Mortgage brokers offer personalized guidance by connecting borrowers with multiple lenders to find tailored loan options, often leveraging established relationships and market expertise. Digital mortgage platforms streamline the application process through automation and online tools, providing faster approvals and increased convenience without traditional face-to-face interaction. Choosing between a mortgage broker and a digital mortgage platform depends on the need for customized advice versus the preference for speed and technological efficiency.

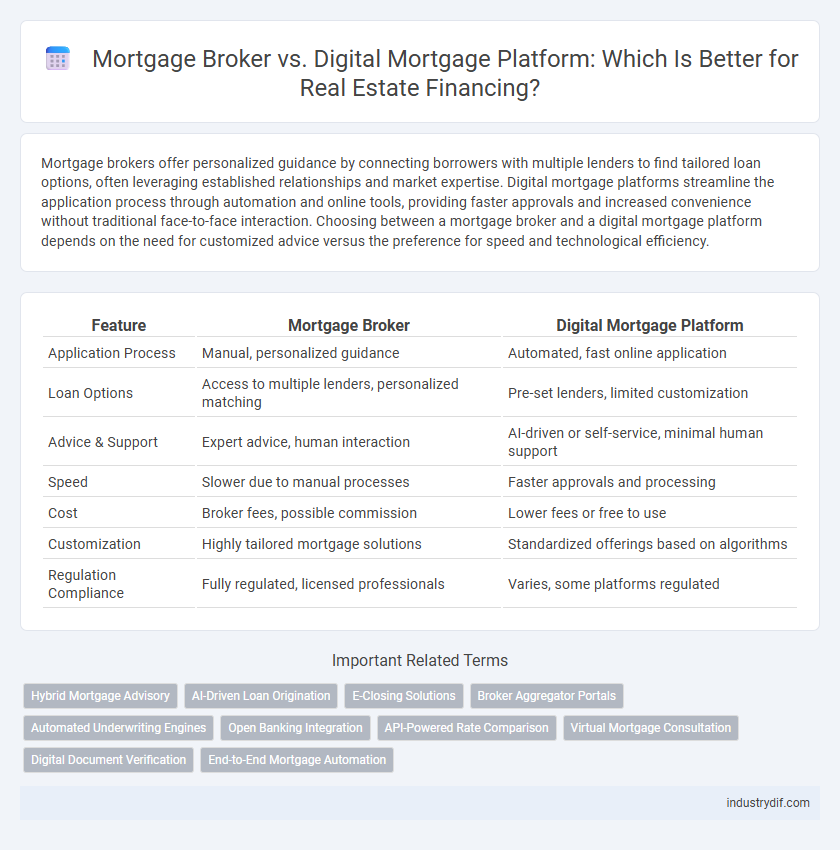

Table of Comparison

| Feature | Mortgage Broker | Digital Mortgage Platform |

|---|---|---|

| Application Process | Manual, personalized guidance | Automated, fast online application |

| Loan Options | Access to multiple lenders, personalized matching | Pre-set lenders, limited customization |

| Advice & Support | Expert advice, human interaction | AI-driven or self-service, minimal human support |

| Speed | Slower due to manual processes | Faster approvals and processing |

| Cost | Broker fees, possible commission | Lower fees or free to use |

| Customization | Highly tailored mortgage solutions | Standardized offerings based on algorithms |

| Regulation Compliance | Fully regulated, licensed professionals | Varies, some platforms regulated |

Introduction to Mortgage Brokers and Digital Mortgage Platforms

Mortgage brokers act as intermediaries connecting borrowers with multiple lenders, offering personalized guidance and comparing loan options to secure the best mortgage rates tailored to individual financial profiles. Digital mortgage platforms utilize advanced technology and automated processes to streamline application submissions, underwriting, and approvals, providing faster and often more convenient access to mortgage products. Both serve critical roles in the real estate financing landscape, with brokers emphasizing expert consultation and platforms prioritizing efficiency and accessibility.

Key Differences Between Mortgage Brokers and Digital Mortgage Platforms

Mortgage brokers offer personalized guidance by assessing multiple lenders to find tailored loan options, while digital mortgage platforms provide automated, streamlined application processes with faster approvals. Brokers leverage expert knowledge to navigate complex financial situations and negotiate terms, whereas digital platforms emphasize convenience and accessibility through technology-driven tools. The key difference lies in human interaction and customization versus speed and efficiency enabled by advanced algorithms.

How Mortgage Brokers Operate in Today’s Market

Mortgage brokers act as intermediaries between borrowers and lenders, providing personalized guidance by analyzing multiple loan products to find the best fit for clients, often leveraging their network to secure competitive interest rates. They conduct thorough credit assessments, assist with complex paperwork, and offer tailored advice based on individual financial situations, which is crucial in a market with diverse lending options and regulations. In today's dynamic real estate market, mortgage brokers combine traditional relationship-building with digital tools to streamline application processes, ensuring efficiency and customized support throughout the home financing journey.

The Rise of Digital Mortgage Platforms in Real Estate

Digital mortgage platforms have transformed the real estate industry by streamlining loan processing through automated underwriting and faster application approvals. These platforms leverage AI-driven analytics to provide personalized loan options, reducing reliance on traditional mortgage brokers and enhancing user experience. Increased adoption of digital mortgage technology drives efficiency, lowers costs, and expands access to financing for homebuyers.

Pros and Cons of Using a Mortgage Broker

Mortgage brokers offer personalized guidance, access to multiple lenders, and tailored loan options, making them valuable for borrowers with complex financial situations or unique credit profiles. However, fees can be higher due to broker commissions, and the process may take longer compared to digital mortgage platforms that provide faster, automated approvals and competitive rates. Relying on a mortgage broker ensures expert negotiation and support but may lack the convenience and instant transparency found in digital mortgage platforms.

Advantages and Disadvantages of Digital Mortgage Platforms

Digital mortgage platforms offer the advantage of streamlined application processes, faster approvals, and 24/7 accessibility, making them ideal for tech-savvy borrowers seeking convenience. However, these platforms may lack personalized guidance and nuanced negotiation skills that experienced mortgage brokers provide, potentially limiting support in complex financing situations. Security concerns and limited customization options also pose disadvantages compared to traditional broker services.

Factors to Consider When Choosing a Mortgage Solution

Choosing between a mortgage broker and a digital mortgage platform depends on factors such as personalized service, speed, and flexibility. Mortgage brokers offer tailored advice and access to multiple lenders, ideal for complex financial situations, while digital platforms provide convenience, quick approvals, and competitive rates through automated processes. Assess your comfort with technology, need for expert guidance, and urgency in securing a loan to select the best mortgage solution.

Impact on Homebuyers’ Experience and Approval Speed

Mortgage brokers provide personalized guidance and negotiate with multiple lenders to secure tailored loan options, enhancing homebuyers' confidence and understanding throughout the approval process. Digital mortgage platforms streamline applications using automated verification and AI-driven credit assessment, significantly reducing approval times from weeks to days. Homebuyers benefit from faster decisions and increased transparency, while brokers offer customized support for complex financial situations.

Security and Data Privacy: Broker vs Digital Platform

Mortgage brokers often provide personalized security measures, relying on established relationships and regulatory compliance to protect client data. Digital mortgage platforms utilize advanced encryption protocols, multi-factor authentication, and AI-driven fraud detection to safeguard sensitive information. Both approaches prioritize data privacy, but digital platforms offer real-time monitoring and automated security updates, enhancing protection against cyber threats.

Future Trends in Mortgage Origination and Technology

Emerging trends in mortgage origination highlight a shift towards seamless integration of AI and machine learning within digital mortgage platforms, enhancing speed and accuracy in loan processing. Mortgage brokers leverage personalized advice and nuanced borrower insights that technology alone struggles to replicate, maintaining a critical role despite automation advances. The future landscape favors hybrid models combining the efficiency of digital platforms with the expertise of mortgage brokers to optimize customer experience and operational scalability.

Related Important Terms

Hybrid Mortgage Advisory

Hybrid mortgage advisory combines the personalized expertise of mortgage brokers with the efficiency of digital mortgage platforms, offering tailored loan options and streamlined application processes. This hybrid approach enhances client experience by integrating human judgment with advanced technology, improving loan approval rates and satisfaction.

AI-Driven Loan Origination

AI-driven loan origination in digital mortgage platforms leverages machine learning algorithms to analyze credit risk, automate document processing, and expedite approvals, resulting in faster and more accurate mortgage approvals compared to traditional mortgage brokers. Mortgage brokers provide personalized guidance and negotiation expertise, but may lack the real-time data integration and scalability offered by AI-powered digital platforms.

E-Closing Solutions

E-closing solutions offered by digital mortgage platforms streamline the mortgage process with automated document management, secure electronic signatures, and faster funding timelines, enhancing borrower convenience and reducing errors. Mortgage brokers rely on these platforms to complement their personalized service, bridging traditional client relationships with modern technology for seamless, compliant closings.

Broker Aggregator Portals

Mortgage broker aggregator portals integrate multiple brokers and lenders into a centralized digital platform, offering users a wide range of mortgage options and competitive rates in real-time. These portals streamline comparison shopping and application processes, combining the personalized service of brokers with the efficiency of digital mortgage platforms.

Automated Underwriting Engines

Automated Underwriting Engines (AUEs) enhance digital mortgage platforms by rapidly analyzing borrower data and credit profiles to approve loans with higher efficiency and accuracy compared to traditional mortgage brokers. These AI-driven systems reduce human error, accelerate the approval process, and offer personalized loan options by integrating vast financial databases and risk assessment algorithms.

Open Banking Integration

Mortgage brokers leverage personalized expertise and relationships to guide clients through complex loan options, while digital mortgage platforms with open banking integration enable instantaneous, secure access to financial data for faster, more accurate loan approvals. Open banking connectivity streamlines verification processes by directly linking bank accounts, reducing paperwork and enhancing transparency in the real estate financing journey.

API-Powered Rate Comparison

API-powered rate comparison enables mortgage brokers to access real-time pricing from multiple lenders, enhancing personalized service and competitive offers. Digital mortgage platforms leverage these APIs to streamline the borrower experience with instant rate updates and seamless application integration.

Virtual Mortgage Consultation

Virtual mortgage consultations through digital mortgage platforms offer streamlined access to real-time loan comparisons and instant pre-approvals, enhancing efficiency for homebuyers. Mortgage brokers provide personalized guidance and tailored loan options but may involve longer processing times and less immediate digital interaction.

Digital Document Verification

Digital mortgage platforms leverage advanced digital document verification technologies, such as AI-driven OCR and blockchain security, to streamline loan processing with increased accuracy and reduced fraud risk. Mortgage brokers often rely on manual verification, which can slow approval times and introduce errors compared to the efficient, automated validation provided by digital platforms.

End-to-End Mortgage Automation

Mortgage brokers offer personalized guidance by navigating complex loan options, while digital mortgage platforms leverage end-to-end mortgage automation to streamline application processing, underwriting, and approval in real-time. Advanced digital platforms reduce human errors and expedite loan closures, transforming traditional mortgage experiences with seamless integration of AI-driven data analysis and e-signatures.

Mortgage Broker vs Digital Mortgage Platform Infographic

industrydif.com

industrydif.com