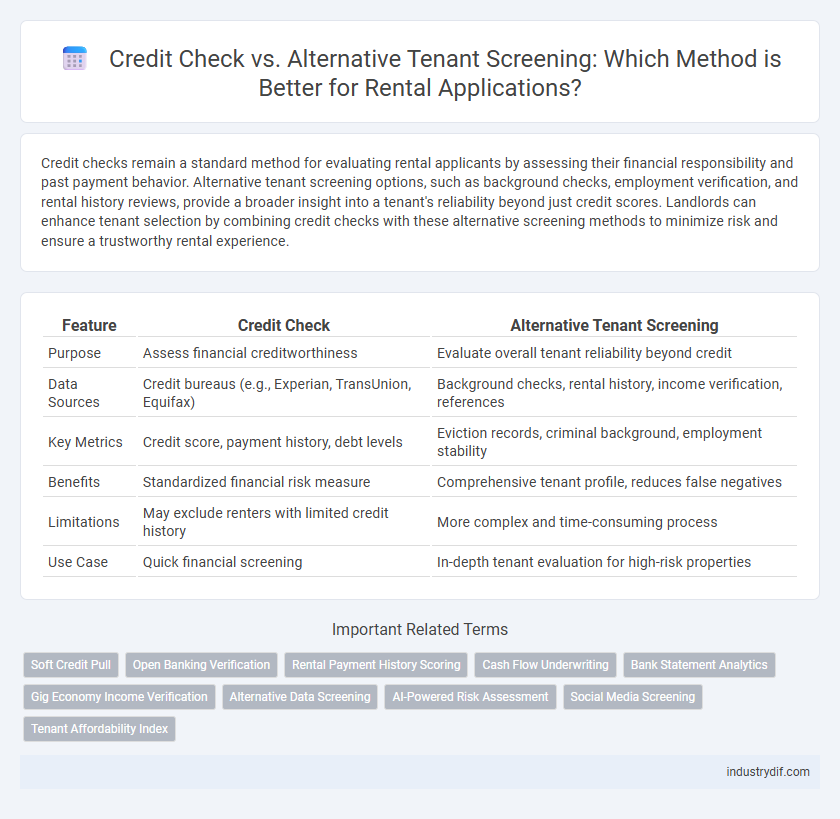

Credit checks remain a standard method for evaluating rental applicants by assessing their financial responsibility and past payment behavior. Alternative tenant screening options, such as background checks, employment verification, and rental history reviews, provide a broader insight into a tenant's reliability beyond just credit scores. Landlords can enhance tenant selection by combining credit checks with these alternative screening methods to minimize risk and ensure a trustworthy rental experience.

Table of Comparison

| Feature | Credit Check | Alternative Tenant Screening |

|---|---|---|

| Purpose | Assess financial creditworthiness | Evaluate overall tenant reliability beyond credit |

| Data Sources | Credit bureaus (e.g., Experian, TransUnion, Equifax) | Background checks, rental history, income verification, references |

| Key Metrics | Credit score, payment history, debt levels | Eviction records, criminal background, employment stability |

| Benefits | Standardized financial risk measure | Comprehensive tenant profile, reduces false negatives |

| Limitations | May exclude renters with limited credit history | More complex and time-consuming process |

| Use Case | Quick financial screening | In-depth tenant evaluation for high-risk properties |

Understanding Credit Checks in Rental Applications

Credit checks in rental applications provide landlords with a detailed history of an applicant's financial responsibility, including payment behavior, outstanding debts, and credit score. This information helps predict the tenant's likelihood to pay rent on time and manage financial obligations reliably. While credit checks are a standard screening tool, alternative tenant screening methods may supplement insights by evaluating factors like rental history, employment verification, and personal references.

What is Alternative Tenant Screening?

Alternative tenant screening provides rental property owners with non-traditional methods to evaluate applicants, such as analyzing social media profiles, employment history, payment patterns on rent or utilities, and references from previous landlords. This approach supplements or replaces credit checks by offering a broader view of tenant reliability, especially for applicants with limited or poor credit history. Utilizing alternative screening helps landlords make more informed decisions while potentially expanding the pool of qualified renters.

Credit Check: Key Factors and Limitations

Credit checks provide landlords with critical information on a tenant's creditworthiness by analyzing credit scores, payment history, and outstanding debts. Key factors include assessing the consistency of rent payments, identifying previous evictions, and evaluating overall financial stability. Limitations arise from credit checks failing to capture non-traditional financial behaviors and potentially excluding qualified tenants with limited credit history or alternative financial arrangements.

Alternative Screening: Methods Beyond Credit Reports

Alternative tenant screening methods include income verification, rental history analysis, and background checks to assess applicant reliability beyond credit scores. Utilizing employment confirmation, references from previous landlords, and criminal record assessments provides a comprehensive risk profile. These approaches mitigate the limitations of credit checks and offer landlords a broader perspective on tenant suitability.

Pros and Cons of Credit Checks for Landlords

Credit checks provide landlords with a clear financial snapshot of potential tenants, helping predict their ability to pay rent on time and reduce the risk of defaults. However, relying solely on credit scores may exclude qualified tenants with limited credit histories or those who have experienced temporary setbacks. Alternative tenant screening methods, such as employment verification and rental history analysis, offer a more comprehensive assessment but can require more time and resources.

Advantages of Alternative Tenant Screening

Alternative tenant screening offers landlords access to a broader range of financial and behavioral data beyond traditional credit scores, enabling a more comprehensive tenant evaluation. This method includes analysis of rental history, income verification, and even online reputation, which helps identify reliable tenants lacking extensive credit records. Utilizing alternative screening reduces the risk of unfairly excluding qualified renters while improving occupancy rates and long-term rental income stability.

Legal Considerations for Tenant Screening

Credit checks remain a standard legal requirement in tenant screening, ensuring landlords comply with the Fair Credit Reporting Act and state-specific regulations to avoid discrimination claims. Alternative tenant screening methods, such as income verification, rental history, and personal references, must also adhere to fair housing laws to prevent bias and maintain transparency. Proper documentation and consistent application of screening criteria are crucial to withstand legal scrutiny and protect landlord rights.

Credit Score Impact on Rental Approval

Credit checks remain a standard method for rental approval, heavily weighing the tenant's credit score to predict financial reliability and payment consistency. Alternative tenant screening methods, such as income verification, rental history, and employment confirmation, offer a broader view that can mitigate the negative impact of a low credit score. Landlords adopting these alternative screenings often increase approval rates for tenants who demonstrate strong financial habits outside of traditional credit scoring metrics.

Comparing Accuracy: Credit Checks vs Alternatives

Credit checks provide a reliable financial snapshot by analyzing credit scores, payment history, and outstanding debts, offering landlords quantifiable data to assess tenant risk. Alternative tenant screening methods incorporate rental history, employment verification, and background checks, which can reveal behavioral and reliability factors not captured by credit reports. Comparing accuracy, credit checks excel in financial risk prediction while alternatives offer a broader perspective on tenant suitability, making a combined approach often the most effective for thorough tenant screening.

Best Practices for Comprehensive Tenant Screening

Comprehensive tenant screening involves combining traditional credit checks with alternative methods such as rental history verification, employment confirmation, and criminal background checks to gain a holistic view of an applicant's reliability. Utilizing data sources like utility payment records, social media behavior, and references enhances the accuracy of tenant risk assessment beyond credit scores alone. Implementing a multi-faceted screening approach reduces default risks and helps landlords make informed rental approval decisions.

Related Important Terms

Soft Credit Pull

Soft credit pull in rental screening offers landlords a non-invasive way to assess tenant creditworthiness without impacting their credit score, making it ideal for preliminary evaluations. Alternative tenant screening leverages soft credit checks along with rental history, employment verification, and background reports to provide a comprehensive risk profile beyond traditional credit reporting.

Open Banking Verification

Open Banking Verification enhances rental screening by providing real-time financial data, offering a more accurate assessment of tenants' creditworthiness compared to traditional credit checks. This method reduces reliance on outdated credit scores, enabling landlords to verify income, spending habits, and financial stability efficiently through secure bank data access.

Rental Payment History Scoring

Rental payment history scoring in credit checks often relies on traditional credit bureaus, limiting the evaluation to reported financial behavior, while alternative tenant screening incorporates utility payments, rental histories, and other non-traditional data sources to provide a more comprehensive assessment of tenant reliability and payment consistency. Utilizing alternative scoring models improves prediction accuracy for timely rent payments, reducing the risk of defaults and enhancing landlord decision-making.

Cash Flow Underwriting

Credit checks primarily assess a tenant's credit history and score, while alternative tenant screening emphasizes cash flow underwriting by analyzing income streams, bank statements, and expense patterns to evaluate rental affordability and financial stability more accurately. This method helps landlords identify reliable tenants with strong cash flow even if they have limited or no credit history, reducing the risk of rental defaults.

Bank Statement Analytics

Bank statement analytics offers a more comprehensive view of a tenant's financial stability than traditional credit checks by evaluating income consistency, spending habits, and cash flow patterns. This method reduces reliance on credit scores alone and provides landlords with actionable insights to assess a tenant's true ability to manage rent payments.

Gig Economy Income Verification

Credit check often fails to capture the financial stability of gig economy workers due to irregular income patterns, making alternative tenant screening methods essential. These methods verify income through bank statements, payment app histories, and tax returns to provide a more accurate assessment of a renter's ability to pay.

Alternative Data Screening

Alternative tenant screening leverages non-traditional data sources such as utility payments, rental history, and social behavior to provide a more comprehensive assessment of a tenant's reliability beyond standard credit checks. This method improves rental decision accuracy by capturing real-time financial responsibility and reducing reliance on potentially outdated or limited credit reports.

AI-Powered Risk Assessment

AI-powered risk assessment enhances rental credit checks by integrating alternative tenant screening methods such as income verification, rental history analysis, and social behavior indicators to provide a comprehensive evaluation of tenant reliability. This advanced technology reduces bias, accelerates decision-making, and improves accuracy in predicting tenant risk beyond traditional credit score evaluations.

Social Media Screening

Social media screening offers landlords a comprehensive view of potential tenants' behavior and lifestyle beyond traditional credit checks, revealing character insights and risk factors that financial history alone may not capture. Integrating social media analysis into tenant screening enhances decision-making by identifying red flags such as inconsistent employment, illegal activities, or poor community engagement, thereby reducing rental defaults and property damage.

Tenant Affordability Index

Credit check primarily evaluates a tenant's past financial behavior and credit score, while alternative tenant screening incorporates the Tenant Affordability Index to assess a renter's current income relative to rental costs, providing a more comprehensive measure of their ability to afford monthly payments. Utilizing the Tenant Affordability Index helps landlords identify tenants with stable financial capacity beyond traditional credit metrics, reducing the risk of missed payments.

Credit Check vs Alternative Tenant Screening Infographic

industrydif.com

industrydif.com