Mortgages traditionally involve lengthy paperwork and in-person meetings, often leading to slower approval times and increased stress for homebuyers. Digital mortgages streamline the home financing process by offering online applications, automated document verification, and faster approval cycles, enhancing convenience and transparency. This shift towards digital solutions not only reduces errors but also provides real-time updates, improving the overall customer experience in real estate transactions.

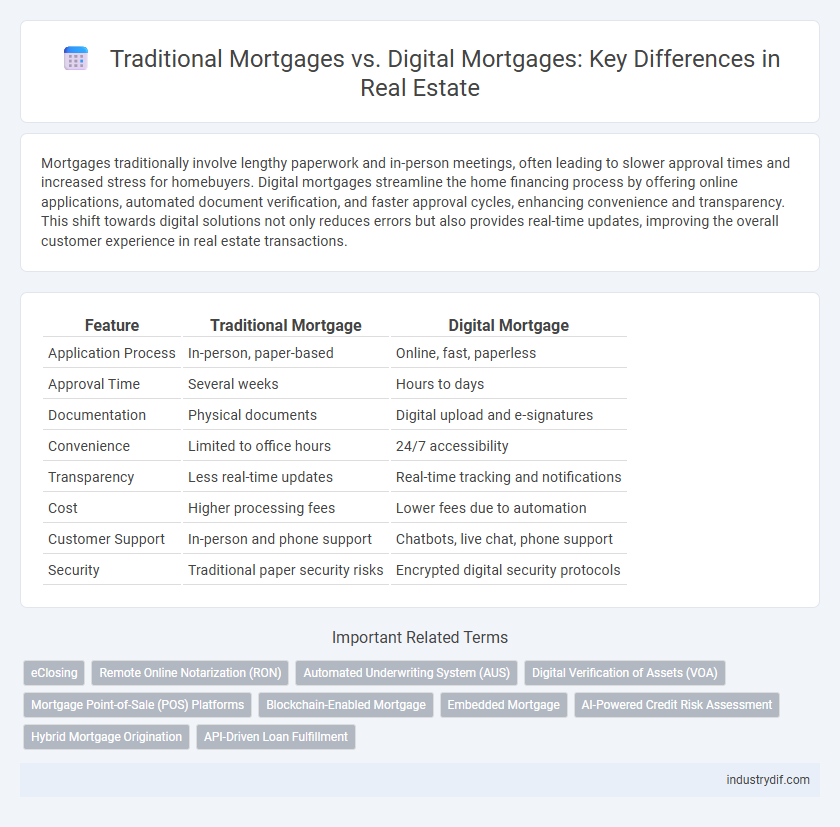

Table of Comparison

| Feature | Traditional Mortgage | Digital Mortgage |

|---|---|---|

| Application Process | In-person, paper-based | Online, fast, paperless |

| Approval Time | Several weeks | Hours to days |

| Documentation | Physical documents | Digital upload and e-signatures |

| Convenience | Limited to office hours | 24/7 accessibility |

| Transparency | Less real-time updates | Real-time tracking and notifications |

| Cost | Higher processing fees | Lower fees due to automation |

| Customer Support | In-person and phone support | Chatbots, live chat, phone support |

| Security | Traditional paper security risks | Encrypted digital security protocols |

Understanding Traditional Mortgages

Traditional mortgages involve a lengthy application process requiring extensive paperwork, in-person meetings, and manual credit verification, which can extend approval times by weeks. These loans typically require physical documentation submission, including income statements, tax returns, and property appraisals, making the process less efficient than digital alternatives. Borrowers often face delays due to slower communication between banks, underwriters, and real estate agents, impacting closing timelines.

What Is a Digital Mortgage?

A digital mortgage streamlines the loan application process by allowing borrowers to complete and submit documents online, leveraging automated data verification and e-signatures. This technology reduces the time and paperwork involved compared to traditional mortgages, increasing efficiency and accuracy in loan approvals. Major lenders and fintech companies are increasingly adopting digital mortgage platforms to enhance customer experience and accelerate home financing.

Key Differences Between Mortgages and Digital Mortgages

Mortgages traditionally involve in-person meetings, paper documentation, and longer approval times, while digital mortgages leverage online platforms for faster, more transparent processing. Digital mortgages use automated underwriting systems, electronic signatures, and cloud storage, reducing the need for physical paperwork and increasing efficiency. These key differences highlight the digital mortgage's ability to streamline loan applications, enhance borrower experience, and minimize processing errors compared to conventional mortgage methods.

The Mortgage Application Process: In-Person vs. Online

The mortgage application process traditionally involves in-person meetings with loan officers, requiring physical documentation and face-to-face consultations, which can extend approval times due to manual processing. Digital mortgage platforms streamline this process by enabling online submission of documents, automated credit checks, and real-time status updates, significantly reducing processing time and increasing convenience. Borrowers benefit from enhanced transparency, faster approvals, and the ability to compare loan options without visiting multiple lenders in person.

Digital Mortgage Technology: Tools and Platforms

Digital mortgage technology leverages advanced tools and platforms such as automated underwriting systems, e-signatures, and AI-powered credit scoring to streamline the loan approval process. Platforms like Blend, Roostify, and Ellie Mae provide integrated solutions that enhance user experience and reduce processing time from weeks to days. These digital tools increase transparency, improve accuracy, and enable remote collaboration between borrowers, lenders, and real estate agents.

Advantages of Digital Mortgages

Digital mortgages streamline the loan approval process by significantly reducing paperwork and accelerating approval times through automated data verification. They offer 24/7 accessibility, allowing borrowers to apply, track, and manage their mortgage applications online from any device. Advanced security measures and AI-driven underwriting also enhance accuracy and reduce fraud risks compared to traditional mortgage methods.

Challenges of Digital Mortgages

Digital mortgages face challenges such as data security risks, integration complexities with traditional banking systems, and limited consumer trust compared to conventional mortgage processes. Regulatory compliance and the need for robust identity verification solutions further complicate digital mortgage adoption. These obstacles slow down the widespread acceptance of fully digital mortgage platforms despite their potential for efficiency and cost reduction.

Security and Privacy in Digital Mortgage Solutions

Digital mortgage solutions leverage advanced encryption protocols and multi-factor authentication to enhance security and protect sensitive borrower data from cyber threats. Unlike traditional mortgages, digital platforms implement blockchain technology and secure cloud storage, reducing the risk of data breaches and fraud. These innovations ensure higher levels of privacy compliance with regulations like GDPR and CCPA, safeguarding personal and financial information throughout the mortgage process.

The Future of Mortgage Lending: Digital Transformation

Digital mortgage platforms streamline the lending process by leveraging AI-driven underwriting, automated document verification, and secure e-signatures, significantly reducing approval times compared to traditional mortgages. Real estate lenders adopting blockchain technology ensure enhanced transparency and fraud prevention, reshaping the mortgage landscape with increased efficiency and trust. This digital transformation accelerates homeownership while expanding access to tailored mortgage products for diverse borrower profiles.

Choosing Between Traditional and Digital Mortgages

Choosing between traditional and digital mortgages depends on factors such as convenience, speed, and personal preference. Traditional mortgages offer face-to-face interactions and established trust with lenders, while digital mortgages provide faster approval processes through online applications and automated underwriting. Evaluating interest rates, fees, and user experience in digital platforms helps homebuyers decide the best mortgage approach for their financial goals.

Related Important Terms

eClosing

Mortgages secured through traditional processes often require extensive paperwork and multiple in-person visits, whereas digital mortgages streamline approvals with eClosing technology, enabling secure, fully electronic signings that reduce closing times and enhance borrower convenience. EClosing platforms integrate notarization and document verification digitally, ensuring compliance while accelerating the transaction from application to finalization in real estate lending.

Remote Online Notarization (RON)

Remote Online Notarization (RON) revolutionizes the mortgage process by allowing borrowers to securely sign and notarize documents online, eliminating the need for physical presence and accelerating closing times. Digital mortgages integrated with RON enhance efficiency, reduce fraud risks, and provide a seamless, compliant experience compared to traditional mortgage workflows.

Automated Underwriting System (AUS)

Automated Underwriting Systems (AUS) streamline mortgage approvals by using algorithms to analyze credit, income, and property data, significantly reducing processing times compared to traditional manual underwriting. Digital mortgages leverage AUS to enhance accuracy, minimize human error, and provide borrowers with faster loan decisions and increased transparency throughout the approval process.

Digital Verification of Assets (VOA)

Digital mortgages leverage advanced technology for digital verification of assets (VOA), enabling faster, more accurate validation of applicant financials by securely accessing bank data in real-time. This streamlines the approval process, reduces paperwork, and minimizes errors compared to traditional mortgages reliant on manual document submission and verification.

Mortgage Point-of-Sale (POS) Platforms

Mortgage Point-of-Sale (POS) platforms streamline the loan application process by integrating digital tools that enhance borrower experience and reduce processing time compared to traditional mortgage methods. These platforms enable real-time document uploads, automated underwriting, and seamless communication between lenders and borrowers, significantly improving efficiency and accuracy in mortgage origination.

Blockchain-Enabled Mortgage

Blockchain-enabled mortgages revolutionize traditional mortgage lending by providing enhanced transparency, security, and reduced processing times through decentralized ledger technology. This innovation streamlines loan verification and approval processes while minimizing fraud risks, offering a more efficient alternative to conventional mortgage systems.

Embedded Mortgage

Embedded mortgages integrate loan approvals directly within property transactions, streamlining the process compared to traditional mortgages that require separate applications and approvals. This seamless integration reduces closing times and enhances user experience by automating credit checks, property valuation, and loan processing through digital platforms.

AI-Powered Credit Risk Assessment

AI-powered credit risk assessment in digital mortgages enhances accuracy by analyzing extensive data points beyond traditional credit scores, enabling lenders to identify low-risk borrowers more effectively. This technology reduces approval times and improves loan portfolio performance compared to conventional mortgage processes.

Hybrid Mortgage Origination

Hybrid mortgage origination combines traditional in-person processes with digital technology, streamlining loan applications and improving borrower experience through enhanced accuracy and faster approvals. This approach leverages automated credit assessments and e-documentation while maintaining personalized advisor support, optimizing efficiency and compliance in mortgage lending.

API-Driven Loan Fulfillment

API-driven loan fulfillment streamlines mortgage processing by integrating digital mortgage platforms with real-time data exchange, reducing approval times and minimizing manual errors. Traditional mortgages rely on slower, paper-based workflows, while digital mortgages leverage APIs to automate underwriting, verification, and compliance checks for faster, more efficient loan approvals.

Mortgages vs Digital Mortgage Infographic

industrydif.com

industrydif.com