Mortgage loans have long been the traditional method for financing property purchases, involving lengthy approval processes and substantial credit requirements. Tokenized real estate offers a modern alternative by enabling fractional property ownership through blockchain technology, increasing liquidity and reducing barriers for investors. This digital approach provides faster transactions and enhanced transparency compared to conventional mortgage financing.

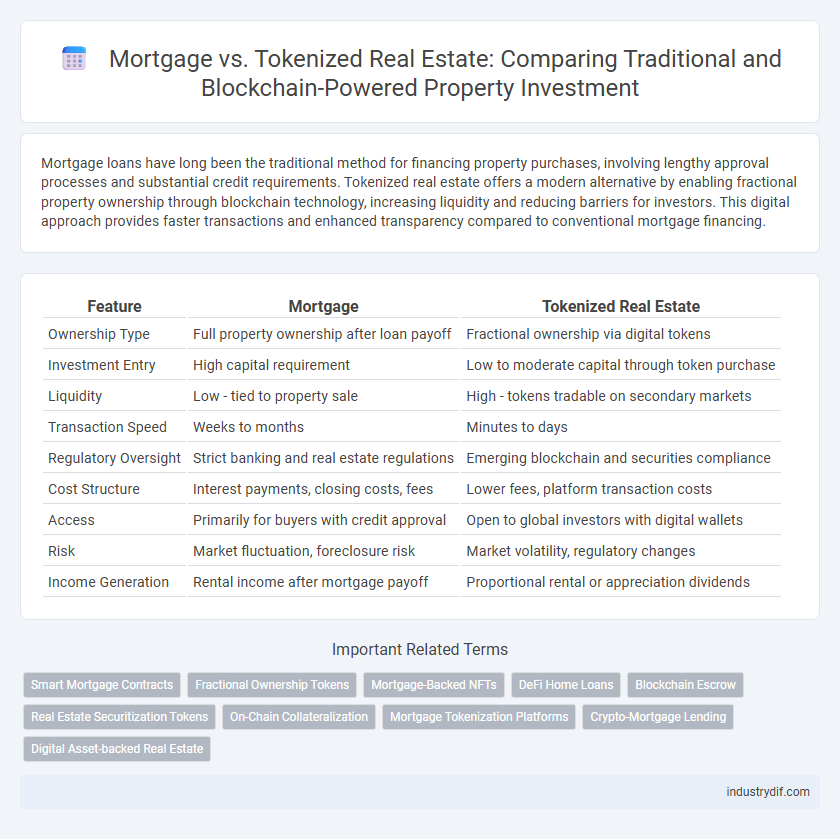

Table of Comparison

| Feature | Mortgage | Tokenized Real Estate |

|---|---|---|

| Ownership Type | Full property ownership after loan payoff | Fractional ownership via digital tokens |

| Investment Entry | High capital requirement | Low to moderate capital through token purchase |

| Liquidity | Low - tied to property sale | High - tokens tradable on secondary markets |

| Transaction Speed | Weeks to months | Minutes to days |

| Regulatory Oversight | Strict banking and real estate regulations | Emerging blockchain and securities compliance |

| Cost Structure | Interest payments, closing costs, fees | Lower fees, platform transaction costs |

| Access | Primarily for buyers with credit approval | Open to global investors with digital wallets |

| Risk | Market fluctuation, foreclosure risk | Market volatility, regulatory changes |

| Income Generation | Rental income after mortgage payoff | Proportional rental or appreciation dividends |

Introduction: Understanding Mortgage and Tokenized Real Estate

Mortgage financing involves borrowing funds from a lender to purchase property, creating a legal lien until the loan is repaid. Tokenized real estate utilizes blockchain technology to represent ownership shares digitally, enabling fractional investment and increased liquidity. This innovative approach transforms traditional property investment by simplifying transactions and broadening access to diverse real estate assets.

Definition and Core Concepts

Mortgage refers to a traditional loan secured by real estate property, allowing buyers to purchase homes by borrowing funds from lenders with the property as collateral. Tokenized real estate involves dividing property ownership into digital tokens on a blockchain, enabling fractional ownership and increased liquidity. Core concepts of tokenized real estate include smart contracts, transparency, and easier transferability compared to conventional mortgage arrangements.

Key Differences Between Mortgage and Tokenized Real Estate

Mortgages involve traditional lending where buyers borrow funds from banks to purchase property, requiring credit checks and long-term repayment schedules. Tokenized real estate converts property ownership into digital tokens on a blockchain, enabling fractional ownership, increased liquidity, and easier access for smaller investors. Unlike mortgages, tokenized assets bypass conventional financial institutions and offer transparent, decentralized transactions with lower entry barriers.

Investment Entry Barriers

Mortgage financing typically requires substantial credit history, income verification, and down payments often exceeding 20%, creating high entry barriers for many investors. Tokenized real estate lowers these barriers by enabling fractional ownership through blockchain technology, allowing investments with significantly smaller capital commitments. This democratization of real estate investment increases liquidity and accessibility, attracting a broader range of participants.

Liquidity and Accessibility

Tokenized real estate provides greater liquidity compared to traditional mortgages by enabling fractional ownership and easier transfer of assets through blockchain technology. Unlike conventional mortgages, which require lengthy approval processes and significant capital, tokenized real estate lowers entry barriers and offers more accessible investment opportunities for a wider range of investors. This digital format allows real estate assets to be bought and sold quickly, increasing market efficiency and accessibility.

Regulatory Environment

The regulatory environment for traditional mortgages is well-established, governed by strict financial laws and oversight bodies such as the Consumer Financial Protection Bureau (CFPB) in the United States. Tokenized real estate faces evolving regulations, with agencies like the Securities and Exchange Commission (SEC) scrutinizing digital tokens under securities laws to ensure investor protection. Compliance challenges in tokenized assets include anti-money laundering (AML) requirements, Know Your Customer (KYC) protocols, and cross-border legal considerations, distinguishing it from conventional mortgage regulations.

Risk Factors and Security

Mortgage loans involve traditional collateral risk and credit checks, exposing borrowers to potential foreclosure if repayments fail. Tokenized real estate leverages blockchain technology to enhance transparency and reduce counterparty risk through smart contracts and immutable records. However, tokenized assets face regulatory uncertainties and cybersecurity threats that require robust digital safeguards to ensure investor protection.

Ownership Structure and Rights

Traditional mortgages grant borrowers legal ownership with a lien held by the lender, allowing homebuyers full property rights while the mortgage is repaid. Tokenized real estate divides ownership into blockchain-based tokens, enabling fractional ownership and direct transferability without intermediaries. This decentralized structure enhances liquidity but may involve regulatory complexities compared to conventional mortgage agreements.

Market Trends and Future Outlook

Mortgage financing remains a dominant method in real estate transactions, with global mortgage debt reaching $12 trillion in 2023. Tokenized real estate platforms are rapidly gaining traction, offering fractional ownership and increased liquidity through blockchain technology, projected to grow at a CAGR of 30% by 2030. Market trends indicate that tokenization will disrupt traditional mortgage models by enabling faster transactions and broader investor access, reshaping the future of real estate investment.

Choosing the Right Option for Investors

Investors weighing mortgage financing against tokenized real estate should consider factors such as liquidity, accessibility, and risk exposure. Mortgages involve traditional debt with fixed payment schedules and potential tax advantages, while tokenized real estate offers fractional ownership, enhanced liquidity through blockchain platforms, and lower entry barriers. Evaluating asset control, transaction transparency, and market volatility enables investors to align their choices with financial goals and risk tolerance.

Related Important Terms

Smart Mortgage Contracts

Smart mortgage contracts leverage blockchain technology to automate and secure the lending process, reducing fraud and enhancing transparency compared to traditional mortgages. Tokenized real estate enables fractional ownership and quicker liquidity, while smart contracts enforce mortgage terms efficiently without intermediaries.

Fractional Ownership Tokens

Fractional ownership tokens in tokenized real estate enable investors to purchase and trade precise shares of properties on blockchain platforms, increasing liquidity and accessibility compared to traditional mortgage financing that requires full loan commitments and lengthy approval processes. These digital tokens reduce entry barriers, allowing diversified real estate portfolios with lower capital investment, unlike conventional mortgages that tie owners to fixed debt and longer-term financial obligations.

Mortgage-Backed NFTs

Mortgage-backed NFTs represent a revolutionary fusion of traditional mortgage financing and blockchain technology, allowing investors to buy fractional ownership in real estate loans with increased liquidity and transparency. These digital assets enable streamlined mortgage-backed securities trading, reducing intermediaries and enhancing access to real estate investment through decentralized finance platforms.

DeFi Home Loans

DeFi home loans leverage blockchain technology to offer mortgage alternatives through tokenized real estate, enabling fractional ownership and increased liquidity without traditional credit checks. Smart contracts automate loan terms and repayments, reducing intermediaries and transaction costs compared to conventional mortgage processes.

Blockchain Escrow

Blockchain escrow in tokenized real estate ensures secure, transparent transactions by automating fund releases through smart contracts, reducing fraud risks common in traditional mortgage processes. This decentralized approach enhances trust and efficiency by verifying ownership and payment milestones instantaneously on the blockchain ledger.

Real Estate Securitization Tokens

Real estate securitization tokens represent fractional ownership of property assets, enabling increased liquidity and flexible investment opportunities compared to traditional mortgages, which involve fixed loan agreements secured by real property. These blockchain-based tokens facilitate faster transactions, reduced costs, and enhanced transparency through smart contracts and decentralized ledgers.

On-Chain Collateralization

Mortgage loans rely on traditional credit assessments and off-chain collateral documentation, whereas tokenized real estate enables on-chain collateralization by representing property ownership through blockchain-based tokens, enhancing transparency and liquidity. On-chain collateralization streamlines asset transfer, reduces fraud risk, and allows fractionalized property investment, revolutionizing how real estate financing operates.

Mortgage Tokenization Platforms

Mortgage tokenization platforms leverage blockchain technology to convert traditional mortgage assets into digital tokens, enhancing liquidity and enabling fractional ownership. These platforms facilitate faster transactions, transparency, and reduced costs compared to conventional mortgage processes, revolutionizing real estate financing.

Crypto-Mortgage Lending

Crypto-mortgage lending merges blockchain technology with real estate financing, enabling borrowers to use cryptocurrency assets as collateral for mortgage loans, providing faster approval and increased liquidity. Unlike traditional mortgage processes that rely on credit scores and extensive paperwork, tokenized real estate facilitates fractional ownership and seamless transfer of property rights through digital tokens on decentralized platforms.

Digital Asset-backed Real Estate

Tokenized real estate leverages blockchain technology to create digital asset-backed ownership, enabling fractional investments and increased liquidity compared to traditional mortgage financing. This innovation reduces entry barriers and streamlines transactions by digitizing property shares, contrasting with the lengthy approval and underwriting processes typical of conventional mortgages.

Mortgage vs Tokenized Real Estate Infographic

industrydif.com

industrydif.com