Traditional mortgages offer stability with fixed interest rates and established legal frameworks, making them a reliable choice for most homebuyers. Crypto-mortgages introduce innovative financing by leveraging blockchain technology and cryptocurrencies, enabling faster approvals and increased transparency. However, they carry higher volatility risks and regulatory uncertainties compared to conventional mortgage options.

Table of Comparison

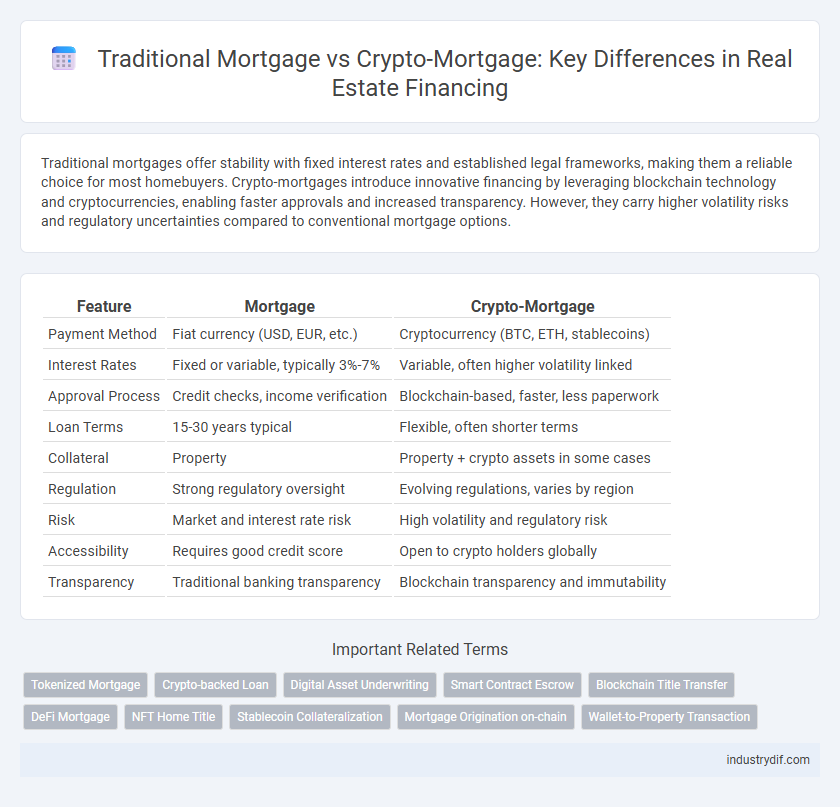

| Feature | Mortgage | Crypto-Mortgage |

|---|---|---|

| Payment Method | Fiat currency (USD, EUR, etc.) | Cryptocurrency (BTC, ETH, stablecoins) |

| Interest Rates | Fixed or variable, typically 3%-7% | Variable, often higher volatility linked |

| Approval Process | Credit checks, income verification | Blockchain-based, faster, less paperwork |

| Loan Terms | 15-30 years typical | Flexible, often shorter terms |

| Collateral | Property | Property + crypto assets in some cases |

| Regulation | Strong regulatory oversight | Evolving regulations, varies by region |

| Risk | Market and interest rate risk | High volatility and regulatory risk |

| Accessibility | Requires good credit score | Open to crypto holders globally |

| Transparency | Traditional banking transparency | Blockchain transparency and immutability |

Understanding Traditional Mortgages

Traditional mortgages involve borrowing a fixed amount of money from a bank or financial institution to purchase property, secured by the real estate itself. These loans typically include a set interest rate, repayment schedule, and require credit checks and income verification to qualify. Understanding the stability, regulatory framework, and long-term financial commitment of traditional mortgages is essential before exploring emerging options like crypto-mortgages.

What Is a Crypto-Mortgage?

A crypto-mortgage is a type of home loan that allows borrowers to use cryptocurrencies like Bitcoin or Ethereum as collateral or payment for real estate purchases. Unlike traditional mortgages that rely on fiat currency and credit evaluations, crypto-mortgages leverage blockchain technology and digital assets for financing. This innovative approach offers faster approval processes and potential access to a broader range of lenders specializing in digital currency transactions.

Eligibility Criteria: Mortgage vs Crypto-Mortgage

Traditional mortgage eligibility typically requires a strong credit score, stable income, and proof of employment, emphasizing financial history and debt-to-income ratio. Crypto-mortgage eligibility centers on the value and liquidity of cryptocurrency holdings, often demanding wallet verification and crypto asset appraisal instead of standard credit checks. Lenders offering crypto-mortgages prioritize blockchain transparency and digital asset volatility when assessing borrower risk.

Application Process Comparison

The application process for traditional mortgages involves extensive credit checks, income verification, and proof of assets submitted through banks or mortgage brokers. Crypto-mortgages streamline approval by leveraging blockchain technology, using digital assets as collateral and enabling faster, often automated verification without traditional credit scoring. While conventional mortgages require lengthy paperwork and bank intermediaries, crypto-mortgages offer a more transparent and efficient process through decentralized systems and smart contracts.

Interest Rates and Repayment Terms

Mortgage interest rates typically range from 3% to 7% annually, with fixed or variable repayment terms spanning 15 to 30 years, ensuring predictable monthly payments and long-term financial planning. Crypto-mortgages offer dynamic interest rates influenced by cryptocurrency market volatility, often starting lower than traditional rates but subject to rapid fluctuations, with repayment terms that can be shorter or more flexible depending on the lender and digital asset performance. Borrowers using crypto-mortgages should consider the potential for higher risk due to price swings in cryptocurrencies, which can impact collateral value and repayment obligations compared to the stability of conventional mortgage agreements.

Security and Regulatory Considerations

Traditional mortgages are governed by well-established regulatory frameworks, offering predictable legal protections and insured transactions, which enhance borrower security. Crypto-mortgages operate on blockchain technology, providing transparency and decentralization but face regulatory uncertainties and varying legal recognition across jurisdictions. Security concerns in crypto-mortgages include smart contract vulnerabilities and lack of standardized consumer protection mechanisms compared to conventional mortgage systems.

Volatility and Financial Risks

Traditional mortgages offer fixed interest rates and predictable payment schedules, minimizing financial volatility for borrowers. Crypto-mortgages, however, expose borrowers to significant volatility due to fluctuating cryptocurrency values, increasing the risk of substantial debt changes. This financial uncertainty can lead to higher risk of default and potential loss of collateral compared to conventional mortgage agreements.

Benefits of Traditional Mortgages

Traditional mortgages offer stability through fixed interest rates and predictable monthly payments, providing borrowers with financial certainty over the loan term. They are widely accepted and supported by established financial institutions, ensuring comprehensive legal protections and streamlined approval processes. Access to government-backed programs and tax benefits further enhance the appeal of conventional mortgage options for homebuyers.

Advantages and Drawbacks of Crypto-Mortgages

Crypto-mortgages offer advantages such as faster approval processes, reduced paperwork, and the potential for lower interest rates by leveraging blockchain technology and digital assets. However, their drawbacks include high volatility of cryptocurrency values, regulatory uncertainties, and limited acceptance among lenders, which may increase financial risks for borrowers. Traditional mortgages, by contrast, provide stability and broader market access but often involve longer approval times and stricter qualification criteria.

Future Trends in Real Estate Financing

Emerging trends in real estate financing highlight a shift towards integrating blockchain technology through crypto-mortgages, offering faster transactions and enhanced transparency compared to traditional mortgage systems. Institutions increasingly explore decentralized finance (DeFi) platforms to streamline loan approvals and reduce intermediary costs, potentially transforming property investment accessibility. Market analysis predicts wider adoption of digital currencies in mortgage settlements, reflecting a growing trust in crypto-assets as viable collateral within the housing sector.

Related Important Terms

Tokenized Mortgage

Tokenized mortgages integrate blockchain technology to convert real estate debt into digital assets, enabling increased liquidity and fractional ownership compared to traditional mortgage processes. This innovation simplifies trading and transparency in mortgage transactions, offering potential cost reductions and faster settlement times within the real estate market.

Crypto-backed Loan

Crypto-backed loans offer homeowners the ability to leverage cryptocurrency assets as collateral for mortgage financing, providing faster approval and flexible terms compared to traditional mortgages. These loans typically feature lower interest rates and avoid credit checks, making them an attractive alternative in real estate financing for investors holding digital assets.

Digital Asset Underwriting

Digital Asset Underwriting in crypto-mortgage assesses blockchain-verified assets, enabling faster approval and reduced fraud compared to traditional mortgage underwriting that relies on conventional credit scores and physical documentation. This innovative approach leverages real-time digital asset valuations and smart contracts, transforming mortgage accessibility and risk evaluation in the real estate market.

Smart Contract Escrow

Smart contract escrow in crypto-mortgages automates fund releases upon meeting predefined terms, enhancing transparency and reducing reliance on traditional intermediaries found in conventional mortgages. This innovation minimizes fraud risks and expedites transaction settlements by executing escrow conditions through blockchain technology.

Blockchain Title Transfer

Blockchain title transfer in crypto-mortgages offers a secure, transparent alternative to traditional mortgage title transfers by recording ownership on an immutable ledger. This technology reduces fraud risk and accelerates transaction times compared to conventional paper-based processes in real estate financing.

DeFi Mortgage

DeFi mortgages leverage blockchain technology to offer decentralized, transparent lending solutions, eliminating traditional banks and reducing approval times compared to conventional mortgages. By using cryptocurrencies as collateral, DeFi mortgages enable faster, borderless transactions with potentially lower interest rates and increased financial inclusivity in the real estate market.

NFT Home Title

A mortgage involves traditional lending secured by a physical property title, whereas a crypto-mortgage leverages blockchain technology with NFT home titles representing ownership as unique digital assets. NFT home titles enhance transparency and security by enabling immutable, verifiable property records that streamline transactions and reduce fraud risks in real estate financing.

Stablecoin Collateralization

Stablecoin collateralization in crypto-mortgages offers a more transparent and efficient alternative to traditional mortgages by leveraging blockchain technology to secure loan value with low-volatility digital assets. This method reduces counterparty risk and facilitates faster loan approvals compared to conventional mortgage processes reliant on fluctuating fiat currency markets.

Mortgage Origination on-chain

Mortgage origination on-chain leverages blockchain technology to automate and secure the loan approval process, enhancing transparency and reducing processing time compared to traditional mortgages. Crypto-mortgages utilize digital assets as collateral, enabling decentralized verification and faster settlement while minimizing reliance on conventional credit bureaus and financial institutions.

Wallet-to-Property Transaction

Wallet-to-property transactions streamline the mortgage process by enabling direct cryptocurrency payments from digital wallets, reducing intermediaries and settlement times. This innovation enhances transparency and security in real estate financing, leveraging blockchain technology to facilitate faster, more efficient property acquisitions compared to traditional mortgage systems.

Mortgage vs Crypto-mortgage Infographic

industrydif.com

industrydif.com