Fixed rent provides predictable monthly expenses, allowing tenants to budget effectively without fluctuating costs. The revenue share model offers flexibility, aligning landlord income with business performance and reducing upfront financial risk. Negotiating between fixed rent and revenue share depends on the tenant's cash flow stability and growth potential.

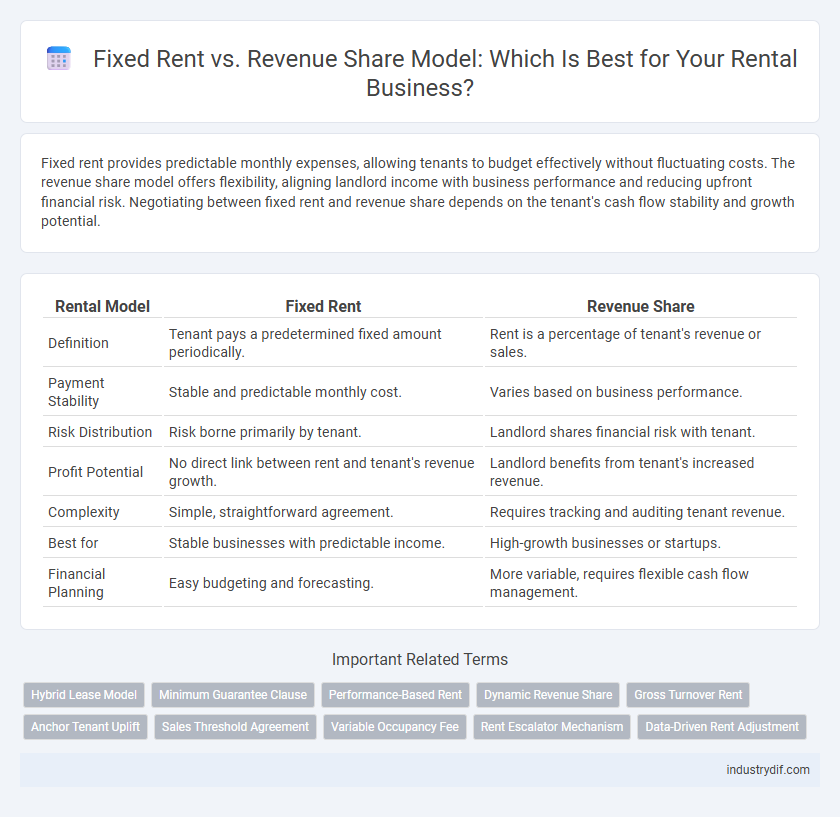

Table of Comparison

| Rental Model | Fixed Rent | Revenue Share |

|---|---|---|

| Definition | Tenant pays a predetermined fixed amount periodically. | Rent is a percentage of tenant's revenue or sales. |

| Payment Stability | Stable and predictable monthly cost. | Varies based on business performance. |

| Risk Distribution | Risk borne primarily by tenant. | Landlord shares financial risk with tenant. |

| Profit Potential | No direct link between rent and tenant's revenue growth. | Landlord benefits from tenant's increased revenue. |

| Complexity | Simple, straightforward agreement. | Requires tracking and auditing tenant revenue. |

| Best for | Stable businesses with predictable income. | High-growth businesses or startups. |

| Financial Planning | Easy budgeting and forecasting. | More variable, requires flexible cash flow management. |

Introduction to Rental Industry Pricing Models

Fixed rent pricing in the rental industry offers predictable, consistent payments regardless of property performance, appealing to landlords seeking stable cash flow. Revenue share models align landlord income with tenant success by linking rent to a percentage of rental revenue, fostering mutually beneficial partnerships. Understanding these contrasting approaches helps stakeholders optimize pricing strategies based on risk tolerance and market dynamics.

Defining Fixed Rent in Commercial Leasing

Fixed rent in commercial leasing refers to a predetermined, consistent payment amount specified in the lease agreement, independent of the tenant's business performance. This model provides landlords with predictable income streams while tenants benefit from stable, budgetable expenses. Fixed rent contrasts with the revenue share model, which ties rental payments to a percentage of the tenant's sales or revenue.

Understanding the Revenue Share Model

The Revenue Share Model in rental agreements involves tenants paying a percentage of their actual income or sales as rent, rather than a predetermined fixed amount. This approach aligns landlord income with tenant performance, reducing the risk during low-revenue periods while maximizing returns in high-revenue scenarios. Businesses in retail, hospitality, and co-working spaces often adopt revenue sharing to create flexible, performance-driven rental arrangements.

Key Differences Between Fixed Rent and Revenue Share

Fixed rent involves tenants paying a predetermined monthly amount regardless of business performance, providing predictable income for landlords but less flexibility during economic fluctuations. The revenue share model requires tenants to pay a percentage of their actual sales, aligning landlord income with tenant success but introducing variability and potential income uncertainty. Key differences lie in risk distribution, with fixed rent favoring stability and revenue share promoting shared business risk and incentive alignment.

Pros and Cons of Fixed Rent Agreements

Fixed rent agreements provide tenants with predictable monthly costs, simplifying budgeting and financial planning. However, landlords may miss out on higher income during peak business periods since rent remains constant regardless of revenue fluctuations. Tenants benefit from stability, but fixed rates can become burdensome during downturns, potentially straining cash flow.

Advantages and Drawbacks of Revenue Share Model

The Revenue Share Model aligns landlord and tenant incentives by linking rent payments to business performance, reducing fixed financial risk during low revenue periods. It offers flexibility and potential for higher overall returns in thriving economic conditions but can result in unpredictable income streams for landlords, complicating budgeting and cash flow management. This model requires transparent financial reporting and trust, which may lead to disputes over revenue calculations and administrative overhead.

Suitability of Each Model for Different Business Types

Fixed rent provides predictable expenses, making it suitable for established businesses with stable cash flow and low seasonal fluctuations. Revenue share models benefit startups and seasonal businesses by aligning rent payments with income, reducing financial strain during low sales periods. Retail and hospitality sectors often prefer revenue share agreements due to their variable revenue patterns, while office and industrial spaces typically opt for fixed rent for budgeting certainty.

Impact on Landlords: Fixed Rent vs Revenue Share

Fixed rent provides landlords with consistent, predictable income regardless of the tenant's business performance, reducing financial uncertainty. The revenue share model ties landlord earnings to tenant sales, potentially increasing profits during high revenue periods but introducing variability and risk. Landlords must balance the security of fixed payments against the opportunity for greater earnings through revenue participation.

Impact on Tenants: Fixed Rent vs Revenue Share

Fixed rent provides tenants with predictable monthly expenses, enabling stable budgeting and financial planning regardless of business performance fluctuations. In contrast, the revenue share model aligns rental costs with actual sales, offering flexibility during low-revenue periods but potentially increasing expenses when business thrives. Tenants choosing fixed rent benefit from cost certainty, while those opting for revenue share enjoy reduced upfront risk and scalability tied to their income.

Factors to Consider When Choosing a Rental Model

Evaluating a fixed rent model requires analyzing predictable monthly expenses and cash flow stability, while the revenue share model demands assessing variable income potential and market performance. Consideration of business risk tolerance, seasonality, and demand fluctuations plays a crucial role in determining the most suitable rental arrangement. Accurate forecasting of revenue projections and understanding landlord-tenant agreements facilitate informed decision-making between fixed rent and revenue share options.

Related Important Terms

Hybrid Lease Model

The hybrid lease model combines fixed rent stability with revenue share flexibility, enabling landlords to secure predictable income while benefiting from tenants' sales performance. This approach optimizes risk distribution and aligns landlord-tenant incentives, enhancing rental profitability and tenant retention.

Minimum Guarantee Clause

The Minimum Guarantee Clause in rental agreements ensures landlords receive a predetermined base rent regardless of revenue fluctuations, providing financial stability absent in pure Revenue Share Models. Fixed Rent offers consistent income, while Revenue Share Models with a Minimum Guarantee balance risk by protecting landlords against underperformance.

Performance-Based Rent

Performance-based rent models link rental payments directly to tenant revenue, aligning landlord income with business success and reducing fixed financial burdens during low sales periods. This structure fosters a partnership mentality, incentivizing landlords to support tenant growth and adapt lease terms based on actual performance metrics.

Dynamic Revenue Share

Dynamic Revenue Share models adjust rental payments based on actual business performance, aligning landlord income with tenant revenue fluctuations. Unlike fixed rent agreements, this approach minimizes financial risk for tenants during low-revenue periods while enabling landlords to benefit from high sales seasons.

Gross Turnover Rent

Gross turnover rent calculates rent as a percentage of a tenant's total sales, aligning landlord income with business performance and reducing fixed costs for tenants compared to fixed rent models. This revenue share model incentivizes tenants' success and offers landlords potential upside during peak sales periods, contrasting with the predictability but rigidity of fixed rent agreements.

Anchor Tenant Uplift

Choosing between Fixed Rent and Revenue Share models significantly impacts anchor tenant uplift; fixed rent offers predictable income but may limit tenant growth incentives, while revenue share aligns landlord interests with tenant sales performance, maximizing joint profitability and encouraging increased store traffic. Anchor tenants under revenue share arrangements often experience greater sales uplift due to collaborative marketing efforts and flexible rent structures that adapt to business cycles.

Sales Threshold Agreement

A Sales Threshold Agreement in rental contracts sets a predetermined sales volume that triggers a shift from fixed rent to a revenue share model, aligning landlord income with tenant business performance. This hybrid approach mitigates risk by ensuring minimum guaranteed rent while enabling landlords to benefit from higher tenant sales through percentage-based rent beyond the threshold.

Variable Occupancy Fee

The Variable Occupancy Fee in rental agreements adjusts based on tenant usage, offering flexibility compared to Fixed Rent by aligning costs with actual occupancy levels. This model benefits property owners through revenue share participation, incentivizing higher tenant engagement and optimizing income over static monthly payments.

Rent Escalator Mechanism

A rent escalator mechanism in a fixed rent model involves predetermined periodic increases, ensuring predictable revenue growth regardless of tenant performance. In contrast, revenue share models adjust rent based on business income fluctuations, eliminating fixed escalations but linking landlord income directly to tenant success.

Data-Driven Rent Adjustment

Data-driven rent adjustment leverages real-time revenue analytics to optimize rental income, aligning rent with actual business performance rather than fixed amounts. Revenue share models provide dynamic flexibility, maximizing profitability for landlords by capturing a percentage of tenant sales instead of predetermined fixed rent.

Fixed Rent vs Revenue Share Model Infographic

industrydif.com

industrydif.com