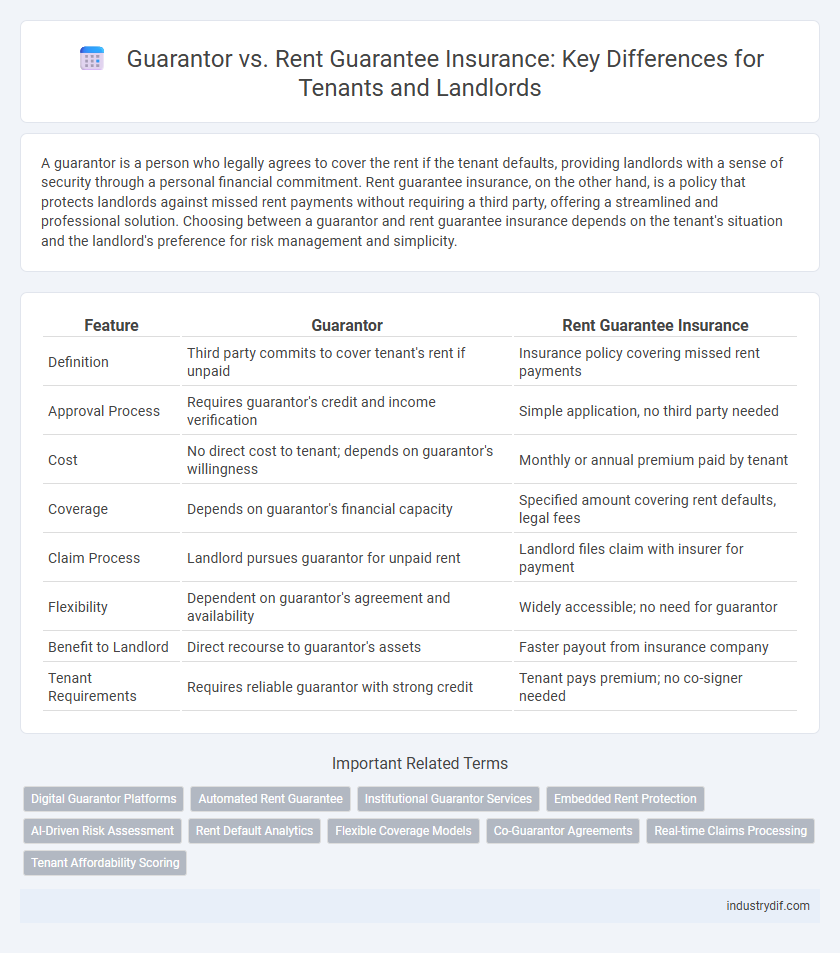

A guarantor is a person who legally agrees to cover the rent if the tenant defaults, providing landlords with a sense of security through a personal financial commitment. Rent guarantee insurance, on the other hand, is a policy that protects landlords against missed rent payments without requiring a third party, offering a streamlined and professional solution. Choosing between a guarantor and rent guarantee insurance depends on the tenant's situation and the landlord's preference for risk management and simplicity.

Table of Comparison

| Feature | Guarantor | Rent Guarantee Insurance |

|---|---|---|

| Definition | Third party commits to cover tenant's rent if unpaid | Insurance policy covering missed rent payments |

| Approval Process | Requires guarantor's credit and income verification | Simple application, no third party needed |

| Cost | No direct cost to tenant; depends on guarantor's willingness | Monthly or annual premium paid by tenant |

| Coverage | Depends on guarantor's financial capacity | Specified amount covering rent defaults, legal fees |

| Claim Process | Landlord pursues guarantor for unpaid rent | Landlord files claim with insurer for payment |

| Flexibility | Dependent on guarantor's agreement and availability | Widely accessible; no need for guarantor |

| Benefit to Landlord | Direct recourse to guarantor's assets | Faster payout from insurance company |

| Tenant Requirements | Requires reliable guarantor with strong credit | Tenant pays premium; no co-signer needed |

Understanding the Role of a Guarantor in Rentals

A guarantor in rentals acts as a financial backup, ensuring unpaid rent or damages are covered if the tenant defaults, providing landlords with increased security. This role typically requires someone with a strong credit history and financial stability to legally commit to the tenant's obligations. Understanding the responsibilities and legal implications for guarantors helps tenants and landlords mitigate risk and secure rental agreements effectively.

What is Rent Guarantee Insurance?

Rent Guarantee Insurance is a financial product designed to protect landlords against tenant rent arrears and potential legal costs associated with recovering unpaid rent. Unlike a guarantor who personally guarantees the tenant's rental payments, this insurance policy provides a third-party assurance that rent will be paid even if the tenant defaults. It offers landlords peace of mind by minimizing financial risks and streamlining the rent recovery process.

Key Differences Between Guarantor and Rent Guarantee Insurance

A guarantor provides a legally binding agreement to cover unpaid rent, often requiring strict credit checks and a personal connection to the tenant, while rent guarantee insurance transfers the risk to an insurance company that pays landlords in case of tenant default. Guarantors typically demand a long-term financial commitment and legal responsibility, whereas rent guarantee insurance offers landlords protection without involving third-party guarantors. The key difference lies in the nature of risk management: guarantors serve as individual backers, while rent guarantee insurance functions as a formal financial product safeguarding landlords against rental income loss.

Pros and Cons of Using a Guarantor

Using a guarantor in rental agreements provides landlords with added security, ensuring rent payment continuity if the tenant defaults, while often requiring less upfront cost compared to insurance premiums. However, relying on a guarantor can be challenging if the guarantor's creditworthiness is poor or difficult to verify, potentially complicating tenant approval. The guarantor's liability remains until the lease ends, exposing them to financial risk if the tenant fails to pay.

Benefits of Rent Guarantee Insurance for Landlords

Rent Guarantee Insurance offers landlords reliable protection against tenant default, ensuring consistent rental income even during payment delays or disputes. This insurance reduces the risk and financial stress associated with evicting non-paying tenants, covering legal costs and lost rent up to specified limits. Unlike relying on a guarantor, who may fail to fulfill obligations, Rent Guarantee Insurance provides a legally enforceable safeguard with streamlined claims processes.

Tenant Eligibility: Guarantor vs. Rent Guarantee Insurance

Tenant eligibility for a guarantor requires a reliable individual with a strong financial background willing to co-sign the lease, often a family member or close friend. Rent guarantee insurance broadens eligibility by allowing tenants without guarantors to secure rental agreements through an insurance policy that covers missed rent payments. This option benefits tenants with limited credit history, self-employed status, or no available guarantor.

Costs Comparison: Guarantor vs Rent Guarantee Insurance

Guarantor agreements often involve minimal upfront costs but can lead to potential financial liability if the tenant defaults, whereas rent guarantee insurance requires a monthly or annual premium that typically covers unpaid rent and legal fees. The cost of a guarantor is usually limited to a nominal admin fee, but qualifying a guarantor can be challenging and risky for landlords. Rent guarantee insurance provides predictable expenses and financial protection, making it a cost-effective solution compared to the uncertain liabilities associated with guarantors.

Legal Implications for Guarantors and Insured Landlords

Guarantors legally commit to covering unpaid rent and damages if tenants default, exposing them to potential court actions and financial liability. Rent guarantee insurance protects landlords by transferring the risk of tenant non-payment to an insurer, limiting legal disputes and providing faster compensation. Understanding these legal implications helps landlords decide whether to require a guarantor or rely on insurance for tenant rent protection.

How to Choose: Guarantor or Rent Guarantee Insurance

When choosing between a guarantor and rent guarantee insurance, consider the financial reliability and availability of a trusted individual versus the convenience and protection offered by insurance policies. Rent guarantee insurance provides landlords with continuous coverage against tenant payment defaults, while guarantors may impose limitations based on their creditworthiness and willingness. Carefully evaluate the tenant's circumstances, landlord requirements, and potential risks to determine the most secure and practical option for rental assurance.

Industry Trends: The Future of Rental Risk Management

Emerging industry trends reveal a growing preference for rent guarantee insurance over traditional guarantors due to increased automation, faster claim processing, and reduced legal complexities. Digital platforms leverage AI-driven risk assessment to tailor insurance policies that provide landlords with more reliable financial protection against tenant defaults. This shift reflects a broader move toward technology-enabled rental risk management solutions that enhance efficiency and security in the rental market.

Related Important Terms

Digital Guarantor Platforms

Digital guarantor platforms streamline the rental process by offering efficient, technology-driven alternatives to traditional guarantors, reducing paperwork and approval times. Rent guarantee insurance provides landlords with financial protection against tenant default, but digital guarantors enhance tenant accessibility and verification speed, making rental agreements more secure and transparent.

Automated Rent Guarantee

Automated Rent Guarantee streamlines tenant approval by using AI to assess guarantor credibility and minimize risks more efficiently than traditional personal guarantors. Rent Guarantee Insurance complements this by providing landlords with financial protection against tenant defaults, ensuring steady rental income without manual intervention.

Institutional Guarantor Services

Institutional guarantor services provide a reliable and formal assurance for landlords by acting as third-party entities that guarantee tenant rent payments, reducing the risk of default significantly. Unlike rent guarantee insurance, which requires claims processing and potential reimbursement delays, institutional guarantors offer streamlined approval processes and immediate financial backing, enhancing rental security for property owners.

Embedded Rent Protection

Embedded rent protection offers tenants seamless security by automatically including rent guarantee insurance within the rental agreement, eliminating the need for a separate guarantor and reducing landlord risk. This integrated solution ensures consistent rental income coverage while enhancing tenant approval rates and simplifying the leasing process.

AI-Driven Risk Assessment

AI-driven risk assessment enhances both guarantor verification and rent guarantee insurance by analyzing vast data sets to predict tenant reliability and reduce default rates. This technology enables landlords to make informed decisions quickly, optimizing rental security and minimizing financial risks.

Rent Default Analytics

Rent Default Analytics highlights that Rent Guarantee Insurance offers landlords a data-driven risk assessment and financial protection against tenant payment failures, whereas a Guarantor relies on personal creditworthiness without automated predictive insights. Leveraging Rent Default Analytics, insurers calculate default probabilities using tenant financial behavior patterns, providing more reliable security compared to traditional guarantor agreements.

Flexible Coverage Models

Guarantor services typically require a third party to co-sign the lease, providing a fixed form of security, while rent guarantee insurance offers flexible coverage models tailored to different tenant risk profiles and landlord needs. Rent guarantee insurance adapts to varying claim limits and policy durations, enhancing protection without the rigid requirements of a guarantor agreement.

Co-Guarantor Agreements

Co-guarantor agreements involve multiple individuals jointly responsible for a tenant's lease obligations, providing landlords with increased security by spreading financial risk. Rent guarantee insurance offers an alternative by transferring the risk to an insurer, eliminating the need for guarantors but often requiring a premium paid by the landlord or tenant.

Real-time Claims Processing

Rent Guarantee Insurance offers real-time claims processing by automating approval and payout workflows, reducing wait times compared to traditional guarantor agreements that often require manual verification and prolonged approval periods. This technology accelerates financial protection for landlords, enhancing rental security through instant claim settlements.

Tenant Affordability Scoring

Guarantors offer landlords a personal financial safety net but can limit tenant accessibility due to stringent credit or income requirements, whereas Rent Guarantee Insurance enhances tenant affordability scoring by providing a third-party assurance that covers missed rent without burdening tenants with extra guarantor obligations. Rent Guarantee Insurance improves approval rates and inclusivity by capturing a broader financial risk profile, thereby enabling tenants with variable or limited credit histories to secure leases more easily.

Guarantor vs Rent Guarantee Insurance Infographic

industrydif.com

industrydif.com