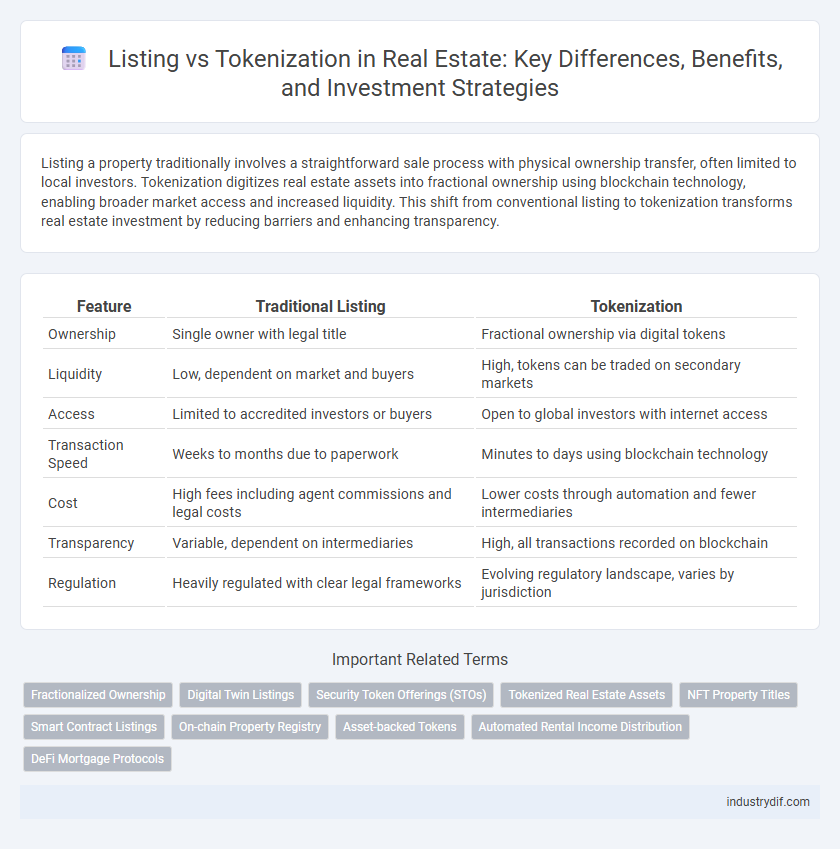

Listing a property traditionally involves a straightforward sale process with physical ownership transfer, often limited to local investors. Tokenization digitizes real estate assets into fractional ownership using blockchain technology, enabling broader market access and increased liquidity. This shift from conventional listing to tokenization transforms real estate investment by reducing barriers and enhancing transparency.

Table of Comparison

| Feature | Traditional Listing | Tokenization |

|---|---|---|

| Ownership | Single owner with legal title | Fractional ownership via digital tokens |

| Liquidity | Low, dependent on market and buyers | High, tokens can be traded on secondary markets |

| Access | Limited to accredited investors or buyers | Open to global investors with internet access |

| Transaction Speed | Weeks to months due to paperwork | Minutes to days using blockchain technology |

| Cost | High fees including agent commissions and legal costs | Lower costs through automation and fewer intermediaries |

| Transparency | Variable, dependent on intermediaries | High, all transactions recorded on blockchain |

| Regulation | Heavily regulated with clear legal frameworks | Evolving regulatory landscape, varies by jurisdiction |

Understanding Real Estate Listing

Real estate listing involves advertising properties for sale or rent through multiple platforms, aiming to attract potential buyers or tenants by providing detailed information such as location, price, and features. Listings are traditionally centralized, often managed by real estate agents or agencies that connect sellers and buyers directly. Unlike tokenization, which digitizes property ownership into blockchain-based tokens for fractional investment, listing remains the primary method for marketing and transacting real estate properties.

What is Real Estate Tokenization?

Real estate tokenization involves converting property ownership into digital tokens on a blockchain, allowing fractional ownership and increased liquidity. This method enables investors to buy and sell shares of real estate assets quickly, reducing barriers traditionally associated with property transactions. Tokenization enhances transparency, security, and access to global markets compared to conventional real estate listing methods.

Key Differences Between Listing and Tokenization

Listing real estate involves traditional processes of marketing properties on platforms or through agents, while tokenization converts property assets into digital tokens on a blockchain, enabling fractional ownership. Key differences include liquidity, with tokenization offering faster transactions and broader investor access, versus listing's longer sales cycles and limited investor reach. Furthermore, tokenization enhances transparency and security through blockchain technology, contrasting with the conventional verification challenges in listed property sales.

Advantages of Traditional Listing

Traditional listing in real estate offers established market trust and regulatory oversight, ensuring greater transparency and investor protection. It provides liquidity through well-known exchanges and broad access to institutional investors. Longstanding valuation methods and standardized processes simplify due diligence and asset appraisal compared to emerging tokenization models.

Benefits of Real Estate Tokenization

Real estate tokenization enhances liquidity by converting property assets into tradable digital tokens, enabling fractional ownership and lowering investment barriers. It streamlines transactions through blockchain technology, ensuring transparency, security, and faster settlement times compared to traditional listing methods. This innovative approach expands market access to global investors while reducing administrative costs and increasing portfolio diversification opportunities.

Regulatory Considerations in Listing vs Tokenization

Listing real estate assets on traditional platforms requires compliance with established securities regulations governed by entities like the SEC, ensuring transparency and investor protection. Tokenization involves issuing digital tokens on blockchain, which may fall under evolving regulatory frameworks with varying jurisdictional requirements for anti-money laundering (AML) and know-your-customer (KYC) compliance. Navigating these regulatory landscapes demands thorough legal assessment to ensure adherence to securities laws, investor eligibility criteria, and reporting obligations in both listing and tokenization processes.

Impact on Property Liquidity and Accessibility

Listing properties traditionally offers limited liquidity due to longer sales cycles and higher transaction costs, restricting access to a narrower pool of buyers. Tokenization significantly enhances property liquidity by enabling fractional ownership and 24/7 trading on blockchain platforms, thus broadening market accessibility to global investors. This democratization of real estate investment reduces entry barriers and accelerates capital movement within the property market.

Risks Involved: Listing vs Tokenization

Listing real estate properties on traditional platforms involves risks such as market volatility, liquidity constraints, and high transaction costs, which can limit investor access and exit opportunities. Tokenization introduces risks related to regulatory uncertainty, cybersecurity threats, and smart contract vulnerabilities that may impact ownership verification and asset transfer processes. Both methods require careful risk assessment, but tokenization offers enhanced liquidity and fractional ownership despite the evolving legal frameworks.

Technology’s Role in Tokenized Real Estate

Tokenization leverages blockchain technology to transform traditional real estate listings into digital assets, enabling fractional ownership and increased liquidity. Smart contracts automate transactions, reducing intermediaries and enhancing security throughout the property transfer process. This technological integration broadens market access, allowing investors to participate globally with lower capital requirements.

Future Trends: Listing and Tokenization in Real Estate

Future trends in real estate indicate a growing convergence between traditional listing platforms and blockchain-based tokenization, enhancing liquidity and accessibility for investors. Tokenization allows fractional ownership of properties, democratizing access and enabling 24/7 trading on digital exchanges, while listings continue to provide comprehensive market visibility and regulatory compliance. Innovations in smart contracts and decentralized finance (DeFi) integration further accelerate the adoption of tokenized assets alongside conventional listings, shaping a more efficient and transparent real estate market.

Related Important Terms

Fractionalized Ownership

Listing real estate involves selling whole property units through traditional markets, while tokenization enables fractionalized ownership by dividing property shares into digital tokens on a blockchain. Fractionalized ownership enhances liquidity, lowers investment barriers, and provides transparent, secure access to diverse real estate assets.

Digital Twin Listings

Digital Twin Listings leverage advanced real-time data integration to create dynamic, virtual representations of physical properties, enhancing transparency and accuracy in real estate transactions compared to traditional listings. Tokenization converts these digital twins into fractional ownership units on the blockchain, enabling increased liquidity, broader investor access, and seamless transferability of real estate assets.

Security Token Offerings (STOs)

Security Token Offerings (STOs) in real estate provide blockchain-based investment opportunities by tokenizing property assets, allowing fractional ownership and enhanced liquidity compared to traditional property listings. These tokenized securities are regulated financial instruments that ensure investor protection, compliance, and transparent transactions, distinguishing them significantly from conventional real estate listings.

Tokenized Real Estate Assets

Tokenized real estate assets enable fractional ownership by converting property rights into digital tokens on a blockchain, increasing liquidity and accessibility for investors worldwide. This innovation enhances transparency, reduces transaction costs, and allows for 24/7 trading, revolutionizing traditional listing methods.

NFT Property Titles

NFT property titles transform traditional real estate listing by enabling secure, transparent ownership transfer on blockchain platforms, reducing fraud and increasing liquidity. Tokenization fractionalizes property assets into digital tokens, allowing investors to buy shares easily, while listings remain conventional methods to market full properties to potential buyers.

Smart Contract Listings

Smart contract listings revolutionize real estate by enabling secure, transparent, and automatic execution of property transactions on blockchain platforms. Tokenization transforms physical properties into digital assets, offering fractional ownership and increased liquidity, while smart contracts enforce listing terms without intermediaries.

On-chain Property Registry

On-chain property registries enhance transparency and security by recording real estate listings directly on the blockchain, ensuring immutable proof of ownership and transaction history. Tokenization of properties further enables fractional ownership and increased liquidity by converting physical assets into tradable digital tokens on the same decentralized ledger.

Asset-backed Tokens

Asset-backed tokens represent fractional ownership of real estate properties through blockchain technology, providing increased liquidity and accessibility compared to traditional listings. These tokens enable seamless trading and transparency, revolutionizing asset management and investment by bridging the gap between physical real estate and digital markets.

Automated Rental Income Distribution

Listing properties on traditional real estate platforms provides a streamlined process for sale and rental management, while tokenization enables fractional ownership through blockchain technology, facilitating automated rental income distribution via smart contracts that ensure transparent, instantaneous payments to investors without intermediaries. This innovation reduces administrative costs and enhances liquidity by allowing investors to trade property tokens, democratizing access to rental income streams.

DeFi Mortgage Protocols

Listing real estate assets on traditional platforms provides straightforward liquidity but lacks the efficiency and global accessibility found in tokenization through DeFi mortgage protocols. Tokenization enables fractional ownership, instant settlement, and programmable smart contracts, revolutionizing property financing by reducing intermediaries and unlocking new investment opportunities.

Listing vs Tokenization Infographic

industrydif.com

industrydif.com