeshare arrangements, allowing members to purchase usage rights for specific time periods annually. Fractional ownership involves acquiring a deeded interest in a property, providing equity and the potential for resale, making it a long-term investment compared to the more limited timeshare usage.

Timeshare Resale Market

The timeshare resale market offers a cost-effective alternative for buyers seeking vacation property ownership without the full financial commitment of fractional ownership, which involves deeded shares and equity in the property. Unlike fractional ownership, timeshare resale units typically provide fixed or floating weeks with limited usage rights, making them more affordable but less flexible and lacking long-term investment value.

Private Residence Club (PRC)

Private Residence Clubs (PRCs) offer a superior alternative to traditional timeshares by providing deeded fractional ownership in luxury properties, ensuring increased equity, flexibility, and exclusive access to high-end real estate assets. PRC members benefit from professionally managed residences with shared amenities, enhanced investment potential, and the ability to customize usage rights compared to the fixed schedules imposed by typical timeshare agreements.

Interval Exchange Networks

Fractional ownership offers buyers a deeded share with equity and legal rights, while timeshares typically provide limited-use rights without ownership. Interval exchange networks enhance timeshare flexibility by allowing participants to trade intervals across different properties globally, unlike fractional ownership which lacks such wide exchange options.

Points-Based Ownership

Points-based ownership in real estate allows buyers to purchase a specific number of points that can be redeemed for stays at various properties within a network, offering flexible vacation options without the limitations of fixed dates. Unlike traditional timeshares, fractional ownership provides a deeded share of the property with greater equity and potential appreciation, while points-based systems emphasize usage flexibility over direct ownership rights.

Co-ownership Platform

Co-ownership platforms streamline the management of fractional ownership by providing transparent scheduling, shared expense tracking, and legal documentation, enhancing the user experience beyond traditional timeshares. Unlike timeshare models that offer limited use rights, fractional ownership through these platforms grants equity stakes and long-term value appreciation in real estate assets.

Fractional Share Registry

Fractional Share Registry offers transparent and secure tracking of ownership in fractional real estate investments, enhancing trust and ease of property management. It provides detailed records of each owner's share, facilitating seamless transactions and reducing disputes in fractional ownership structures.

Exit Strategy Program

Timeshare exit strategy programs typically involve surrendering usage rights to avoid ongoing fees, while fractional ownership exit strategies focus on selling or transferring subdivided property shares for potential equity recovery. Understanding transfer restrictions and marketplace demand is crucial for maximizing returns in both exit approaches within the real estate sector.

Timeshare vs Fractional Ownership Infographic

industrydif.com

industrydif.com