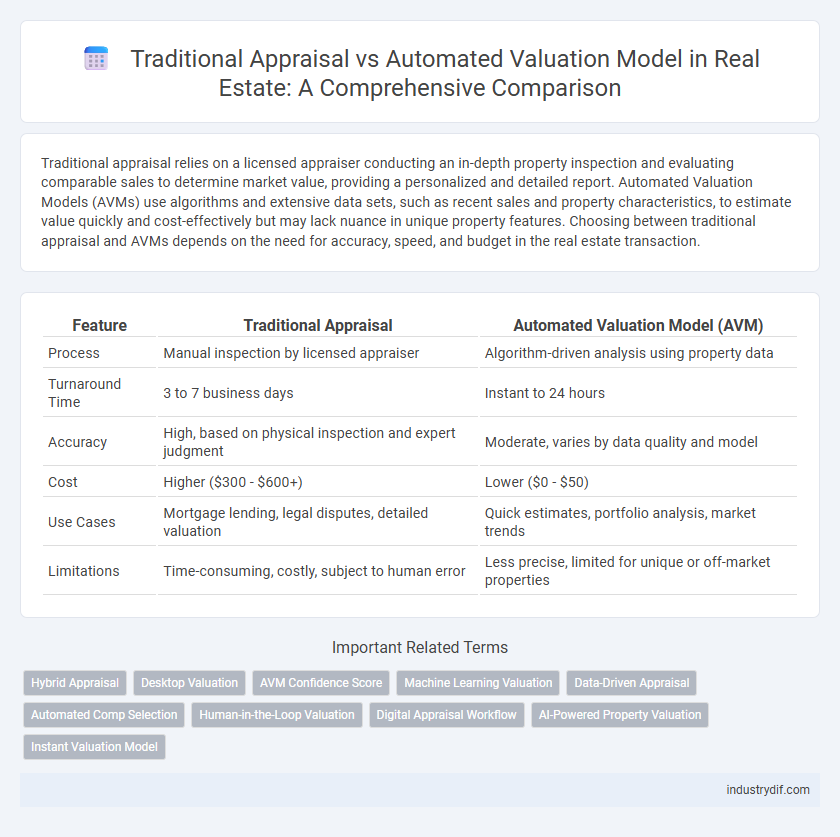

Traditional appraisal relies on a licensed appraiser conducting an in-depth property inspection and evaluating comparable sales to determine market value, providing a personalized and detailed report. Automated Valuation Models (AVMs) use algorithms and extensive data sets, such as recent sales and property characteristics, to estimate value quickly and cost-effectively but may lack nuance in unique property features. Choosing between traditional appraisal and AVMs depends on the need for accuracy, speed, and budget in the real estate transaction.

Table of Comparison

| Feature | Traditional Appraisal | Automated Valuation Model (AVM) |

|---|---|---|

| Process | Manual inspection by licensed appraiser | Algorithm-driven analysis using property data |

| Turnaround Time | 3 to 7 business days | Instant to 24 hours |

| Accuracy | High, based on physical inspection and expert judgment | Moderate, varies by data quality and model |

| Cost | Higher ($300 - $600+) | Lower ($0 - $50) |

| Use Cases | Mortgage lending, legal disputes, detailed valuation | Quick estimates, portfolio analysis, market trends |

| Limitations | Time-consuming, costly, subject to human error | Less precise, limited for unique or off-market properties |

Introduction to Property Valuation Methods

Traditional appraisal involves a licensed appraiser conducting an on-site inspection to assess property value based on factors such as location, condition, and comparable sales. Automated Valuation Models (AVMs) utilize algorithms and large datasets, including recent sales, tax records, and market trends, to provide rapid property value estimates without physical inspections. Understanding these valuation methods is essential for accurate real estate pricing, informed investment decisions, and effective market analysis.

What Is a Traditional Real Estate Appraisal?

A traditional real estate appraisal involves a licensed appraiser conducting an in-person property inspection and analyzing comparable sales, market trends, and property conditions to determine the home's fair market value. This detailed evaluation considers unique features, structural integrity, and neighborhood factors, providing an authoritative and comprehensive value assessment. The result is an appraisal report used by lenders, buyers, and sellers to make informed decisions in real estate transactions.

Understanding Automated Valuation Models (AVMs)

Automated Valuation Models (AVMs) leverage advanced algorithms and extensive property data to estimate real estate values quickly and consistently, making them a valuable tool for lenders and real estate professionals. Unlike traditional appraisals, which rely on subjective assessments by certified appraisers, AVMs analyze recent sales, property characteristics, and market trends to produce objective valuations. The accuracy of AVMs depends on the quality and quantity of available data, making them most effective in well-documented markets.

Key Differences Between Appraisals and AVMs

Traditional appraisals involve a licensed professional conducting an on-site property inspection, analyzing market trends, and providing a detailed, personalized report, often required by lenders for accuracy and compliance. Automated Valuation Models (AVMs) utilize algorithms and large datasets such as recent sales, tax assessments, and property characteristics to generate quick, cost-effective property value estimates without physical inspections. Key differences include the level of human expertise, customization, and the potential for AVMs to lack context-specific adjustments that a traditional appraisal offers.

Accuracy: Manual Expertise vs Algorithmic Data

Traditional appraisal relies on manual expertise, where licensed appraisers analyze property features, market conditions, and comparable sales to determine value, often resulting in nuanced and context-aware assessments. Automated Valuation Models (AVMs) use algorithmic data processing large datasets, including recent sales, tax records, and market trends, offering rapid and consistent valuations but sometimes lacking the ability to account for unique property attributes or local market idiosyncrasies. Accuracy in real estate valuation hinges on balancing the detailed insights of traditional appraisals with the data-driven efficiency of AVMs to best reflect property value.

Speed and Efficiency in Property Valuation

Traditional appraisal involves a licensed appraiser conducting an in-person property inspection, which typically takes several days to weeks, affecting overall valuation speed. In contrast, Automated Valuation Models (AVMs) use algorithms and extensive databases to generate property values within minutes, significantly enhancing efficiency. This rapid turnaround enables real estate professionals and buyers to make quicker, data-driven decisions in dynamic markets.

Cost Comparison: Appraisal vs AVM

Traditional appraisals typically cost between $300 to $600 per property, reflecting fees for on-site inspections and expert analysis. Automated Valuation Models (AVMs) offer a more cost-effective alternative, often ranging from free to under $50 due to their reliance on algorithm-based data processing. Choosing between the two methods depends on budget constraints and the required precision in property valuation.

Regulatory and Compliance Considerations

Traditional appraisals comply with rigorous regulatory frameworks such as USPAP and ECOA, ensuring thorough property inspections and expert judgment, which are critical for meeting lending and legal standards. Automated Valuation Models (AVMs) utilize algorithms and large datasets to provide swift property value estimates but must adhere to guidelines from regulators like FHFA and OCC to address accuracy, transparency, and bias concerns. Financial institutions balance these tools by integrating compliance protocols to satisfy regulatory scrutiny while leveraging AVMs for efficiency in mortgage underwriting and risk management.

Use Cases: When to Choose Each Method

Traditional appraisals are ideal for complex property transactions, unique homes, or legal proceedings where detailed, expert assessments are necessary to capture nuanced factors affecting value. Automated Valuation Models (AVMs) excel in quick, cost-effective estimations for conventional residential properties, refinancing, or portfolio analysis where speed and efficiency are prioritized over granular detail. Selecting between methods depends on property uniqueness, transaction complexity, and accuracy requirements in real estate valuation processes.

Future Trends in Real Estate Valuation

Traditional appraisal methods rely heavily on expert judgment and in-person inspections, ensuring detailed property analysis but often facing delays. Automated Valuation Models (AVMs) use advanced algorithms and big data to provide rapid, consistent valuations with growing accuracy fueled by machine learning advancements. Future trends in real estate valuation emphasize integrating AI-driven AVMs with human expertise to enhance precision, efficiency, and scalability across diverse markets.

Related Important Terms

Hybrid Appraisal

Hybrid appraisal combines the accuracy of traditional appraisal methods with the efficiency of automated valuation models (AVMs) by integrating expert appraiser insights and algorithmic data analysis. This approach enhances property valuation reliability by leveraging comprehensive market data alongside professional judgment, reducing estimation errors and improving decision-making in real estate transactions.

Desktop Valuation

Desktop valuation leverages Automated Valuation Models (AVMs) to provide swift, data-driven property estimates using algorithms that analyze market trends, comparable sales, and public records, offering a cost-effective alternative to traditional appraisals. While traditional appraisals rely on in-person inspections and subjective analysis by licensed appraisers, desktop valuations enable real estate professionals to access immediate, scalable property valuations remotely, enhancing efficiency in decision-making processes.

AVM Confidence Score

The Automated Valuation Model (AVM) Confidence Score quantifies the reliability of property value estimates by analyzing data accuracy, market trends, and algorithm robustness, providing real estate professionals with a transparent metric for decision-making. Unlike traditional appraisals that rely on subjective expert judgment and physical inspections, AVMs leverage big data and machine learning to deliver scalable, cost-efficient, and consistently updated property valuations.

Machine Learning Valuation

Machine learning valuation leverages large datasets and advanced algorithms to analyze property features, historical sales, and market trends, providing fast and data-driven estimates compared to traditional appraisal methods that rely on expert judgment and physical inspections. Automated Valuation Models (AVMs) continuously learn from new data, enhancing accuracy and scalability in real estate pricing while reducing human bias inherent in manual appraisals.

Data-Driven Appraisal

Data-driven appraisal leverages Automated Valuation Models (AVMs) that utilize extensive property databases, market trends, and algorithmic analytics to deliver rapid, objective property valuations. Traditional appraisal relies on human expertise and on-site inspections, which provide nuanced insights but often at the cost of slower, subjective evaluations.

Automated Comp Selection

Automated Valuation Models (AVMs) use algorithm-driven comp selection to analyze comparable properties more rapidly and objectively than traditional appraisals, incorporating extensive datasets including recent sales, property characteristics, and market trends. This technology enhances accuracy in property valuation by minimizing human bias and offering real-time updates, making AVMs invaluable for lenders and investors seeking efficient, data-driven insights.

Human-in-the-Loop Valuation

Human-in-the-Loop Valuation combines the precision of Automated Valuation Models (AVMs) with expert appraisal insights to enhance accuracy and account for nuanced property factors often missed by algorithms alone. This hybrid approach integrates machine learning data analysis with human expertise, improving reliability in market value estimates across diverse real estate segments.

Digital Appraisal Workflow

Traditional appraisal relies on onsite inspections and expert judgment, often resulting in longer turnaround times and higher costs. Automated Valuation Models (AVMs) utilize algorithms and large datasets to provide rapid, data-driven property valuations, enabling a streamlined digital appraisal workflow that enhances efficiency and scalability in real estate transactions.

AI-Powered Property Valuation

AI-powered property valuation leverages machine learning algorithms and vast datasets to deliver rapid, data-driven property appraisals with enhanced accuracy, reducing human bias inherent in traditional appraisal methods. Automated Valuation Models (AVMs) integrate real-time market trends, historical sales data, and property specifics, providing scalable, cost-effective solutions that outperform manual appraisals in speed and consistency.

Instant Valuation Model

Instant Valuation Models leverage advanced algorithms and big data analytics to provide rapid property value estimates, significantly reducing the time compared to traditional appraisals that require in-person inspections and expert judgment. These automated valuations use multiple data points such as recent sales, property characteristics, and market trends, offering scalable and cost-effective solutions for real estate professionals and buyers.

Traditional Appraisal vs Automated Valuation Model Infographic

industrydif.com

industrydif.com