Real estate investment offers direct ownership and long-term value appreciation, while tokenized real estate provides fractional ownership and increased liquidity through blockchain technology. Tokenized assets allow investors to diversify portfolios with lower entry costs and faster transactions. Both methods present unique opportunities, but tokenization enhances accessibility and transparency in property investment.

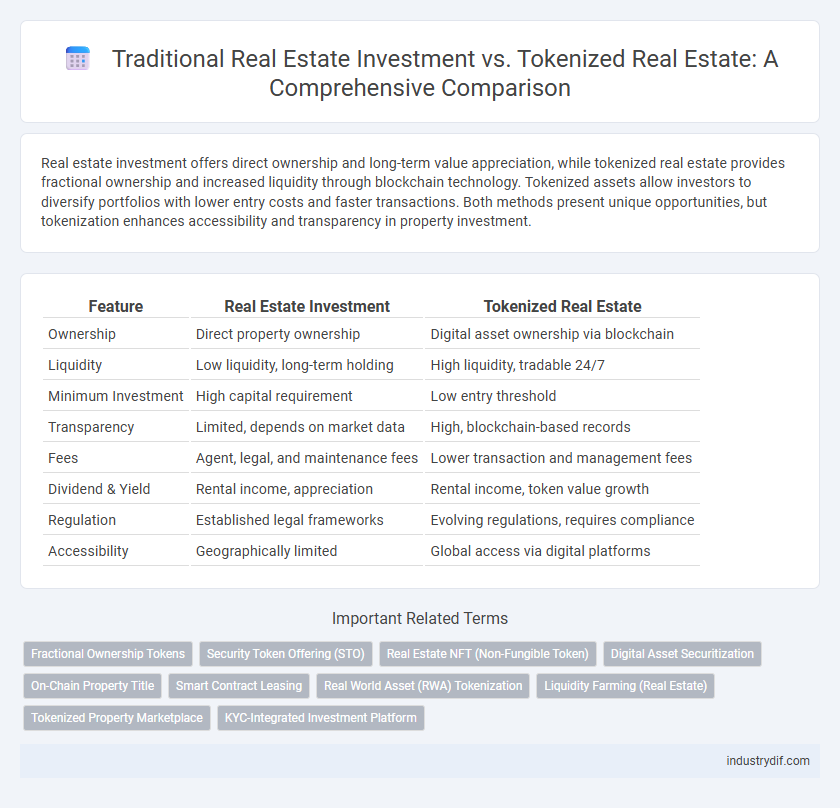

Table of Comparison

| Feature | Real Estate Investment | Tokenized Real Estate |

|---|---|---|

| Ownership | Direct property ownership | Digital asset ownership via blockchain |

| Liquidity | Low liquidity, long-term holding | High liquidity, tradable 24/7 |

| Minimum Investment | High capital requirement | Low entry threshold |

| Transparency | Limited, depends on market data | High, blockchain-based records |

| Fees | Agent, legal, and maintenance fees | Lower transaction and management fees |

| Dividend & Yield | Rental income, appreciation | Rental income, token value growth |

| Regulation | Established legal frameworks | Evolving regulations, requires compliance |

| Accessibility | Geographically limited | Global access via digital platforms |

Understanding Traditional Real Estate Investment

Traditional real estate investment involves purchasing physical properties such as residential, commercial, or rental units, requiring substantial capital and managing maintenance, tenants, and legal responsibilities. Investors benefit from asset appreciation, rental income, and tax advantages but face liquidity challenges and high entry barriers. Understanding market trends, property valuation, and location are critical factors to maximize returns and minimize risks in conventional real estate investing.

What Is Tokenized Real Estate?

Tokenized real estate refers to the process of converting ownership rights in a property into digital tokens on a blockchain, enabling fractional ownership and easier transferability. This innovation reduces entry barriers for investors by allowing smaller investments and enhancing liquidity compared to traditional real estate transactions. Tokenization also streamlines property management and offers transparency through immutable ledger records.

Key Differences: Ownership and Accessibility

Real estate investment traditionally involves direct ownership of physical property, requiring significant capital and limiting access to accredited investors. Tokenized real estate divides ownership into digital tokens on a blockchain, enabling fractional ownership and broader accessibility for retail investors. This decentralized approach enhances liquidity and simplifies transactions compared to conventional real estate investment models.

Liquidity Comparison: Tokenized vs Traditional

Tokenized real estate offers significantly higher liquidity compared to traditional real estate investment by enabling fractional ownership and 24/7 trading on digital platforms. Traditional real estate investments often require lengthy sale processes and incur high transaction costs, limiting quick access to capital. The integration of blockchain technology in tokenized assets provides greater transparency and faster settlement times, enhancing overall market efficiency.

Investment Minimums and Barriers to Entry

Real estate investment traditionally requires substantial capital, with minimums often starting at tens of thousands of dollars, creating high barriers to entry for average investors. Tokenized real estate platforms significantly lower these thresholds by allowing fractional ownership, enabling investors to participate with amounts as low as a few hundred dollars. This democratization of access reduces liquidity constraints and diversifies investment opportunities across broader investor demographics.

Regulatory Considerations and Compliance

Real estate investment requires adherence to well-established regulatory frameworks such as property laws, zoning regulations, and traditional financial compliance including SEC oversight for investment funds. Tokenized real estate introduces complexities with securities law compliance, anti-money laundering (AML) rules, and evolving blockchain-specific regulations that vary widely by jurisdiction. Investors must navigate these differing compliance landscapes to ensure legal security and protect asset valuation in both traditional and tokenized markets.

Fractional Ownership in Tokenized Real Estate

Real estate investment traditionally requires significant capital, limiting access for many investors, while tokenized real estate enables fractional ownership through blockchain technology, allowing investors to purchase and trade property shares easily. Fractional ownership in tokenized real estate reduces entry barriers and increases liquidity by dividing properties into digital tokens representing portions of the asset. This innovative model offers transparency, faster transactions, and global accessibility, transforming how investors participate in real estate markets.

Risk Factors in Both Investment Models

Real estate investment carries risks such as market volatility, property depreciation, and illiquidity, which can affect long-term returns. Tokenized real estate introduces additional risks including regulatory uncertainty, cybersecurity threats, and platform reliability, alongside traditional market risks. Both models require thorough due diligence, with tokenized assets demanding awareness of technology-driven vulnerabilities and evolving legal frameworks.

Future Outlook: Tokenization in Property Markets

Tokenized real estate offers enhanced liquidity and fractional ownership, allowing investors to access diverse portfolios with lower capital requirements compared to traditional real estate investment. Blockchain technology ensures transparency, reduces transaction times, and minimizes costs, making property markets more efficient and accessible. The future outlook for tokenization in property markets predicts widespread adoption as regulatory frameworks evolve and digital asset platforms mature.

Choosing the Right Real Estate Investment Strategy

Real estate investment options range from traditional property ownership to tokenized real estate platforms, each offering distinct benefits and risks. Traditional investments provide tangible asset control and long-term appreciation, while tokenized real estate offers enhanced liquidity, lower entry barriers, and fractional ownership through blockchain technology. Evaluating factors such as investment horizon, risk tolerance, and portfolio diversification helps investors select the optimal strategy aligned with their financial goals.

Related Important Terms

Fractional Ownership Tokens

Real estate investment traditionally requires substantial capital and involves complex transactions, whereas tokenized real estate utilizes blockchain technology to offer fractional ownership tokens that lower entry barriers and enhance liquidity. Fractional ownership tokens enable investors to buy and sell portions of high-value properties seamlessly, increasing market accessibility and diversifying investment portfolios efficiently.

Security Token Offering (STO)

Real estate investment through Security Token Offerings (STO) enables fractional ownership with enhanced liquidity, regulatory compliance, and reduced entry barriers compared to traditional real estate investment models. Tokenized real estate via STOs offers transparent asset management, automatic dividend distribution, and broader market access through blockchain technology.

Real Estate NFT (Non-Fungible Token)

Real estate investment in traditional markets often involves high capital and limited liquidity, while tokenized real estate via Real Estate NFTs enables fractional ownership, increased liquidity, and streamlined transactions on blockchain platforms. Real Estate NFTs represent unique, verifiable property assets with transparent ownership records, fostering accessibility and global participation in real estate markets.

Digital Asset Securitization

Real estate investment traditionally involves buying physical properties requiring significant capital, whereas tokenized real estate leverages digital asset securitization to fractionalize ownership through blockchain technology, enhancing liquidity and accessibility. This method enables investors to trade real estate tokens on digital platforms, providing transparent, efficient transactions and reducing entry barriers in the property market.

On-Chain Property Title

Real estate investment traditionally involves physical property ownership with title deeds managed through centralized registries, leading to potential delays and bureaucratic hurdles. Tokenized real estate utilizes on-chain property titles stored on blockchain networks, enabling transparent, immutable records and seamless fractional ownership transfers, enhancing liquidity and security for investors.

Smart Contract Leasing

Smart contract leasing in tokenized real estate automates rental agreements with blockchain-based, self-executing contracts that enhance transparency, reduce intermediaries, and enable fractional ownership. Traditional real estate investment lacks this automated precision, often resulting in slower processes and higher management costs.

Real World Asset (RWA) Tokenization

Real estate investment offers traditional ownership with tangible asset control, while tokenized real estate leverages blockchain technology to fractionalize ownership through Real World Asset (RWA) tokenization, enhancing liquidity and accessibility. RWA tokenization enables seamless, transparent transactions and global investor participation without the limitations of conventional real estate markets.

Liquidity Farming (Real Estate)

Liquidity farming in traditional real estate investment often faces challenges due to illiquid assets and lengthy transaction processes, limiting quick capital access. Tokenized real estate enhances liquidity farming by enabling fractional ownership and seamless trading on blockchain platforms, allowing investors to efficiently earn yields through decentralized finance mechanisms.

Tokenized Property Marketplace

Tokenized property marketplaces revolutionize real estate investment by enabling fractional ownership through blockchain technology, enhancing liquidity and accessibility for investors worldwide. Unlike traditional real estate investments, these platforms offer transparent transaction records and lower entry barriers, democratizing property market participation.

KYC-Integrated Investment Platform

Real estate investment through traditional methods often involves lengthy due diligence and manual KYC processes, whereas tokenized real estate leverages blockchain technology with KYC-integrated investment platforms to streamline investor verification and enhance transparency. These platforms enable secure fractional ownership, reduce entry barriers, and facilitate faster transactions while maintaining compliance with regulatory standards.

Real estate investment vs Tokenized real estate Infographic

industrydif.com

industrydif.com