Condo ownership provides full title and exclusive use of the property, allowing owners to customize and rent it out freely, while fractional ownership divides the property into shares, giving buyers limited use based on their investment fraction. Fractional ownership reduces upfront costs and maintenance responsibilities, making it ideal for those seeking vacation properties without full ownership burdens. Understanding the differences helps buyers choose between complete control or shared benefits in real estate investment.

Table of Comparison

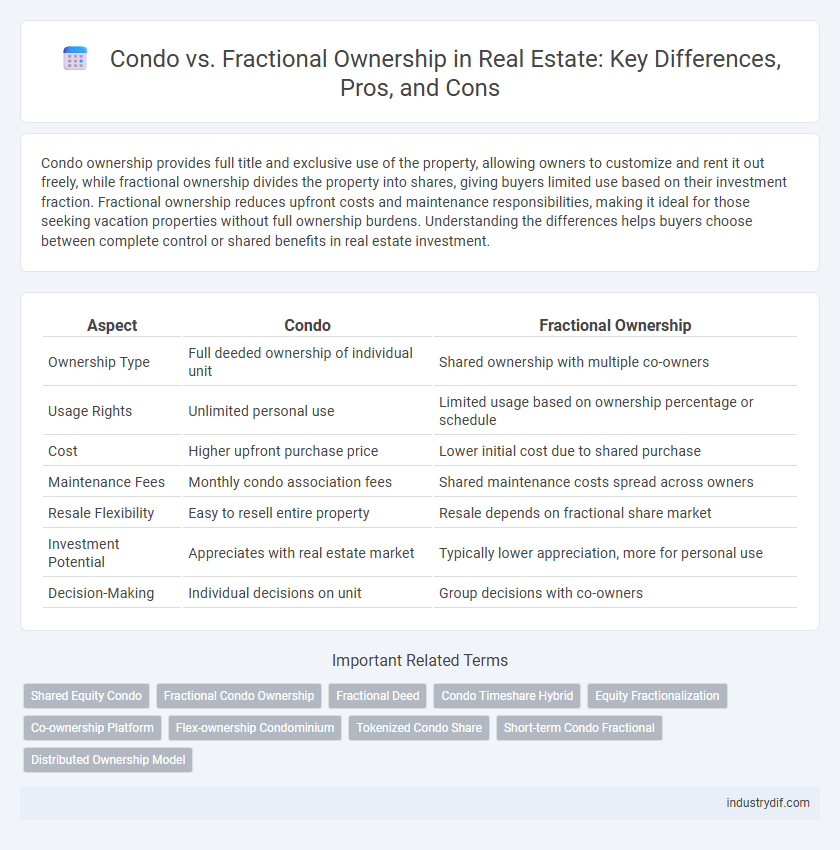

| Aspect | Condo | Fractional Ownership |

|---|---|---|

| Ownership Type | Full deeded ownership of individual unit | Shared ownership with multiple co-owners |

| Usage Rights | Unlimited personal use | Limited usage based on ownership percentage or schedule |

| Cost | Higher upfront purchase price | Lower initial cost due to shared purchase |

| Maintenance Fees | Monthly condo association fees | Shared maintenance costs spread across owners |

| Resale Flexibility | Easy to resell entire property | Resale depends on fractional share market |

| Investment Potential | Appreciates with real estate market | Typically lower appreciation, more for personal use |

| Decision-Making | Individual decisions on unit | Group decisions with co-owners |

Understanding Condo Ownership

Condo ownership provides buyers with exclusive title to their unit and shared interest in common areas such as pools, gyms, and landscaping, governed by a homeowners association (HOA). Owners pay monthly HOA fees covering maintenance, insurance, and amenities, ensuring manageable upkeep and community standards. This structure offers stability and full control over the property, unlike fractional ownership, which divides usage rights among multiple owners without full title.

What Is Fractional Ownership?

Fractional ownership in real estate refers to multiple buyers purchasing a share of a high-value property, granting each owner the right to use the property for a specific period annually. Unlike traditional condo ownership, which involves full ownership of a single unit, fractional ownership allows access to luxury vacation homes or resorts at a fraction of the cost, with shared maintenance and management responsibilities. This model optimizes investment by combining property use with potential rental income and property value appreciation.

Key Differences: Condo vs Fractional Ownership

Condo ownership provides exclusive title and full control over a specific unit, allowing owners to use, sell, or rent their property independently. Fractional ownership divides property rights among multiple owners, who share usage time and maintenance costs but have limited individual control. Unlike condos, fractional ownership often includes shared decision-making and obligations, making it ideal for vacation properties or investment diversification.

Legal Frameworks and Property Rights

Condo ownership grants full legal title to an individual unit along with shared rights to common areas, governed by condominium laws and association bylaws that impose specific maintenance and usage obligations. Fractional ownership divides the property's title into multiple shares, with each owner holding a legally recognized interest but sharing usage rights according to a predefined schedule, often regulated under tenancy-in-common agreements or specialized fractional ownership statutes. Understanding the distinct legal frameworks is crucial for navigating rights, responsibilities, transferability, and dispute resolution in both investment models.

Financial Implications and Costs

Condo ownership involves purchasing the entire unit outright, leading to full responsibility for mortgage payments, property taxes, insurance, and maintenance fees, which can result in higher upfront and ongoing costs. Fractional ownership allows multiple investors to share the purchase price and expenses proportionally, significantly reducing individual financial burdens but often involving additional management fees and limited usage periods. Understanding the differences in tax implications, resale value, and monthly fees is crucial for assessing the financial impact of each option in real estate investment.

Flexibility and Usage Rights

Condo ownership grants full property rights, allowing unlimited personal use and the ability to rent or sell the unit independently. Fractional ownership divides property rights among multiple investors, providing limited usage based on predefined schedules or agreements. This structure often restricts flexibility but reduces costs and maintenance responsibilities compared to sole condo ownership.

Resale Value and Market Demand

Condo ownership offers stronger resale value due to full ownership rights and broader market demand, making it easier to sell and finance. Fractional ownership units often have limited market appeal, as buyers seek partial use and shared costs, which can restrict liquidity and resale price growth. Market demand for condos typically exceeds fractional properties, driven by clear ownership benefits and traditional financing options.

Maintenance and Management Responsibilities

Condo owners are responsible for individual unit maintenance while the homeowners association manages common areas, streamlining upkeep and repairs. Fractional ownership spreads maintenance costs and management duties among co-owners, often handled by a management company to ensure efficient property care. Both options offer shared responsibility, but condos typically provide more structured management through formal associations.

Target Buyers: Who Chooses Which?

Target buyers for condos typically include full-time residents, investors seeking rental income, and those desiring complete control over their property. Fractional ownership appeals to vacationers and luxury buyers interested in shared use of high-end properties with reduced costs and maintenance responsibilities. Buyers prioritize condos for permanence and equity growth, while fractional ownership attracts those valuing flexibility and access to premium real estate without full financial commitment.

Pros and Cons Summary

Condo ownership offers full property rights and the ability to customize living spaces, but entails higher upfront costs and full responsibility for maintenance and property taxes. Fractional ownership provides a cost-effective entry to luxury real estate with shared expenses and reduced personal liability, although usage is limited by time-sharing agreements and less control over property management. Both options have tax implications and resale considerations that vary by jurisdiction and individual investment goals.

Related Important Terms

Shared Equity Condo

Shared equity condo ownership combines the benefits of condo living with co-investment, allowing multiple buyers to hold proportional shares of the property and share both usage rights and appreciation. This model reduces individual financial burden compared to full condo ownership while offering increased flexibility and investment potential in real estate markets.

Fractional Condo Ownership

Fractional condo ownership allows multiple buyers to share equity and usage rights in a single property, significantly lowering individual costs compared to full condo ownership. This model provides access to high-end real estate with reduced financial commitment and shared maintenance expenses, making it attractive for vacation properties and investment diversification.

Fractional Deed

Fractional deed ownership in real estate grants buyers a legally recorded interest in a property, ensuring deeded equity and the ability to sell or mortgage their share independently. Unlike timeshares, fractional deed ownership offers true asset appreciation and exclusive usage rights, making it a lucrative investment option in luxury condo markets.

Condo Timeshare Hybrid

Condo timeshare hybrid ownership combines the benefits of traditional condominium ownership with the flexibility of timeshare use, allowing multiple owners to purchase specific time slots while sharing common property expenses and maintenance. This model offers a cost-effective way to enjoy luxury vacation properties with guaranteed access and potential rental income, blending the long-term value of condos with the rotational convenience of fractional ownership.

Equity Fractionalization

Equity fractionalization in fractional ownership allows multiple investors to hold proportional shares of a property, enabling lower individual capital investment compared to full condo ownership. This model offers liquidity and potential rental income while sharing maintenance costs, contrasting with sole equity control and full responsibility typical in condo ownership.

Co-ownership Platform

Co-ownership platforms revolutionize real estate investment by enabling multiple investors to purchase and share equity in high-value condos through fractional ownership, significantly lowering entry costs while preserving full ownership rights. These platforms streamline property management and legal processes, offering transparent schedules, expense tracking, and resale opportunities, making condo co-ownership a flexible and accessible alternative to sole ownership.

Flex-ownership Condominium

Flex-ownership condominiums combine the benefits of traditional condo ownership with the flexibility of fractional ownership, allowing multiple owners to share usage rights and costs while maintaining individual property interests. This model optimizes investment potential and vacation property access by offering scheduled occupancy and reduced financial commitment compared to full condo ownership.

Tokenized Condo Share

Tokenized condo shares represent a cutting-edge approach to fractional ownership by leveraging blockchain technology to offer investors secure, transparent, and easily tradable real estate assets. This method enhances liquidity and accessibility compared to traditional fractional ownership, allowing smaller investors to participate in high-value condo markets with lower entry costs.

Short-term Condo Fractional

Short-term condo fractional ownership offers partial property rights, allowing investors to enjoy vacation properties at a fraction of the cost and maintenance obligations typically associated with full condo ownership. This model provides flexible usage schedules and shared expenses, making it an attractive option for buyers seeking affordable access to luxury real estate without long-term commitment.

Distributed Ownership Model

Distributed ownership models in real estate, such as condos and fractional ownership, offer distinct approaches to property rights and usage. Condos provide individual ownership of a specific unit within a larger property with shared access to common areas, while fractional ownership allocates a percentage of the property to each owner, allowing shared use and cost efficiency without full individual title.

Condo vs Fractional Ownership Infographic

industrydif.com

industrydif.com