Title insurance offers protection against financial loss from title defects or disputes, ensuring buyers have clear ownership in traditional real estate transactions. Blockchain title leverages decentralized digital ledgers to provide transparent, tamper-proof property records, reducing the risk of fraud and simplifying verification processes. Understanding the differences between title insurance and blockchain title helps buyers choose between established legal safeguards and emerging technology-driven solutions.

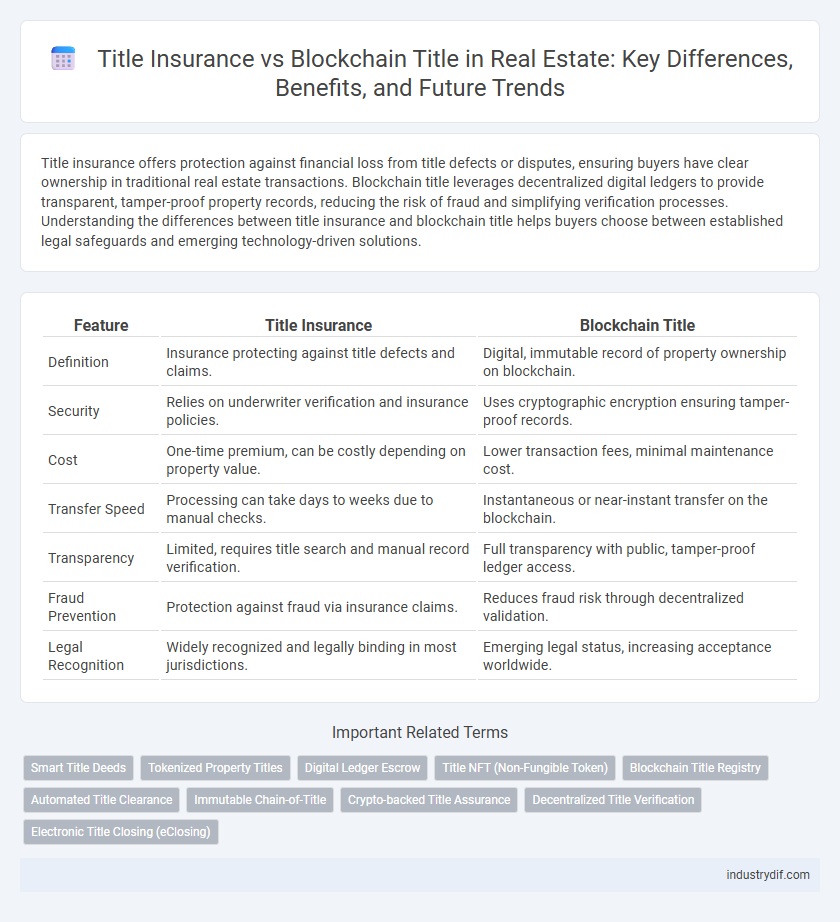

Table of Comparison

| Feature | Title Insurance | Blockchain Title |

|---|---|---|

| Definition | Insurance protecting against title defects and claims. | Digital, immutable record of property ownership on blockchain. |

| Security | Relies on underwriter verification and insurance policies. | Uses cryptographic encryption ensuring tamper-proof records. |

| Cost | One-time premium, can be costly depending on property value. | Lower transaction fees, minimal maintenance cost. |

| Transfer Speed | Processing can take days to weeks due to manual checks. | Instantaneous or near-instant transfer on the blockchain. |

| Transparency | Limited, requires title search and manual record verification. | Full transparency with public, tamper-proof ledger access. |

| Fraud Prevention | Protection against fraud via insurance claims. | Reduces fraud risk through decentralized validation. |

| Legal Recognition | Widely recognized and legally binding in most jurisdictions. | Emerging legal status, increasing acceptance worldwide. |

Understanding Title Insurance in Real Estate

Title insurance protects real estate buyers and lenders from financial losses due to defects in property titles, such as liens, unforged documents, or hidden ownership claims. Unlike traditional title insurance, blockchain title leverages decentralized ledger technology to create immutable, transparent, and easily accessible records, potentially reducing fraud and errors. Understanding the role of title insurance involves recognizing its function in safeguarding property rights and ensuring clear ownership transfer during real estate transactions.

What is Blockchain Title?

Blockchain Title is a digital method of recording property ownership using blockchain technology, which ensures transparency, security, and immutability of title records. Unlike traditional title insurance that protects against title defects through insurance policies, blockchain title provides a decentralized ledger that verifies and stores ownership history in real-time. This innovation reduces fraud risks, streamlines transactions, and can significantly lower costs associated with title searches and insurance premiums.

Traditional Title Insurance: Process & Limitations

Traditional title insurance involves a detailed title search and underwriting process to protect property buyers from potential ownership disputes, liens, or defects not uncovered during the search. This process can be time-consuming, costly, and prone to human error due to reliance on manual record verification and outdated public records. Limitations include delays in closing, incomplete historical data, and limited transparency, which may leave gaps in protection and increase the risk for buyers and lenders.

Blockchain Title: Process & Advantages

Blockchain title leverages decentralized ledger technology to securely record property ownership, eliminating risks of fraud and title disputes common in traditional title insurance. The process involves cryptographic verification and transparent transaction history, enabling faster closings and reduced administrative costs. Enhanced data immutability and real-time updates provide buyers and lenders greater confidence and streamlined access to ownership records.

Security: Title Insurance vs Blockchain Title

Title insurance provides robust protection against defects or disputes in property ownership by leveraging established legal frameworks and indemnity coverage. Blockchain title employs decentralized, tamper-resistant ledger technology to enhance security through transparent, immutable records, reducing fraud and errors in title transfers. Both methods offer distinct security advantages, with insurance mitigating financial risk and blockchain ensuring data integrity and real-time verification.

Cost Comparison: Title Insurance and Blockchain Title

Title insurance typically involves upfront costs ranging from 0.5% to 1% of the property purchase price, covering risks like fraud and title defects through a third-party insurer. Blockchain title solutions offer lower transaction fees by leveraging decentralized ledgers, reducing the need for intermediaries and extensive paperwork. While blockchain titles can minimize closing costs and enhance transparency, regulatory acceptance and adoption rates vary, influencing overall cost-effectiveness in different markets.

Transaction Speed: Legacy vs Blockchain Solutions

Title insurance traditionally involves multiple intermediaries, resulting in transaction speeds that can take days to weeks to finalize due to thorough title searches and manual verifications. Blockchain title solutions leverage decentralized ledgers to enable near-instant verification and transfer of property titles, drastically reducing closing times and enhancing transaction efficiency. This shift minimizes delays associated with legacy systems, accelerating real estate transactions through automated, transparent processes.

Risk and Fraud Prevention Differences

Title insurance protects property buyers from financial loss due to defects in a property's title, such as liens or ownership disputes, by transferring risk to the insurer. Blockchain title systems use decentralized, immutable ledgers to securely record transactions, reducing the risk of fraud through tamper-proof, transparent property records. While title insurance offers post-purchase financial protection, blockchain title emphasizes real-time fraud prevention and risk reduction through enhanced data security and verification processes.

Scalability and Adoption Challenges

Title insurance remains the dominant solution for property ownership protection due to its established scalability and widespread adoption by real estate markets and legal systems. Blockchain title systems face significant scalability challenges, including limited transaction throughput and integration difficulties with existing public records and regulatory frameworks. Adoption hurdles stem from the need for legal recognition, standardization across jurisdictions, and overcoming the inertia of traditional title insurance providers and stakeholders.

The Future of Real Estate Titles: Insurance or Blockchain?

Title insurance currently provides essential protection against ownership disputes and defects, ensuring secure real estate transactions. Blockchain title transfers promise enhanced transparency, reduced fraud, and faster processing by decentralizing and automating record-keeping. The future of real estate titles may integrate blockchain technology with traditional insurance models to balance innovative security and comprehensive risk coverage.

Related Important Terms

Smart Title Deeds

Smart title deeds leverage blockchain technology to offer immutable, transparent property ownership records that reduce fraud and streamline transactions compared to traditional title insurance. By digitizing title verification through decentralized ledgers, smart title deeds enhance security, lower costs, and expedite real estate transfers with real-time updates accessible to all stakeholders.

Tokenized Property Titles

Tokenized property titles leverage blockchain technology to provide immutable, transparent ownership records, reducing the risk of fraud and streamlining title transfers compared to traditional title insurance, which relies on manual verification and underwriting processes. This decentralized approach enhances security and efficiency in real estate transactions by enabling real-time verification and fractional ownership possibilities.

Digital Ledger Escrow

Title insurance provides financial protection against title defects or disputes in real estate transactions, ensuring buyer security through an established insurance policy. Blockchain title leverages a decentralized digital ledger escrow system that enhances transparency, reduces fraud risk, and streamlines property transfers by recording immutable transaction data on a secure, distributed network.

Title NFT (Non-Fungible Token)

Title insurance protects property buyers from financial losses due to defects in a property's title, while blockchain title leverages decentralized ledger technology to store and verify ownership records securely. Title NFTs represent property titles as unique digital assets on a blockchain, ensuring transparent, tamper-proof proof of ownership and streamlining property transfer processes.

Blockchain Title Registry

Blockchain Title Registry offers a decentralized and tamper-proof system for recording property ownership, reducing fraud risks and enhancing transparency compared to traditional title insurance. This technology ensures real-time updates and immutable records, streamlining title searches and facilitating faster, more secure real estate transactions.

Automated Title Clearance

Automated title clearance leverages blockchain technology to enhance accuracy and speed by securely recording property ownership and transaction history on an immutable digital ledger, reducing the risk of human error and fraud common in traditional title insurance processes. Title insurance relies on manual title searches and human verification, which can be time-consuming and less transparent compared to the automated, real-time verification capabilities offered by blockchain title systems.

Immutable Chain-of-Title

Title insurance provides financial protection against title defects, but blockchain title offers an immutable chain-of-title that ensures transparent, tamper-proof ownership records. This decentralized ledger reduces fraud risk and streamlines property transactions by permanently recording every transfer in a secure, verifiable manner.

Crypto-backed Title Assurance

Title insurance provides traditional protection against property ownership disputes, while blockchain title uses decentralized ledger technology to secure and verify ownership with enhanced transparency. Crypto-backed title assurance integrates digital assets and smart contracts, enabling faster, tamper-proof transactions and reducing fraud risk in real estate deals.

Decentralized Title Verification

Decentralized title verification via blockchain technology provides enhanced transparency and tamper-proof record-keeping compared to traditional title insurance, which relies on centralized entities to guarantee ownership and resolve disputes. Blockchain's immutable ledger reduces fraud risks and accelerates property transfers by enabling real-time, trustless validation of title history.

Electronic Title Closing (eClosing)

Electronic Title Closing (eClosing) streamlines real estate transactions by enabling secure, digital signing and recording of title documents, minimizing errors and delays traditionally associated with paper-based title insurance processes. Blockchain Title technology enhances eClosing by providing decentralized, tamper-proof records that increase transparency and reduce the risk of fraud in property title verification.

Title Insurance vs Blockchain Title Infographic

industrydif.com

industrydif.com