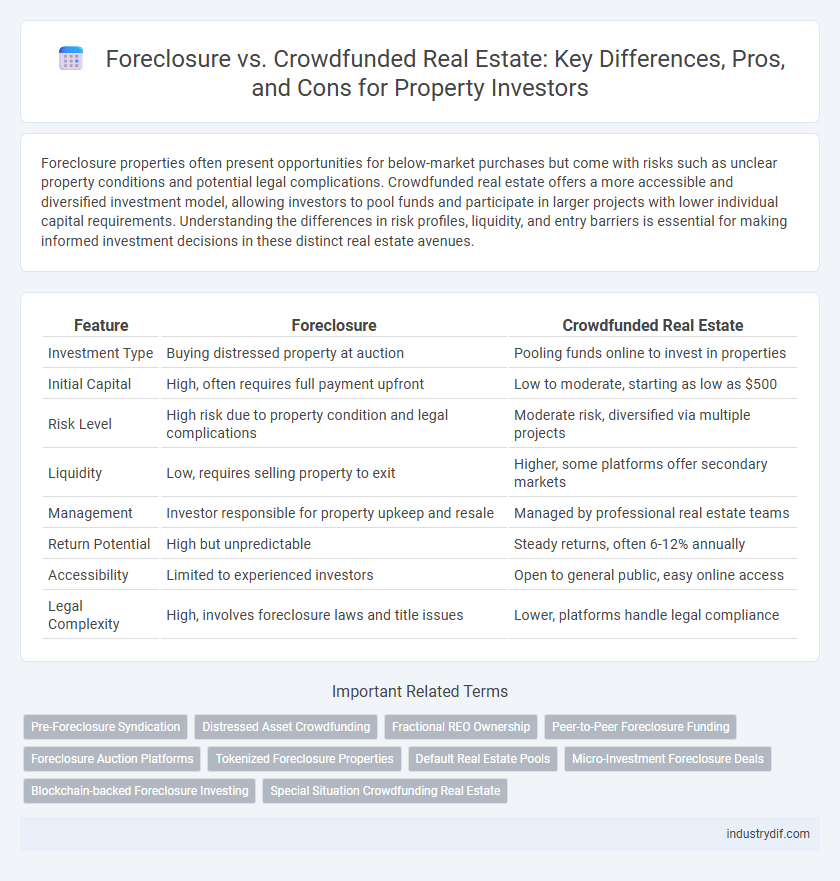

Foreclosure properties often present opportunities for below-market purchases but come with risks such as unclear property conditions and potential legal complications. Crowdfunded real estate offers a more accessible and diversified investment model, allowing investors to pool funds and participate in larger projects with lower individual capital requirements. Understanding the differences in risk profiles, liquidity, and entry barriers is essential for making informed investment decisions in these distinct real estate avenues.

Table of Comparison

| Feature | Foreclosure | Crowdfunded Real Estate |

|---|---|---|

| Investment Type | Buying distressed property at auction | Pooling funds online to invest in properties |

| Initial Capital | High, often requires full payment upfront | Low to moderate, starting as low as $500 |

| Risk Level | High risk due to property condition and legal complications | Moderate risk, diversified via multiple projects |

| Liquidity | Low, requires selling property to exit | Higher, some platforms offer secondary markets |

| Management | Investor responsible for property upkeep and resale | Managed by professional real estate teams |

| Return Potential | High but unpredictable | Steady returns, often 6-12% annually |

| Accessibility | Limited to experienced investors | Open to general public, easy online access |

| Legal Complexity | High, involves foreclosure laws and title issues | Lower, platforms handle legal compliance |

Understanding Foreclosure in Real Estate

Foreclosure in real estate occurs when a property owner fails to meet mortgage payment obligations, leading the lender to seize and sell the property to recover the outstanding loan balance. This process involves a legal procedure that results in the property being auctioned, often below market value, presenting investment opportunities but also higher risks such as title issues or property damage. Understanding foreclosure requires knowledge of loan defaults, foreclosure timelines, and the potential impact on credit scores and market dynamics.

What is Crowdfunded Real Estate?

Crowdfunded real estate involves pooling funds from multiple investors to collectively finance property acquisitions or developments, often through online platforms. This investment model allows individuals to access diversified real estate portfolios with lower capital requirements compared to traditional methods. Unlike foreclosure investments, which focus on distressed properties purchased below market value, crowdfunded real estate emphasizes shared ownership in both commercial and residential projects with managed risk and potential income distribution.

Key Differences Between Foreclosure and Crowdfunded Real Estate

Foreclosure involves purchasing properties that lenders repossess due to the previous owner's failure to meet mortgage obligations, often requiring significant capital and expertise in property renovation and legal processes. Crowdfunded real estate allows multiple investors to pool funds online to invest in real estate projects with lower individual capital requirements, offering diversified portfolios managed by professional teams. Key differences lie in investment accessibility, risk exposure, and the level of active management required from investors.

Risks and Rewards of Foreclosure Investments

Foreclosure investments offer the potential for high returns by purchasing properties below market value, but they carry significant risks such as title issues, hidden liens, and costly repairs. Investors must conduct thorough due diligence to mitigate risks including legal complications and market volatility. While the reward is rapid equity buildup and profit through resale or rental, the unpredictability and financial exposure make foreclosure investing suitable only for experienced investors with adequate capital reserves.

Advantages of Investing in Crowdfunded Real Estate

Investing in crowdfunded real estate offers diversified portfolio opportunities with lower capital requirements compared to traditional foreclosure properties. It provides access to professionally managed commercial and residential projects, reducing individual investor risk and enhancing potential returns. Crowdfunded platforms also deliver transparent performance tracking and liquidity options often unavailable in foreclosure investments.

Legal Considerations: Foreclosure vs Crowdfunded Deals

Foreclosure deals involve navigating strict legal processes governed by state laws, including notices, redemption periods, and potential court actions that protect borrower rights, requiring investors to conduct thorough title searches to avoid liens or undisclosed claims. Crowdfunded real estate investments operate under securities regulations such as the JOBS Act, necessitating compliance with SEC rules on investor qualifications, disclosure requirements, and fund management, which reduces individual investor liability but mandates due diligence on the fund's legal structure. Understanding these legal distinctions is crucial to mitigate risks, ensure compliance, and protect investor interests in either foreclosure acquisitions or crowdfunded property projects.

Accessibility: Entry Barriers in Each Investment Type

Foreclosure investments often require substantial capital and deep market knowledge, creating high entry barriers for individual investors. Crowdfunded real estate platforms significantly lower these barriers by allowing smaller investments, often starting at just a few hundred dollars, making real estate accessible to a broader audience. The streamlined online process of crowdfunding further reduces complexity and time commitment, enhancing accessibility compared to traditional foreclosure purchases.

Profit Potential: Foreclosure vs Crowdfunded Real Estate

Foreclosure real estate investments often offer higher profit potential due to below-market purchase prices and the ability to add value through renovations or market recovery. Crowdfunded real estate provides diversified risk with more stable but typically lower returns, benefiting from professional management and pooled capital. Investors seeking rapid, high returns may lean towards foreclosures, while those prioritizing steady cash flow and reduced risk prefer crowdfunding platforms.

Market Trends in Foreclosure and Crowdfunded Investments

Foreclosure real estate market trends reveal increased inventory due to rising mortgage delinquencies, presenting opportunities for discounted property acquisitions but also signaling economic distress. Crowdfunded real estate investments have surged, driven by technology platforms that democratize access and diversify portfolios, attracting a broader base of small investors seeking steady returns. Data from recent years show crowdfunded deals growing at a double-digit annual rate while foreclosure sales fluctuate with lending conditions and market pressure.

Which Strategy Is Right for Your Investment Portfolio?

Foreclosure investing offers the potential for high returns by acquiring properties below market value but requires extensive due diligence and risk tolerance. Crowdfunded real estate provides diversified access to commercial and residential projects with lower capital and reduced management responsibilities through online platforms. Assess your portfolio goals, liquidity needs, and risk appetite to determine if direct foreclosure purchases or passive crowdfunding aligns better with your investment strategy.

Related Important Terms

Pre-Foreclosure Syndication

Pre-foreclosure syndication offers investors early access to distressed properties before they hit the foreclosure auction, often enabling better negotiation terms and higher returns compared to traditional foreclosure purchases. Crowdfunded real estate platforms facilitate this by pooling capital from multiple investors, reducing individual risk and increasing buying power in the competitive pre-foreclosure market.

Distressed Asset Crowdfunding

Distressed asset crowdfunding in real estate allows multiple investors to pool funds to purchase and rehabilitate foreclosed or distressed properties, reducing individual risk and increasing access to lucrative turnaround opportunities. This investment approach contrasts with traditional foreclosure investing by democratizing capital entry points and leveraging collective due diligence to unlock higher potential returns.

Fractional REO Ownership

Fractional REO ownership through crowdfunded real estate platforms offers investors access to distressed properties without the complexities of full foreclosure purchases, enabling diversified portfolios with lower capital requirements. This model provides streamlined property management and transparent returns, contrasting traditional foreclosure investments that often demand higher expertise and liquidity.

Peer-to-Peer Foreclosure Funding

Peer-to-peer foreclosure funding enables individual investors to directly finance distressed property purchases, bypassing traditional lenders and often resulting in higher returns compared to conventional crowdfunded real estate platforms. This approach leverages a decentralized network of investors who share both the risks and profits associated with foreclosure auctions and property rehabilitation.

Foreclosure Auction Platforms

Foreclosure auction platforms provide investors access to distressed properties sold below market value, presenting opportunities for substantial returns through competitive bidding processes. These platforms often feature real-time bidding, transparent property data, and streamlined transactions, differentiating them from crowdfunded real estate models that pool smaller investments into diversified portfolios.

Tokenized Foreclosure Properties

Tokenized foreclosure properties enable investors to purchase fractional shares of distressed real estate through blockchain-based platforms, increasing liquidity and lowering entry barriers compared to traditional foreclosure investments. Crowdfunded real estate leverages multiple investors pooling funds for diversified portfolios, but tokenization of foreclosed assets uniquely offers transparent ownership transfer and real-time market access.

Default Real Estate Pools

Default real estate pools, often found in foreclosure investments, involve bundled properties that face high default risks, presenting opportunities for significant discounts but increased volatility. In contrast, crowdfunded real estate distributes risk among multiple investors, offering diversified exposure with typically lower default rates and more stable returns.

Micro-Investment Foreclosure Deals

Micro-investment foreclosure deals offer a unique opportunity for individual investors to acquire properties at significant discounts through crowdfunded platforms, enabling access to high-potential real estate assets with lower capital requirements. These deals often provide higher returns compared to traditional foreclosure purchases by leveraging pooled funds and expert asset management within diversified real estate portfolios.

Blockchain-backed Foreclosure Investing

Blockchain-backed foreclosure investing leverages decentralized ledger technology to increase transparency, reduce fraud, and enable fractional ownership in distressed property assets. Crowdfunded real estate platforms integrating blockchain facilitate secure, efficient transactions and provide investors with real-time access to foreclosure portfolios, enhancing liquidity and lowering entry barriers in the real estate market.

Special Situation Crowdfunding Real Estate

Special Situation Crowdfunding Real Estate targets distressed properties like foreclosures, leveraging collective investor capital to acquire undervalued assets with high return potential. This approach provides diversified exposure to opportunistic real estate investments by financing renovations, legal resolutions, or market repositioning that traditional foreclosure purchases alone may not offer.

Foreclosure vs Crowdfunded Real Estate Infographic

industrydif.com

industrydif.com