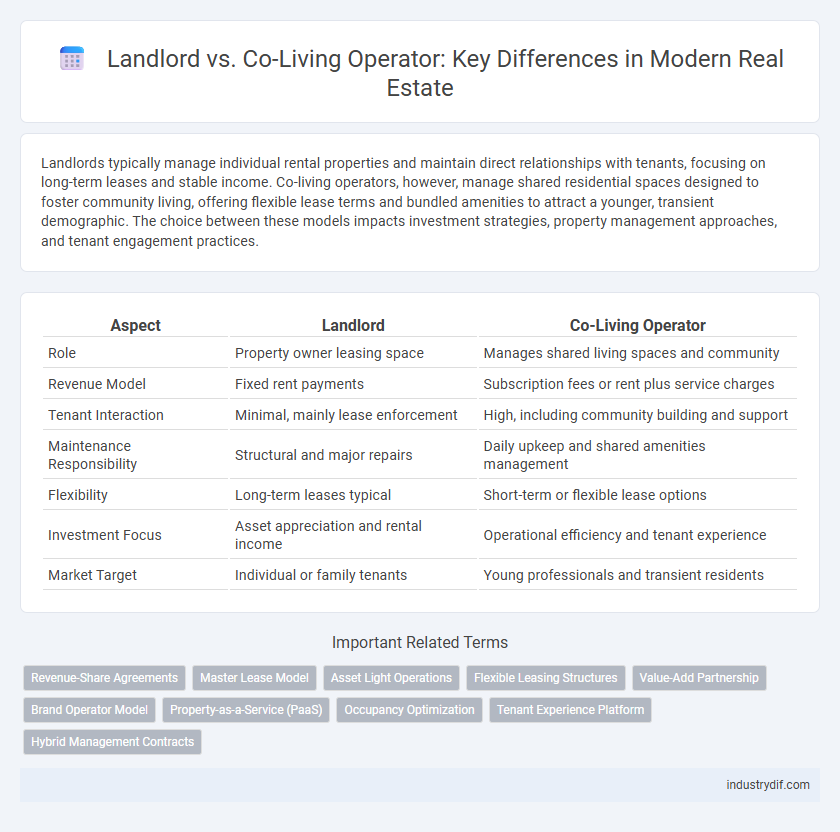

Landlords typically manage individual rental properties and maintain direct relationships with tenants, focusing on long-term leases and stable income. Co-living operators, however, manage shared residential spaces designed to foster community living, offering flexible lease terms and bundled amenities to attract a younger, transient demographic. The choice between these models impacts investment strategies, property management approaches, and tenant engagement practices.

Table of Comparison

| Aspect | Landlord | Co-Living Operator |

|---|---|---|

| Role | Property owner leasing space | Manages shared living spaces and community |

| Revenue Model | Fixed rent payments | Subscription fees or rent plus service charges |

| Tenant Interaction | Minimal, mainly lease enforcement | High, including community building and support |

| Maintenance Responsibility | Structural and major repairs | Daily upkeep and shared amenities management |

| Flexibility | Long-term leases typical | Short-term or flexible lease options |

| Investment Focus | Asset appreciation and rental income | Operational efficiency and tenant experience |

| Market Target | Individual or family tenants | Young professionals and transient residents |

Definition: Landlord vs Co-Living Operator

A landlord is an individual or entity that owns and leases residential or commercial properties to tenants, typically managing leases, rent collection, and maintenance responsibilities. A co-living operator manages shared living spaces designed to foster community, offering fully furnished rooms with communal amenities and often providing flexible lease terms tailored to urban professionals or students. Unlike traditional landlords, co-living operators emphasize curated social environments and value-added services alongside property management.

Ownership Structure and Asset Control

Landlords typically retain full ownership and legal control of the property, managing asset decisions independently to align with long-term investment goals. Co-living operators often lease or hold management contracts rather than ownership, focusing on daily operations, tenant experience, and revenue optimization without direct property control. This distinction affects risk allocation, capital commitments, and strategic influence over asset disposition and improvements.

Revenue Models and Profit Streams

Landlords primarily generate revenue through fixed rental income from tenants, ensuring consistent cash flow with minimal operational involvement, while co-living operators leverage multiple profit streams including flexible short-term leases, premium service fees, and community-driven amenities that enhance tenant experience and increase overall occupancy rates. Co-living models capitalize on dynamic pricing strategies and value-added services such as cleaning, events, and networking opportunities, which significantly boost revenue beyond traditional rental income. This diversified approach allows co-living operators to optimize profit margins by blending real estate assets with hospitality-inspired services, contrasting the more stable but limited earnings typical of traditional landlords.

Lease Arrangements and Tenant Contracts

Lease arrangements for landlords typically involve long-term contracts directly with individual tenants, ensuring stable rental income and control over property management. Co-living operators negotiate master leases with landlords, subsequently subletting to multiple tenants under flexible, short-term agreements designed for higher turnover and community living. Tenant contracts in co-living spaces emphasize shared amenities and communal rules, contrasting with landlords' traditional lease agreements that focus on individual tenant responsibilities and property maintenance.

Property Management Responsibilities

Landlords primarily handle lease agreements, rent collection, and maintenance requests for individual units, ensuring tenant compliance and property upkeep. Co-living operators manage shared living spaces by coordinating communal area maintenance, organizing tenant onboarding, and enhancing resident experiences through community-building activities. Both roles require efficient property management, but co-living operators emphasize resident engagement and shared space maintenance beyond traditional landlord duties.

Tenant Experience and Community Building

Landlords typically provide traditional rental arrangements focused on individual tenant agreements, often resulting in limited community interaction. Co-living operators enhance tenant experience by offering furnished shared spaces, organized events, and communal amenities that foster a strong sense of community. This model improves tenant satisfaction and retention through curated social environments and collaborative living.

Regulatory Compliance and Legal Obligations

Landlords must adhere to traditional rental regulations including lease agreements, property maintenance laws, and tenant rights, while co-living operators face a more complex compliance landscape involving zoning laws, shared living permits, and intensified health and safety standards. Co-living operators are frequently required to navigate multiple jurisdictions and ensure compliance with community engagement policies and occupancy limits that differ from standard landlord requirements. Failure to meet these legal obligations can result in fines, license revocations, and potential litigation, making regulatory diligence critical for both parties in the real estate sector.

Risk Management and Liability

Landlords face traditional risks such as property damage, tenant default, and regulatory compliance, requiring robust lease agreements and regular property inspections to mitigate liability. Co-living operators encounter amplified risks related to shared communal spaces, increased wear and tear, and complex tenant dynamics, necessitating comprehensive insurance policies and strict operational protocols. Effective risk management for both involves proactive maintenance, clear communication channels, and thorough vetting processes to minimize financial exposure and legal disputes.

Technological Integration in Operations

Landlords traditionally manage properties with basic digital tools like online rent payments and maintenance requests, while co-living operators leverage advanced technological platforms for resident onboarding, community engagement, and smart home integration. Co-living operators use AI-driven analytics to optimize space utilization and personal preferences, enhancing tenant experience and operational efficiency. This deep technological integration differentiates co-living operators by creating scalable, adaptive living environments that go beyond conventional landlord services.

Market Trends and Future Outlook

Landlord market trends show a steady increase in demand for long-term residential leases, driven by urban population growth and housing shortages. Co-living operators are rapidly expanding, capitalizing on millennial preferences for affordable, flexible, and community-oriented living spaces in metropolitan areas. The future outlook indicates a convergence where traditional landlords may partner with co-living operators to maximize occupancy rates and diversify rental income streams amid evolving tenant lifestyles.

Related Important Terms

Revenue-Share Agreements

Revenue-share agreements between landlords and co-living operators enable landlords to earn a percentage of rental income generated from fully managed shared living spaces, optimizing property profitability without direct involvement in daily operations. These agreements balance risk and reward by aligning incentives, allowing co-living operators to maximize occupancy and rental yields while providing landlords with stable, performance-based income streams.

Master Lease Model

The Master Lease Model enables co-living operators to lease entire properties from landlords, allowing them to manage tenant relationships and operational responsibilities directly while paying a fixed rent. This structure reduces risk for landlords by guaranteeing stable income and transfers day-to-day management to operators who specialize in dynamic co-living markets.

Asset Light Operations

Co-living operators leverage asset light operations by managing multiple properties without owning them, optimizing profitability and scalability through technology-driven tenant management and flexible leasing models. Landlords typically invest heavily in property ownership and maintenance, limiting their operational flexibility and exposure to market fluctuations compared to co-living operators who focus on maximizing asset utilization with minimal capital expenditure.

Flexible Leasing Structures

Flexible leasing structures offered by co-living operators provide tenants with short-term, all-inclusive rental agreements, contrasting with traditional landlords who typically require long-term, fixed leases and separate utility contracts. This adaptability attracts urban professionals seeking convenience and mobility, while landlords benefit from stable, long-term cash flow.

Value-Add Partnership

Landlords partnering with co-living operators enhance property value by leveraging shared amenities and community-driven living experiences that attract quality tenants and reduce vacancy rates. This value-add partnership maximizes rental income through streamlined management, increased occupancy, and differentiated market positioning.

Brand Operator Model

The Brand Operator Model in co-living transforms traditional landlord roles by integrating specialized management, community building, and branded living experiences that enhance tenant retention and property value. Unlike conventional landlords, co-living operators leverage technology and lifestyle amenities to create dynamic, scalable environments tailored to urban professionals and millennials, driving higher occupancy rates and premium rental yields.

Property-as-a-Service (PaaS)

Landlords traditionally manage rental properties directly, focusing on long-term leases and tenant relationships, whereas Co-Living Operators implement Property-as-a-Service (PaaS) models that offer flexible, fully managed living spaces with amenities and community experiences bundled in subscription-based agreements. PaaS optimizes asset utilization and tenant satisfaction through technology-driven services, dynamic pricing, and enhanced operational efficiency in shared housing environments.

Occupancy Optimization

Landlords typically manage occupancy through traditional long-term leases, focusing on stable tenant retention and consistent rental income, while co-living operators optimize occupancy by offering flexible short-term leases and community-driven amenities that attract diverse, transient renters. Utilizing dynamic pricing models and real-time data analytics, co-living operators achieve higher occupancy rates by quickly adapting to market demand fluctuations compared to the more static strategies of landlords.

Tenant Experience Platform

Tenant experience platforms empower co-living operators to deliver seamless community engagement, personalized services, and streamlined communication, enhancing tenant satisfaction beyond traditional landlord management. These platforms integrate smart building technology and data analytics, enabling real-time responsiveness and fostering a collaborative living environment that standard landlord models often lack.

Hybrid Management Contracts

Hybrid management contracts blend the strengths of traditional landlord agreements with co-living operator services, enabling property owners to retain strategic control while leveraging professional community management and tenant engagement. This model optimizes revenue streams and tenant satisfaction by combining asset oversight with specialized co-living operational expertise.

Landlord vs Co-Living Operator Infographic

industrydif.com

industrydif.com