Timeshares offer shared property ownership with fixed usage schedules, limiting flexibility and resale options. Tokenization leverages blockchain technology to divide real estate into tradable digital assets, enhancing liquidity and enabling fractional ownership. This modern approach provides increased transparency, ease of transfer, and access to a broader pool of investors compared to traditional timeshares.

Table of Comparison

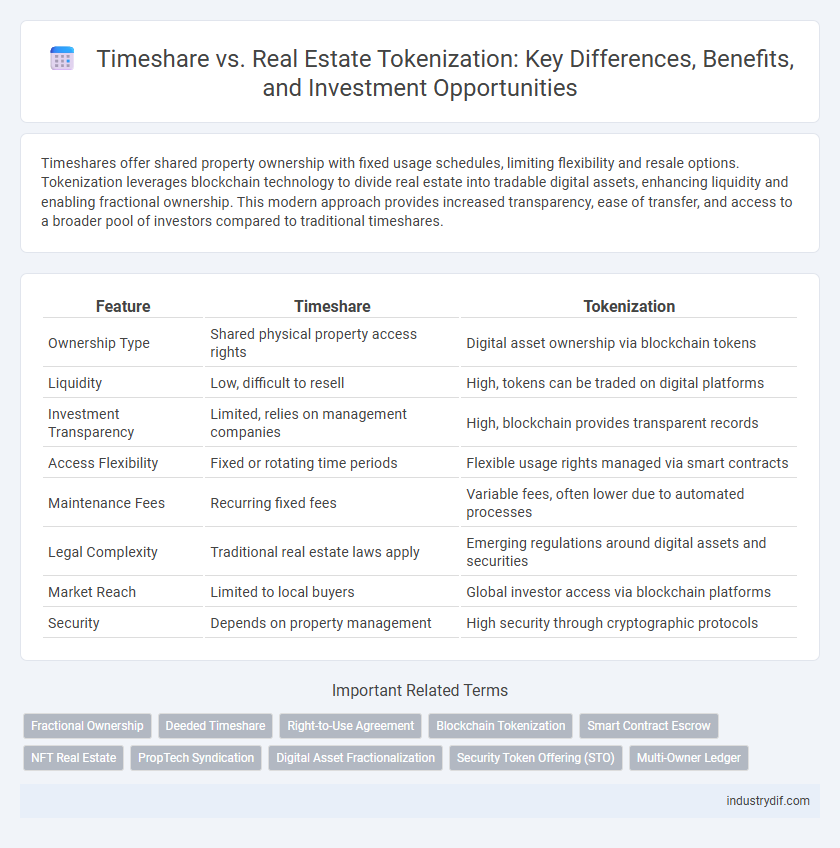

| Feature | Timeshare | Tokenization |

|---|---|---|

| Ownership Type | Shared physical property access rights | Digital asset ownership via blockchain tokens |

| Liquidity | Low, difficult to resell | High, tokens can be traded on digital platforms |

| Investment Transparency | Limited, relies on management companies | High, blockchain provides transparent records |

| Access Flexibility | Fixed or rotating time periods | Flexible usage rights managed via smart contracts |

| Maintenance Fees | Recurring fixed fees | Variable fees, often lower due to automated processes |

| Legal Complexity | Traditional real estate laws apply | Emerging regulations around digital assets and securities |

| Market Reach | Limited to local buyers | Global investor access via blockchain platforms |

| Security | Depends on property management | High security through cryptographic protocols |

Understanding Timeshare in Real Estate

Timeshare in real estate involves multiple buyers purchasing rights to use a property for specific time periods, typically weeks or months each year, sharing ownership without full title transfer. Unlike traditional ownership, timeshares offer limited usage but reduce costs and maintenance responsibilities by distributing expenses among participants. Understanding this model is essential before comparing it to modern tokenization, which leverages blockchain to fractionalize property ownership digitally.

What is Real Estate Tokenization?

Real estate tokenization involves converting property ownership into digital tokens on a blockchain, enabling fractional ownership and increased liquidity. This innovative approach allows investors to buy and sell shares of real estate assets seamlessly without the traditional barriers of time and high capital requirements. Compared to timeshares, tokenization offers true ownership rights and broader market accessibility through secure, transparent digital transactions.

Key Differences Between Timeshare and Tokenization

Timeshare involves purchasing the right to use a property for a specific time period, while tokenization converts real estate assets into digital tokens representing ownership shares. Timeshare offers fixed, limited usage rights often with maintenance fees, whereas tokenization enables fractional ownership, liquidity, and easier transferability on blockchain platforms. The key difference lies in timeshare's traditional, restricted access model versus tokenization's innovative, decentralized approach to real estate investment.

Ownership Structures: Timeshare vs Tokenization

Timeshare ownership divides property use into fixed time intervals shared among multiple owners, limiting flexibility and resale options. Tokenization leverages blockchain technology to represent real estate assets as digital tokens, enabling fractional ownership with enhanced liquidity and transparency. This decentralized structure allows investors to buy, sell, or trade property shares seamlessly, revolutionizing traditional ownership models.

Investment Potential: Traditional vs Digital Assets

Timeshares offer fractional ownership with limited liquidity and potential appreciation, often tied to specific vacation properties and fixed schedules. Tokenization leverages blockchain technology to create digital assets representing real estate shares, providing greater liquidity, fractional ownership, and access to a broader market. Digital asset tokenization typically enhances investment potential by enabling real-time trading and diversification beyond physical property constraints.

Legal and Regulatory Considerations

Timeshare ownership is subject to well-established legal frameworks that mandate specific consumer protection laws, including resale restrictions and mandatory disclosure requirements, whereas tokenization operates within evolving regulatory environments influenced by securities laws and digital asset regulations. Tokenized real estate assets demand careful compliance with jurisdiction-specific anti-money laundering (AML) statutes and know-your-customer (KYC) protocols, reflecting the intersection of property law and fintech regulations. Timeshare contracts often involve long-term liability clauses and fiduciary duties, while tokenized ownership structures require clarity on governance, transferability, and smart contract enforceability under current legal standards.

Liquidity and Market Accessibility

Timeshare ownership often faces liquidity challenges due to limited resale markets and complex transfer processes, restricting quick asset liquidation. Tokenization leverages blockchain technology to enable fractional ownership and seamless secondary market trading, significantly enhancing market accessibility and liquidity. This digital transformation allows investors to buy, sell, or trade real estate assets with greater speed and reduced transaction costs compared to traditional timeshare models.

Risk Factors and Security Concerns

Timeshare ownership involves risks such as limited liquidity, market volatility, and potential legal disputes over usage rights, which can affect long-term value retention. Tokenization of real estate introduces concerns about cybersecurity vulnerabilities, regulatory compliance, and the potential for smart contract failures, raising questions about investor protection. Both models require thorough due diligence to mitigate risks and ensure secure transactions within the evolving property investment landscape.

Future Trends in Real Estate Investments

Future trends in real estate investments increasingly favor tokenization over traditional timeshares, offering enhanced liquidity, fractional ownership, and broader market access through blockchain technology. Tokenized assets enable seamless trading on digital platforms, reducing barriers for investors and increasing transparency via smart contracts. As regulatory frameworks evolve, tokenization is poised to revolutionize property investment, outperforming timeshares in flexibility and scalability.

Which Model Suits Your Investment Goals?

Timeshare investments offer fixed usage rights for vacation properties, ideal for individuals seeking predictable, recurring access to specific locations. Tokenization leverages blockchain technology to divide ownership into tradable digital tokens, providing increased liquidity and fractional investment opportunities in diverse real estate assets. Choosing between timeshare and tokenization depends on your goals: prioritize stable, personal use with timeshares or seek flexible, diversified portfolios with tokenized real estate.

Related Important Terms

Fractional Ownership

Timeshare ownership grants buyers designated time slots at a property, limiting flexibility and resale value, whereas tokenization leverages blockchain to enable fractional ownership with increased liquidity, transparency, and ease of transfer. Fractional ownership via tokenization offers real estate investors the ability to purchase, trade, and manage digital shares of a property, unlocking new opportunities for diversification and global market access.

Deeded Timeshare

Deeded timeshares provide buyers with a legal ownership interest in a specific property, granting usage rights and potential resale value, while tokenization transforms real estate assets into blockchain-based digital tokens, enhancing liquidity and fractional ownership flexibility. Unlike tokenization, deeded timeshares involve traditional property deeds and often require more complex management and transfer processes.

Right-to-Use Agreement

Right-to-Use agreements in timeshare grant buyers limited property usage for specific periods annually, contrasting with tokenization, which offers fractional ownership through blockchain-based digital assets representing real estate shares. Timeshare's fixed schedule restricts flexibility, whereas tokenization allows for liquid trading and customizable investment rights within decentralized platforms.

Blockchain Tokenization

Blockchain tokenization transforms real estate assets, including timeshares, into secure, tradable digital tokens that enhance liquidity and fractional ownership. Unlike traditional timeshares, tokenization leverages smart contracts on blockchain to provide transparent, decentralized management and seamless global transferability.

Smart Contract Escrow

Smart contract escrow in tokenization automates secure fund holding and conditional asset transfer, minimizing fraud risks inherent in traditional timeshare agreements. By using blockchain technology, tokenization enhances transparency, trust, and efficiency in real estate transactions compared to conventional timeshare contracts.

NFT Real Estate

NFT real estate leverages blockchain technology to enable fractional ownership of properties through tokenization, offering higher liquidity and transparency compared to traditional timeshares. Tokenized real estate assets can be traded on decentralized platforms, providing real-time valuation and reducing intermediaries typically involved in timeshare transactions.

PropTech Syndication

Timeshare models offer fractional ownership with limited liquidity, while tokenization leverages blockchain technology to enable seamless PropTech syndication through digital asset trading and enhanced transparency. Tokenized real estate syndication reduces entry barriers, increases market accessibility, and provides investors with programmable equity in property assets.

Digital Asset Fractionalization

Digital asset fractionalization in real estate enables investors to hold tokenized shares of properties, offering improved liquidity and transparency compared to traditional timeshares, which often involve fixed ownership and limited resale options. Tokenization leverages blockchain technology to create secure, transferable digital tokens representing property fractions, streamlining investment management and expanding access to a global investor base.

Security Token Offering (STO)

Security Token Offering (STO) in real estate offers enhanced liquidity and regulatory compliance compared to traditional timeshare models by digitizing property ownership on a blockchain. Unlike timeshares, STOs provide fractional ownership with transparent, tradable security tokens that represent actual asset value and legal rights.

Multi-Owner Ledger

Multi-owner ledger technology in real estate enables more transparent and efficient management of shared property interests, distinguishing tokenization by offering immutable records and fractional ownership on a blockchain platform. Timeshare models rely on traditional legal agreements and fixed schedules, while tokenization facilitates seamless transferability and liquidity of property shares through digital tokens.

Timeshare vs Tokenization Infographic

industrydif.com

industrydif.com