Deposit-based rental requires tenants to pay a security deposit upfront, which serves as financial protection for landlords against potential damages or unpaid rent. Deposit-free rental eliminates the need for an initial security deposit, often replacing it with alternative guarantees such as insurance or third-party guarantees, providing more flexibility for tenants with limited savings. Choosing between deposit-based and deposit-free rental options depends on financial preparedness and risk tolerance for both tenants and landlords.

Table of Comparison

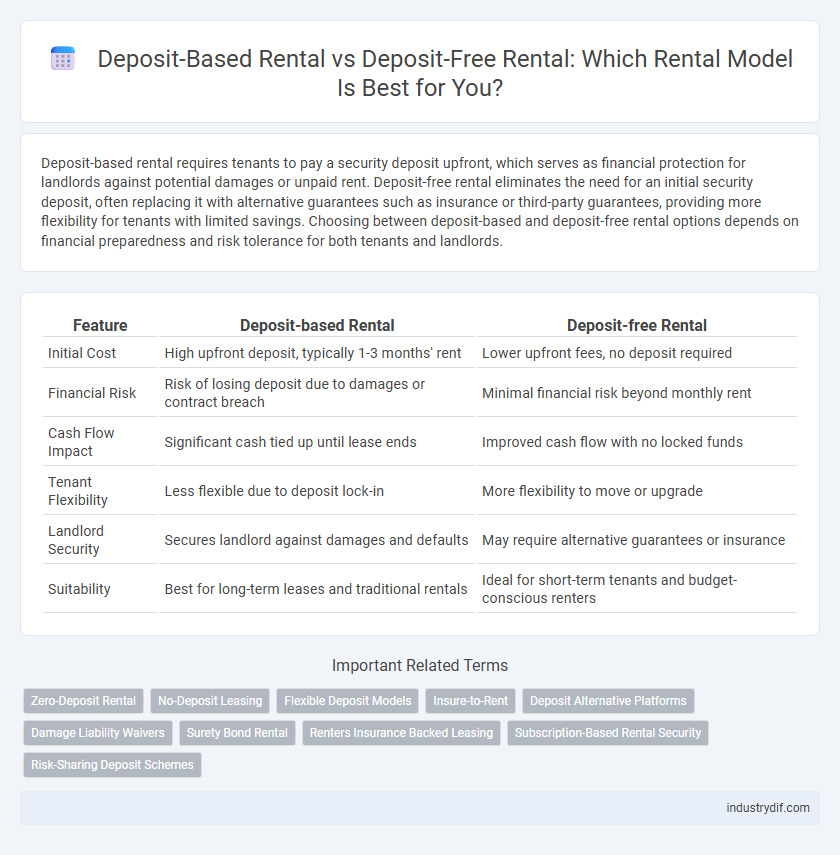

| Feature | Deposit-based Rental | Deposit-free Rental |

|---|---|---|

| Initial Cost | High upfront deposit, typically 1-3 months' rent | Lower upfront fees, no deposit required |

| Financial Risk | Risk of losing deposit due to damages or contract breach | Minimal financial risk beyond monthly rent |

| Cash Flow Impact | Significant cash tied up until lease ends | Improved cash flow with no locked funds |

| Tenant Flexibility | Less flexible due to deposit lock-in | More flexibility to move or upgrade |

| Landlord Security | Secures landlord against damages and defaults | May require alternative guarantees or insurance |

| Suitability | Best for long-term leases and traditional rentals | Ideal for short-term tenants and budget-conscious renters |

Understanding Deposit-Based Rental

Deposit-based rental requires tenants to pay a security deposit upfront, typically equivalent to one to three months' rent, which serves as financial protection against damages or unpaid rent. This model ensures landlords have a safeguard but can pose affordability challenges for tenants due to the higher initial cost. Understanding the terms and conditions of deposit refunds is crucial for both parties to avoid disputes at the end of the rental period.

What is Deposit-Free Rental?

Deposit-free rental eliminates the upfront security deposit traditionally required when leasing a property, allowing tenants to move in with just the first month's rent. This option often involves purchasing insurance or paying a non-refundable fee to protect landlords against potential damages or unpaid rent. Deposit-free rentals offer increased affordability and flexibility, making them attractive to renters who may struggle to gather a large sum of money upfront.

Key Differences Between Deposit-Based and Deposit-Free Rental

Deposit-based rental requires tenants to provide a security deposit, typically equal to one to three months' rent, which safeguards landlords against damages or unpaid rent. Deposit-free rental eliminates the upfront deposit, often replacing it with insurance or guarantor services that cover potential losses, enhancing cash flow for tenants. Key differences include upfront cost burden, risk management methods, and tenant accessibility, where deposit-free options offer greater flexibility but may incur additional fees.

Pros and Cons of Deposit-Based Rental

Deposit-based rental agreements require tenants to pay a security deposit, often equivalent to one to three months' rent, which protects landlords against damages or unpaid rent, promoting responsible tenant behavior. However, the upfront cost can be significant for tenants, limiting affordability and reducing accessibility, particularly for low-income renters. Landlords benefit from financial security but must manage and legally handle deposits according to regulations, which can complicate the rental process and delay refund timelines.

Pros and Cons of Deposit-Free Rental

Deposit-free rental eliminates upfront security deposits, enhancing cash flow and making the rental process more accessible for tenants. This model reduces financial barriers and simplifies move-in procedures but may involve higher monthly rent or require insurance payments, potentially increasing overall costs. Landlords benefit from faster tenant acquisition but assume greater financial risk without a traditional security deposit.

Tenant Perspective: Which Option Is Better?

Tenants benefit from deposit-free rental options by avoiding large upfront costs and gaining quicker access to properties, improving cash flow and financial flexibility. Deposit-based rentals provide a security net to landlords, potentially resulting in fewer disputes but often tying up tenants' funds for months. Evaluating personal financial stability and risk tolerance helps tenants decide which model aligns better with their renting needs.

Landlord Perspective: Deposit-Based vs Deposit-Free

From a landlord's perspective, deposit-based rentals provide financial security by covering potential damages or unpaid rent, reducing the risk of financial loss. Deposit-free rentals attract tenants more quickly and improve vacancy rates but require landlords to rely on alternative risk management tools like insurance or credit checks. Carefully weighing these factors helps landlords balance tenant convenience with asset protection.

Risks and Benefits for Both Parties

Deposit-based rental provides landlords with financial security against damages or unpaid rent, reducing risk but requiring tenants to lock in a significant sum upfront, which may impact affordability. Deposit-free rental schemes offer tenants greater cash flow flexibility and quicker move-in processes, yet may expose landlords to higher financial risks without the traditional security cushion. Both models require clear contractual agreements to balance protections and responsibilities, ensuring transparency and minimizing disputes.

Cost Comparison: Traditional Deposit vs Deposit-Free Schemes

Deposit-based rental schemes require tenants to pay a substantial upfront security deposit, often equivalent to one to three months' rent, which ties up significant capital. Deposit-free rental models eliminate this upfront cost by offering alternatives such as insurance-backed guarantees or monthly fee surcharges, reducing initial financial burden but possibly increasing overall expense through recurring charges. Comparing total costs over the lease term reveals that while deposit-free rentals improve cash flow flexibility, traditional deposits may be more cost-effective if tenants recover deposits fully without damages.

Future Trends in Rental Deposits

Future trends in rental deposits indicate a significant shift towards deposit-free rental models driven by increasing tenant demand for financial flexibility and landlord adoption of insurance-backed guarantees. Technologies like blockchain and smart contracts are facilitating secure, transparent, and instant deposit alternatives, reducing traditional deposit barriers. Market analyses predict continued growth in deposit-free rentals, supported by regulatory changes and innovative fintech solutions that enhance risk management for property owners.

Related Important Terms

Zero-Deposit Rental

Zero-deposit rental eliminates the upfront security deposit, allowing tenants to move in with minimal initial costs while landlords often utilize insurance policies or third-party guarantees to mitigate risk. This model increases rental accessibility and cash flow flexibility, appealing to tenants seeking reduced financial barriers and enabling landlords to retain secure coverage against damages or defaults.

No-Deposit Leasing

No-deposit leasing eliminates the upfront security deposit, reducing the initial financial burden for tenants while often involving higher monthly rent or insurance fees to mitigate landlord risk. This rental model enhances affordability and accessibility for renters but requires thorough vetting and clear contractual terms to protect both parties.

Flexible Deposit Models

Flexible deposit models in rental agreements cater to diverse tenant needs by offering options between traditional deposit-based rentals and deposit-free alternatives, such as installment payments or insurance-backed deposits. These models enhance affordability and accessibility, reducing upfront financial burdens while maintaining landlord security through customizable risk management solutions.

Insure-to-Rent

Deposit-based rental requires tenants to provide a security deposit typically equal to one or two months' rent, which landlords hold as financial protection against damages or unpaid rent. Insure-to-Rent offers a deposit-free alternative by allowing tenants to pay a small insurance premium that safeguards landlords against potential losses, making rentals more accessible and cash-flow friendly for tenants while maintaining landlord protection.

Deposit Alternative Platforms

Deposit alternative platforms offer renters flexible options by replacing traditional security deposits with affordable, low-cost insurance or bond services, enabling upfront cost reductions and improving cash flow management. These platforms enhance tenant accessibility and landlord security by mitigating risk through third-party guarantees, streamlining the rental process without requiring large deposit payments.

Damage Liability Waivers

Deposit-based rental requires tenants to pay a refundable security deposit to cover potential damages, creating financial safeguards for landlords but often tying up tenant capital. Deposit-free rental with damage liability waivers shifts the risk management to insurance providers, allowing renters to avoid upfront deposits while ensuring landlords receive compensation for property damages.

Surety Bond Rental

Surety Bond Rental offers tenants a flexible alternative to traditional Deposit-based Rental by replacing cash deposits with a third-party guarantee, reducing upfront costs and improving cash flow management. This rental model enhances landlord security while providing tenants with increased financial liquidity and faster move-in processes.

Renters Insurance Backed Leasing

Deposit-based rental requires tenants to provide a security deposit upfront, often equivalent to one or two months' rent, as financial protection for landlords against damages or unpaid rent. Renters insurance backed leasing offers a deposit-free alternative by allowing tenants to purchase insurance that covers potential losses, reducing upfront costs and increasing accessibility for renters.

Subscription-Based Rental Security

Deposit-based rental requires tenants to lock in a significant security deposit, which ties up capital and limits cash flow flexibility, whereas deposit-free rental models, often structured as subscription-based services, enhance affordability by replacing upfront deposits with manageable periodic payments that secure rental agreements while improving tenant access and financial ease. Subscription-based rental security leverages ongoing monthly fees to mitigate landlord risk and streamline the rental process, making it an innovative alternative to traditional lump-sum deposits.

Risk-Sharing Deposit Schemes

Risk-sharing deposit schemes in rental agreements distribute the financial burden between tenants and landlords, reducing upfront costs for renters while protecting landlords against potential damages or payment defaults. These schemes enhance affordability and flexibility compared to traditional deposit-based rentals, making housing more accessible without compromising landlord security.

Deposit-based Rental vs Deposit-free Rental Infographic

industrydif.com

industrydif.com