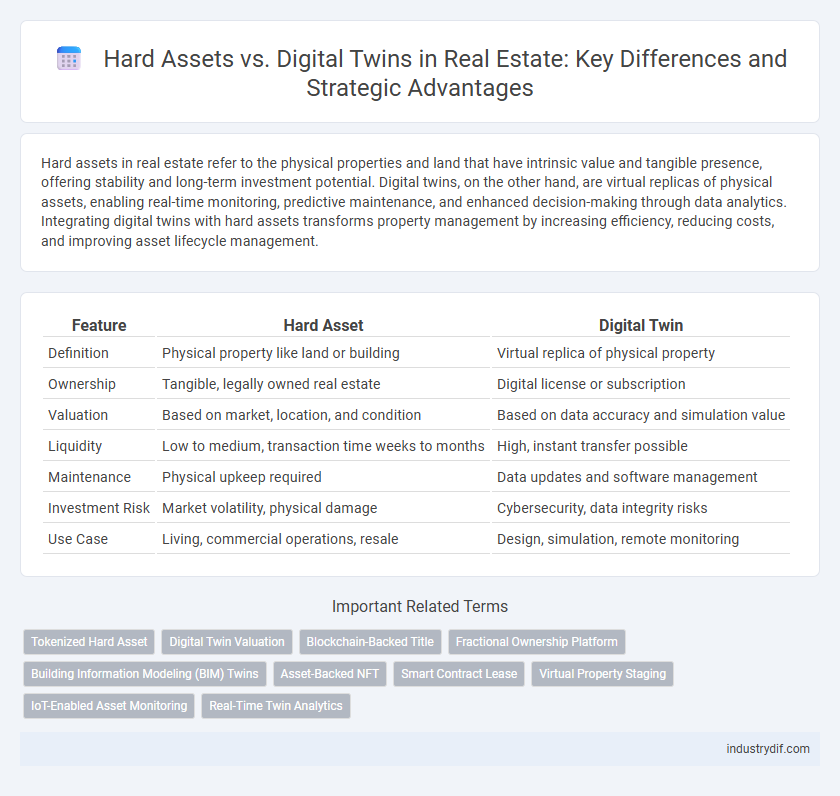

Hard assets in real estate refer to the physical properties and land that have intrinsic value and tangible presence, offering stability and long-term investment potential. Digital twins, on the other hand, are virtual replicas of physical assets, enabling real-time monitoring, predictive maintenance, and enhanced decision-making through data analytics. Integrating digital twins with hard assets transforms property management by increasing efficiency, reducing costs, and improving asset lifecycle management.

Table of Comparison

| Feature | Hard Asset | Digital Twin |

|---|---|---|

| Definition | Physical property like land or building | Virtual replica of physical property |

| Ownership | Tangible, legally owned real estate | Digital license or subscription |

| Valuation | Based on market, location, and condition | Based on data accuracy and simulation value |

| Liquidity | Low to medium, transaction time weeks to months | High, instant transfer possible |

| Maintenance | Physical upkeep required | Data updates and software management |

| Investment Risk | Market volatility, physical damage | Cybersecurity, data integrity risks |

| Use Case | Living, commercial operations, resale | Design, simulation, remote monitoring |

Defining Hard Assets in Real Estate

Hard assets in real estate refer to tangible properties such as land, buildings, and infrastructure that hold intrinsic value and provide physical utility. Unlike digital twins, which are virtual replicas for monitoring and managing properties, hard assets represent the actual physical investments that generate income, appreciate over time, and serve as collateral. These assets offer stability and security in the real estate market due to their concrete existence and long-term value retention.

What is a Digital Twin in Real Estate?

A digital twin in real estate is a virtual replica of a physical property that integrates real-time data and analytics to monitor, manage, and optimize building performance and operations. Unlike hard assets, which are tangible and fixed, digital twins enable detailed simulations and predictive maintenance, enhancing decision-making and reducing costs throughout the property lifecycle. This technology advances property management by providing instant insights into energy usage, structural integrity, and tenant behavior.

Key Differences Between Hard Assets and Digital Twins

Hard assets in real estate represent physical properties such as land and buildings, offering tangible value and long-term investment stability with inherent depreciation considerations. Digital twins, conversely, are virtual replicas of these properties, enabling real-time data analysis, predictive maintenance, and enhanced asset management through IoT integration. The key difference lies in hard assets' physical presence versus digital twins' role as dynamic, data-driven models that optimize performance and operational efficiency.

Importance of Hard Assets in Property Investment

Hard assets provide tangible value and long-term security in property investment, offering physical ownership and potential appreciation through land and buildings. Unlike digital twins, which serve as virtual replicas for management and analysis, hard assets deliver inherent stability and collateral for financing. Investors prioritize hard assets to mitigate risk and capitalize on real estate's enduring market demand.

How Digital Twins Are Transforming Real Estate

Digital twins are revolutionizing real estate by creating precise virtual replicas of physical properties, enabling real-time monitoring, predictive maintenance, and enhanced facility management. These digital replicas improve decision-making through data analytics and simulations, reducing operational costs and extending asset lifecycles. Unlike traditional hard assets, digital twins provide dynamic insights that increase property value and streamline investment strategies.

Asset Management: Physical vs Digital Approaches

Hard asset management in real estate involves direct oversight of physical properties, including maintenance, inspections, and tenant relations, ensuring tangible value and control over the asset. Digital twin technology leverages real-time data and virtual models to simulate and monitor buildings, enhancing predictive maintenance, energy efficiency, and operational decision-making. Combining physical asset management with digital twins creates a hybrid approach that optimizes performance, reduces costs, and improves long-term asset sustainability.

Enhancing Property Value with Digital Twins

Digital twins enhance property value by providing real-time data and predictive analytics, enabling proactive maintenance and efficient energy management in real estate assets. Unlike traditional hard assets, digital twins offer dynamic, virtual representations of physical properties that improve decision-making and reduce operational costs. Integrating digital twin technology increases asset transparency and tenant satisfaction, driving higher returns and long-term value in property management.

Risk Assessment for Hard Assets and Digital Twins

Risk assessment for hard assets in real estate involves evaluating physical vulnerabilities such as structural integrity, environmental exposure, and market fluctuations, which can lead to significant financial loss and asset depreciation. Digital twins enable continuous, real-time monitoring and predictive analytics by simulating physical asset behavior, enhancing risk detection and mitigation strategies through data-driven insights. Leveraging digital twin technology improves accuracy in identifying potential failures, optimizing maintenance schedules, and minimizing unexpected downtime compared to traditional hard asset risk assessment methods.

Integration of Digital Twins into Traditional Real Estate

Integrating digital twins into traditional real estate transforms hard assets by enabling real-time monitoring, predictive maintenance, and enhanced asset management through virtual replicas. This fusion improves decision-making efficiency, reduces operational costs, and provides detailed spatial analytics for property managers and investors. Leveraging IoT sensors and BIM data within digital twins creates a dynamic interface that bridges physical structures with digital intelligence.

Future Trends: Hard Assets and Digital Twins in Real Estate

Hard assets in real estate maintain intrinsic value through physical ownership and tangible properties such as land and buildings, providing long-term investment security. Digital twins offer innovative future trends by creating virtual replicas of physical real estate, enabling real-time monitoring, predictive maintenance, and enhanced property management efficiency. Integration of digital twins with blockchain technology is poised to revolutionize asset transparency, transaction speed, and data-driven decision-making in the real estate sector.

Related Important Terms

Tokenized Hard Asset

Tokenized hard assets in real estate represent fractional ownership of physical properties secured on blockchain, enhancing liquidity and transparency compared to traditional hard asset investments. Digital twins complement tokenized assets by providing detailed virtual replicas of properties, enabling real-time monitoring and data-driven decision-making for investors.

Digital Twin Valuation

Digital twin valuation leverages real-time data and advanced analytics to generate precise asset performance insights, enabling dynamic market assessment beyond traditional hard asset valuation methods. By integrating IoT sensors and BIM models, digital twins enhance predictive maintenance, reduce operational costs, and provide investors with a comprehensive understanding of property value fluctuations.

Blockchain-Backed Title

Blockchain-backed title systems enhance real estate transactions by securely linking hard assets with their digital twins, ensuring immutable ownership records and reducing fraud risk. This integration streamlines title verification and transfer processes, leveraging decentralized ledgers to provide transparent, real-time updates for both physical properties and their virtual representations.

Fractional Ownership Platform

Fractional ownership platforms leverage digital twin technology to provide precise, real-time virtual representations of hard assets, enabling investors to buy, sell, and manage shares with enhanced transparency and liquidity. This integration transforms traditional real estate investment by combining tangible property value with scalable, data-driven asset management.

Building Information Modeling (BIM) Twins

Building Information Modeling (BIM) Twins transform traditional hard assets by creating precise digital replicas that enable enhanced visualization, simulation, and management of real estate properties throughout their lifecycle. This integration of physical building data with advanced digital models optimizes maintenance, reduces costs, and improves decision-making accuracy in real estate development and operations.

Asset-Backed NFT

Asset-Backed NFTs in real estate uniquely combine the tangible value of hard assets like properties with the efficiency and liquidity of digital twins, enabling fractional ownership and streamlined transactions on the blockchain. This innovation enhances transparency, reduces intermediaries, and ensures secure, verifiable asset representation for investors worldwide.

Smart Contract Lease

Hard assets like real estate provide tangible ownership and long-term value, while digital twins create precise virtual replicas enabling real-time property management. Smart contract leases leverage blockchain technology within digital twins to automate transactions, enforce lease terms, and reduce disputes in property management.

Virtual Property Staging

Virtual property staging utilizes digital twin technology to create realistic, interactive models of physical real estate assets, enhancing marketability without altering the hard asset itself. This approach reduces costs and time associated with traditional staging, enabling potential buyers to visualize interior design possibilities through immersive virtual experiences.

IoT-Enabled Asset Monitoring

IoT-enabled asset monitoring in real estate enhances hard asset management by providing real-time data on structural integrity, energy usage, and environmental conditions, enabling predictive maintenance and improved operational efficiency. Digital twins replicate physical properties in a virtual environment, leveraging IoT sensors to simulate performance and optimize building management through data-driven insights.

Real-Time Twin Analytics

Real-time twin analytics in real estate enable dynamic monitoring of property performance by integrating sensor data and digital twin models, providing actionable insights for asset management and predictive maintenance. Hard assets offer tangible value and physical presence, while digital twins enhance decision-making through continuous data-driven optimization and operational efficiency.

Hard asset vs Digital twin Infographic

industrydif.com

industrydif.com